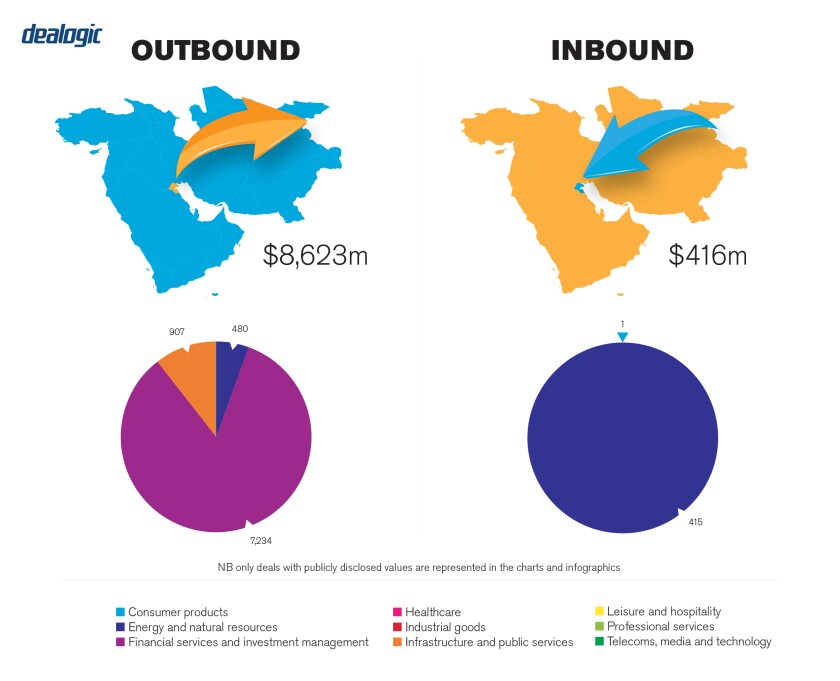

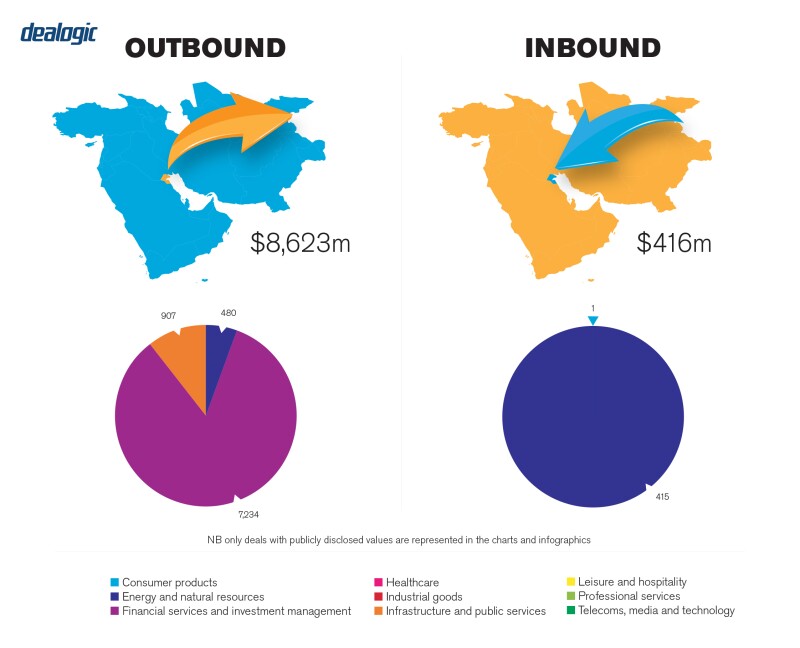

The environment has largely remained the same over the past 12 months and Kuwait has not seen any significant uptick in M&A transactions. If anything, there has been somewhat of a levelling out of M&A activity.

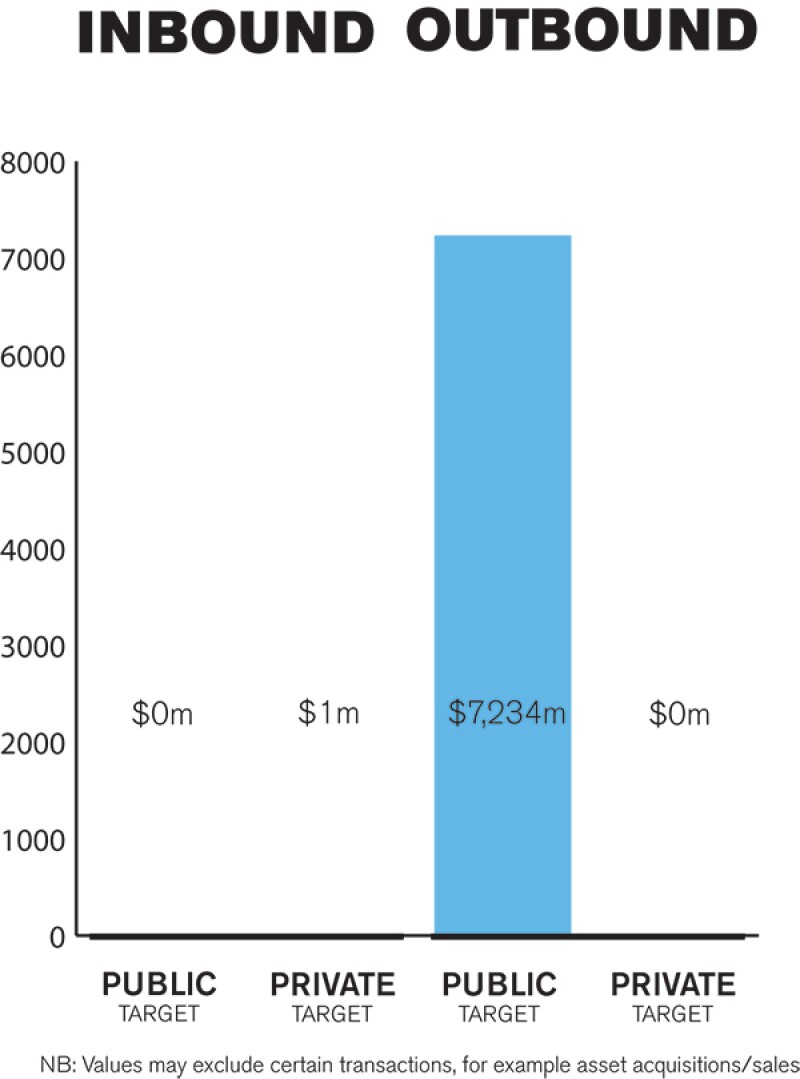

Having said this, there has been a slight narrowing in the activity between public vs. private M&A transactions and we expect this gap to continue to narrow over the next 12 months. This is particularly so given the MCSI's (the world's top equity indexing provider) upgrade reclassification of Kuwait from a frontier market to an emerging market. This is expected to result in significant inflows into Kuwait's stock exchange, Boursa Kuwait (previously known as the Kuwait Stock Exchange). We expect that this development will contribute to increased public M&A activity in Kuwait.

The last 12 months have seen some consolidation activity in the financial sector of Kuwait. Notable in this regard is the proposed takeover of Bahrain-based Ahli United Bank by Kuwait Finance House, Kuwait's largest Islamic bank. Mergers in other GCC (Gulf Cooperation Council) jurisdictions have also impacted the Kuwait market, for example the merger of Union National Bank (UNB) and Abu Dhabi Commercial Bank (ADCB). There has also been some consolidation among Kuwait investment companies, where smaller niche investment companies are being acquired by larger and longer-established investment companies in Kuwait.

Lastly, we did see a slight uptick in public M&A activity in Kuwait. A topic that has come into focus for transaction parties during the last 12 months, and that they are more seriously considering, is the impact of the local competition law regulation. Notwithstanding that local competition legislation has been on the books for quite some time now, it has equally taken some time for the local competition regulator (the Competition Protection Body – CPB) to organise itself internally and put in place all the relevant systems and processes so as to effectively carry out its supervision mandate. In this respect, there has been an awakening of the regulatory role of the CPB and we have seen a much more active CPB, in the sense that it is more visible in the local market and in certain instances has been actively surveying the market (including social media channels) to ensure compliance with local competition regulation. As a result, transaction parties are now more aware of competition regulation issues and will need to be more sensitive to them. We expect this to be an area of further development over the next 12 months.

The Kuwaiti market however remains primarily driven by private M&A. Although we have in the last 12 months seen a slight narrowing between private and public M&A and we do expect more momentum in the area of public M&A.

TRANSACTION STRUCTURES

Along with the recent uptick in public M&A activity, financing considerations have been impacting on deal structures, particularly in relation to the provision of security for financing. Additionally, Kuwait law foreign ownership restrictions also impact M&A transactions and must be catered for accordingly. As touched upon above, antitrust/competition legislation has also been taken more seriously. Lastly, more time is now also being spent on delving into cross-border tax structuring.

Several transactions have raised issues with regard to the scope of confidential information that can be made available to potential purchasers in the context of both private and public targets. A further debate that has been had revolves around the issue of regulatory jurisdiction and applicability of legislative authority over a companies which are cross-listed in Kuwait, and in some instances, which also share common shareholders between two or more companies involved in M&A transactions. A typical example would be the recent takeover of Bahrain based Ahli United Bank (AUB) by Kuwait Finance House (KFH), Kuwait's largest Islamic bank. The issue in this instance was the cross-listing of AUB in Kuwait and potential conflict of interest considerations arising from a certain common shareholder between AUB and KFH. The debate is mainly due to lack of clarity on the subject under the companies and securities laws and regulations. Until this is resolved by clarifying amendments or guidance from the authorities, the matter will be left to parties to determine on a case by case basis.

LEGISLATION AND POLICY CHANGES

Law No. 7 of 2010 as amended (CML) and its executive CML Bylaws, which together comprise the CML Rules, is the primary legislation governing public M&A in Kuwait, particularly Book IX (Mergers and Acquisitions) of the CML Bylaws. The CML Rules apply to M&A transactions where there is an acquisition or consolidation of control of, a) a Kuwait incorporated company listed on Boursa Kuwait (formerly known as the Kuwait Stock Exchange), b) a listed or unlisted company in the event of a reverse acquisition, or c), a listed company by way of a partial purchase offer (resulting in an acquirer holding no less than 30% and no more than 50% of the shares of a listed company).

The Kuwait Capital Markets Authority (CMA) is the primary regulator for public M&A activity in Kuwait. The CML Rules provide a statutory framework for public M&A in Kuwait where there is a takeover offer for 100% of the share capital of a company listed on Boursa Kuwait, and a mandatory takeover offer which must be made to remaining shareholders when the offeror acquires more than 30% of the shares of a listed company.

Consideration should also be had to the CPB in Kuwait. The antitrust/competition regulations in the Competition Law (Law No. 10 of 2007) and the CML Bylaws apply to business combinations in Kuwait. Under the Competition Law, a transaction that results in a person acquiring assets that result in a person exercising 'control' over a market or increasing their 'control' over a market must be referred to the CPB for approval. A person is deemed to exercise 'control' of the market if they alone control more than 35% of a market; or they work directly or indirectly with another person or group or persons to control more than 35% of a market. In addition, the CML Bylaws require that a merger or acquisition should comply with the Competition Law if a transaction results in a person exercising 'control' over a market or increasing control over a market (CPB Notification Threshold).

It is possible to apply to the CPB for a waiver of the notification requirements. In the event the CPB Notification Threshold is not met, there will be no need for CPB approval of a transaction that is governed by the CML Bylaws. However, where applicable, the entities involved in the transaction are usually required to submit an undertaking to the CMA that it is compliant with the Competition Law. The CMA also reserves the right to refer the transaction to the CPB for appropriate action.

There have been no significant changes to legislation that would have an impact on M& A transaction activity in the last 12 months. However, we understand that there is set to be significant overhaul and amendment of the legislative framework vis-à-vis competition regulation in Kuwait and we understand that a draft of the updated regulatory competition framework is already in an advanced stage. This would appear to be in line with the recent increased regulatory oversight presence of the CPB on M&A transactions in Kuwait. Unfortunately, there is no clear timeline on when these changes are to occur.

Value added tax (VAT), although not applicable in Kuwait at this time, needs to be considered for future structuring purposes in M&A transactions. Investors should be aware that the GCC states, including Kuwait, have agreed to the implementation of a GCC-wide VAT framework, to be introduced at a rate of 5% VAT on goods and services, which was to take effect from January 1 2018. Kuwait has recently announced however that it would postpone the implementation of VAT in Kuwait until 2021. In addition, the Kuwait government is implementing fiscal reforms that include introducing a proposed 10% corporate income tax. The national legislation in Kuwait implementing the VAT framework has yet to be promulgated and no Kuwait-specific details of the regime have been released as this time.

MARKET NORMS

Some of misconceptions with regards to the Kuwaiti market include: poor disclosure processes because sellers are sometimes inexperienced in the M&A processes, and targets do not keep track of all the documents needed to be disclosed to the buyers; and misconceptions about the regulatory processes, which are often more complicated than expected. Another common mistake made by practitioners is to import legal structures and documentation developed in other jurisdictions without a proper adaptation to the peculiarities of the Kuwait legal system. This can lead to complications in the execution phase of the transaction and in the enforcement of rights arising under M&A transaction documentation.

An area that is often overlooked and/or paid less attention to, is due diligence. In particular, appropriate translation of due diligence findings into contractual protections, whether by means of pre-closing remedial actions, associated variation of commercial terms, special indemnities or other methods is deficient. This often arises because the legal practitioners that carry out the due diligence do not always lead the negotiation of transaction documentation. Parties involved in an M&A transaction also often overlook certain aspects of the Kuwait competition law, however, a more serious consideration is being provided to competition law considerations and the impact these may have on M&A transactions. Furthermore, the rendering of M&A/investment advisory services with respect to securities onshore of Kuwait is a regulated securities activity under the CML Rules. As such, foreign services providers should be aware of the restrictions applicable in connection with the rendering of such services onshore of Kuwait.

Technology is playing an ever more significant role in the M&A deal-making process. It is also key in identifying the latest trends, benchmarking and further enhancing the knowledge system databases of M&A practitioners. The great advances made in cognitive technology – such as artificial intelligence software – also enable the rapid identification and extraction of key provisions through review of thousands of transaction documents within a relatively short space of time. Including an M&A technology partner on one's team can enable you to greatly facilitate the M&A process, reduce costs and free up resources.

PUBLIC M&A

The general conditions for a public M&A transaction have been outlined above but there some key factors that specifically concern takeovers. In such cases parties must obtain all relevant regulatory consents from the applicable regulatory body, such as for example, the CMA for licensed companies and/or (as applicable) the CBK vis-à-vis financial institutions which are subject to supervision by the CBK. Disclosure of the transaction is also required as per the CML Rules.

Parties must also abide by the laws and regulations of each sector. For example, pursuant to the CML Rules, for companies listed on the exchange of Boursa Kuwait, an MTO must be launched by the bidder once the bidder has come into possession of more than 30% of the voting shares of a target company listed on the exchange.

An MTO must not be subject to conditions that can only be satisfied at the discretion, and in the subjective judgment, of the bidder or the target company, or where their satisfaction is within the control of the bidder or the target company. Only voluntary takeover offers (VTO) may be subject to conditions required by the bidder. However, in the case of an MTO takeover offer, no conditions may be imposed by the bidder.

Otherwise, the terms of an M&A agreement are generally left to the discretion of the parties. There are no specific rules in Kuwait dealing with break fees and parties are free to agree specific arrangements to this effect. We are not aware of any trends/market standards in this regard.

PRIVATE M&A

Locked-box mechanisms are common in Kuwait. Earn-outs and escrow are very common in larger transactions of KD30 million ($100 million) and above, whereas completion accounts are less used in the Kuwaiti market. The use of tools such as warranty and indemnity insurance are not common in Kuwait.

An MTO must not be subject to conditions that can only be satisfied at the discretion, and in the subjective judgment, of the bidder or the target company, or where their satisfaction is within the control of the bidder or the target company. Only voluntary takeover offers (VTO) may be subject to conditions required by the bidder. However, in the case of an MTO takeover offer, no conditions may be imposed by the bidder.

The use of foreign governing law and/or jurisdiction (for example English law and English courts/arbitration in London) is more common in the case of mid to upper tier M&A transactions involving at least one foreign party, and less so in relatively small or purely local M&A transactions.

Although not common in Kuwait, transaction parties have been looking more closely into W&I insurance, and in limited instances have also sought to procure the same. However, to date there has not been any serious uptake in W&I insurance. This is primarily due to a general perception of such insurance being cost prohibitive. We do however expect this perception to change over time.

LOOKING AHEAD

As touched on above, we are expecting to see an uptick in public M&A transactions on account of the MSCI reclassification of Kuwait to emerging market status, as well the further development of Kuwait law regulation, particularly to the CML Rules, which adds to more deal regulation certainty. We expect to see a narrowing in deal activity between private and public M&A deals, however, we would expect that private M&A activity continue to lead the way.

Of note, we believe that there will be an uptick in tech start-up commercial activity, given the encouragement and support provided by the Kuwait government to small- to medium-enterprises and the role of entrepreneurial incubators in Kuwait that reach into strategic investors and buyers.

About the author |

||

|

|

John Cunha Partner, ASAR-Al Ruwayeh & Partners Kuwait T: 965 2292 2700 John Cunha is a partner at ASAR and has been with the firm since April 2006. John practices in the areas of banking and finance, capital markets and M&A. John holds a law degree awarded by the University of the Free State, South Africa in 1999. In 2002 John was awarded a master of business administration degree (MBA) from the University of the Free State, South Africa (in collaboration with De Paul University in Chicago, US). He also holds a master of laws degree (international trade law) (LLM) awarded by the University of Stellenbosch, South Africa. John was admitted to the South African bar in 2000 and was admitted as a solicitor of the Senior Courts of England and Wales in 2007. John's practice languages are English, Afrikaans and Portuguese. |

About the author |

||

|

|

Ezekiel Tuma Partner, ASAR-Al Ruwayeh & Partners Kuwait T: 965 2292 2700 Ezekiel Tuma is a partner at ASAR and has been with the firm since March 2008. Ezekiel practices in the areas of M&A, private equity, corporate law, banking and finance, project finance, restructuring and insolvency, and oil and gas. Ezekiel has been involved at a senior level and has led on several corporate, M&A, private equity, banking and financing transactions ranging from typical transactions to highly complex ones. Ezekiel holds a bachelor of laws degree (LLB) awarded by Makerere University Kampala, Uganda in 1997. He also holds a master of laws degree (commercial, LLM) awarded by the University of Cambridge, UK, 2000. Ezekiel was admitted to the Ugandan bar in 1999 and is a member of the International Bar Association. Ezekiel's practice languages are English, French and Swahili. |