M&A activities in Luxembourg dropped considerably until mid-2020 alongside a global slowdown due to Brexit and the COVID-19 crisis. Recovery has begun with a slow, but stable pace since the second half of 2020.

Due to legal and political stability of Luxembourg's regulatory and legislative framework, and growing fund industry and financial sector, the Luxembourg market continues to generate further M&A transactions aimed at European-based targets.

In December 2020, the EU and China reached an agreement in principle on investment that places an emphasis on providing access to the Chinese market for European investors. It ensures fair treatment for EU companies in the Chinese market and enables more cross-border deals between EU and China, in order to create a better balance in the EU–China trade relationship. The framework is likely to play a key role in helping the Luxembourg and EU markets to recover.

|

|

M&A recovery that began in the second half of 2020 will accelerate in 2021 |

|

|

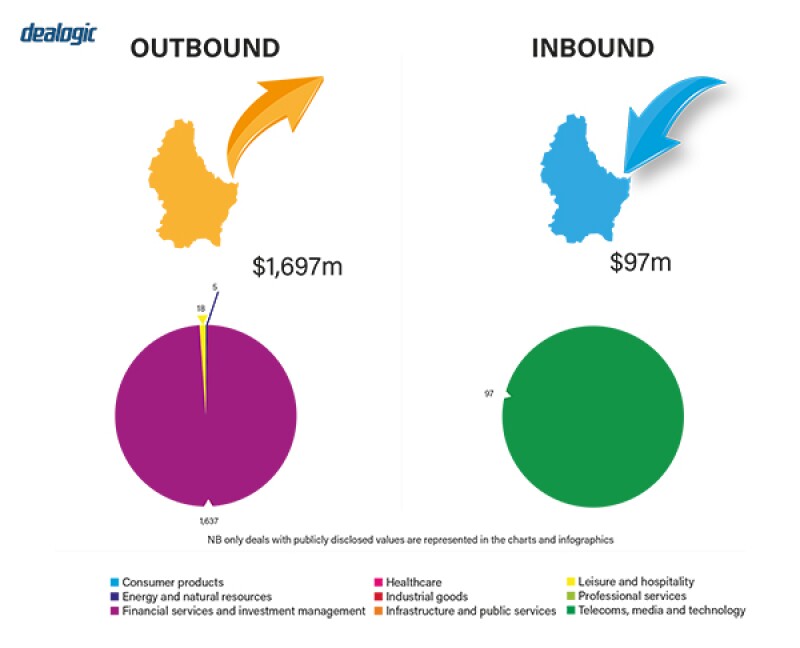

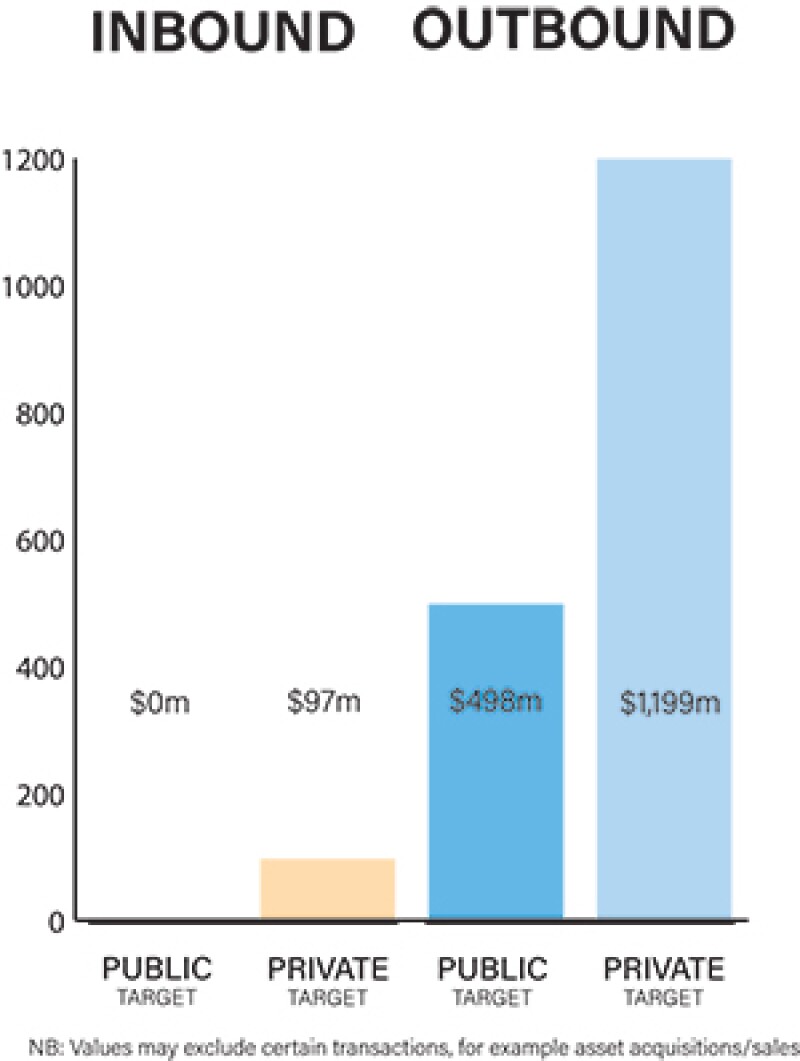

The market is characterised by a mix of private and public M&A transactions, while key sectors for M&A activity remain diverse. The deal volume for Luxembourg itself is rather small, however the number of M&A deals steered through Luxembourg vehicles into other markets remains high. M&A targets in both the private and public sectors are often not located in Luxembourg itself but in other jurisdictions. Due to the positive legal and business environment in Luxembourg, M&A transactions with European targets orchestrated from a Luxembourg-based structure (investment fund or other) are quite common.

Despite the reduction in deal flow, major Benelux-based deals have progressed. A recent notable transaction saw TMF Group acquire Selectra Management Company, a regulated management company from Luxembourg serving both alternative investment funds and undertakings for the collective investment in transferable securities, from Farad Group. The transaction was completed in mid-February 2021.

Moreover, in mid-2020, Netherlands-based Van Mossel Automotive Group acquired a Luxembourg car dealer called Autopolis, with around 320 people in Luxembourg who deal in 13 car brands, from a Belgian investment firm to form the largest car network in the Benelux region. The transaction was completed in January 2021.

COVID-19 and recovery plans

The disruption caused by the COVID-19 pandemic is far-reaching and profound. Both domestic deals and cross-border deals have declined. 'Safety first' are the keywords for most businesses during the COVID-19 pandemic. The priority is to conserve cash and protect revenue streams rather than investing in M&A.

The most significant factors influencing deal structures relate to:

Industry consolidation, M&A-driven growth, financing considerations or other factors;

Distressed M&A work: takeover reorganisations, bidding, post-M&A closings; and

The impact of COVID-19 on M&A-related disputes, use of indemnity provisions.

During the COVID-19 pandemic, parties may structure M&A deals differently. It is prudent for sellers to look into the material adverse change (MAC) clause carefully, as there could be a high possibility that purchasers may argue that the COVID-19 pandemic qualifies as material adverse change and attempt to terminate the transaction on that basis.

As for structuring the purchase price, the substantial drop in market value of some listed issuers and unlisted entities due to COVID-19 should be considered. A certain recovery in share prices and enterprise values is currently occurring, which is very good supporting hopefully further M&A activities in 2021.

Under these circumstances it is important for both parties, having negotiated the purchase price of the target company during the pre-COVID-19 period, to ensure that it is still considered fair for the value exchanged, or otherwise either party or both parties may attempt to renegotiate or terminate the deal. By tying a portion of the purchase price to the performance of the target company after closing, i.e. earn-out provisions, is also a way to give purchasers a degree of security and certainty. An agreement on the allocation of risk on earn-outs may be a suitable compromise to save certain deals as well as diminish the impact of COVID-19.

The investment funds industry continues to play a major role in the Luxembourg financial and legal market. As at December 31 2020, the total net assets of undertakings for collective investment, comprising UCIs, specialised investment funds and SICARs, amounted to €4,973.780 billion (approximately $5,991 billion). The volume of net assets rose by 5.40% in the last 12 months. These funds have been investing and will generate further M&A transactions aimed at mostly European-based targets.

M&A activities in the Luxembourg market are expected to bounce back in the second half of 2021 and 2022.

Legislation and policy changes

The key legislation is the law of August 10 1915 on commercial companies, as amended (Corporate Law). The Corporate Law provides for all kinds of corporate entities and corporate instruments to create tailor-made structures useable for M&A transactions. The Corporate Law has introduced new forms of corporate entities, further enhancing corporate structuring via Luxembourg as a platform. The special limited partnership (société en commandite spéciale) and the simplified private limited liability company (société à responsabilité simplifiée) are examples of this.

|

|

New legislation in relation to reportable cross-border arrangements is expected to have an impact on cross-border M&A structuring |

|

|

Another key piece of legislation is the law of May 19 2006 implementing Directive 2004/25/EU on takeover bids, as amended (Takeover Law), which covers squeeze-out and sell-out rights and contributes to M&A transactions of Luxembourg-based target companies. A natural or legal person acquiring, alone or with persons acting in concert with it, control over a company by holding 33.3% of the voting rights is required to make a mandatory takeover bid to all the holders of shares in the Luxembourg company. As far as the competent authority is concerned, the Takeover Law states that if the target company's securities are not admitted to trading on a regulated market in the EU member state in which the company has its registered office, the competent authority to supervise the bid will be the authority of the member state responsible for the regulated market on which the company's securities are admitted to trading.

The law of July 21 2012 governing the mandatory squeeze-out and sell-out of securities of companies admitted or previously admitted to trading on a regulated market, or having been offered to the public (Luxembourg Squeeze-Out and Sell-Out Law) also plays a role.

The Luxembourg Squeeze-Out and Sell-Out Law applies to the following scenarios:

If all or part of a company's securities are currently admitted to trading on a regulated market in one or more EU member states; or

If all or part of a company's securities are no longer traded, but were admitted to trading on a regulated market and the delisting became effective earlier than five years ago; or

If all or part of a company's securities were the subject of a public offer which triggered the obligation to publish a prospectus in accordance with Directive 2003/71/EC of the European Parliament and of the Council of November 4 2003 on the prospectus to be published when securities are offered to the public or admitted to trading (Prospectus Directive) or, if there is no obligation to publish according to the Prospectus Directive, where the offer started in the previous five years.

The Luxembourg Squeeze-Out and Sell-Out Law does not apply during, and for a certain grace period after, a public takeover, which is or has been carried out pursuant to the Takeover Directive.

Also, numerous treaties on the avoidance of double taxation allows Luxembourg to support the worldwide M&A activities of Luxembourg private equity (PE) funds and M&A parties.

On March 21 2020, the Luxembourg parliament passed a law implementing Council Directive (EU) 2018/822 of May 25 2018 amending Directive 2011/16/EU as regards mandatory automatic exchange of information in the field of taxation in relation to reportable cross-border arrangements, which is expected to have an impact on cross-border M&A structuring.

On March 17 2020, Luxembourg's Ministry of Finance announced the relaxation of certain tax payment deadlines for companies and self-employed individuals affected by the COVID-19 outbreak. Taxpayers experiencing liquidity problems can ask to cancel advance tax payments for the first two quarters of 2020. Additionally, the same categories of taxpayer will be given up to four months to pay certain taxes due after February 29 2020, without incurring late payment interest charges. These measures provided more relaxation in terms of cash flows for investors coming in and having business Luxembourg during COVID-19 pandemic.

In addition, on July 17 2020, the Law of July 10 2020 was passed creating a register of fiducies and trusts entered into force. It transposed Article 31 of Directive 2015/849/EU as amended by Directive 2018/843/EU, thereby introducing a series of measures increasing the transparency of the beneficial ownership of trusts, fiducies (i.e. fiduciary arrangements) and similar legal arrangements.

It provides, in particular, for the mandatory registration of certain personal data on the beneficial owners of trusts and fiducies in a newly created register of fiducies and trusts, managed by the Administration de l'Enregistrement, des Domaines et de la TVA (the Luxembourg Registration Duties, Estates and VAT Authority). The register is complementary to the register of beneficial owners established by the Law of January 23 2019 creating a register of beneficial owners for legal entities registered in the Luxembourg Trade and Companies Register.

Market norms

Common questions relate to the best choice of PE fund vehicle for an M&A activity. Tax is always an important element when setting up a structure. The structure needs to be tax compliant, serve the interest of the investing group and target entity and consider the upcoming legislative initiatives of the EU.

Any changes proposed by the European Commission to tax regimes applicable to M&A structuring must not treat one member state in an unjustified manner while other member states continue to implement unreasonable tax rules. From Luxembourg's perspective, a more unbiased approach by the European Commission would be welcomed. In this context, the European Commission should not completely suppress tax competition among member states, given the growing pressure from the UK and the US in lowering tax rates. The European Commission should also take a look at other regions in the world and be careful to open up more than they do. Otherwise competitive disadvantages might occur for the EU and its member states.

Technology makes negotiations and deal closings easier for parties who are not residing in the same country. Some law firms use artificial intelligence (AI) software to conduct legal due diligence. AI software enables rapid identification and extractions of key provisions by reviewing thousands of contracts and other documents within a short period of time. However, advanced technology is not a substitute for human beings, rather a tool to allow us to get deals done more quickly and efficiently, and often at a lower cost.

Public M&A

Key factors for public M&A involve complying with the provisions of the Takeover Law. This includes complying with the requirement to notify supervising authorities and with reporting requirements under the law, as well as with other elements related to the activity. In particular, parties to an M&A transaction need to assess how the managing bodies of the takeover target are to be approached and what governmental authorities need to be notified.

The market practice in Luxembourg regarding break fees shows that break fees are regularly negotiated at the beginning of a transaction. This is common in Luxembourg and it is also accepted by Luxembourg service providers that a break fee can include a certain discount, given the economic downside of an unsuccessful bid.

Private M&A

The concepts mentioned above also apply to Luxembourg private M&A transactions. The locked-box mechanism might span a minimum period of six months to two years. Completion accounts need to be presented and they may be audited. A growing number of private M&A transactions can be seen in financial sector entities such as alternative investment fund managers or banks.

|

|

The relaxation of certain tax payment deadlines for companies was announced in 2020 |

|

|

In private takeovers, deal conditions are subject to specific transactions. All conditions, however, must comply with applicable law and should be identified duly in advance of starting the deal. The Corporate Law provisions apply, as do the constitutive documents of the privately-owned target entity. A shareholders' agreement will most likely also be put in place and this will contain provisions pertaining to drag-along, tag-along and pre-emptive rights.

Parties to M&A transactions are inclined to have the share purchase agreement (SPA) governed by and construed in accordance with the law of the country where the target entity is located. SPAs involving Luxembourg-based target entities are typically drafted under and made subject to Luxembourg law.

Exit strategies remain the standard ones. IPOs are often prepared as an exit strategy; however, a sale is often preferred over an IPO. Sales to strategic sponsors are rare, however sales to or among PE firms are increasingly common.

Looking ahead

It is expected that the M&A recovery that began in the second half of 2020 will accelerate in 2021, as corporate and private investors have access to capital and can pursue deals to build scale and expand scope.

A growing number of M&A transactions are expected, including in Luxembourg, however, M&A transactions launched from Luxembourg vehicles into other EU jurisdictions are even more important. Brexit will hopefully continue to bring new opportunities to the Luxembourg market.

Click here to read all chapters from the IFLR M&A Report 2021

Marcus Peter

Partner

GSK Stockmann

T: +352 271802 00

Marcus Peter is a partner at GSK Stockmann. He earlier worked in a leading independent Luxembourg law firm for 12 years (four years as partner), before opening the Luxembourg office of GSK Stockmann in 2016.

Marcus specialises in investment funds, PE and venture capital as well as corporate and M&A law. He regularly speaks at investment fund events and is also a member of the Cross-Border Business Lawyers Network.

Marcus studied at Rostov-na-Donu State University and Saarland University, and is qualified in both Germany and Luxembourg.

Kate Yu Rao

Senior associate

GSK Stockmann

T: +352 271802 00

Kate Yu Rao is a senior associate at GSK Stockmann in Luxembourg. Prior to joining the firm, she worked for a leading independent Luxembourg law firm.

Kate specialises in matters associated with investment funds, PE activity, corporate and finance. She holds a qualification as a fund manager accredited by the Securities Association of China.

Kate studied at the East China University of Political Science and Law, at the Erasmus University Rotterdam and at Bologna University. She also speaks Chinese and is qualified to practice in China.