The Portuguese M&A market has been experiencing an excellent level of development. According to data from Transactional Track Record (TTR), M&A transactions in 2019 reached €13.4 billion ($14.5 billion).

Real estate is still the most active sector, although in 2019 it experienced a slight decrease in the number of completed transactions. The sectors which evidenced the strongest growth were the financial and insurance sectors. These sectors have helped to compensate for the decrease in real estate sector activity.

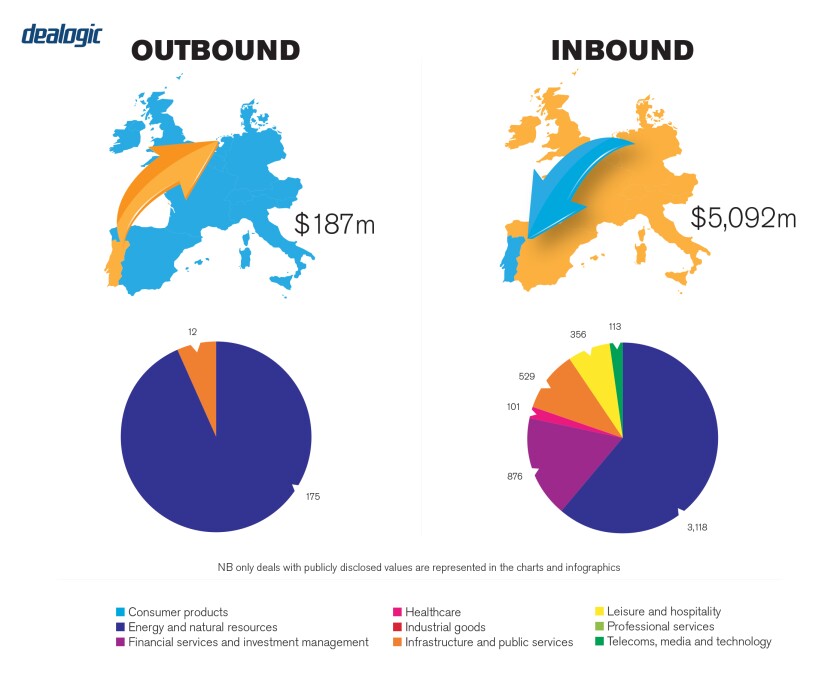

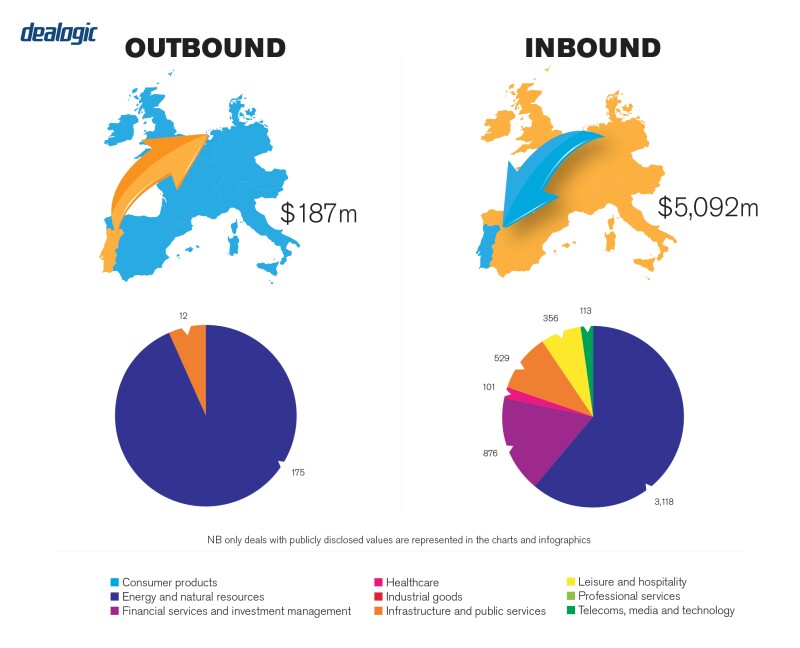

Regarding cross-border deal-making, in 2019 there were nearly 100 M&A transactions involving acquisitions of national companies by foreign entities. Spain remains the most active investor in Portugal with the highest number of deals involving Portuguese companies, all of which add up to a total value exceeding €289 million. Spain is followed by the US, which generated aggregate investments of €682 million, and UK companies, which invested about €710 million. Looking exclusively at overall deal value, France was the most important source of inbound M&A investment, reaching over €1 billion in 2019.

In the outbound market, Portuguese companies' main targets were in Spain and France with similar results: three transactions with a total investment amount of approximately €800 million. Portuguese companies concluded three deals in Brazil but with a total valuation of just €50 million.

Although the Portuguese market is in an upward trajectory, there have been some fluctuations in investment values as well as in the target sectors.

The number of transactions and the amounts involved both increased as compared with the previous year (by 15.09% and 17.85%, respectively). The number of transactions was in fact the highest ever, however the deals were smaller in terms of value. For example, the total amount in euros was smaller than for 2017. In what concerns the number of transactions, there was a total of 427 with the real estate sector at the top of the board despite some deceleration as compared to the previous year, according to TTR. The technology sector came second closely followed by the financial and insurance sectors, which experienced a roughly 20% increase in activity.

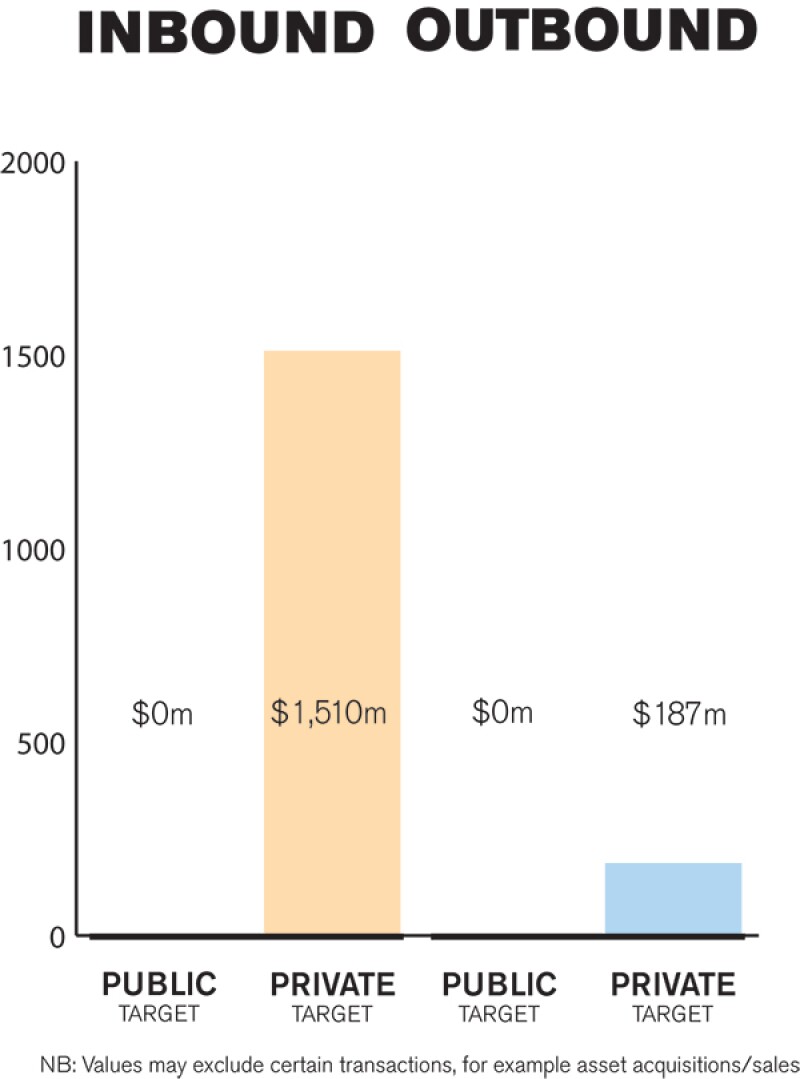

The Portuguese market is mainly driven by private M&A. However, this does not mean that there are no relevant public company transactions.

TRANSACTION STRUCTURES

Portuguese market consolidation is increasing as a result of several factors. First, access to financing is no longer a decisive block on deals. It is less probable than before that a transaction fails because of lack of funding sources, whether equity financing, private equity, partnerships with family offices, funds, private or mixed placements or even traditional bank financing.

The truth is that the opening and exposure of the Portuguese M&A market brought with it investors with the knowledge and capacity to get things done. Some external factors, such as Brexit, may even be boosting this trend. We may well see an increasing number of investments by institutional players diverting away from other EU countries to Portugal in search of a more favourable M&A climate.

The European Central Bank's (ECB) decision to keep interest rates low for a few more years in order to leverage economic growth is also playing an important role in supporting the Portuguese M&A market. We should also highlight the role of international funds, because they still have sufficient liquidity invest in assets that provide an attractive payback. Finally, the quality of some Portuguese assets is also a decisive factor in the investment decision process.

The demand from investors and funds that invest in private equity has been quite relevant in the Portuguese market, especially in relation to small and medium Iberian enterprises and in acquisitions of controlling stakes in profitable companies that have never been listed. Notably, in 2019 the Portuguese market witnessed more venture capital transactions than private equity transactions. Investments from venture capital funds increased 81.8% and reached a value of €363 million year on year.

In terms of the investors' nationality, Spanish companies have been the most active investors and have shown a strong appetite for real estate.

The investment made by private equity funds evolved in the opposite direction – in 2019 there were 38 operations closed which represents a 13,64% decrease.

One of the major M&A deals of 2019 was without a doubt the sale of Partex Holding to PTTEP, which closed in November.

In November it was disclosed that the Fundação Calouste Gulbekian and PTTEP, a listed Thai company and part of the Dow Jones Sustainability index, concluded the acquisition of Partex Holding. Following the sale and purchase agreement executed on June 17 2019 and after obtaining all necessary permits, the final documents were executed on November 4, allowing the Thai oil and production company to take over Partex. The transaction value was $622 million, although subject to the normal price adjustments.

Another relevant transaction that was concluded in 2019 and deserves to be highlighted was the purchase by the Italian insurance group Generali of the Portuguese companies Seguradoras Unidas and AdvanceCare. Generali was already present in the Portuguese market and these acquisitions allowed it to increase market share. Generali paid €510 million for Seguradoras Unidas and €90 million for AdvanceCare. The 100% stake in both companies was purchased by Generali from Calm Eagles Holdings and Calm Eagle Parent Holdings, both entities controlled by investment funds managed by Apollo Global Management.

A third notable transaction, despite having not fully closed in 2019, is the acquisition by Cofina of a majority stake in Media Capital's share capital. Media Capital's main asset is a TV channel. The deal announcement disclosed that Cofina will increase its share capital up to €85 million in order to conclude the transaction. On December 30 2019, the Portuguese Competition Authority (Autoridade da Concorrência – AdC) announced that it would not oppose to the acquisition.

LEGISLATION AND POLICY CHANGES

The main regulatory bodies that govern M&A transactions are the Portuguese Securities Market Commission (Comissão do Mercado de Valores Mobiliários – CMVM); Bank of Portugal (Banco de Portugal); Competition Authority (Autoridade da Concorrência); the Insurance and Pension Fund Supervision Authority (Autoridade de Supervisão de Seguros e Fundos de Pensões); tha National Authority for Communications (ANACOM); the Energy Services Regulatory Authority (ERSE); and the ERC (media regulator). Depending on the target and the relevant sector of activity, other laws and regulations may apply.

The legislative and regulatory process in Portugal is always very broad and dynamic, and requires permanent update and contextualisation. Given this, local legal advice is mandatory and decisive in the preliminary assessment of the operation.

There have been several legislative and regulatory developments recently that impact M&A. these include changes to the ultimate beneficiary regime. The changes bring in the obligation to register the material or effective beneficiary of a company with the Central Register of Effective Beneficiaries. Although approved in 2017 and implemented through regulations in 2018, the application regime has been postponed several times. It was only in January 2020 when the regime became mandatory for all companies. As a consequence, all corporate transactions that imply a change to the effective beneficiaries of the company must be reported and registered. Secrecy on share ownership no longer exists.

On December 30 2019 Decree Law no. 147/2019 was implemented. The Decree approves contingency measures to be adopted in a no-deal Brexit scenario during the UK's exit from the European Union. It is most relevant for service providers and investment activities. A third notable legal update was CMVM Regulation no. 686/2019 on the Specific Duties to Prevent and Combat Money Laundering and Terrorist Financing of the Entities Managing Platforms for Donation or Reward Based Crowdfunding.

An amendment to the securities code and to supervisory models is also on the agenda for the coming years, although it is not possible to anticipate when this process will be concluded. More significant than this pending change has been the impact of the recent legislation on loan funds', which creates a new financing alternative to Portuguese companies which already exists in other European jurisdictions. We expect that collective investment undertakings such as mutual funds, real estate investment funds and pension funds will be able to grant loans directly to companies.

We would also like to highlight an increasing recourse to arbitration in Portugal and its consolidation in several sectors as the effective means of alternative dispute resolution. Within the context of international transactions Lisbon is chosen as the arbitration seat in an increasing number of international arbitrations, especially for litigation involving the African Portuguese-speaking countries. This is a trend that will continue in coming years.

As far as new legislation that may impact M&A activity and the way company behave, the corporate arbitration law is also an important development. This law, which is due to be approved imminently, is essential to achieve an important milestone in alternative dispute resolution within the scope of company activities and the relation between shareholders and corporate bodies.

Data privacy and cybersecurity is another field of law to which companies have been dedicating important efforts and resources and where the supervision of the local authorities will have a stronger focus.

MARKET NORMS

The most common issues that arise in relation to the Portuguese market derives from the fact that legislative and regulatory processes applicable to a specific M&A transactions, with specific criteria and requirements, are not familiar to foreign investors. It is not uncommon for foreign investors to believe that the procedures of their origin jurisdiction are the same as those applicable in Portugal. This can lead to a duplication of efforts, with irrelevant documents being drafted.

The nature of frequently asked questions by investors varies a lot and depends largely on the target company's sector as well as the stage the transaction is at. Nevertheless, the more important questions usually address issues of corporate matters, M&A rules, competition, tax and regulatory aspects.

As for legal practice, technology in the deal-making process is increasingly important and companies are more aware of it and have been acting accordingly. During an M&A process it is not uncommon that a company is exposed to risks because it becomes the object of due diligence and auditing and therefore needs to share documents and negotiate with counterparties that may not adopt the same levels of security and care. Apart from preparing for external threats, companies must also internally control which information is disclosed during a negotiation process.

The days of a physical data room, paper format, traditional post mail and the deployment of large teams are gone; these are no longer viable in a globalised environment of 'virtual' cross-border M&A deal-making. Companies with even a minimum level of sophistication are aided by specialised software and IT companies in order to guarantee accurate information disclosure of companies' sale and purchase deals.

PUBLIC M&A

The applicable rules for obtaining control of a public company are the ones delineated in the Securities Code as well as in the regulations issued by the Portuguese Securities Market Commission. Those rules define the structure, content and procedure for formalising a public offer. Public offers (addressed to most investors) differ from private offers because they require information to be issued in a standard way and are subject to registration with the CMVM.

The documents containing the offers' mandatory information are called the prospectus (prospecto) and offer announcement (anúncio de lançamento) and are always available on the CMVM's website and elsewhere; when preparing public offers and when drafting these documents the intervention of a financial intermediary is mandatory.

The prospectus and the offer announcement are the official documents that ensure that all the information necessary for the investors to take an informed and well-grounded decision regarding the public offer is made available. The organisation of the information in these documents is subject to models and templates, to allow for an easy comparison with different offers, between several types of securities and between different companies.

The prospectus and the offer announcement shall mandatorily include information on:

The offeror;

The type of offer;

The quality in which the financial intermediaries intervene;

The price and global amount of the offer or the range between the maximum and minimum price, the nature and other terms of payment;

The offer period;

The allotment criteria;

The conditions to which the offer is subject;

The places where the prospectus is published and made available;

The clearing entity.

As a further note, it is unusual to see break fees in M&A transactions involving public companies.

PRIVATE M&A

With the increasing amount of complex transactions it is standard to see different solutions and mechanisms to determine a transaction's price, either by means of a fixed price (locked-box mechanism) or an adjusted one (depending on the company's performance – earn-out – or based in completion accounts). Considering the characteristics of the different price adjustment models, some are usually seen as pro-buyer and while fixed price models are usually favoured by sellers.

|

|

Lisbon is chosen as the arbitration seat in an increasing number of international arbitrations |

|

|

Likewise, the increase in M&A has led to more activity in the M&A-related insurance sector. The economic situation has benefitted the M&A environment due to low interest rates, strengthening balance sheets and an exponential increase in private equity activity. The increasing demand of insurance for these type of transactions is a reality for Portugal. It is important to note that W&I insurance is a high premium product and there is already a demand for tax, litigation and environmental and cyber contingencies insurance.

The takeover of a private company is not subject to special conditions or to any formal or standardised structure. What appears in a written SPA depends on the situation and on what is agreed between the parties. Most M&A transactions involving Portuguese companies are subject to Portuguese law and jurisdiction, despite transaction parties being able to subject the documents to foreign law, especially when there are foreign investors involved. It is also very common that disputes are subject to foreign arbitration.

As for the exit environment, according to the CMVM the secondary market in January 2020 reached €2.48 billion, a €605 million (32.3%) increase from December 2019 and a €654 million (35.8%) increase on January 2019. Transaction value on the Euronext Lisbon was €2.31 billion, representing an increase of 31.3% on a monthly basis and a 29.5% increase year-on-year. Although the market is experiencing an increase in both IPO and secondary offers it is still far from achieving its full potential.

LOOKING AHEAD

Considering the Portuguese economy and announced M&A transactions (particularly the M&A involving 80% of the share capital of Brisa) we are expecting a fantastic 2020 for M&A, particularly in the real estate sector (tourism, hospitality sector, logistics, offices and housing), in the renewable energy sector and in the technology sector. It will undoubtedly be an intense year for legal services providers.

About the author |

||

|

|

Nelson Raposo Bernardo Managing partner, Raposo Bernardo Lisbon, Portugal T: + 351 21 3121330 E: nrbernardo@raposobernardo.com Nelson Raposo Bernardo is the managing partner and head of the banking and projects practices. Nelson has more than 25 years of international experience in high-profile and complex operations and has been involved in multiple transactions in Portugal and abroad. He focuses on M&A, banking and finance, capital markets, project finance and private equity, as well corporate restructuring and corporate finance. Some of his recent transactions include advising BNP Paribas on an Aircraft Portfolio Financing; Helios Investment Partners in the acquisition of Fertilizers and Inputs Holding, held by Louis Dreyfus; Mitsubishi Corporation Bank on international credit operations; Japan Bank for International Cooperation in operations regarding export loan agréments; Rabobank for financing operations of Ferry Boats; General Electric for a power wind farm project; and Barclays Bank and Caixa Bank in a banking syndicate with another 15 banks for the refinancing of an internation al construction group. |

About the author |

||

|

|

Joana Andrade Correia Partner, Raposo Bernardo Lisbon, Portugal T: +351 21 3121330 E: jacorreia@raposobernardo.com Joana Andrade Correia has co-headed Raposo Bernardo's corporate and M&A department for 18 years. She has led multiple domestic and international operations, concerning corporate restructuring and M&A for key players in different sectors, including banking and finance, aviation, tourism, energy, among others. Recent work includes advising Icelandair Airlines on the privatisation of the National Airline of Cape Verde; Iberostar Hotels and Resorts Group in its business incorporation in Portugal and opening of two hotels; Deutsche Bank in the negotiation and preparation of a bank financing agreement relating to the acquisition of commercial aircrafts; China Africa Development Bank on financing of investments in infrastructure and construction projects; Afreximbank on the financing of the construction of a Hilton hotel; and Elix Capital on transactions involving airlines and aircraft leasing companies, acquisition and leveraged financing. |