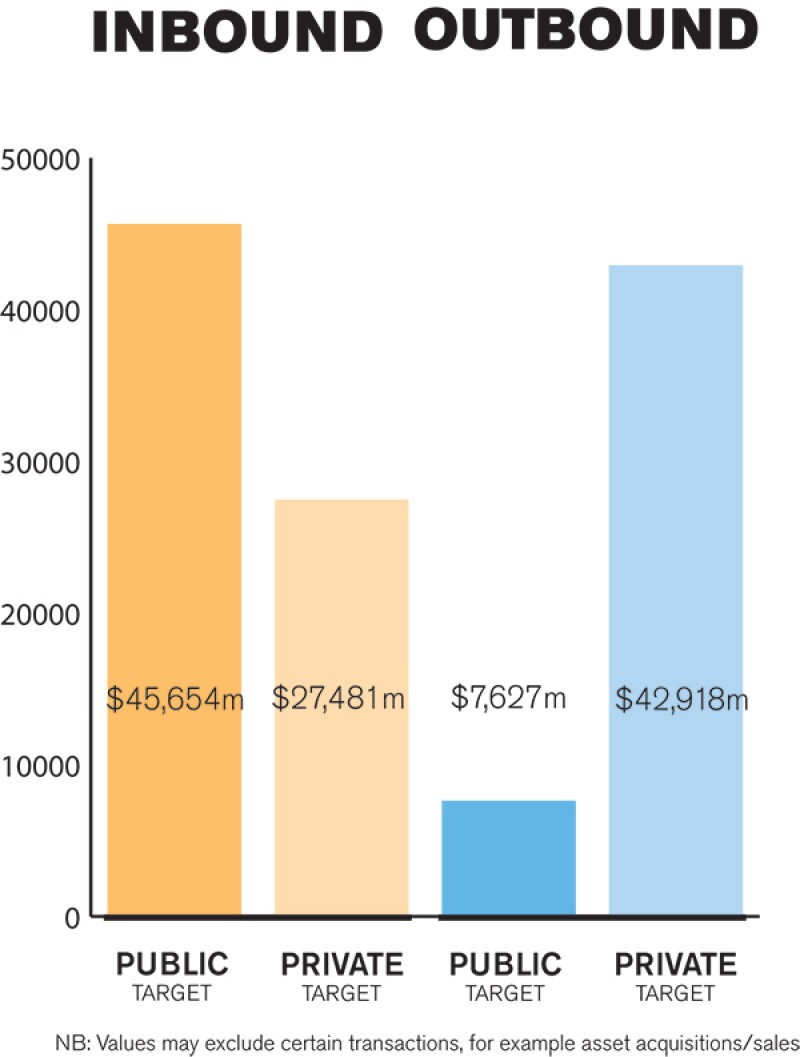

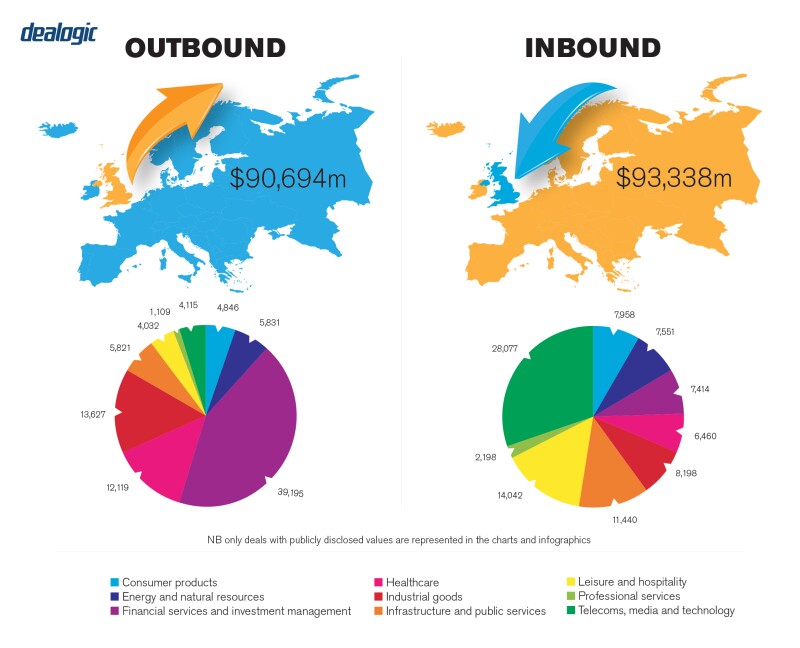

UK M&A in 2019 was primarily driven by inbound deals, encouraged by the post-Brexit decline in the value of sterling and supported by the continuing availability of transaction financing at attractive rates. Interestingly, a significant proportion of offers for UK companies from foreign investors were in dollars rather than sterling (possibly to hedge currency risk due to Brexit).

Despite political uncertainty due to the general election and Brexit, UK M&A was resilient in 2019. Deal volume was only slightly lower compared to 2018, although deal value decreased significantly. We expect to see similar deal volume in 2020, while deal value could increase as companies seek to bolster profits from M&A activity against a declining economic backdrop. We also expect the life sciences and technology sectors to continue to dominate.

Both public and private M&A play an important part in the UK market, with private M&A deals making up a far higher number of UK target M&A deals: 2,051 deals worth £50.8 billion ($65.8 billion) in 2019. While the overall value of M&A deals dropped in 2019 compared to 2018, with a particularly significant decrease in the total deal value of public M&A transactions (£40 billion in 2019 compared to £92 billion in 2018), last year's deal value was nonetheless greater than that of 2016 and 2017.

TRANSACTION STRUCTURES

Continuing the trend from 2018, the decreased value of the pound and availability of transaction financing at attractive rates in the UK has led to greater leveraged deals in UK M&A transactions.

|

|

If these reforms are adopted, the approval timetable for cross-border M&A will likely be lengthened and costs likely increased |

|

|

2019 also saw a significantly higher number of public takeover transactions than in 2018, which may be due to underperforming high street brands becoming targets. Of these public takeovers, 42% were implemented as schemes of arrangement, demonstrating the continued popularity of this structure. However, there was a significant increase in the number of takeover deals structured as contractual offers – an 82% growth. As noted above, consortium bids have also increased in public-to-private transactions.

The continued rise of financial investors, especially on the sell side, is associated with a wider use of W&I insurance. Consequently, corporates have needed to familiarise themselves with such product in order for their bids to remain competitive. We have also seen an increase in the number of corporate sellers requiring bidders to take out W&I insurance.

In addition, financial investors are forming consortia to finance larger and more complex transactions. For example, Latham advised a consortium led by Blackstone and CVC Capital Partners made a £2.96 billion offer for Paysafe Group plc, as well as Canada Pension Plan Investment Board on a consortium offer for Merlin Entertainments.

Among other notable deals, Apollo's failed takeover bid of RPC demonstrates the potential for a target company in a mid-market deal to obtain a higher price through competitive bids. A week after Apollo announced a £3.3 billion offer, Berry Global announced that they had also approached RPC regarding the deal. This resulted in an increased offer price, and Berry Global ultimately purchased RPC for almost £2 billion more than Apollo's offer – a deal on which Latham & Watkins advised. Mid-market targets are not well-tracked by potential offerors, and a target company usually only becomes of interest after an announcement.

LEGISLATION AND POLICY CHANGES

The Companies Act 2006 applies to public and private companies registered in the UK. While the Companies Act does not govern M&A activity as such, its requirements dictate the way that deals by UK companies are effected.

The acquisition of private companies is a matter of negotiation between the buyer and seller, and no regulated offer process is required. In non-regulated industries (i.e., other than financial services, telecoms, media, etc.), deals are not typically subject to input from regulatory bodies, save for competition matters.

Public acquisitions are governed by the City Code on Takeovers and Mergers (the Takeover Code), as administered by the Panel on Takeovers and Mergers.

The regulatory environment for UK M&A is relatively stable, although Brexit does pose certain challenges. For example, in terms of UK merger control, during the transition period, EU law will continue to apply to the UK; however, once the transition period ends, cases that previously would have fallen within the jurisdictional scope of the EU merger control regime will also need to be notified to the Competition and Markets Authority (CMA), assuming that the UK merger control thresholds are met.

In February 2019, the CMA published proposals to reform the UK's competition laws, seeking to shift to a mandatory notification regime for mergers above a certain threshold, and introduce a standstill obligation designed to prevent parties from completing transactions prior to CMA approval. For mergers below the threshold, the system would remain voluntary, with parties notifying the CMA only when they consider that there is a risk to competition. If these reforms are adopted, the approval timetable for cross-border M&A will likely be lengthened and costs likely increased.

A consultation is also underway regarding a new proposed national security regime, which will encourage parties to notify the government of certain events that may raise national security concerns. As currently drafted, such events are wide-reaching (including tangible and intangible assets) and will apply to all entities carrying on activities or supplying goods or services to persons in the UK. Given the government's increased scrutiny on national security grounds in 2019, investors active in particularly sensitive sectors, such as technology, should monitor the status of this proposal.

MARKET NORMS

UK companies can be acquired by way of a share purchase (i.e. purchasing all the shares of the target company) or an asset purchase (i.e. purchasing all the assets of the target company) but, as a matter of UK domestic law, M&A transactions between private UK companies cannot be consummated by way of a merger by absorption, unlike as between a UK company and a company incorporated within the EEA which is possible but uncommon (although, post-Brexit, depending on the jurisdiction this might not be possible). The Companies Act does provide for mergers for UK public companies, but these provisions are generally not used and a scheme of arrangement is more commonly seen. This is in contrast to other jurisdictions where mergers are frequently encountered.

The UK merger control regime is voluntary (whereas if it has an EU dimension it must be notified to the European Commission) and there is no obligation for the notification of mergers in the UK, although, in practice, notifications are made to avoid any interim enforcement orders which might create deal uncertainty or delay.

Regarding developments in legal practice, law firms are increasingly using AI technology to conduct due diligence in M&A transactions, while also using project management tools to assist with a smooth transaction.

PUBLIC M&A

A bidder may choose to stake-build in order to obtain control of a public company, however, depending on the time of such acquisition and form of consideration, this may set a floor price and form for any future offer. Furthermore, acquiring 30% of the voting rights in a public company will require a bidder to launch a mandatory cash offer for the remainder of the shares it does not own.

In addition, any dealing giving rise to speculation, rumour or an untoward movement in the public company's share price may mean an announcement is required, while disclosures will also be necessary once certain thresholds of ownership are crossed.

A takeover offer will usually be subject to an extensive set of conditions, including: securing acceptances carrying more than 50% of the voting rights in the target, antitrust and regulatory approvals, bidder's shareholder approvals, listing of consideration shares (when appropriate), as well as conditions dealing with the state of the target's business. A bid cannot be subject to conditions that depend on the subjective judgement of the bidder, while seeking to rely on a material adverse effect condition to not proceed with an offer is a high bar to meet (requiring the circumstances to be of considerable significance and aiming to strike at the heart of the purpose of the transaction). Occasionally, a bidder will announce a firm intention to bid on a pre-conditional basis, when posting of the bid document is suspended pending satisfaction of stated pre-conditions, often material antitrust conditions if it is anticipated that these will involve protracted processes.

In public takeover offers, break fees (when the target pays the prospective buyer) are now largely prohibited, whereas reverse break fees (when the prospective buyer pays the target) are not prohibited. Only in limited circumstances can a break fee be offered, for example, a break fee offered to a 'white knight' (subject to such fee being de minimis and payable only upon the offer becoming or declared wholly unconditional).

If the bidder is a UK public company and subject to the UK Listing Rules, and the total value of the reverse break fee(s) exceeds 1% of the market capitalisation of the bidder, the bidder's directors will need to treat the reverse break fee as a material transaction (which, amongst other things, requires shareholder approval). If the bidder controls more than 10% of the target, a reverse break fee may also constitute a related party transaction for the purposes of the UK Listing Rules.

PRIVATE M&A

According to the Latham & Watkins 2019 Private M&A Market Study (the Study), which examined over 240 deals signed between July 2017 and June 2019, 49% of deals included a locked box mechanism, 28% of deals included a completion accounts mechanism and 23% of deals did not provide for price adjustment. This trend is consistent with results from the previous three editions of the survey and reflects the continuing seller-friendly nature of the UK M&A market.

Completion accounts are relatively common, and involve a business being carved out of a larger group in circumstances in which it may not be possible to define or lock the box. The number of deals that feature an earnout remained limited at 14%.

The Study also revealed a significant decrease in the use of escrows in private M&A deals, down to 17% of deals compared with 27% two years ago.

In addition to the continued popularity of W&I insurance, there has been an emergence of contingent risk insurance policies that cover risks traditionally outside the scope of protection. The availability of such cover provides buyers with an alternative to negotiating a lower purchase price or an escrow agreement.

|

|

Such cover provides buyers with an alternative to negotiating a lower purchase price or an escrow agreement |

|

|

In private M&A, the conditions to closing which are included in a purchase agreement will vary based on the circumstances of each transaction. In UK deals, historically conditionality beyond regulatory and anti-trust clearances is uncommon but the increase of US acquirers in the UK market could change this.

According to the Private M&A Study, only 10% of deals included a material adverse change clause (material adverse changes clauses refer to events which have a negative impact on the market generally or, more specifically, on the target company's business). The use of breach of covenant/warranty conditions and financing conditions also remains very limited (10% and 4%, respectively). According to the same study, 35% of transactions used W&I insurance, with 48% of private equity sellers requiring it and, interestingly, a steady increase to 26% of corporate sellers.

Purchase agreements relating to UK companies and assets are typically governed by English law and are subject to the jurisdiction of the English courts. For global transactions, depending on the location of the parties and their advisers, purchase agreements are frequently governed by English law (as it is viewed as stable, impartial and commercial, with a developed litigation infrastructure) but may alternatively be subject to the laws and courts of another jurisdiction, such as New York.

With regards to the exit environment, the market for exits remains resilient, with sellers seeking an IPO or sale to realise their investment; in some instances, sellers employ dual-track exits to give greater certainty that an exit will occur.

LOOKING AHEAD

Brexit is likely to continue to cause uncertainty for investors, with a finalised trade agreement between the UK and the EU not expected until the end of the transition period on December 31 2020 (subject to any extensions). However, given that deal value in 2019 exceeded 2016 and 2017 values, it appears that investors are accepting of the risks surrounding Brexit uncertainty. Moreover, the results of the 2019 general election have eased some of the market uncertainty.

About the author |

||

|

|

Nick Cline Partner, Latham & Watkins London, England T: +44 20 7710 1087 W: www.lw.com/people/nicholas-cline Nick Cline is a partner and co-chair of the corporate department of Latham & Watkins' London office. Nick is an M&A lawyer with more than 20 years of experience focusing on UK and international, cross-border M&A, private equity and joint-ventures. Chambers UK 2019 notes that "in the most difficult moments of negotiation, Nick's calm, methodical, and diplomatic manner achieved several breakthroughs that we needed." |

About the author |

||

|

|

Robbie McLaren Partner, Latham & Watkins London, England T: +44 20 7710 1880 W: www.lw.com/people/robbie-mclaren Robbie McLaren is a partner in the London office of Latham & Watkins and co-chair of the London corporate department. His practice focuses primarily on cross-border M&A, joint-ventures, venture capital, reorganisations and general corporate matters. Robbie has represented clients who operate in a number of industries, with a particular focus on clients in the life sciences, healthcare and technology industries. Robbie is the editor of the newly published Carve-out M&A Transactions: A Practical Guide. |

About the author |

||

|

|

Catherine Campbell Knowledge management counsel, Latham & Watkins London, England T: +44 20 7710 1016 W: www.lw.com/people/catherine-campbell Catherine Campbell is a knowledge management counsel in Latham & Watkins' M&A practice. Before joining the knowledge management team, Catherine was an associate in the M&A practice. |

About the author |

||

|

|

Terry Charalambous Associate, Latham & Watkins London, England T: +44 20 7710 3095 W: www.lw.com/people/lefteris-charalambous Terry Charalambous is an associate in the London office of Latham & Watkins and a member of the firm's corporate department. Terry advises clients on mergers and acquisitions, private equity, venture capital and general corporate matters. He previously trained and qualified at another law firm, where he also spent time on secondment to Amazon, assisting with general commercial matters in the UK and across Europe. |