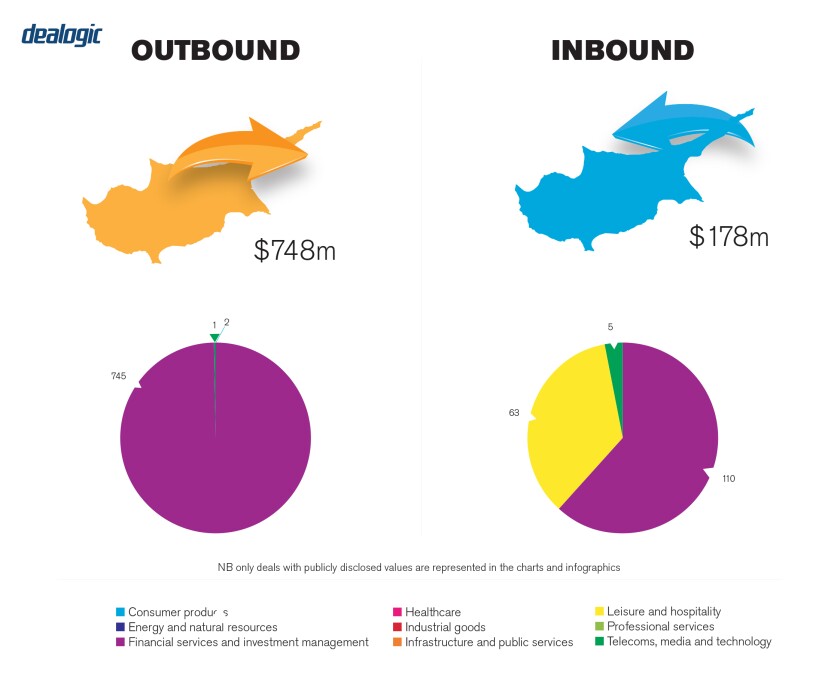

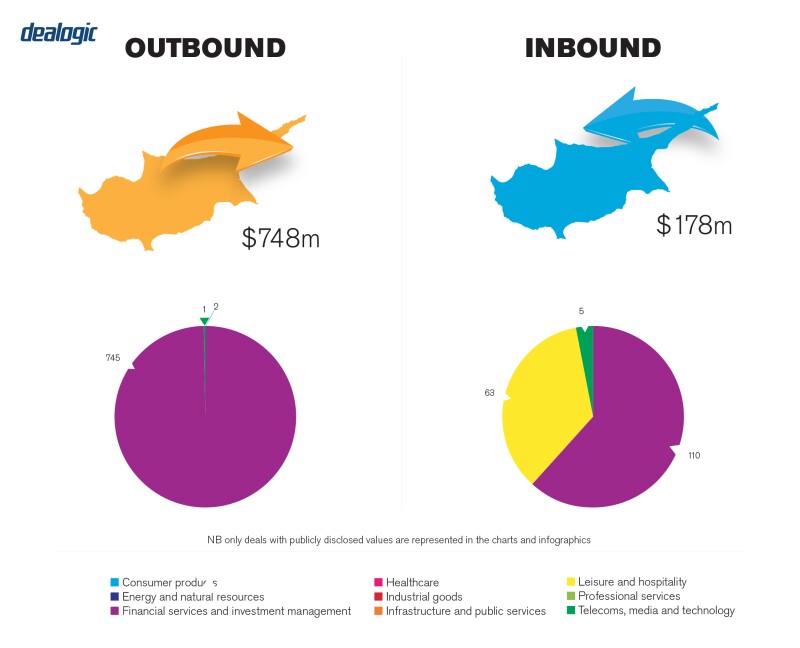

There has recently been a significant increase in domestic M&A activity in Cyprus, mostly as a result of privatisations promoted by the Cypriot government and a wave of consolidation in various sectors, for example in hotels.

The flurry of legislative and regulatory activity in Cyprus and the EU that started in 2017 also boosted M&A activity in Cyprus's banking sector. This trend continued over subsequent years. Nevertheless, the volumes and values of domestic M&A transactions in Cyprus are much lower than those of international M&A transactions involving Cypriot entities. This shows that Cyprus is geared towards international M&A activity.

Cyprus is witnessing a general increase in M&A activity compared to previous years. The country's return to economic growth has seen remarkable interest from foreign investors in the local market, with M&A and joint-ventures (JVs) on the rise. Increased economic activity in Cyprus's key sectors led to a GDP growth close to 4% in real terms in 2018 and average rate close to 3.4% (September 2019), boosted by M&A activity.

The regulatory overhaul in the banking sector over recent years encouraged transactions in the sector, while the hospitality and leisure industries attracted noteworthy investment in the form of new ventures and M&A. Industry consolidation continues to be a major theme in M&A.

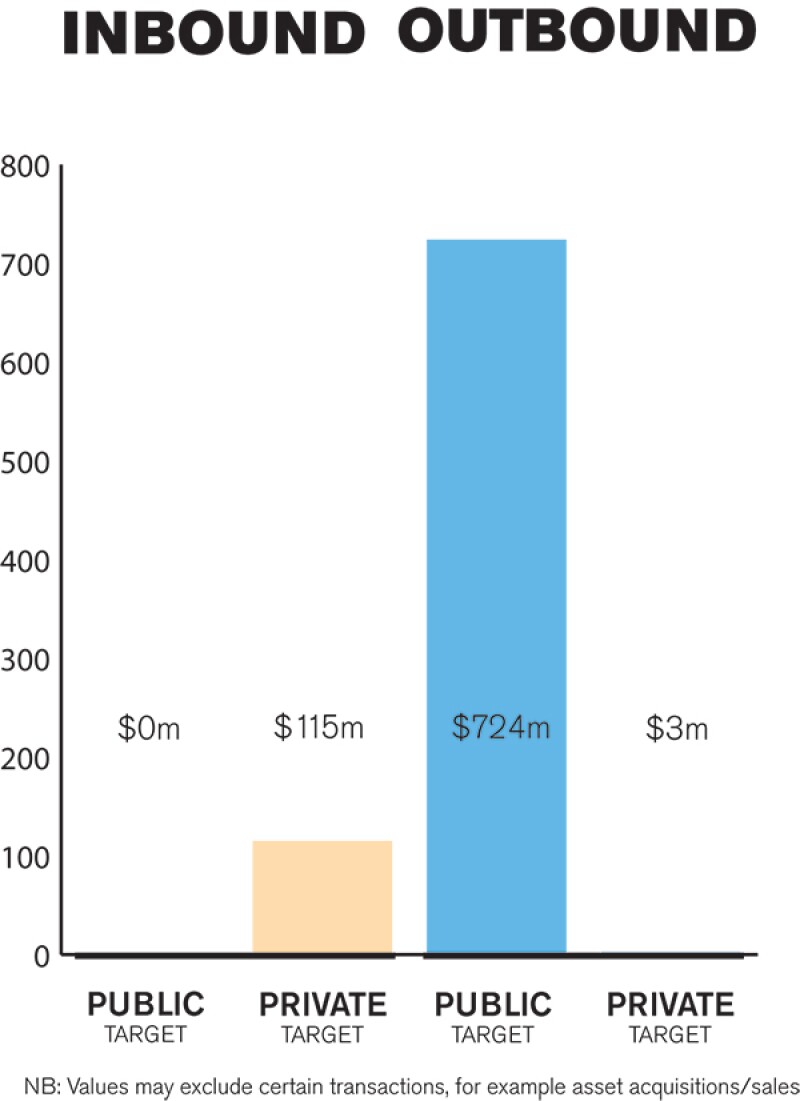

The Cypriot market is driven by both private and public M&A, with a varying emphasis depending on the economic sector. For instance, banking M&A tends to be public, while for private transactions, the main sectors include tourism and leisure. Looking ahead, further consolidation will come as no surprise, as the global trend toward vertical integration and consolidation within industries continues. However, there is no strict correlation between global and domestic trends.

TRANSACTION STRUCTURES

Cypriot case law has developed significantly. Cyprus adopted EU Directive 2005/56 on cross-border mergers and has implemented wide-ranging tax law changes which incorporate provisions for tax-free corporate reorganisations. Both have impacted M&A structuring. Tax for its part, has always been a key value driver in M&A transactions, with substantial cash flows and various potential risks turning on tax considerations.

The increased focus on GDPR and AML policies along with due diligence requirements have also influenced M&A deals.

Given that Cyprus is a common law jurisdiction and its corporate statutory framework is modelled on the English Companies Act of 1948, the Brexit vote has given rise to foreign investment into the UK. Another trend, which will impact private equity participants, is the steady rise in private company valuations. Valuations will be affected by the new limits on deductibility of interest, which tighten up a company's earnings before interest and taxes (EBIT).

Ever-increasing competition in the market is another important trend that will lead to sweeping industry consolidation as both serial and opportunistic acquirers focus on larger strategic transactions with industry rivals and complementary businesses in order to strengthen their market positions.

The oil and gas sector is also likely to generate M&A. Expected activity includes companies entering into new business lines via acquisitions to discover hydrocarbon fields in Cyprus' exclusive economic zone, the exploration efforts being made by oil majors such as Total and ExxonMobil, and the exploration of possible synergies between Cyprus, Israel, Egypt and/or Lebanon.

Recent transactions

Cyprus lurched towards international M&A in 2017 with Eurogate Container Terminal Limassol's acquisition of the operation of the Limassol port, which is Cyprus's principal port and handles 90% of imports and exports in terms of number of containers. The transaction involved Eurogate International, Interorient Navigation Co and East Med Holdings. This deal followed a 25-year concession granted by the government of the Republic of Cyprus to DP World Limassol (which is part of the Dubai-based port and terminal operator).

In 2018, yields inflated amid uncertainties in the Cypriot banking sector, which were linked to developments surrounding the Cyprus Cooperative Bank (CCB). Since an agreement with Hellenic Bank Public Company (HB) to acquire a portion of CCB's assets and liabilities, yields appeared to have fairly recovered, dropping to 2% by the end of June 2018.

In January 2018, there was Astrobank's €40 million acquisition of USB Bank's banking operations. With this acquisition, AstroBank significantly strengthened its position in the Cypriot market. The bank's balance sheet increased by over 50%, reaching €2.1 billion, with gross loans rising to €1.2 billion, customer deposits to €1.9 billion and total capital to over €160 million.

LEGISLATION AND POLICY CHANGES

The key legislation that regulates mergers and acquisitions is the Companies Law (Cap 113). The Law (Articles 198-202) contains provisions about mergers and the reconstruction and amalgamation of companies, and the exchange of shares between two or more companies.

Reference should be made to the Control of Concentration between Enterprises Law (22(I)/ 1999) and the Safeguarding and Protection of Employees Rights in the Event of the Transfer of Undertakings, Businesses or Parts Thereof (104/ (I)/2000). The first relates to fair competition and the second refers to the safeguarding of employees' rights in the event of a transfer of undertakings.

When it comes to public M&A, the relevant regulatory framework is contained in the:

Public Offer Law 2007;

Cyprus Securities and Stock Exchange Law 1995;

Cyprus Securities and Stock Exchange (Public Offer for the Acquisition of Securities and Merger of Companies Listed on the Stock Exchange) Regulations of 1997;

Companies Law sections 198-208;

Insider Dealing and Market Manipulation;

Market Abuse Law (116(I)/2005) (Law 2005).

Key regulatory bodies include the Registrar of Companies, which is the competent authority for recording changes in the shareholding and management of both public and private companies. The Cyprus Securities and Exchange Commission is the regulator for public takeover bids. The Cyprus Securities and Exchange Commission may approve partial bids, provide exemptions to obligatory public bids and impose administrative fines.

The Commission for the Protection of Competition is the national competition authority to which mergers, acquisitions and JVs that meet the jurisdictional thresholds are notified. Implementation of transactions is prohibited prior to clearance by the Commission.

Recent changes in law

Although there have been no significant direct amendments to the Companies Law there have been changes in other laws that could affect M&A transactions. As a general note, lawmakers emphasise investor protection, transparency and corporate governance.

The Markets in Financial Instruments Directive No II (Mifid II) came into force in 2019 and includes:

A new concept of a management body and the strengthening of corporate governance requirements.

Significant penalties for breach of the new laws.

New transparency requirements.

Broadening the regulated legal persons that must now apply for authorisation and in extend to be governed by the EU Directive.

New financial instruments (for example emissions allowances) and new investment products (for example structured products) are now covered under the scope of the new EU Directive.

There have been some changes to the Competition Law in line with the EU framework. In fact, the new law sets rules to ensure that any physical or legal person or public authority that has suffered damage as a result of infringement of the competition law, by an undertaking or association of undertakings, can effectively claim compensation against those undertakings. The new law establishes rules for the disclosure of evidence, whether this is in the possession of the parties or any third parties or included in the file of the national competition authority. In addition, the new law lays down rules on the liability of undertakings or associations of undertakings which have infringed competition law in relation to the damage suffered.

Lastly, we note that the Market Abuse Law 2016 has changed to adopt the rules set out in the Inside Information and Manipulation of the Market Law for the prevention of insider dealing and market manipulation in both regulated and unregulated markets.

There are no high-level discussions for any amendment in the near future regarding the legal framework impacting M&A in the Republic. However, given the rapid economic and political changes in Europe, we are of the opinion that the European Commission will issue further guidelines for implementation in the national law.

MARKET NORMS

The M&A process requires careful planning and a comprehensive assessment of the acquisition target is a must. The following mistakes should be avoided:

Not doing a thorough operational due diligence.

Paying too much for the target.

Failing to communicate the vision and significant growth prospects to bidders together with the financial projections.

Not taking into account the tax considerations, including any applicable rates and trade-offs.

Not identifying organisations' cultural issues and not developing a 'cultural integration outline' that could help to smooth the integration process.

Many M&A deals fail because companies overlook one of three key areas. First, professional assistance. An M&A advisor will help to achieve maximum value and an optimum deal structure from the beginning to the end of the deal. Second, what happens to employees after the deal – for instance, by not having all the key employees tied down to employment contracts? This is critical for the seller to deliver the senior team and the key people to the buyer upon closing; any unwillingness to follow may be crucial. Third, technology underpins every part of a company's day-to-day operations, yet it continues to take a backseat in M&A deal preparations. Ignoring IT can lead to inaccuracies in other parts of the pre-deal process. Any disparities between merging IT systems can slow the process of bringing two companies together.

PUBLIC M&A

Control over a public company can be obtained directly from the shareholders without making a public offer, via court approval, through a merger and/or division of public companies or by making a public offer.

The most common way is making a public offer under the Takeover Bids Law. The procedure is supervised by the Cyprus Securities and Stock Exchange Committee. The bidder must announce its bid to the Cyprus Stock Exchange, the Cyprus Security Committee and the board of directors of the company in order to obtain the relevant approvals.

As per the Takeover Bids Law, a bidder may still proceed with the decision to make a bid in relation to the target, even where the board of directors of the target does not recommend the bid to its shareholders. Once the announcement to make a public offer has been made, the target board is obliged to promptly and accurately provide information to its shareholders and employees, to assess the bid and make recommendations to shareholders.

A buyer must obtain the requisite regulatory approvals (as mentioned above) as well as secure the necessary financing to proceed with the bid and the advanced support of the shareholders in the form of irrevocable undertakings. The major shareholders must also accept the terms of the public offer.

In accordance with the Takeover Law, a public offer will be considered as successful when the bidder has acquired more than 50% of the voting rights in the target company. The squeeze-out procedure will be triggered when the bidder, through a public offer, acquires at least 90% of the voting rights in the target company.

The Takeover Law also provides that all holders of the same class of shares of the target company should be treated equally in a public offer. When a buyer acquires a sufficient number of shares to provide it with voting rights equal to or greater than 30% of the voting rights in the target company, the buyer is then obliged to make a public offer for the acquisition of all the shares in the target company.

Break fee or inducement fee commitments are available and may be obtained from the target or target shareholders. Although they are not specifically regulated under Cypriot law and there are no restrictions regarding the same, they remain uncommon on a recommended bid.

PRIVATE M&A

Most private transactions contain a locked-box mechanism and completion accounts are fundamental. It is important to focus on them both pre- and post-signing of the share purchase agreement (SPA) as they can protect or enhance the deal value.

The earn-out provision facilitates the buyer's position by allowing it to pay part of the deal value at completion date and the remaining deal value in further payments, depending on the profits of the acquired company.

A frequently used mechanism when exchange does not occur simultaneously is an escrow for holding the deal value, or a part of it, until preconditions are satisfied.

In addition, extensive warranties, representations and indemnities must be provided by the seller to the buyer. These are important and form an essential part of the SPA as they give the buyer further assurance concerning the acquisition.

The conditions of private takeover offers are set out in the SPA and usually vary based on the circumstances of each transaction. One important condition regards warranties and indemnities (W&I). When it comes to a buyer with a strong bargaining position, warranties are strictly negotiated as they give the buyer the right to withdraw from the acquisition in the event of a breach.

Another important condition is the material adverse change (MAC) clause, which gives the buyer the right to terminate the M&A contract in the event of a material adverse change in the business of the acquired company, when it comes to its assets/profits. This provision provides protection to the buyer against the general risk of adverse events that may occur during the period between signing the SPA and completion.

A well-drafted SPA is one of the most important keys to a successful transaction as it is the instrument that governs the terms and conditions between the acquiring company and the target company. It is the process of prioritising the objectives of a deal and ensuring that the top-priority objectives of all parties involved are satisfied according to the weight of risk each party can bear.

Private equity investors must also plan exit strategies early. While considering an IPO to expand a business, improve market presence or as a long-term planned exit strategy, advanced planning is vital because this can take a significant amount of time and many IPOs are delayed – or even fail – because a company has underestimated the amount of work required.

In an IPO, a private equity firm must retain a significant stake in the company, which prolongs the holding period for an investment. With that in mind, if the end of the planned holding period is approaching or has passed or an exit must be assured to meet fund return targets, a trade sale can be used as a backup option to expedite an exit and receive proceeds from a sale.

It takes significant resources and energy for company management to prepare for an IPO and trade sale exit simultaneously. Sponsors must make an honest assessment about whether management has sufficient bandwidth to sustain both tracks while running the daily business.

LOOKING AHEAD

The European and international communities are on hold due to Brexit with an especially keen eye on the 'hard Brexit' scenario, which is the only scenario under discussion in Brussels at the moment.

Brexit under any scenario will likely affect M&A in a negative way. However, we foresee that because of the unstable situation and high volatility in the markets, some assets could become quite attractive for trading, a change of ownership and merging. This could give rise to an increase in M&A activity.

We believe that the lawmakers will ensure the protection of investors, enhance transparency and strengthen corporate governance. It is yet unclear how legal practice will respond however, the unfortunate events of the past (and we refer to the collapse of various national economies within the Eurozone) have taught us that the best cure is prevention.

About the author |

||

|

|

Charalambos Samir Lawyer / founder & CEO, C Samir & Co Nicosia, Cyprus T: +357 2225 8800 Charalambos Samir is a member of the Cyprus Bar Association. He has a broad specialisation in international corporate law, legal and tax services and private wealth, with a strong focus on M&A, the setting up and restructuring of international projects, international tax planning and immigration. He is also a licensed international professional mediator approved by the Ministry of Justice and Public Order in Cyprus. Charalambos advises high net worth individuals (HNWIs) from CIS countries, China, India, Europe and the Middle East on tax planning, asset management and commercial transactions using the favourable Cypriot legal, tax and banking environment. His articles on various business issues are regularly published in business publications in Cyprus and abroad. He is also a member of all the main business associations linking Cyprus and other countries, as well as the founder and president of CYMEBA (Cyprus Middle East Bridge to Africa). In January 2019, Charalambos obtained the STEP Professional Postgraduate Diploma in Private Wealth Advising (PPgD) taught at the Oxford University, UK. |

About the author |

||

|

|

Athina Katiri Deputy managing director, C Samir & Co Nicosia, Cyprus T: +357 2225 8800 Athina Katiri graduated from the Kingston University London with a bachelor of laws. She earned her MSc in business management from Cyprus International Institute of Management and she is a member of the Cyprus Bar Association. Athina is specialised in corporate law disciplines such as the drafting, negotiation and implementation of Cyprus law security documents, charges and pledges, the issuance of corporate capacity legal opinions in M&A transactions and the restructuring of international projects. |

About the author |

||

|

|

Andrea M Hadjigeorgiou Lawyer, C Samir & Co Nicosia, Cyprus T: +357 2225 8800 Andrea Hadjigeorgiou holds a law degree from the Law School of Athens. Andrea earned her master's degree in commercial law (LLM) from Cardiff Law School. She is a member of the Cyprus Bar Association. Over the past years, Andrea has been highly involved in compliance, AML, regulatory, and legal and risk matters for numerous Cyprus investment firms. She has obtained advanced certification from the Cyprus Securities and Exchange Commission. Moreover, Andrea has also been engaged in compliance, AML compliance and regulatory matters for alternative investment funds and fund managers. |