The 2020 prospects for M&A in the Brazilian market are very positive. The government expects to carry out a series of privatizations and has been focused on pursuing the main structural reforms that the market has long been craving. The devaluation of the real, a trend not expected to change in the short-term, makes Brazilian assets attractive to foreign investors. On top of that, the lower interest rates have been a great boon to investors wishing to finance their deals locally under appealing conditions.

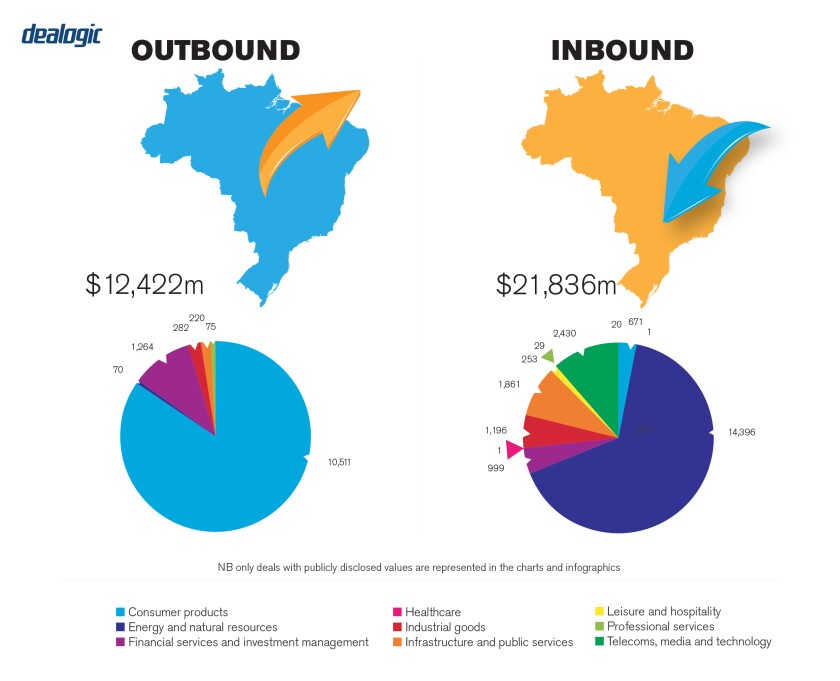

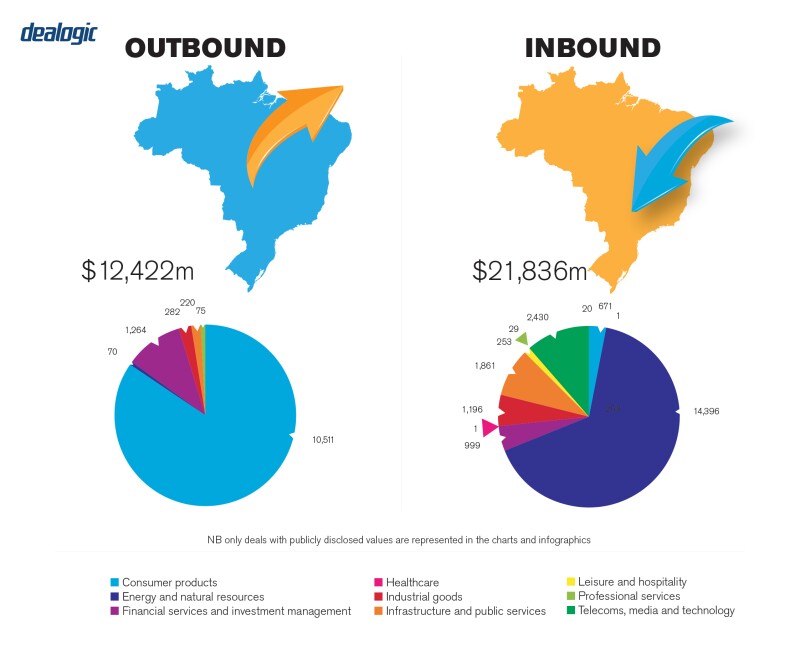

Looking back, 2019 was a record-breaking year for M&A in Brazil, which was the country that registered the highest number of deals in Latin America by far. According to a survey carried out by KPMG, the number of M&A transactions reached 1,231. This represents an increase of 27% as compared to 2018. This movement was led by the tech sector, which accounted for 28.5% of transactions closed in 2019.

Most of the deals were closed in the second semester, following the approval by Congress of the long-anticipated social security reform. Local investors were the first to react to the signs of economic recovery: the number of local transactions more than doubled in the last three years, from a total of 378 in 2017 to 782 in 2019. The implementation of other important reforms, such as the tax, administrative and political reforms, are also on the government's agenda for 2020, which will certainly contribute to maintaining the favourable economic environment in the years ahead.

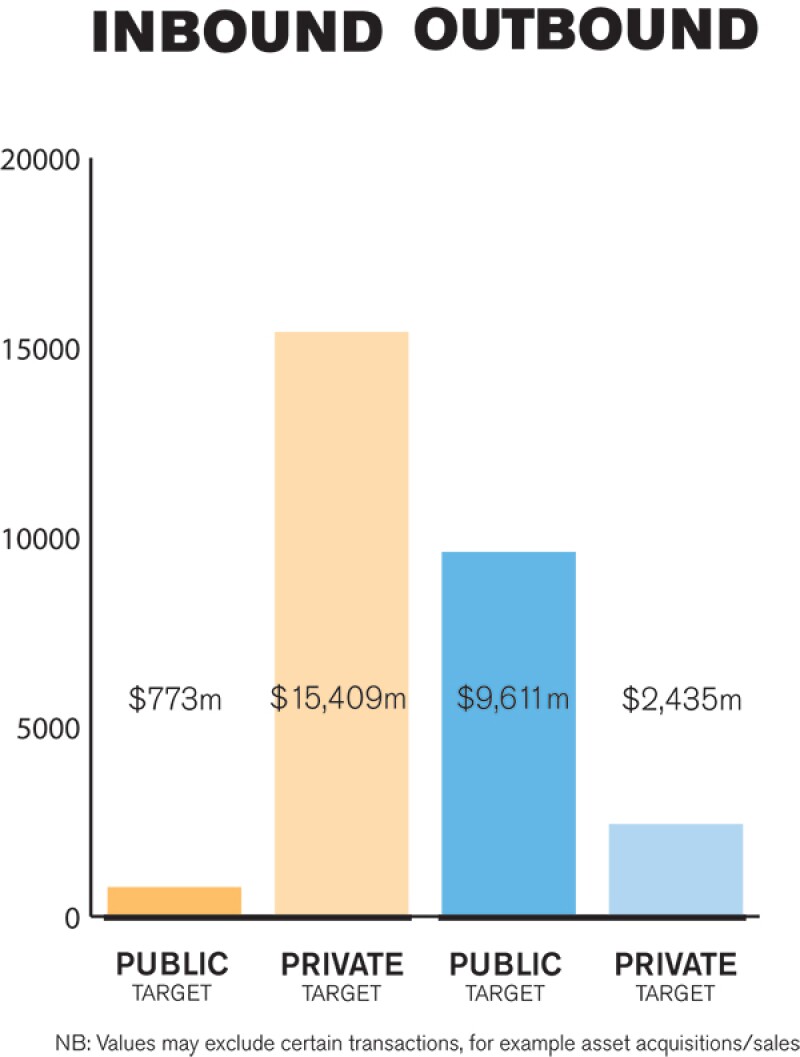

Historically, the Brazilian market has been driven mainly by private M&A transactions, with a minority of deals being public. However, given the recent improvement in Brazil's economic prospects – with the resumption of GDP growth, lower interest rates and the implementation of important market-friendly reforms – the capital markets are again becoming an attractive investment/divestment platform. On another note, following the privatization trend, Petrobras and BNDES have continued to pursue their asset divestment programmes through follow-on offerings in the market.

TRANSACTION STRUCTURES

The Brazilian Federal Government has launched a significant privatization programme, which has drawn interest from a wide range of investors, including international corporations, private equity, pension funds and sovereign wealth funds.

Deal structures in 2019 were mostly influenced by regulatory and tax considerations and the mitigation of contingencies associated with the target company. Another factor playing a key role in structuring of cross-border transactions has been compliance, and pre-deal background checks and compliance due diligence on potential partners have become rather normal in Brazil.

Transactions by financial investors represented about 40% of total recorded deals in 2019, amounting to about R$35 billion ($8 billion) – an increase of up to 25% as compared to 2018. Also, there is no question that financial investors have been responsible for the enhancement of corporate governance rules in Brazilian companies, while also ensuring compliance with the relevant codes.

Among the most notable recent M&A transactions in the market were Petrobras' sale of stakes in TAG and BR Distribuidora.

TAG – R$33.5 billion: Petrobras sold 90% of the shares held in TAG, its gas transportation arm, to an international consortium formed by Engie and the Canadian fund CDPQ. The transaction triggered a lot of discussion as to whether the sale of state-owned companies' subsidiaries should require approval from Congress and be required to run a public auction in strict compliance with the public procurement law. The controversy reached the Brazilian Supreme Court, which ultimately decided that: (I) congressional approval was not necessary in this case; and (II) as long as an efficient competitive bid was put in place, there was no need to follow the public procurement law formalities. This ruling was important as it paved the way for public companies to more easily divest their subsidiaries.

BR Distribuidora – R$9.6 billion: Petrobras sold 33.75% of its shares in BR Distribuidora, its oil distribution division, by means of follow-on offerings, totalling R$9.6 billion. Following the offerings, Petrobras' equity interest dropped from 71.25% to 37.5%, resulting in the transformation of BR Distribuidora into a private capital corporation. Petrobras has already announced that an additional number of BR Distribuidora shares will be sold in 2020 as part of the government's privatization plan.

LEGISLATION AND POLICY CHANGES

M&A transactions in Brazil are generally regulated by the Civil Code, Corporations Act, Competition Law and other specific legislation relevant to regulated sectors. The National Tax Code and other tax legislation, as well as some provisions of the Labour Code, may also apply incidentally.

The main regulatory bodies involved in M&A transactions are: (i) the Antitrust Agency – CADE, whenever the transaction triggers antitrust concerns; (ii) the Brazilian Securities and Exchange Commission – CVM, whenever the transaction involves public companies or offerings; and (iii) regulatory agencies, whenever the target activities are developed in a regulated sector. The Brazilian Central Bank's regulations must also be observed in case of direct foreign investments and whenever the transaction involves financial institutions.

There have been at least two significant regulatory changes in this context. The first is social security reform. One of the government's key milestones in 2019 was the approval of the social security reform package. There was a lot of speculation as to whether Congress would approve it by the end of the year. This certainly contributed to the volatility of the stock market and prompted many companies to postpone IPOs planned for 2019. The reform was finally approved in the second semester, resulting in Brazilian interest rates reaching an all-time low, while credibility in the public accounts balance increased. This helped to attract further investment into Brazil and explains why most of the deals were closed in the second semester; for example, in the tech sector, 223 transactions were completed between July and December, against 151 in the six first months of the year.

A second key legislative change came in the form of the Economic Freedom Law. The Declaration of Economic Freedom Rights was enacted in September 2019, with the aim of reducing overall bureaucracy for new investments and increasing freedom within private relations. Some of its changes include the possibility of limiting the liability of shareholders of investment funds and mechanisms to facilitate the incorporation, operation and maintenance of legal entities in Brazil.

Meanwhile, two structural reforms are top priority in the government's agenda for the first quarter of 2020: the Tax Reform and the Administrative Reform. Brazilian tax legislation is notorious for being complex and burdensome. This is certainly one of the main hurdles for foreign investors when analysing investments into the country. The main goal of the Tax Reform is to simplify the tax system to make the rules more predictable and clearer.

MARKET NORMS

A frequent misconception that investors have about the Brazilian market is that an asset deal entails fewer liabilities than a share deal. This might be true in some of the cases, but prospective buyers must keep in mind that whenever the sale of a whole division of a company is on the table, successor liability may apply, including in connection with tax and labour contingencies. For this reason, if an asset deal is considered the best option for a certain transaction, parties should carefully evaluate the need to extend the scope of due diligence to cover not only the target's assets, but also the seller. In these cases, it is also important to include proper protective language in the agreement and ask the seller for warranties against losses in connection with successor liability.

Another common mistake is for parties to kick off due diligence without first performing an antitrust assessment of the proposed transaction. The provision of sensitive commercial information to prospective investors prior to antitrust clearance, if required, may be considered as gun jumping, subjecting the parties to quite significant penalties. Accordingly, before granting a prospective buyer access to a target's information, the seller must check if there is any need to limit the provision of sensitive information to specific members of the buyer team (ie clean team) and/or to execute an antitrust protocol.

Legal tech

As in any other industry, artificial intelligence (AI) is consistently gaining ground in the legal scene and in the M&A deal-making process. According to the latest surveys, some of the ripest areas for development and AI usage will be in market and sector data extraction, company selection, due diligence, business valuation, add-on transactions and exit strategies. An example of how AI can currently optimize M&A activities is machine learning software that analyses contracts and other documents, generating quantitative and qualitative reports to help advisors map key issues associated to the transaction and the target.

PUBLIC M&A

The acquisition of control of public companies is generally regulated by the Corporations Act and more specifically by CVM Ruling No. 361, which sets forth the general principles and procedures applicable to public offerings, including their launching, modification, liquidation, intermediation, valuation and auction, as well as rules about the content and publicity of such offerings.

The acquisition of control of public companies through private negotiations with the controlling shareholder triggers a legal requirement that the buyer issues a public offering to acquire the remaining shares of the company. Pursuant to the Corporations Act, the price paid for non-controlling shares must correspond to at least 80% of the price paid to the controlling shareholder. In the event target is listed in certain special corporate governance segments of B3, the conditions offered to minority shareholders must match the ones offered to the controlling shareholder.

Voluntary offers are a relatively recent phenomenon in Brazil; a product of the increase in the number of companies with a higher free float of shares and no defined control. The rules applicable to voluntary offers have been recently amended by CVM to eliminate some gaps and ambiguities that became evident in light of recent transactions. Indeed, one of the main objectives of the changes was to better regulate competitive offerings for control.

Separately, public takeovers are usually conditioned to the acceptance by shareholders holding at least 50% plus one of the common shares of the target or whatever number of shares that represents the control of the company. Other common conditions include antitrust clearance, approval from the relevant governmental agency and the non-occurrence of material adverse changes affecting target.

Although not very common, break fees are also becoming more frequent in the Brazilian market, especially following the introduction of the pre-merger control of transactions. Depending on the deal, there is a real chance that the agency will not approve the transaction or that it will impose conditions for closing that might be too challenging for buyer to pursue. Based on past announced transactions, the value of break fees in Brazil corresponds in average to 8% of the transaction amount.

PRIVATE M&A

Completion accounts are still the most popular price adjustment mechanism adopted in the acquisition of Brazilian companies. However, the locked box mechanism is being gradually adopted by some foreign investors (especially European) as an alternative to the time-consuming process of preparing completion accounts, as well as the potential disputes associated to it. Escrow accounts and holdbacks continue to be widely used in Brazil, but we noticed a reduction in the amounts and their duration.

Approval from regulatory agencies, waiver from creditors and antitrust clearance, as applicable, are some of the most common conditions attached to private takeovers in Brazil. It is also common to condition closing to the non-occurrence of material adverse changes (MAC) affecting the target prior to closing. The concept of MAC can vary, from broad conceptual definitions to very specific quantifiable events agreed by the parties. Accuracy of R&Ws on the closing date is also usual, in most cases associated to a materiality criterion.

Although it is possible to use a foreign law in Brazilian deals, it is not common to provide for foreign governing law in agreements for the acquisition of Brazilian companies. Considering that Brazilian law would still apply to many extents of the transaction (ie transfer of shares, registration rules, governance, regulatory requirements, etc) most investors choose to have Brazilian law governing the contracts. It is common, though, for investors to raise the prospect of using a foreign jurisdiction or arbitration seat outside Brazil to solve disputes under these agreements. However, foreign decisions, whether court rulings or arbitral awards, are subject to ratification by the Superior Court of Justice in order to be enforceable in Brazil (exequatur), and this process can take a long time. For this reason, investors tend to agree on the election of arbitration (seen as a more neutral dispute resolution method) in Brazil.

W&I insurance is still rather incipient in Brazil. Currently, we only have notice of two insurance companies that offer the product in the local market and the number of deals that relied on such coverage is still very low.

In terms of the financing environment, over the last years, Brazilian interest rates have been systematically falling and have now reached historical lows. This fact, added to the expected growth in GDP and the anticipated reduction of the state's interference in the economy, was responsible for a booming capital markets in 2019 and promises excellent prospects for 2020. From January to October 2019, R$71.3 billion was raised in the market, compared with a R$7.2 billion over all of 2018. This environment is especially favourable for mid-sized companies that have traditionally sought funding from bank debt and may now find a solid alternative in the Brazilian capital markets in the years to come.

LOOKING AHEAD

The prospects for Brazilian economy look very promising for the year ahead. The interest rates have reached historical minimums in a sustainable fashion and GDP should grow at 2.5%, according to projections. On the other hand, the Federal Government of Brazil has committed to implementing long-awaited reforms, for instance in the tax and administrative areas. Also on the government's agenda is an aggressive privatization plan that includes the sale of up to 300 public assets, including state-owned companies, their subsidiaries and other corporate stakes. It is estimated that these transactions will raise as much as R$150 billion for the state coffers. These factors taken together with low inflation and the devaluation of the Brazilian real should make for a positive and busy year in the M&A markets.

About the author |

||

|

|

Fabiano Gallo Senior partner, Campos Mello Advogados São Paulo, Brazil T: +55 11 3077 3500 Fabiano Gallo is a senior partner in Campos Mello Advogados, based in São Paulo. He is the co-head of the firm's corporate and energy practices. His experience spans different areas of law, especially in M&A, corporate governance, foreign investment, energy and infrastructure. Throughout the years, Fabiano has participated in over 100 M&A and joint-venture transactions (local and cross-border). He has been recognized as a leading lawyer by the main legal rankings, including IFLR 1000, Chambers Global, Chambers Latin America, The Legal 500, Leaders League, Best Lawyers and Análise 500. |

About the author |

||

|

|

Carolina Marcondes Sant'Angelo Partner, Campos Mello Advogados São Paulo, Brazil T: +55 11 3077 3500 E: carolina.santangelo@cmalaw.com Carolina Marcondes Sant'Angelo is a partner in Campos Mello Advogados' corporate practice, based in São Paulo. Her experience is focused in corporate law, corporate governance, M&A and private equity transactions, foreign investment and commercial contracts. Her experience also encompasses planning and structuring of business transactions and corporate activities in different sectors of the economy, legal advice and coordination of corporate reorganisation projects and joint-ventures, as well as legal assistance with day-to-day corporate issues. She has been recognised as a leading lawyer by some of the main legal rankings, including The Legal 500 and Análise Advocacia 500. |

About the author |

||

|

|

Carla Steinberg Senior associate, Campos Mello Advogados São Paulo, Brazil T: +55 11 3077 3500 Carla Steinberg is a senior associate in Campos Mello Advogados corporate and energy practices, based in São Paulo. Carla's practice is focused in M&A, corporate law, corporate governance, foreign investment, private equity, energy and infrastructure. Carla also has experience in assisting foreign investors to establish and consolidate their presence in Brazil through the acquisition of projects, operating assets and companies, as well as by forming partnerships with local players in the market. |

About the author |

||

|

|

Breno Menezes Coelho Cintra Associate, Campos Mello Advogados São Paulo, Brazil T: +55 11 3077 3500 Breno Cintra is an associate in Campos Mello Advogados' corporate and energy practices, based in São Paulo. He is focused on corporate law, M&A, foreign investment and commercial contracts. His experience also encompasses assisting clients in the power sector, especially in M&A transactions, and legal advice with day-to-day corporate and contract matters. |