By Brie Lam

In September 2013, the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions (BCBS-Iosco) released their finalised framework on Margin Requirements for Non-centrally Cleared Derivatives. The framework, which established a set of international standards covering the over-the-counter (OTC) derivatives markets, came about at the prompting of the G20 following the global financial crisis of 2008-2009.

The guidelines had two stated objectives: firstly, to minimise systemic risk, and relatedly, to promote centralised clearing. Global regulators adopted and implemented the BCBS-Iosco framework into a set of rules dubbed the uncleared margin rules (UMR).

The rules directly address the G20’s call for non-centrally cleared contracts to be subject to higher capital requirements. By raising the amount of collateral required to trade uncleared derivatives, UMR increase the cost of funding for trading bilaterally; counterparties are incentivised to shift their trading to the cleared space, where collateral requirements are lower.

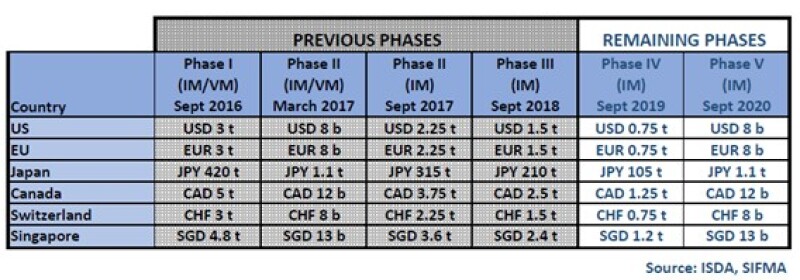

While there are jurisdictional differences in the implementation of the BCBS-Iosco framework, the timeline for implementation is globally consistent, and is underway (see table 1). Variation margin compliant with UMR, known as regulatory variation margin or regulatory VM, was phased in on September 1 2016 for an initial 19 dealers, and on March 1 2017 for remaining market participants.

Regulatory initial margin (regulatory IM) is currently being implemented in five progressive phases.

Phase five, which captures an estimated 1,100 entities, will come into force on September 1 2020, based on the International Swaps and Derivatives Association’s (Isda) estimates. Sixty entities are estimated to be captured under the phase four implementation deadline. By comparison, fewer than 40 entities were caught by the rules in phases one, two and three combined.

Table 1: Regulatory variation margin and regulatory initial margin phase-in schedule for major jurisdictions

The more gradual phase-in of regulatory IM versus VM is appropriate given the more complex nature of the requirements as applicable to initial margin reform. Before delving into complexity differences, let’s examine the difference between VM and IM. Reference table 2 for definitions of each.

What’s the difference between variation margin and initial margin?

Historically, collateralisation for uncleared derivatives was bilaterally negotiated and documented under a single legal agreement, typically an Isda credit support annex (CSA) to an Isda master agreement, or an equivalent legal document.

The CSA specified the frequency, thresholds and minimum transfer amounts by which VM would be exchanged and the forms of eligible collateral, cash and securities, that could be posted. Initial margin (independent amount) was determined at the time of trade execution, and was determined based on counterparty credit. Neither VM nor IM had been subject to mandatory rules before, much less a global framework.

Prior to across-the-board regulatory VM exchange effective March 1 2017, non-regulatory VM was already being exchanged by market participants; with VM, the UMR applied specific rules to an existing type of funding requirement and process. Conversely, the shift from non-regulatory IM to regulatory IM involves full operational reform due to the introduction of requirements around collateral calculation and collateral segregation, requirements that necessitate extensive process change.

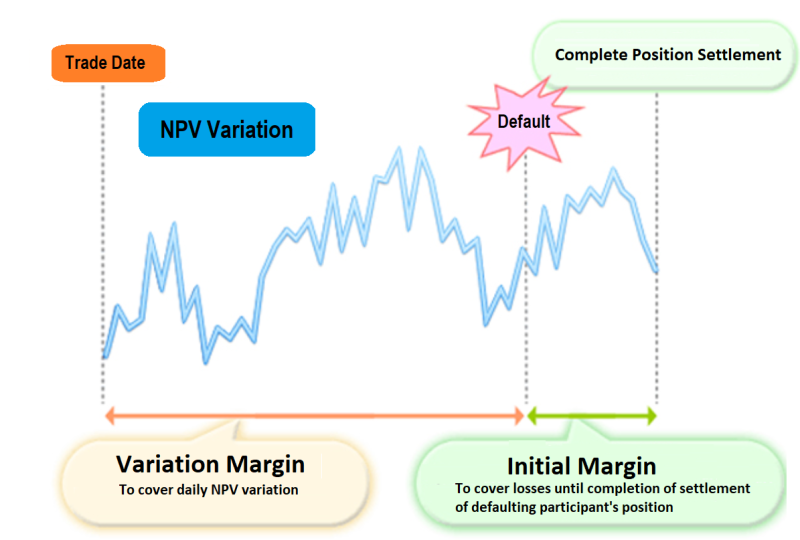

Table 2: Definition of variation margin and initial margin

Source: Japan Securities Clearing Corporation |

|

Variation margin (VM) |

Variation margin protects the transacting parties from the current exposure that has already been incurred by one of the parties from changes in the mark-to-market value of the contract after the transaction has been executed. The amount of variation margin reflects the size of this current exposure. It depends on the mark-to-market value of the derivatives at any point in time, and can therefore change over time. (Source: BCBS-IOSCO) |

Initial margin (IM) |

Initial margin protects the transacting parties from the potential future exposure that could arise from future changes in the mark-to-market value of the contract during the time it takes to close out and replace the position in the event that one or more counterparties default. The amount of initial margin reflects the size of the potential future exposure. It depends on a variety of factors, including how often the contract is revalued and variation margin exchanged, the volatility of the underlying instrument, and the expected duration of the contract closeout and replacement period, and can change over time, particularly where it is calculated on a portfolio basis and transactions are added to or removed from the portfolio on a continuous basis. (Source: BCBS-IOSCO) |

What’s the impact on initial margin processing?

At a high level, UMR apply the requirements below to regulatory IM exchange:

Calculation of regulatory IM

Initial margin must be calculated by one of two means: (1) calculation using standardised schedule included by regulators in the UMR, or (2) calculation using an approved IM model. As of this writing there is one regulator-approved model, Isda’s Standard Initial Margin ModelTM (SIMM). All entities that have implemented regulatory IM in phases one through three are using the Isda SIMMTM.

Collateral segregation and rehypothecation

Regulatory IM must be held and segregated through a third-party custodian. Rehypothecation of IM is not permitted.

Eligibility of collateral

Collateral eligibility for regulatory IM (and regulatory VM) is prescribed by the applicable regulator, and is subject to concentration limits and credit quality assessments. In the EU, wrong-way risk rules apply. Haircuts are applied to securities, including an additive FX haircut where a security posted as collateral is not denominated in the currency of settlement.

Settling of collateral

In most cases regulatory IM (and regulatory VM) will be exchanged on a T+1 basis.

Threshold application

An in-scope entity is not required to post or receive regulatory IM until a consolidated threshold at a group level of €50 million (or $50 million as per the US rules) IM is reached with its counterparty's group.

What are the mandatory UMR compliance dates?

As illustrated in table 1, there are five phased go-live dates for market participants. Which phase of implementation a market participant falls under is determined by the average aggregate notional amount (AANA) of uncleared derivatives by its consolidated group, with each successive phase capturing firms exceeding a lower AANA threshold. Calculating AANA may by particularly challenging for entities under a multi-entity group operating independently.

Implementation deadlines for regulatory VM have passed for market participants. Phases one through three have taken place for regulatory IM; firms deemed in scope for phase four must be compliant with UMR by September 1 2019, and firms deemed in-scope for phase five have until September 1 2020.

Isda and the Securities Industry and Financial Markets Association (Sifma) have highlighted a risk: as smaller and smaller firms are caught under the rules, “[with firms caught under the rules in phases four and five], there may be less familiarity and experience with some of the critical rule requirements, and fewer resources to devote to necessary and comprehensive planning – all in a condensed timeframe.”

Firms that are not compliant by the applicable phase-in date will be unable to continue trading uncleared derivatives, and will be limited to centrally-cleared contracts.

Counterparties with AANA of less than €8 billion or $8 billion are out of scope, as are jurisdictionally-exempted firms. In the EU, for example, firms that are classified as "NFC-", or non-financial counterparties that are not subject to the clearing obligations under the European Market Infrastructure Regulation (Emir): an EU regulation that similarly aims to reduce the risks posed to the financial system by derivatives transactions – are exempt.

What are the major challenges?

There are significant complexities for derivatives market participants in the transition to UMR-compliant regulatory IM exchange.

Industry bodies have sounded the alarm: Isda and Sifma have banded together to highlight to regulators that “the significant number of counterparties coming into scope in the final phases will create an untenable rush of demand on market resources across participants and service providers in a relatively short time period.“

For a given counterparty falling into the scope of UMR, the challenges of transitioning to compliance under the UMR are extensive and not to be underestimated, each arguably deserving of a standalone primer. The challenges can be roughly categorised into three major areas:

Negotiating and executing compliant legal documentation

Counterparties falling in scope on either of the upcoming phase four or five implementation dates will need to ensure that new and compliant CSAs are negotiated and executed with counterparties, and that eligible collateral schedules and account control agreements are negotiated and executed with custodians and counterparties.

Given the high number of market participants falling into scope for phase five, this will cause an industry-wide strain on resources. “There’s a shortage of legal resources with two to five years of experience negotiating Isda documentation. The legal service providers focused on initial margin compliance are all searching for that profile, so the demand is high,” says Matt Allen, head of legal for JDX, a global financial services firm with a practice dedicated to helping clients achieve compliance with margin reform.

Utilising technology

Technological tools are available to streamline and expedite the legal negotiation and documentation processes. Isda and Linklaters have developed Isda Create, an online platform that automates the process of producing and agreeing initial margin documentation. IHS Markit, Allen & Overy, and SmartDX have partnered to introduce another offering, Margin Xchange, which aims to cover all stages of mass repapering of derivatives contracts required to comply with initial margin reform.

Both platforms were released to the marketplace at the start of 2019 to provide a degree of relief to strained legal resources ahead of phases four and five go-live in recognition of the dramatically increased volume of legal documentation required in these latter phases.

Dealers recognise the value of the technological tools. “It’s assumed that all dealer counterparties will be using some type of automation tool in the repapering process,” says Allen. Automation may provide some respite, but does not negate the heavy time investment that negotiation will necessitate. CSAs and eligible collateral schedules are often heavily negotiated and will require significant time input.

Further, for each counterparty pair, mutual readiness to negotiate may come into play. “You may be ready to negotiate, but if your counterparty is not, there is an issue,” says Chris Arnold, partner in the banking and finance practice at Mayer Brown.

Read more from Practice Insight: Race for top initial margin platform is on

Operational integration

Under UMR, firm must calculate regulatory IM using one of two methods: (1) by way of a standardised schedule, also referred to as “grid”, or (2) by way of an approved IM model. Only one IM model has been approved by regulators to date: Isda’s SIMMTM.

Calculating IM by schedule is computationally simpler, but results in calculations reflecting limited netting benefits and higher funding costs. Implementation of the Isda SIMMTM model is more complex, and impacted firms must factor resource availability in to the decision of whether to build or outsource calculation of SIMMTM to a licensed vendor.

In-house build requires resourcing for both actual build and testing, and typically requires longer timelines than outsourcing. With outsourced options, impacted firms need to budget for cost, and plan for vendor integration resourcing. Whether outsourced or built, a counterparty opting for SIMMTM-based IM calculations will have to demonstrate robust model validation processes, including evidencing testing, recalibration and regular auditing. UMR in some jurisdictions require regulatory approval ahead of usage.

Jurisdictional differences in products that are in scope for regulatory IM play a role here, regardless of whether IM calculations are schedule-based or SIMMTM-based. Impacted counterparties will need the ability to tag trades as in or out of scope for the purposes of the IM calculation. Due to jurisdictional nuances, different trades may be in scope depending on the counterparty, and may also be different than those products in scope for VM for a given counterparty pair. Impacted counterparties will need to ensure that the IM calculation is based on the correct trades.

When should they start?

Under the UMR, counterparties must segregate regulatory IM with a third-party custodian. Firms must select one (or more) custodians to execute custodial agreements with, and operationally integrate with their selected custodian(s) ahead of their applicable phase-in date.

As part of that process, impacted firms must satisfy custodial onboarding requirements. From a market-wide perspective, industry participants should begin this process well ahead of their phase-in date, recognising the onboarding and integration pressures that will fall upon a finite number of custodians.

Phase five will be challenging due to the number of entities falling into scope, as well as entity type. “In phase five, we’re likely to see asset managers wanting to post more diverse forms of collateral,” explains Arnold, alluding to the large number of buyside firms that will be caught in the final phase of implementation, and the layer of complexity that it might add to negotiating eligible collateral schedules.

Given the multifaceted nuances of UMR, and the strain that the wide net of phase five will put on resources, industry experts are advising firms to begin the process of UMR adherence earlier rather than later.

Isda recommends that firms likely to fall in-scope in phases four and five notify their anticipated in-scope status to counterparties at least 24 months in advance of the applicable IM go-live date, to best ensure bidirectional readiness. Full readiness may take a counterparty a year or more from start to finish. “In general, an asset manager with multiple dealer counterparties should begin preparations 12 to 15 months prior,” states Arnold, adding: “we’re starting to field enquiries from firms likely to fall into scope for phase five”.

Is there potential for relief?

On September 12 2018, a group of trade associations, led by Isda, recommended a series of amendments to the UMR (as applicable to phases four and five) to the BCBS- Iosco, namely that they:

Raise the phase five threshold to either €100 billion (or equivalent) from the current €8 billion;

Remove physically settled foreign exchange swaps and forwards from AANA calculations for phase five average notional amount calculations;

Exempt phase four and five non-dealers from governance requirements for the Isda SIMMTM;

Exempt non-dealers from Isda SIMMTM approval requirements applicable under EU and Japanese UMR.

A partial response from the BCBS-Iosco was received on March 5 2019, in the form of a statement. The response acknowledged recognition of the industry-wide strain on resources that would take place leading up to phase four and five go-live dates.

The BCBS-Iosco statement declared:

“The Basel Committee and Iosco note that the framework does not specify documentation, custodial or operational requirements if the bilateral initial margin amount does not exceed the framework's €50 million initial margin threshold. It is expected, however, that covered entities will act diligently when their exposures approach the threshold to ensure that the relevant arrangements needed are in place if the threshold is exceeded.”

To an entity expected to go live with regulatory IM under phase five, any relief provided by this statement is limited. An entity would still need to have implemented a facility to calculate IM in order to determine whether they are close to breaching the €50 million threshold, although the BCBS-Iosco statement does allow for relief in terms of legal documentation requirements relating to posting regulatory IM.

The other points raised by Isda remain unaddressed. The marketplace awaits further clarity. In the meantime, impacted firms continue their preparations, as the clock ticks on.

Read more on this topic at Practice Insight, IFLR's sister publication. Practice Insight eases regulatory uncertainty by speaking to banks, asset managers, exchanges and trading platforms about how they are complying - or failing to comply - with new rules.

BCBS/Iosco initial margin note is "helpful but vague"

Buyside seeks KYC deadline clarity on initial margin