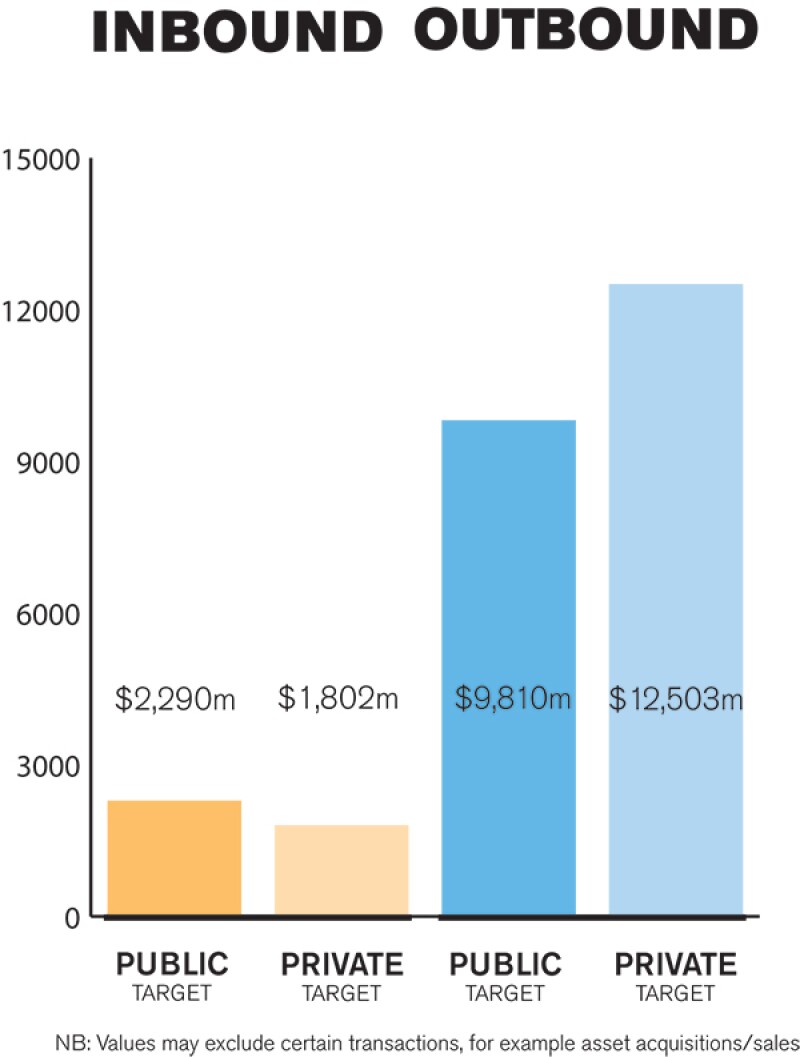

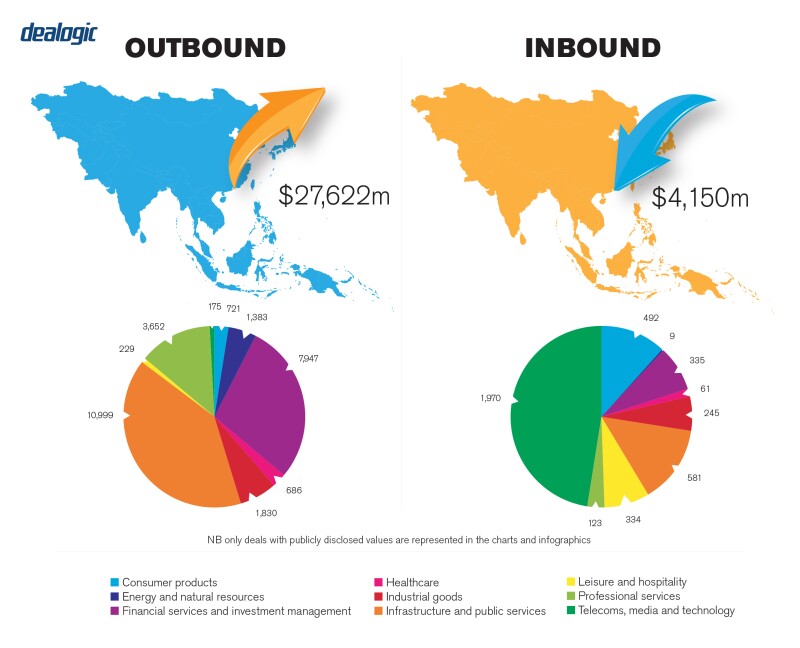

Hong Kong's M&A activity sharply declined in 2019 for both outbound and inbound deals (in value and volume), as well as deal count, as compared to 2018. The 2020 outlook continues to be somewhat subdued, reflecting lingering caution from investors about executing Hong Kong outbound deals amidst the fallout from the US-China trade war, social unrest in Hong Kong, and the recent outbreak of the novel coronavirus (Covid-19). Notwithstanding these concerns, and caution around property transactions, dealmakers remain hopeful that the city will bounce back in Q3/Q4 2020.

Hong Kong is a hub for both large-scale private and public M&A transactions, with private equity participation in public company acquisitions growing in recent years. Hong Kong-listed companies are common buyers and sellers in M&A transactions, which has a significant impact on the stock market and on investor confidence. The state of capital markets overall has heavily influenced deal pricing and valuations, particularly in the case of public transactions.

TRANSACTION STRUCTURES

We are increasingly seeing sellers undertaking auction sale processes to maximise sale proceeds, taking advantage of a lot of private equity dry powder following several successful fund raisings over the last two years.

As a result of these successful fund raisings, there is an excess of capital that needs to be put to work in a market that has seen high valuations for assets, giving private equity an important role to play on the buy-side. On the sell-side, funds are under pressure to take advantage of such valuations by selling assets and returning cash to investors, particularly those investors looking to raise capital for their next fund.

|

|

Effective October 1 2019, the Exchange introduced amendments to the Listing Rules addressing reverse takeovers |

|

|

Industry consolidation continued to be source of big-ticket M&A in 2019, with HKBN closing its acquisition of the second-largest fixed telecommunication services operator in Hong Kong, WTT Holding Corporation for approximately $1.3 billion.

In addition to raising debate in the industry as to the benefits to the consumer of further consolidation, HKBN's acquisition of WTT Holding Corporation gave rise to a number of complex structuring issues, including the need to avoid triggering a mandatory general offer under the Takeovers Code. Separately, two of HKBN's existing significant shareholders were investors in the sellers' funds, which required significant engagement with the HKSE and the Securities and Futures Commission (SFC) Executive to secure the ability of one or both of such shareholders to vote on the transaction at the HKBN shareholders' meeting, and to manage concert party issues under the Takeovers Code. Due to competition rules (telecoms is the one sector in Hong Kong that is subject to a merger control regime), this transaction reduces the potential for further consolidation in the fixed line telecoms space, leaving mobile convergence as the only realistic option for players in this sector.

LEGISLATION AND POLICY CHANGES

M&A transactions involving public companies or companies with a primary listing of their equity security securities in Hong Kong are subject to the regulations of Takeovers Code and Mergers and Share Buy-backs (the Code) administered by the Executive Director (the Executive) of the Corporate Finance Division of the SFC, the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong (Exchange) and the Securities and Futures Ordinance. If a Hong Kong target entity or subsidiary operates in a regulated industry, consent of the relevant regulator may be required as a precondition to a change-of-control.

Effective October 1 2019, the Exchange introduced amendments to the Listing Rules addressing reverse takeovers (for example, backdoor listings) and the criteria for continued listing, which aim to prevent the listing and continued listing of shell companies, which may become vehicles for backdoor listings. This is expected to affect business expansion or diversification, particularly in transactions involving strategic moves pursued by listed issuers.

Hong Kong's merger control regime currently only applies to M&A transactions that involve an undertaking that directly or indirectly holds a carrier licence within the meaning of the Telecommunications Ordinance. In line with the trend across Asia, the Competition Commission is thought to be reviewing the existing framework of its broader anti-competition regime. In addition, there likely will be more co-operation between regulators, as well as more cross-border co-operation, particularly in South-East Asia and in the Mainland.

MARKET NORMS

It is commonly assumed that the Code only applies to companies listed in Hong Kong, when in fact it applies to public companies in Hong Kong, which may include unlisted companies. Another common misconception is that there is no merger control regime in Hong Kong. As mentioned above, there is a merger regime, but the regime only applies to certain companies in the telecommunications and broadcasting sectors, and a more expansive merger control regime is expected in the near future.

We are often asked to advise whether Chinese law applies to transactions. Hong Kong maintains its own law that is still closely based on English law (as opposed to the civil law regime that applies in China), including the Code, which is similar to the UK takeovers code in most respects. We are also often asked to advise on the merits of warranty and indemnity (W&I) insurance. Parties are increasingly using this tool on M&A deals, both on the sell-side to execute a clean break and on the buy-side to create a more competitive bid in auction context. Typically, we see premiums in the range of 1%-2% of the sum insured.

In terms of legal practice, there has been a trend towards using software to perform at least part of the due diligence process for a transaction. Cognitive software or artificial intelligence (AI) software can identify and extract key words and provisions, thereby reviewing potentially thousands of documents within a short space of time and with great accuracy. Electronic and digital signatures and digital transaction management platforms, such as DocuSign, combined with supporting legislation, are therefore making it easier to execute M&A transactions.

PUBLIC M&A

Most listed companies in Hong Kong have a controlling shareholder that holds more than 30% (and often more than 50%) of the company's shares. Therefore, securing the controlling shareholder's support is vital for any attempt to obtain control, and, as a result, hostile bids rarely occur.

A takeover of a public company listed in Hong Kong may be executed principally by way of a general offer (mandatory or voluntary) or a scheme of arrangement (SOA). If a takeover offer is made and acceptances are received in respect of 90% or more of the shares to which the offer relates, the offeror may compulsorily acquire the non-accepting shareholders' shares. An SOA requires approval by members representing at least 75% of the voting rights of members present and voting in person or by proxy at the meeting, with not more than 10% of the voting rights attached to all disinterested shares opposed to the scheme.

All conditions to a voluntary general offer (VGO) or SOA must be satisfied within the time periods prescribed by the Code. Consequently, many takeovers in Hong Kong are effected by way of pre-conditional offer or SOA if there are mandatory regulatory conditions that cannot (or may not) be satisfied within the prescribed time periods. Other than the acceptance condition, conditions that are usually attached to a takeover offer include regulatory approvals and various standard no material adverse change (MAC) or illegality conditions, although the consent of the Executive is required to invoke such conditions. No financing conditions are accepted, as the announcement of an offer should include confirmation by the financial adviser that the offeror has sufficient financial resources to satisfy the full offer price under the offer.

In the case of a mandatory general offer, there must be no conditions other than an acceptance level of 50% of the voting rights.

Break fees in public M&A remain uncommon in Hong Kong, as most deals are consensual and require the controlling shareholder to agree to the deal. The Code provides that an inducement fee or a break fee must be de minimis (usually no more than 1% of the offer value). The target's board and financial advisor must confirm to the Executive that each of them believes that any agreed fee is in the best interests of the shareholders.

PRIVATE M&A

Consideration mechanisms involving post-completion net debt and/or working capital adjustments based on completion accounts are more prevalent than locked-box structures in M&A transactions in this region, especially for buyer-friendly transactions – although locked-box mechanisms are becoming more widespread in the secondary buy-out market. For seller-friendly transactions in which targets are being sold in extremely competitive auctions, locked-box structures are also becoming more common.

We do not often see earn-out structures feature in transactions in this region, largely due to the uncertainties that such structures create for both buyers and sellers. Escrow arrangements are still widely used, particularly when there are financial sponsor sellers who would not typically provide a parent guarantee.

While W&I insurance was initially used by private equity sponsors looking to achieve a clean exit, it is now regularly used in corporate acquisitions. We increasingly see parties use this insurance as a tool to bridge gaps between liability caps offered by sellers and coverage required by buyers, particularly in private equity deals. Insurance underwriters within the region generally view Hong Kong as a relatively stable and low-risk jurisdiction, which has a positive effect on premium levels.

|

|

Break fees in public M&A remain uncommon in Hong Kong, as most deals are consensual |

|

|

In competitive auctions, sale conditions may be limited to receipt of requisite third-party consents, such as regulatory consents in respect of targets operating in regulated industries and consents required under contractual obligations binding on the vendors and/or target entities. In bilateral transactions, potential buyers generally have more leverage to negotiate additional bespoke conditions precedent, including MAC clauses, repeated warranties and no breach conditions.

Under Hong Kong law, contract parties are generally free to choose the governing law of their agreement and the jurisdiction for dispute resolution or seat of arbitration. In M&A transactions involving a Hong Kong target entity, the transaction documentation is typically governed by Hong Kong law, given that local laws dictate the share transfer and attendant control transfer procedures. For regional M&A transactions, foreign governing laws are sometimes adopted, for example New York law or Singapore law, and parties increasingly designate Hong Kong or Singapore for arbitration.

In 2019, the Hong Kong Stock Exchange ranked first globally in terms of IPO proceeds, despite various external uncertainties including the US-China trade war and social unrest in Hong Kong. Several notable listings were completed in the second half of 2019, including by Alibaba, Budweiser APAC and the Warburg Pincus-backed ESR Cayman. There has also been significant activity in the healthcare sector, with several pre-revenue biotech companies taking advantage of the new listing regime to list in Hong Kong. While the start of 2020 has been overshadowed by the outbreak of Covid-19, there remains a healthy pipeline of candidates looking to list in Hong Kong.

LOOKING AHEAD

The outlook for the M&A market in 2020 remains uncertain, given the continuing uncertainties in the macro-economic and social environment. However, Hong Kong still plays a key role in helping international investors and dealmakers access the mainland China market. Private equity houses continue to hold stockpiles of capital that need to be deployed, which should drive greater deal flow in 2020. At the same time, the softened stock price of Hong Kong-listed targets likely will encourage more deal-making in public M&A, and the expected increase in distressed assets in Greater China may present opportunities for special situation investment. Therefore, overall, we predict an active M&A market in 2020, though there may still be uncertain times ahead.

About the author |

||

|

|

Simon Cooke Partner, Latham & Watkins Hong Kong SAR T: +852 2912 2709 W: www.lw.com Simon Cooke is a partner in the corporate department of Latham & Watkins' Hong Kong office. Mr. Cooke specialises in public and private M&A and corporate finance, with a focus on pan-Asia private equity transactions. He regularly advises Asian and international private equity clients on a broad range of domestic and cross-border buy-outs, growth capital, pre-IPO, PIPE and other private equity transactions. He also advises a range of clients on general private and public company and cross-border M&A and corporate finance transactions. |

About the author |

||

|

|

Amy Beckingham Partner, Latham & Watkins Hong Kong SAR T: +852 2912 2550 W: www.lw.com Amy Beckingham is a partner in the Hong Kong office of Latham & Watkins and a member of the corporate department and the private equity practice. Amy specialises in public and private M&A and joint-ventures, acting for private equity and other financial investor clients on transactions throughout Asia, across a wide range of industry sectors. She has also advised private equity clients on their IPO exits in a number of jurisdictions across Asia. |

About the author |

||

|

|

Frank Sun Partner, Latham & Watkins Hong Kong SAR T: +852 2912 2512 W: www.lw.com Frank Sun, a partner in the Hong Kong office of Latham & Watkins and a member of the corporate department, specialises in private equity investment and public and private M&A transactions. He regularly advises private equity funds and corporate clients in private equity investments, cross-border acquisitions, PIPEs, privatisations and a wide range of other complex M&A transactions. |

About the author |

||

|

|

Maurice Conway Counsel, Latham & Watkins Hong Kong SAR T: +852 2912 2731 W: www.lw.com Maurice Conway is a counsel in the Hong Kong office of Latham & Watkins and a member of the corporate department. Maurice's practice focuses on international M&A and private equity transactions, as well as general corporate matters across a diverse range of industries, with a focus on representing private equity clients and corporates on investments in Southeast Asia. |