Loyens & Loeff associate Diana Lafita explains what portfolio managers need to know about the new requirements and how they fit into the existing regulatory framework

The regulation of the world's financial market has reached a peak in the aftermath of the last global financial crisis. After the banks, who were the first to undergo more stringent capital requirements, other financial players have become next in line to face more severe regulatory control: potentially a direct consequence of a crisis that affected investors in a variety of circumstances.

Along with a desire for efficiency, this has led Switzerland to homogenise regulatory requirements and apply them to all financial market players following the golden rule 'same business, same risks, same rules'. For this purpose, a new cross-sectorial financial markets architecture has been developed with the aim of creating a level playing field for all market participants.

In this context, the Financial Services Act (FinSA) and Financial Institutions Act (FinIA) entered into force in January 2020 as a central piece of the new financial market architecture in Switzerland, having a horizontal impact across different sectors of the financial market, and including asset managers. Of all financial players, the new regulations are undoubtedly having the greatest impact on asset managers.

As a direct result of the new regulations, asset managers face the regulatory duties of FinSA at the point of sale, and of FinIA by means of a new licensing requirement and a corresponding supervisory framework.

Among financial institutions, FinIA lists the following five categories:

Portfolio managers (Vermögensverwalter – this is the new designation of asset managers and will be used in the remainder of this article);

Trustees;

Managers of collective assets (Verwalter von Kollektivvermögen – this is the new designation for managers of collective investment schemes);

Fund management companies (Fondsleitungen);

Securities firms (Wertpapierhäuser – this is the new designation for securities dealers).

This article addresses the new licensing requirements for portfolio managers and trustees as well as the relevant transitory provisions.

The previous system

Formerly referred to as independent or external asset managers, portfolio managers historically operated without a licence and were not subject to prudential supervision. However, they were obliged to comply with anti-money laundering (AML) regulations and to be affiliated with a self-regulating organisation (SRO) for the purposes of compliance oversight with AML and sector-specific standards. Alternatively, they could operate as Directly Supervised Financial Intermediaries (DSFIs) under the supervision of the Swiss Financial Markets Supervisory Authority (FINMA) with regard to AML.

Prior to this rule change, managers of collective assets were already subject to a licensing requirement under the old regime and were supervised by FINMA. An exception to this is when the collective investment fund's units were exclusively distributed to qualified investors and the assets under management did not exceed a de minimis threshold.

New licensing requirements for portfolio managers

General

FinIA provides that all financial institutions, including portfolio managers, require a license from the FINMA. Only after obtaining such a license shall portfolio managers be able to register with the Commercial Registry and start their activity.

The institutions regulated by FinIA are mainly dedicated to deal with assets of third parties. Therefore, FinIA has come up with a licensing cascade in the form of a regulatory pyramid allowing institutes with higher regulatory requirements to carry out the activity of those with lower regulatory requirements, without having to request an additional license.

Activities in scope of the licensing requirement

The core element of the activity of a portfolio manager is the right of disposal of individual portfolios belonging to third parties. The provision of investment advice, portfolio analysis and offering of financial instruments are activities that may typically be offered on top of the core activity

of portfolio managers, but such activities do not trigger any licensing requirement – although they are subject to other regulatory requirements under FinSA.

Although similar licensing requirements apply to them, trustees are assigned a different regulatory category than portfolio managers, and thus require a separate license, except when their activity is conducted by an institution higher in the regulatory pyramid as described above. Their activity is defined as the management or disposal of assets of a trust.

Furthermore, the activity of portfolio managers and trustees must be conducted on a commercial basis. This is the case if one of the following criteria is met:

Yearly gross income of more than CHF50,000 ($51,000);

Onboarding more than 20 clients a year that do not entail one single activity, or maintain more than 20 client relationships in a year; or

Have fully discretionary mandate(s) of assets amounting to more than CHF5 million at a particular point in time.

Some activities are excluded from the scope of application of FinIA, of which the following two can be highlighted: a) management of assets of persons with business or family ties (e.g. single-family office exemption); b) management of assets within the context of employee participation plans.

From a territorial point of view, the portfolio managers subject to authorisation and supervision by the FINMA are those who are active in Switzerland or from Switzerland, including, therefore, those who are based in a foreign country and become active in Switzerland or towards investors domiciled in Switzerland. Cross-border matters are covered later in this article.

The portfolio manager licence also allows managers to be active as a) a manager of collective assets under a de minimis threshold and if distribution is limited to qualified investors and b) a manager of funds of occupational pension schemes, also under a particular threshold.

Licences, supervision and audit

The new supervision of portfolio managers and trustees can be described as a tripartite supervision. Even if portfolio managers and trustees have to be licensed by FINMA, the direct ongoing supervision will be carried out by a new body to be referred to as a Supervisory Organisation (SO). The SO's activity will be conducted by one or more private organisations authorised by FINMA (see for instance FINcontrol Suisse AG, which has been established for this purpose and is a subsidiary of the SRO VQF).

|

|

A new cross-sectorial financial market architecture has been developed with the aim of creating a level playing field |

|

|

It is expected that one or more SOs will be authorised by FINMA in the coming months. If no such SO is authorised by FINMA, supervision would revert to FINMA. The SO can also be, at the same time, an SRO for the purposes of supervision of members with AML regulations. FINMA is the higher supervisory body that will be in charge of licensing the SO, as well as of enforcement actions against portfolio managers and trustees.

Portfolio managers and trustees have to be audited yearly, extendable to once every four years, based on the particular risks of the business. The audit can be conducted by either an audit firm or by the SO.

An overview of the new licensing requirements established by FinIA follows below. FINMA provides a web-based application platform for the submission of encrypted licensing applications in electronic form.

Legal form Portfolio managers or trustees having their registered office or place of residence in Switzerland have to be constituted as either a) a sole proprietorship (Einzelunternehmen); b) a commercial enterprise (Handelsgesellschaft); or c) a cooperative (Genossenschaft); and be registered with the commercial registry.

Fit and proper requirements Directors and executive members, as well as persons or entities with a qualifying holding, must have a good reputation and ensure that their influence is not detrimental to a prudent and sound business activity.

Management The management body must consist of at least two duly qualified persons with representation powers of joint signature. If going concern operations are guaranteed, the management may only consist of one qualified person. At least five years' experience and 40 hours of training in the particular field of activity is considered sufficient for fulfilling the criteria of management qualification.

Financial institutions must effectively be managed from Switzerland. Therefore, managers must be a resident of a place from which they can exercise such management effectively. At least one person that can represent the portfolio manager or the trustee must be resident in Switzerland and be a member of the management or of the supervisory body.

Organisation Financial institutions must establish an organisational framework in order to ensure compliance with the applicable regulations (such as the FinSa). To this end, they have to define their material and geographical scope of activity, assign sufficient qualified staff, and define appropriate risk management and effective internal controls, all in proportion to the size and the risks of the business.

Minimum capital and own funds The minimum capital to be fully paid-in amounts to CHF100,000. In addition, portfolio managers and trustees have to either a) dispose of adequate collateral; or b) take out professional liability insurance which can be accounted to up to half of the own funds to cover the risks of the particular business.

The own funds have to amount to a quarter of the fixed costs of the most recent reported annual financial statements, but do not have to exceed CHF10 million.

Operations Clients' assets have to be deposited separately with a supervised bank or securities firm, and managed based on a power of attorney that allows proof by means of text.

Transitory provisions

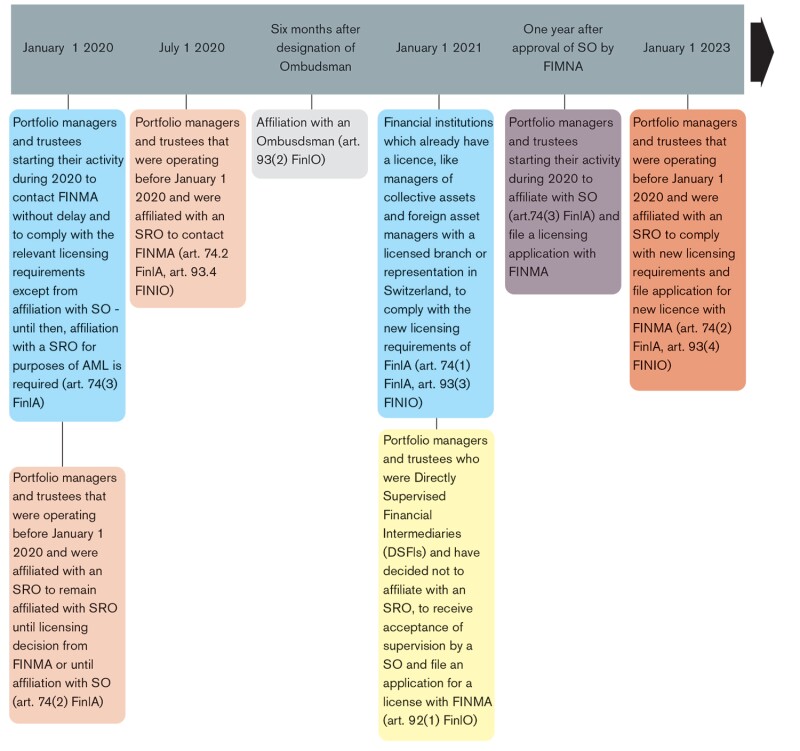

Portfolio managers and trustees who started their activities before January 1 2020 and are affiliated with an SRO will have to contact FINMA by July 1 2020 in order to file an application for the corresponding licence, as well as comply with the licensing requirements by January 1 2023. Until the licence is granted, they must continue to be affiliated with an SRO for AML compliance purposes.

Portfolio managers starting their activities during 2020 are required to contact FINMA and immediately comply with the licensing requirements, except for the requirement of supervision by the SO. At the latest, one year after the approval of an SO, portfolio managers and trustees that started their activities in 2020 will have to affiliate an SO and file an application for a licence with FINMA. Until they have been granted such licence, they are obliged to be affiliated with an SRO for AML compliance purposes.

Figure one on the previous page provides an overview of the transitory provisions of FinIA for portfolio managers, trustees and managers of collective assets.

Figure1

Practical insights

Provided that grandfathering provisions were rejected during the legislative process, portfolio managers who do not reach the size of a profit-based business when taking regulatory costs into account will have to redefine their structure, maximising efficiencies, to survive. Outsourcing certain activities to the extent legally permissible, like risk management, compliance and the internal control system, or the merging of several portfolio managers, may be successful strategies to overcome regulatory challenges.

Cross-border aspects and the EU

According to the Swiss Bankers Association, as of the end of 2018, Switzerland remains the largest market for cross-border wealth management worldwide, managing 27% of global assets managed cross-border. This data includes the business of banks that manage the assets of foreign clients. It is worth addressing some aspects of the cross-border framework of asset management in Switzerland, both inbound and outbound.

Even if non-Swiss portfolio managers do not permanently employ staff to represent them in Switzerland, conducting activities considered as a financial service according to FinSA (such as portfolio management, investment advice or distribution of financial instruments) towards clients in Switzerland triggers the regulatory duties of FinSA - subject to transitory provisions - like the compliance with conduct rules and organizational measures, the affiliation with an ombudsman or the registration with a client advisory registry, with certain exceptions. The offer of fund units by a non-Swiss financial service provider to clients in Switzerland may in addition be subject to further regulatory requirements according to the Swiss Collective Investment Schemes Act.

Non-Swiss portfolio managers that permanently employ staff to represent them in Switzerland require a licensed representation or branch in Switzerland. Financial services – including asset management – of non-Swiss financial services providers which are requested at the express initiative of the client, are subject to certain conditions, deemed not to be provided in Switzerland (self- or reverse-solicitation).

According to Mifid [Markets in Financial Instruments Directive] II, EU member states may decide whether they require the establishment of a licensed branch for the provision of investment services by third-country providers in the EU. Portfolio managers based in Switzerland are generally not allowed to freely provide their services to retail investors which are domiciled in the EU, except by establishing a licensed EU branch or subsidiary, for which purpose they have to notify FINMA in advance. However, in certain member states, Swiss portfolio managers can provide services to professional and institutional clients, subject to the fulfilment of certain conditions. This particular structure is popular due to the good reputation of Swiss portfolio managers. Furthermore, the figure of self-solicitation under Mifid II allows EU investors to approach Swiss portfolio managers at their own exclusive initiative.

For Swiss managers of collective assets, in the past the Alternative Investment Fund Managers Directive (AIFMD) generated some expectations for a so-called third country passport. However, at the moment, the only passport that exists is among EU countries. For Swiss portfolio managers to be active in the EU, EU AIFMs often use the figure of the delegation which inter alia requires the cooperation between regulatory authorities. Alternatively, EU member states may allow third country AIFMs to market AIFs outside the scope of the AIFMD, by establishing a national private placement regime.

Outlook

The Swiss asset management industry faces a considerable regulatory challenge as detailed above but will profit of an enhanced reputation in the global financial arena. The industry will remain alert and will continue to closely follow developments, which will now turn to questions regarding the implementation of the new provisions and the related market practice.

About the author |

||

|

|

Diana Lafita Attorney-at-law, Loyens & Loeff Zurich, Switzerland T: +41 43 434 67 49 E: diana.lafita@loyensloeff.com Diana Lafita graduated from ESADE University in Barcelona, Spain (lic. iur.) in 2005 and from the University of Zurich with an LLM in International Business Law, Banking, Capital Markets and Insurance in 2008. She was admitted to the Swiss Bar in 2012. Diana Lafita was the legal advisor to a multinational insurance group in Zurich dealing with international cross-border matters for four years, then worked as an associate at a leading law firm in Zurich in financial services for five years. In 2019, she joined Loyens & Loeff Switzerland. Her main practice areas are banking and finance, asset management, insurance and fintech. Lafita is a member of the Zurich and Swiss Bar association. She regularly contributes to publications in her areas of practice. She speaks English, German, Spanish and French fluently. |