While there are many positive developments taking place that will encourage the Mexican M&A market there are also negative factors that have generated some uncertainty.

The approval of the United States–Mexico–Canada Agreement (USMCA) by the US is influencing and will continue to positively influence cross-border deal-making. This is counterbalanced however by uncertainty caused by the economic policies adopted by the government of President López Obrador.

While M&A deal flow in Mexico is thinner than in previous years, we have seen a constant flow of deals and the size and nature of the targets have changed. We have seen family owned businesses that had not been available before now being open for acquisition or investment and we have seen some clients disinvesting from projects with low returns.

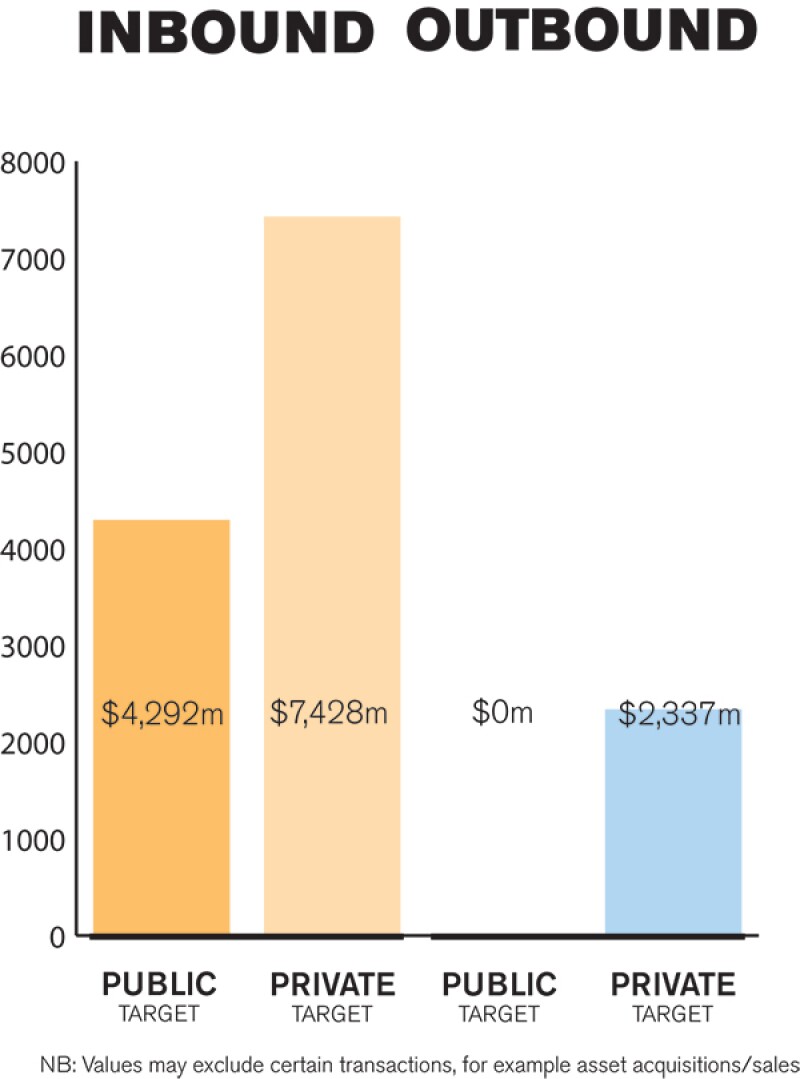

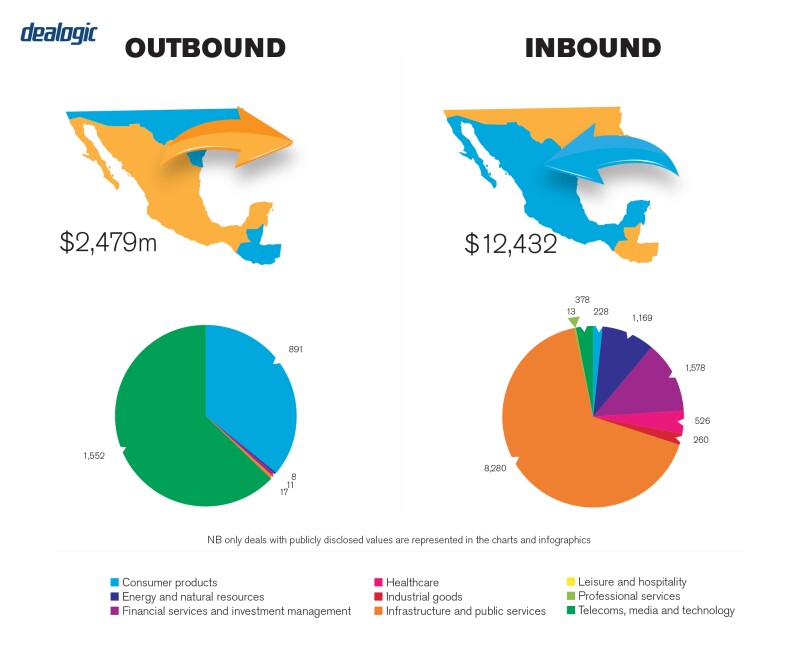

We believe that the volume of deals in Mexico (including foreign and national investment) will remain constant during the first half of 2020. However, we may start seeing an upward trajectory towards the end of the year, mainly due to the stability that the USMCA will bring to long-term investment prospects in Mexico. Regarding outbound M&A transactions, Mexican companies will focus on remaining afloat in their current markets and will not be looking to expand their businesses abroad, however wealthy Mexican individuals are actively looking for investment opportunities in foreign companies. Although real estate transactions are slow in central Mexico, other regions are still active.

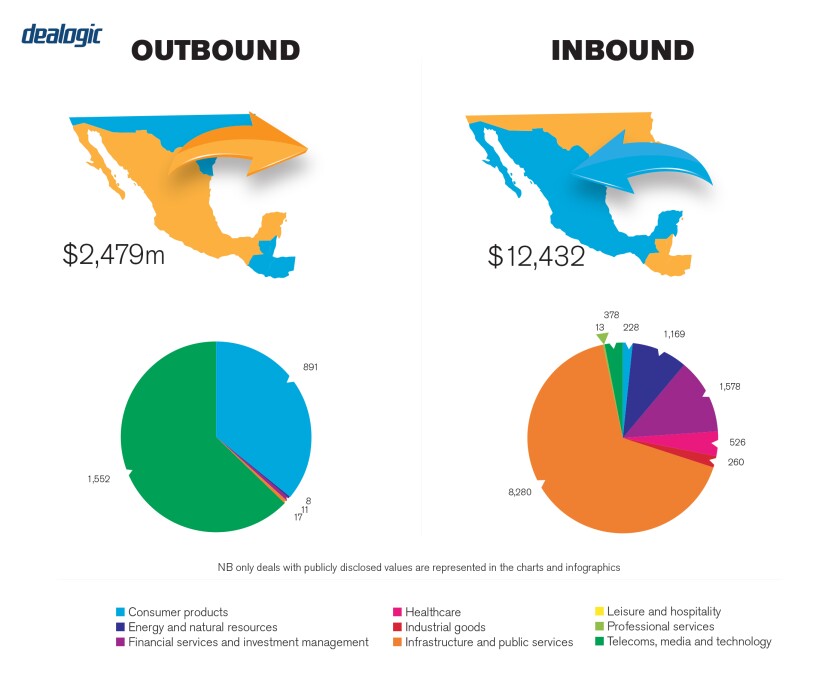

The number of publicly traded companies in Mexico is small and unlikely to grow this year. Private capital transactions continue to represent a large portion of M&A work in Mexico and will probably continue to do so in the following years.

What we are seeing as trends these days in Mexico are: (i) companies, private equity funds and family offices investing in the retail sector due to the fact that private consumption has remained one of the strongholds of the Mexican economy; and (ii) national and foreign investors investing in the tourism sector, both in real estate and services. Private equity funds and family offices are playing an important role in the Mexican M&A environment, mainly focusing on opportunistic transactions. Some private equity funds and family offices have been increasing their participations in companies in which they have previously invested. They are doing this through capital injections, debt and debt conversions, among other structures.

What we saw in 2019 – and believe will continue to see in 2020 – are investments made by the Federal Government of Mexico into sectors that have been left to private investment over the last decade. Some of these sectors are oil & gas, electric energy, public transport (including airports and trains) and healthcare. This has obviously had a negative impact on private investments into these sectors.

LEGISLATION AND POLICY CHANGES

The main regulatory body for M&A transactions is the Federal Commission of Economic Competition (Comisión Federal de Competencia Económica – COFECE). This is a constitutional autonomous body in charge of promoting, protecting and guaranteeing free market access and economic competition. COFECE is responsible for preventing, investigating, combatting, effectively prosecuting, severely punishing and eliminating monopolies, alongside monopolistic practices, unlawful concentrations, barriers to entry and to economic competition. COFECE also looks at other restrictions to the efficient operation of markets to oversee, promotie and ensure free competition within the Mexican market. COFECE is regulated by the Constitution (Art. 28), the Federal Economic Competition Law and the Organic Statue of the COFECE.

There have not been any recent changes to regulations or to regulators that would impact M&A, however there have been a number of actions taken by the government may disincentivise investment in various sectors of the Mexican economy. Furthermore, there have been a number of initiatives either launched or threatened by the government that would, among other things, increase labour costs for companies and limit private investment in the energy sector. These have had an impact on investor confidence and reduced M&A activity. In recent years, anti-money laundering (AML) laws and regulations have also been reinforced and important players in the market must now be more careful with compliance and reporting obligations. Specifically, there have been controversial changes made to AML laws and regulations that enable the government to confiscate and sell private property before a trial is concluded when money laundering and/or criminal activity is deemed to be taking place.

New laws to prevent and pursue tax evasion, which include new reporting obligations for tax advisors, are causing a more careful approach on tax strategies. Tax authorities have also announced that new legislation will be enacted to strengthen the regulation on outsourcing to prevent tax and social security payment evasion.

MARKET NORMS

Foreign investors are often surprised to find that Mexican businessmen and their lawyers and financial advisers are sophisticated and knowledgeable of international transactions. For instance, our law firm has a strong tax practice that works hand in hand with our M&A practice, which is important because we structure our deals from the beginning both from a tax perspective and a transactional perspective. We have also seen that technology is becoming more and more relevant in the M&A deal-making process, by optimising the process and reducing time and costs for the parties involved.

PUBLIC M&A

The size of the public market in Mexico limits the number of transactions which seek to obtain control of a publicly traded company. We have seen that Mexican investors are reluctant to make hostile takeovers. While it is not completely rare that a seller requests a break fee, cases where the break fee goes beyond payment of transaction expenses are very rare.

PRIVATE M&A

Locked-box mechanisms are common in financial deals but rare in M&A; earn-outs and escrows are present in almost every transaction, whereas insurance is still new to M&A in Mexico. Depending on the size of the transaction and the nature of its parties, COFECE approval may be needed to consummate a deal. Furthermore, in transactions in which the participants are involved in regulated activities, approval from other governmental authorities may be required.

Multinational companies tend to prefer a foreign governing law in private M&A transactions, however, some aspects of the transaction must be regulated by Mexican law, such as intellectual property rights and corporate governance of Mexican entities. Additionally, multinational companies tend to prefer the jurisdiction of their national courts; however, our advice for election of jurisdiction depends largely on the location of assets, availability of international enforcement of judgments and possible violations of Mexican public policy.

Warranty and indemnity (W&I) insurance, is not common in Mexico and insurance companies have not yet invested time and resources to developing this product, making it time consuming and costly to implement.

As for exits, using an IPO as an exit strategy for private equity investors is usually very often their goal and best-case scenario and has been a growing as a trend in Mexico. However, such trend saw a halt in 2018 due to external factors (especially the uncertainty created by the renegotiation of NAFTA) and the presidential elections. We believe that IPOs will not pick up pace again in the near future due to internal factors, such as low governmental incentives for economic growth. We believe that Mexico has been lagging behind other economies with respect to IPOs, though we are bound to catch up eventually.

LOOKING AHEAD

We believe that there are a few factors that will translate into moderate economic growth this year and activate the M&A market. The key factors are:

The implementation of the USMCA. This alone helps clear most of the clouds of uncertainty that have been lingering above the Mexican economy since President Trump took office. It leaves only those clouds of uncertainty being self-generated by the Mexican government. The USMCA will have a great effect on long-term investments that various foreign investors had delayed as they were unsure of the future of the economic relations between the three North American neighbours.

There has been an increase in minimum salaries which should have a positive effect on private consumption and consequently on the overall economy.

Interest rates are high and are bound to be lowered by the central bank (Bank of Mexico) and this will positively impact economic growth.

It is believed that the Federal Government has been withholding government expenditure. The consensus among analysts is that this year the government will increase its spending, which will hopefully stimulate the economy.

If these developments factors materialise, and new negative factors do not spring up, we should see the start of a recovery in M&A activity in Mexico.

About the author |

||

|

|

Miguel Ishii Yokoyama Partner, Jauregui y Del Valle Mexico City, Mexico T: +52 555 267 4500 E: mishii@jaureguiydelvalle.com Miguel Ishii has been a partner at Jáuregui y Del Valle since 2014. He has led many practice areas in the law firm, including corporate, M&A, banking and finance and real estate. Miguel has advised his clients for over 20 years on relevant M&A transactions. Clients emphasise the quality of his legal counsel, his availability and his capacity to propose creative solutions in complex negotiations. He is actively involved in the structuring, negotiation and documentation of loans and financings. Miguel was a professor of commercial law at the law school of the Center for Economic and Research and Education (CIDE) from 2009-12. He is ranked in Chambers & Partners' Global Guide 2018 and Latin America Guide 2018 and is member of the Mexican Bar Association (Barra Mexicana, Colegio de Abogados) and National Association of Business Lawyers (ANADE). His academic qualifications include: Escuela Libre de Derecho, Attorney at Law (1993); Universidad Panamericana, postgraduate degrees in corporate law and tax Law (1997); and Kyushu University, LLM in international economic and business law (1999). |

About the author |

||

|

|

Alejandro Creel Ysita Senior associate, Jauregui y Del Valle Mexico City, Mexico T: +52 555 267 4500 E: acreel@jaureguiydelvalle.com Alejandro Creel is a senior associate at Jáuregui y Del Valle with experience in the acquisitions and leasing sectors as well as on project financings, real estate, M&A and commercial transactions. Alejandro is a member of the Mexican Bar Association (Barra Mexicana, Colegio de Abogados). His academic qualifications include: the Instituto Tecnológico y de Estudios Superiores de Monterrey Campus Santa Fep, post-graduate diploma in business administration (2010); Instituto de Empresa (IE) Madrid, Spain, master in laws (LLM) in international legal practice (2009); the Universidad Iberoamericana, México City, law degree (JD equivalent) (2001-06); Université Jean Moulin (Lyon 3), Lyon, France, academic exchange program for European business and economics (2004); and Instituto Cumbres, Mexico City (1990-01) / Saint Andrews College, Aurora, Ontario, Canada (1995-97). |