Latham & Watkins corporate specialists Nick Cline, Robbie McLaren, Terry Charalambous and Catherine Campbell consider the evolving nature of deal risk and the tactics needed to minimise and mitigate

In a complex and competitive market, minimising and mitigating risk in M&A is a key concern for deal teams. High demand for assets saw strong deal volumes and values in 2019, following a standout year in 2018. The search for opportunity has brought large corporates face to face with new or rapidly expanding businesses whose risk and compliance processes may not have kept pace with other areas of growth. New risks are gaining in size and profile – meaning companies must remain alert to value-compromising issues and inherited liabilities within targets. Corporate veil cases, as well as big-ticket regulatory fines for competition failures and data protection breaches, all indicate that corporates are in the firing line.

If M&A is in getting riskier, what can deal teams do?

Our own research has shown that risk appetite varies among deal types, industries and parties, with the effect that a multifaceted approach to risk minimisation and mitigation is required. Many deal teams are being called upon to find new solutions to deal-blocking issues. In this introduction, we consider developments in due diligence that can help to focus resources on identifying risks; we explore findings from the latest edition of the Latham & Watkins Private M&A Market Study, including the types of deal protections acquirers are successfully negotiating; we comment on how W&I insurance is responding to an all-time high demand for the product; and we reflect on exciting trends in the deal insurance market that address contingent risks.

|

|

W&I insurance is not a panacea for all potential liabilities |

|

|

AI technologies are now bringing time and cost efficiencies to legal due diligence, allowing deal teams to focus their resources on technical or enhanced due diligence in higher-risk areas. Teams should strive to be as fully aware of the nature and extent of risks as the deal process allows.

In recent deals, prior knowledge has proved valuable, particularly when public policy concerns have limited the utility of insurance (for example, for regulatory fines). But in a sellers' market, continued pressure on process timetables, due diligence and buyer protections have brought challenges for acquirers seeking to understand and protect against risk, while also winning and sealing a deal.

Historically, commercial warranties were a key tool for understanding and allocating risk, forming part of the diligence and disclosure process. However, the allocation of risk between buyers and sellers for commercial warranties has changed in recent years. In 2019, 63% of sellers in our survey limited liability to less than 20% of equity value, compared with 41% in the 2014 survey. The proportion of deals surveyed that included a nominal cap of €1 or £1, with W&I insurance covering liability above that nominal amount, increased to 21%, reflecting the increasing use of W&I insurance. The length of limitation periods for claims under commercial warranties (other than the tax and environmental warranties) appears to be stable and is typically long enough to allow one full audit cycle to be completed post-completion. The fact that many buyers are looking to W&I insurance to bridge the risk gap is therefore unsurprising.

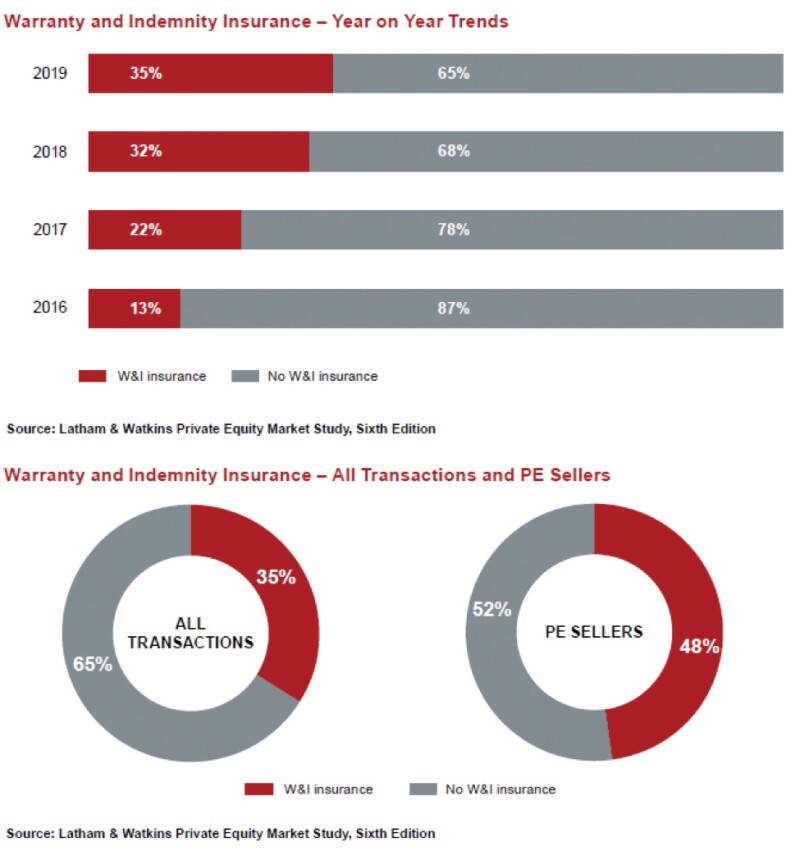

Approaches to insurance

The use of W&I insurance has increased year on year over the past four editions of our survey, up to 35% of deals in our latest survey from 13% in the 2016 edition, as buyers seek to improve the level of risk protection over that agreed in the share purchase agreement (SPA). As the W&I insurance market has matured and the number of underwriters providing cover has increased, downward pressure on premiums and excess levels has rendered W&I insurance a more cost-effective and attractive option that has proved responsive to claim; however, an increase in claims under W&I insurance has led to insurers taking a closer look at warranty coverage.

While we have seen increased flexibility on terms and reduced areas excluded from cover, W&I insurance is not a panacea for all potential liabilities. Known risks, including those in relation to the environment and pollution, as well as certain tax liabilities, are regularly excluded from cover. Transaction-specific exclusions can also appear during the underwriting process. Exclusions in some areas, particularly relating to tax matters, are broader compared to those in an uninsured deal, meaning that a W&I policy can weaken a buyer's tax protection.

Some W&I policy exclusions can be negotiated in exchange for the provision of additional details and a higher premium. However, if flexibility on W&I terms is not possible, creative solutions in the form of ancillary lines of insurance can provide useful protection and help deal teams remain flexible in competitive processes by re-risking a range of issues.

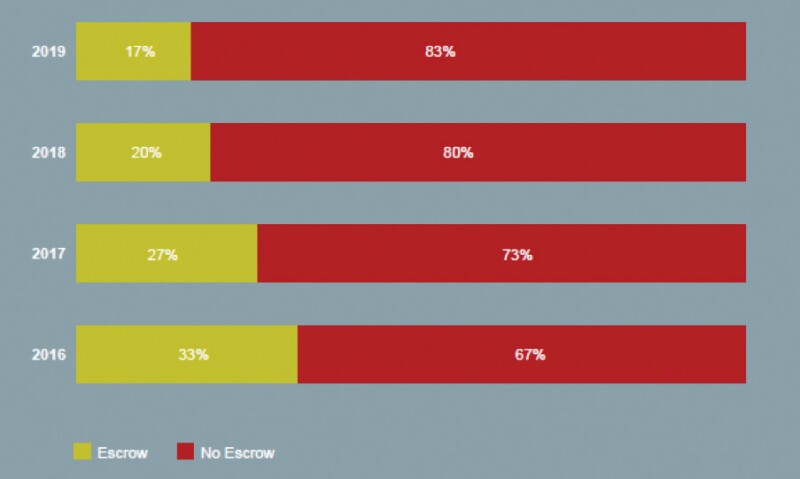

Corporate acquirers that identify previously uninsurable risks through due diligence now have the possibility of transferring those risks to insurers, rather than seeking either a price reduction or escrow retention from the purchase price. Escrows continue to be relatively uncommon across Europe; only 17% of deals in our latest survey featured an escrow and this number has declined successively in each of the last three years. The use of contingent risk insurance can make an acquirer's bid more competitive and, as a result, more likely to succeed.

Prevalence of escrows – year-on-year trends

Source: Latham & Watkins Private M&A Study.

Source: Latham & Watkins Private M&A Study.

Opportunities in tax risk and environmental risk insurance

Specific policies have emerged for tax risks that fall outside the scope of W&I, such as liabilities arising from known potential tax assessments or the loss of tax reliefs relevant to deal value. Similarly, there is now a move towards considering specific environmental policies to address pollution risks, given the limited cover available under W&I insurance.

However, implementing these policies needs careful management, as they can be expensive, require significant due diligence and can disrupt a transaction's timeline if not properly planned. In the case of current bespoke environmental policies, cover can take months to complete, making it unsuitable for pre-closing implementation on most deals. Typically, tax insurance can be implemented in parallel with any pre-existing W&I insurance process, but deal teams should note that insurers may be willing to offer cover only if additional tax diligence is conducted. This can include calls between the broker, insurers and CFO, or the preparation of a tax memorandum by a firm of chartered accountants, which can impact the transaction timeline.

Unlike standard W&I insurance, insurers typically will not provide their terms until a comprehensive profile of the risk is provided, which can present challenges in competitive deal processes. For this reason, engaging with the transaction lawyers and broker early on to ascertain what information will be required is important.

Both straightforward and more innovative policies are developing, particularly for pollution and other environmental risks, mirroring the coverage that would have historically been available through traditional commercial warranties. In our view, deal teams should watch for further market developments to address risks, including new tools and solutions for getting the deal done.

About the author |

||

|

|

Nick Cline Partner, Latham & Watkins London, England T: +44 20 7710 1087 W: www.lw.com/people/nicholas-cline Nick Cline is a partner and co-chair of the corporate department of Latham & Watkins' London office. Nick is an M&A lawyer with more than 20 years of experience focusing on UK and international, cross-border M&A, private equity and joint-ventures. Chambers UK 2019 notes that "in the most difficult moments of negotiation, Nick's calm, methodical, and diplomatic manner achieved several breakthroughs that we needed." |

About the author |

||

|

|

Robbie McLaren Partner, Latham & Watkins London, England T: +44 20 7710 1880 W: www.lw.com/people/robbie-mclaren Robbie McLaren is a partner in the London office of Latham & Watkins and co-chair of the London corporate department. His practice focuses primarily on cross-border M&A, joint-ventures, venture capital, reorganisations and general corporate matters. Robbie has represented clients who operate in a number of industries, with a particular focus on clients in the life sciences, healthcare and technology industries.Robbie is the editor of the newly published Carve-out M&A Transactions: A Practical Guide. |

About the author |

||

|

|

Catherine Campbell Knowledge management counsel, Latham & Watkins London, England T: +44 20 7710 1016 W: www.lw.com/people/catherine-campbell Catherine Campbell is a knowledge management counsel in Latham & Watkins' M&A practice. Before joining the knowledge management team, Catherine was an associate in the M&A practice. |

About the author |

||

|

|

Terry Charalambous Associate, Latham & Watkins London, England T: +44 20 7710 3095 W: www.lw.com/people/lefteris-charalambous Terry Charalambous is an associate in the London office of Latham & Watkins and a member of the firm's corporate department. Terry advises clients on mergers and acquisitions, private equity, venture capital and general corporate matters. He previously trained and qualified at another law firm, where he also spent time on secondment to Amazon, assisting with general commercial matters in the UK and across Europe. |