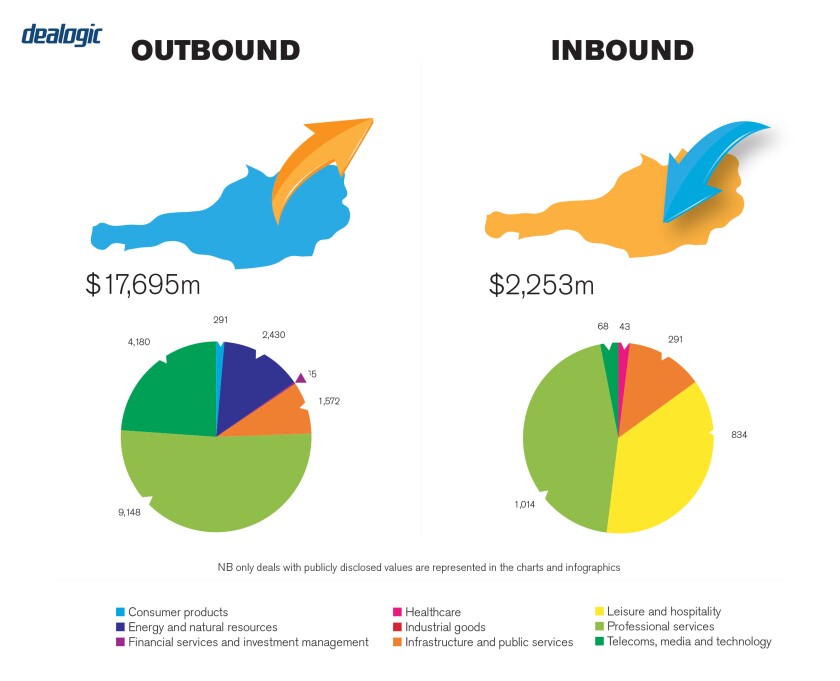

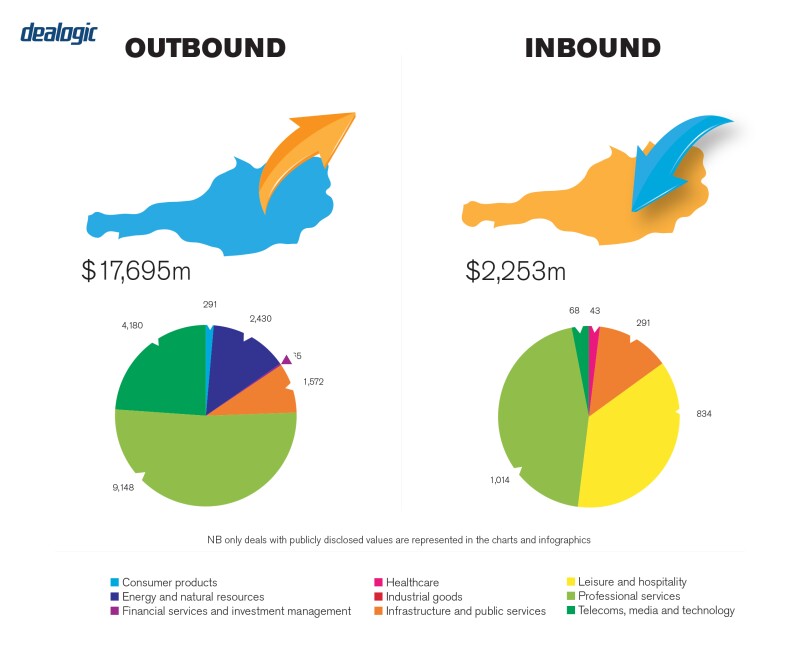

Although the volume and value of M&A involving Austrian targets declined in 2019, Austria's M&A market remains stable. According to Deloitte's M&A Deal Tracker Austria, 242 transactions completed in the first three quarters of 2019. Consumer goods proved the most active sector, accounting for about 30% of all target companies. The services and tech sectors came next, while for foreign buyers the tech and real estate sectors remained highly attractive.

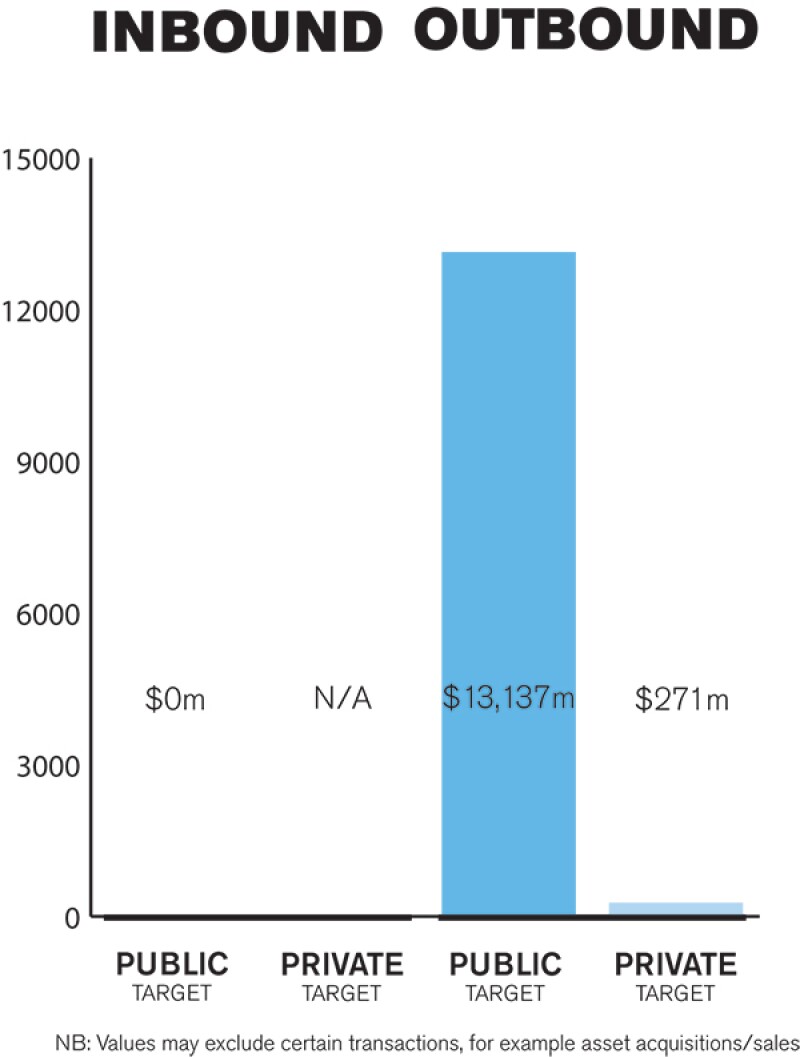

The number of completed M&A transactions in the market again decreased, but only slightly compared to the previous two years. According to Deloitte, the 242 transactions that took place in the first three quarters of 2019 represented a 5% decline in activity. Domestic market transactions declined noticeably, from accounting for 28% of all deals in 2018 to 22% in 2019. This trend shows that the market is becoming increasingly cross-border. International transactions – outbound as well as inbound – are growing. The relative share of outbound deals now stands at 41%. Inbound transactions currently account for 37% of all Austria-related transactions.

Germany remains Austria's most important M&A jurisdiction. The German market is of interest to both Austrian buyers and sellers. A total of 60 deals were concluded with companies from Germany in the first three quarters of 2019 alone. This means that German companies are involved in every third transaction on the Austrian market, although there has also been a noticeable decline here.

Across the market, the most significant sectors for M&A are consumer goods, telecoms, media and technology (TMT), real estate and services. As for deal trends, most M&A investments into Austria are undertaken by strategic buyers. However, private equity investment is becoming increasingly important for inbound transactions and this trend has not changed significantly compared to previous years. Foreign financial investors make up approximately one-third of inbound investments. In the domestic and outbound market, financial investors play a subordinate role, as this area is largely occupied by strategic investors.

The most significant transaction of the first half of 2019 that had an Austrian aspect took place in the oil sector, with OMV's investment of around €2.2 billion for the acquisition of a 15% share in Abu Dhabi Oil Refining Company (ADNOC Refining) and a 15% share in a to-be-established trading joint-venture (J-V). The transaction will give OMV a stake in a refinery hub in Abu Dhabi, with integrated petrochemicals consisting of Ruwais East, Ruwais West and Abu Dhabi Refinery, which has a total capacity of 922,000 barrels/day.

The next most significant transaction was the takeover of real estate company Galeria Karstadt Kaufhof by the SIGNA Group for around €900 million. The market also saw the takeover of the Warsaw Spire Tower by Immofinanz for €386 million. All in all, the top three deals in the first half of 2019 occurred in the real estate sector.

All three were outbound deals.

LEGISLATION AND POLICY CHANGES

Austrian law does not have one specific law regulating all issues on the acquisition of companies, but rather various different statutes apply depending on the specific type and form of an acquisition.

For asset deals, the regulations in Sec 1409 of the General Civil Code and Sec 38 of the Commercial Code are the most pertinent. Sec 1409 of the General Civil Code provides that a purchaser generally is jointly and severally liable with the seller to the seller's creditors for any of the acquired business' pre-transaction liabilities. The purchaser's liability is limited to the current net asset value of the acquired assets and applies in case the purchaser knew or should have known at the time of the purchase of the pre-existing liabilities. Sec 1409 of the General Civil Code is a mandatory law and cannot be waived or amended by contract. Liability can be reduced if the purchase price payable by the buyer is used to pay off the debts of the sold business. Sec 38 of the Commercial Code provides that a legal entity which acquires and continues a commercial business is liable for all the debts the former owner incurred in the course of business conduct, even those which are not contractually agreed to be taken over by the buyer. Unlike liability under Sec 1409 of the General Civil Code, liability under the Commercial Code is not limited to the value of the acquired assets. Nevertheless, under Article 38 of the Commercial Code the seller and buyer can agree to limit the liability of the seller. Such a limitation of liability, however, is only valid if a timely notification to the commercial register is submitted or otherwise made public.

A key regulatory authority with regard to M&A transactions is the Federal Competition Authority (Bundeswettbewerbsbehörde), which is responsible for the clearance of mergers where a transaction value does not meet the EC Merger Control Regulation thresholds but does meet those set by Austrian competition law.

Further relevant authorities are the Commercial Register Courts (Firmenbuchgerichte), which register and publish transactions and reorganisations in the Austrian commercial register, and the Financial Market Authority (Finanzmarktaufsicht), which reviews banking acquisitions. Public M&A transactions involving listed joint stock corporations (Aktiengesellschaft) are also subject to the supervision of the Austrian Takeover Commission (Übernahmekommission), which monitors compliance with the Austrian takeover regulations and decides on all matters related to the Takeover Act.

Recent changes in law

Under corporate law, after closing an M&A transaction, the management of the target company is obliged to file a notification with the Ultimate Beneficial Owners (UBOs) Register to update the registration with respect to the beneficial owners who ultimately own or control a legal entity. This is generally the case if a direct or indirect owner holds shares or voting rights of more than 25% in a company. If no beneficial owner can be identified, the members of the top management level of the legal entity (for example, the managing director and/or board of directors) are considered to be beneficial owners.

One recent change that will affect M&A transactions was the Amendment of the Austrian Law on the Ultimate Beneficial Owners (UBOs) Register (UBO Register, Wirtschaftliche Eigentümer Registergesetz). The amendment was part of the EU Financial Adaptation Act 2019 (EU-Finanz-Anpassungsgesetz), which was published on July 22 2019 and came into force on January 10 2020. The law amendment increases access to the database on UBOs.

The new regulations brought in via the amendment implement the 5th Money Laundering Directive. One of the most important single changes is that the UBO Register will become accessible to the general public. As of January 10 2020, any person can request an extract from the register about any legal entity without having to demonstrate any specific reason or legitimate interest. Previously, only authorities and certain groups of persons such as lawyers, notaries or credit institutes had access. The public extract contains information on the legal entity's name, address, register and register number and legal form as well as information regarding the period of time for which the legal entity has been in existence, the direct or indirect beneficial owner's forename and surname, date of birth, nationality and country of residence and the nature and scope of the beneficial ownership.

Furthermore, the notification obligations for legal entities have been made more stringent. An annual statement regarding the completeness and correctness of the data on the UBO Register is required regardless of whether any changes have occurred. Apart from this annual statement, changes must be reported on an ongoing basis within four weeks of the change taking place. The Austrian Ministry of Finance, as the competent register authority, is obliged to ensure the accuracy and completeness of the registrations, which can be enforced by penalties that have been increased.

Another change to the UBO Register concerns the voluntary provision of a "KYC compliance package" by a professional party representative. The UBO Register will be able to store and exchange KYC-relevant documents about beneficial owners, and these will only be accessible to certain persons, such as financial institutions, tax advisors, attorneys and notaries, to make KYC due diligence more efficient. Access to this data can be limited to individual persons and entities.

Regulatory changes under discussion

In many countries, laws are being discussed to prevent foreign buyers from taking over companies in sensitive industries. Austria is one of the EU member states that already has such a control mechanism in place: Section 25a of the Foreign Trade Act 2011 (AußWG 2011). This mechanism allows the government to prevent and control purchases of shares in companies in sensitive industries by foreign investors. In short, foreign direct investments (FDI) in companies involved in public security and public order, as defined by Art 52 and Art 65 (1) TFEU, are subject to approval. This primarily impacts the defence goods industry, security services and services of general interest (in particular energy and water supply, telecoms, transport and certain infrastructure for healthcare education and training).

Since May 2019 a ministerial draft has been in existence, and under consideration by the government, to amend the Foreign Trade Act. The draft foresees a change to Section 25a. The minimum threshold for shareholdings acquired by foreign investors in Austrian companies will be reduced from 25% to 10%. Anything above the 10% threshold will require approval. Certain companies in the media industry which contribute to the formation of public opinion via broadcasting, tele media or print products and which are characterised by their particular topicality and broad impact, will also be included in the group of companies where foreign investors need approval. Furthermore, the obligation to obtain approval would not only apply to the foreign acquirer of the Austrian company – as is now the case – but also to the Austrian target company, which will have to obtain approval and to submit the application for approval. As a new Austrian government was only appointed in January 2020, the timeline as to when and to what extent the amendment will come into force is unclear.

Also of note is that the new government's 2020 – 2024 programme aims to further accelerate and simplify the procedures for business start-ups, for example by promoting the development of digitisation in corporate law.

MARKET NORMS

The Austrian legal system has a few peculiarities that are commonly misunderstood. As most M&A deals in Austria are private M&A transactions with the target being an Austrian limited liability company, the share deal must be made in the form of a notarial deed in front of an Austrian notary public. One misconception is that the notarial requirement poses a large hurdle. This is not true, as share purchase agreements can also be done in the English language with notaries so qualified. With the increasing foreign involvement in Austrian M&A transactions, it has become more and more common that such notarial deeds are drawn up in English.

An area that does require specific attention is Austrian stamp duty tax. Typically, stamp duty tax can become payable based upon the simple fact that a written document is being drawn up in Austria. Though a share purchase agreement itself is not subject to stamp duty tax, suretyship arrangements, whereby one company is obliged to step in and fulfil a liability if, for example, a subsidiary does not perform, can trigger stamp duty.

For real estate transactions, care needs to be taken in the structuring so as not to trigger real estate transfer tax, which can also apply to share deals.

PUBLIC M&A

Most factors regarding the acquisition of a controlling stake in a public company are regulated by the Austrian Takeover Act. A compulsory public offer must be made to the other shareholders when a shareholder acquires a stake of 30% or more. Hostile bids do not have different rules. In a friendly bid however, the bidder is commonly given the opportunity to carry out due diligence, while in a hostile bid the bidder is generally restricted to publicly available information. In hostile takeovers, the management board is also obliged to remain neutral. Due to the limited number of Austrian-listed companies, hostile bids are rather unusual in Austria.

Pursuant to Sec 5 para 2 of the Austrian Takeover Act, the intention to acquire a stake in a public company needs to be communicated as soon as there are rumours that could alter the stock price. The bidder that intends to place an offer must also inform the target's representatives immediately, notifying them that the executive board and the supervisory board have decided to place an offer, or that conditions have been met that oblige them to place an offer. Public takeover offers need to be executed in a way that minimise market manipulation and insider trading. The members of the target company also have corresponding secrecy and transparency duties. A further condition is the notification of the workers council pursuant to Sec 11 para 3 of the Austrian Takeover Act. A financial expert must also be included in the public takeover offer process.

As for break fees, in public M&A transactions these are rather uncommon, partly due to legal restrictions.

PRIVATE M&A

One of the biggest recent developments is that warranty and indemnity (W&I) insurance is no longer a purely theoretical consideration and has seen increasing use in the Austrian market. Private equity buyers are at the forefront of this development. Given the bridge function W&I insurance serves between buyers needing increased contractual protection and sellers for various reasons not willing to provide this, we expect a further increase in its use.

Earn-outs and escrows have also become more common, but whether a buyer can successfully negotiate these is very deal specific. Whereas locked-box mechanisms are common in auction settings, closing accounts often are agreed upon in one-on-one negotiated deals.

In the case of a private takeover, typically offers prior to the signing of definitive agreements are conditional upon a satisfactory due diligence, the completion of transaction documentation and the approvals of internal boards.

In terms of governing law, the parties to a private M&A share purchase agreement (SPA) generally agree on Austrian substantive law and dispute resolution in Austria. For the mode of transfer, which is necessary for the transfer of shares in a limited liability company, Austrian law is mandatorily applied. This means that the SPA for such transfers needs to be in the form of a notarial deed.

As for the exit environment, IPOs do not play a significant role in the Austrian market. Generally, a shareholder interested in selling its shareholding will either seek potential purchasers and negotiate exclusively or will initiate a structured bidding process to which interested parties are invited. As the Austrian market is rather small, the shareholder will very often be aware of potentially interested parties in the domestic market and address them directly.

LOOKING AHEAD

We expect the Austrian M&A market to remain robust and for the trend towards larger transactions to continue. Although Austria is a relatively small market, Austrian companies have a strong reputation worldwide for having excellent expertise, especially in the high-end tech area. As the modern M&A market is driven by tech transformation, we believe that Austria's expertise in this field will drive growth in Austrian M&A transactions. Another reason for optimism is Austria's strong economic position, which is firmly embedded in the EU. Persistently low interest rates and high rates of liquidity in the market will also continue to push the M&A market forward.

About the author |

||

|

|

Markus Fellner Partner, Fellner Wratzfeld & Partners Vienna, Austria T: +43 1 53770 311 W: www.fwp.at Markus Fellner is a founding partner and the head of the firm's corporate and M&A practice. He also specialises in banking and finance, insolvency law and restructuring. Markus was admitted to the Austrian Bar in 1998 and lectures at various institutions. He obtained his law degree from the University of Vienna and his business degree from the Vienna University of Economics and Business. |

About the author |

||

|

|

Paul Luiki Partner, Fellner Wratzfeld & Partners Vienna, Austria T: +43 1 537 315 W: www.fwp.at Paul Luiki is a US native partner at fwp specialising in the full range of M&A transactions. He has a specific focus on cross-border transactions, in particular in the CEE region and the US. His other fields of specialisation include banking and finance, contract law and arbitration. Paul is a frequent lecturer at the University of Vienna on M&A and joint-ventures. |

About the author |

||

|

|

Elisa Maria Kaplenig Attorney at law, Fellner Wratzfeld & Partners Vienna, Austria T: +43 1 537 700 W: www.fwp.at Elisa Maria Kaplenig is an attorney at law at fwp specialising in corporate and M&A, antitrust and competition law and corporate litigation. She has a law degree as well as an international business administration degree from the University of Vienna and was admitted to the Austrian Bar in January 2020. |