Bulgaria's M&A market is being helped by the recovery of the EU-wide economy, including in the smaller economies across the EU. EU sources of funding for Bulgarian small- to medium-sized enterprises (SMEs) are also among the significant factors providing a boost to the Bulgarian M&A market.

Investors are typically interested in the acquisition of majority shareholdings in market leaders in different sectors of the economy or in companies with serious optimisation potential. Often, they look for consolidation opportunities where they would first invest in one of the local market leaders and subsequently, use the investment as a platform to acquire more companies in the same business sector in order to consolidate and optimise the market. Consolidation in the banking sector also represents a significant trend.

In 2019 we saw a major reshuffling in the media sector as the two largest Bulgarian private TV media groups were transferred to new owners: bTV was acquired by a major CEE private equity fund and NOVA was acquired by a leading Bulgarian investor. Important changes occurred in the banking sector as well. Hungarian OTP Bank's local subsidiary DSK Bank (the second largest Bulgarian bank by assets) acquired Société Générale's local subsidiary, while Eurobank's local subsidiary Eurobank Bulgaria acquired Piraeus Bank's local subsidiary, which was later merged into its new parent to create the fourth largest Bulgarian bank. Other sectors that are of typical interests for the foreign investors, include IT, agricultural land and telecommunications.

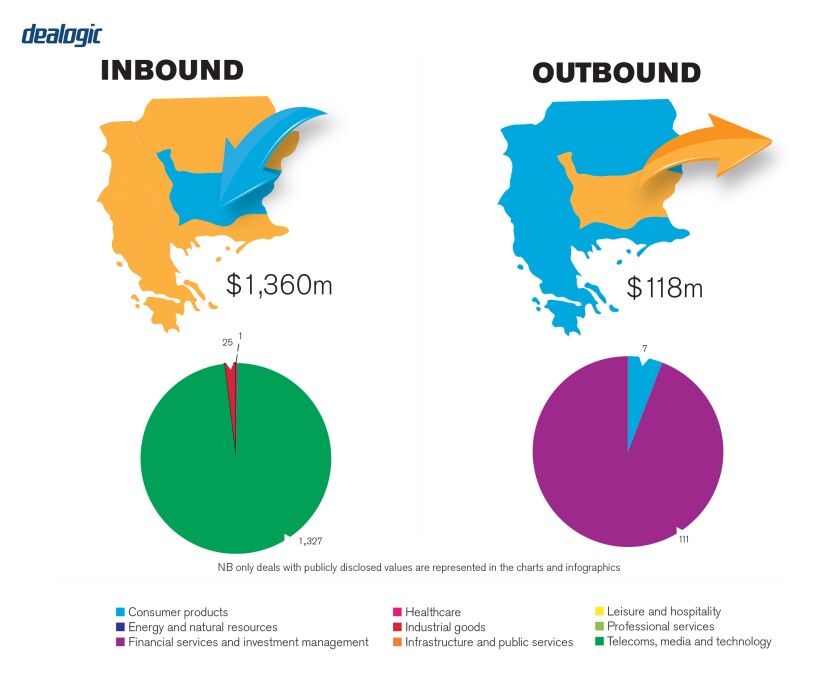

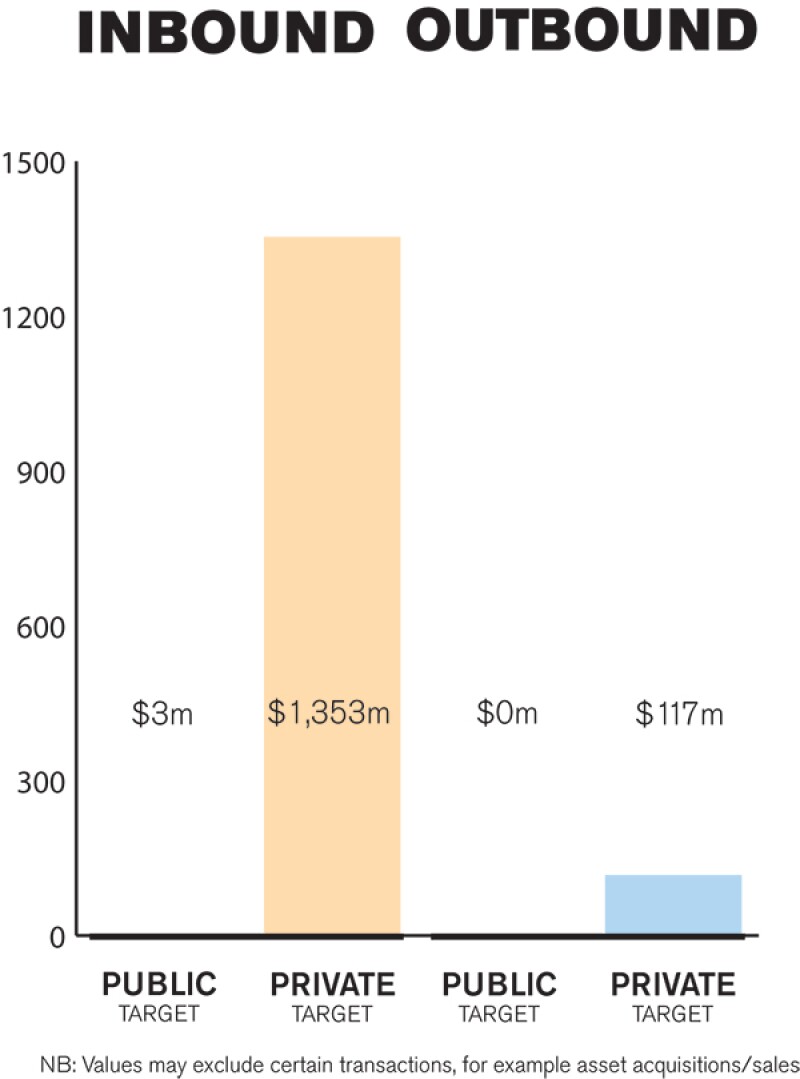

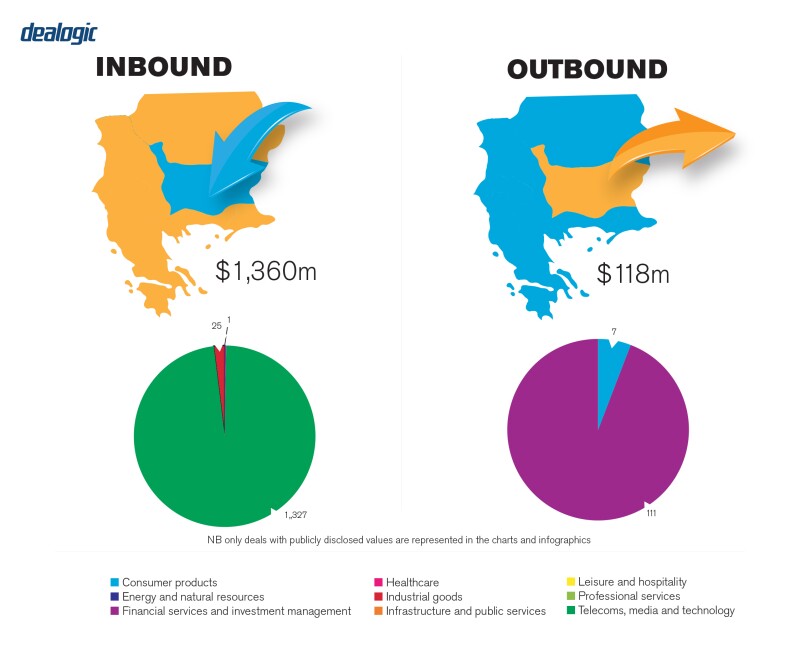

Private M&A transactions prevail in the Bulgarian market, whereas notable public M&A transactions are very rare. The most serious problem facing the Bulgarian Stock Exchange is low liquidity and the number of investors in Bulgarian companies has generally declined in recent years. The market is dominated by large Bulgarian institutional investors and a solid number of individual high-income investors, while long-term international investors are scarce.

TRANSACTION STRUCTURES

The acquisition techniques that are employed depend on many factors, such as the aims of the M&A transaction, whether it is a first investment in Bulgaria, whether the target has a good management team in the respective sector and what position the investee company has in the market, etc. In general, transactions can be summarised as: acquisitions of a majority shareholding; acquisitions of a 100% shareholding; minority investments; or acquisitions of going concerns or assets. Sale of distressed assets by their creditors, banks or others, where the stress is on the preservation of the business capabilities of the units being sold, is also becoming a distinctive trend in the local market.

|

|

In recent years, W&I insurance has appeared in more and more deals |

|

|

In most of the cases, a foreign investor will set up a local subsidiary and use the subsidiary as an investment vehicle or holding company for its interests in the country. Depending on the optimisation structure, the investor can hold its investments in separate companies, consolidate them under one holding company or merge all the investee companies into one entity.

Majority or 100% stake investments give to the investor very strong corporate control and decisive influence over the investee company. These are very important in optimising business structures, corporate governance and the preservation of the investors' rights. At the same time, the majority investment allows the investor to keep and incentivise the management of the company, creating options for further increase of its value.

The investment in shares also makes an exit easier. It can receive beneficial tax treatment and allow the investee company to be listed (also facilitating an exit), etc. Investment in assets, through an SPV, usually results from issues or irregularities found in the due diligence process.

In recent years we have seen the creation of several private equity (PE) funds looking to invest in high-growth Bulgarian SMEs with support from EU investment initiatives (for example, with funding from the European Investment Fund, part of the European Investment Bank, through the JEREMIE initiative to support Bulgarian SMEs). Large foreign PE funds are active in various sectors of the Bulgaria economy – RE, telecommunications, etc.

Recent transactions

Many current global trends can be observed in recent M&A transactions in Bulgaria. One of the most interesting new developments is the use of warranty and indemnity (W&I) insurance to cover potential sellers' liabilities for misrepresentations or breaches of warranties. Such products are not offered by Bulgarian insurance companies but it is getting easier to find foreign insurers willing to agree to cover risks in Bulgaria, even though most Bulgarian M&A deals involve lower values. Increasing competition is pushing the insurance premiums down. Yet, in almost every large-scale transaction, W&I insurance is being at least seriously considered, especially where the selling party is a PE fund, be it Bulgarian or foreign. Sometimes, this is the most difficult part of the negotiation, especially if the buy side is less experienced and used to more exotic proposals. Yet, we firmly believe that W&I insurance policies will become a more popular instrument to deal with the delicate issue of a seller's liability.

Another interesting trend that we have observed over the last two to three years is a gradual preference for locked-box mechanisms (LBM) over post-closing price adjustment deals. LBMs offer more simplicity and predictability in closing mechanics and fewer closing expenses. They are very often combined with the retention of a portion of the price in an escrow account, covering the assumingly higher risk of the purchaser of unauthorised leakages or other events that may erode the price. The use of W&I insurance may eliminate the use of retention mechanisms and in so doing further facilitate a clean exit for a seller.

Brexit is also leading to new and unexpected discussions during M&A deal negotiations. Until recently, the laws of England and Wales and the English courts were considered a very standard feature in an international M&A deal involving Bulgarian parties. In the short term, English laws and courts will perhaps keep their leading role, but this may change with time and parties to Bulgarian M&A deals could start looking at different law options to govern their relations and to resolve their disputes.

LEGISLATION AND POLICY CHANGES

M&A transactions in Bulgaria are not subject to any special legislation and are regulated by general company law. Therefore, the main acts that would affect the formation and management of a company or PE fund and M&A transactions are the Commerce Act and the Obligations and Contracts Act. The requirements of the Markets in Financial Instruments Act (Mifid), the Collective Investment Schemes and Other Undertakings for Collective Investments Act and the Public Offering of Securities Act also settle important issues where an investor operates in the capital markets. Likewise, investments in certain regulated entities must observe the rules applicable to those activities – for example, the Insurance Code, the Social Insurance Code, the Credit Institutions Act, etc.

There have been no recent pieces of legislation aimed at promoting or constraining M&A transactions.

In 2014, Bulgaria adopted the Act on the Economic and Financial Relations with Companies Registered in Preferential Tax Treatment Jurisdictions, the Persons Controlled by Them and Their Beneficial Owners. It introduced restrictions aimed at limiting the participation of offshore structures in some of the most important sectors of the economy, such as banking, public procurement, concessions for underground resources, etc. These restrictions can impact investors using such structures but can be overcome subject to compliance with some additional disclosure / registration requirements.

At the end of 2016 and 2017, several amendments to the Commerce Act provided more formalistic requirements for transfers of going concerns and shares in LLCs, which increased the time and paperwork needed for the perfection of these M&A transactions.

The Measures against Money Laundering Act (promulgated in the State Gazette No. 27/27.03.2018 and effective as of March 31 2018) contains measures to protect the financial system from money laundering activities, as well as requirements to identify of clients and improve reporting requirements. This Act provided for an obligation on the part of companies incorporated within the territory of the Republic of Bulgaria to disclose, on the commercial register, information on the natural persons who are their beneficial owners.

There are no rules, legislation or policy frameworks under discussion that may materially impact M&A activities in Bulgaria.

MARKET NORMS

The market in Bulgaria is becoming increasingly professional. Parties to an M&A transaction, even if they are 100% Bulgarian, are normally surrounded by legal, tax and financial advisors. The decision-making process is moving increasingly to the side of the rational rather than the emotional. Still there are many 'old fashion' business owners that operate and manage quite sizable businesses directly and without trusting professional advisors or consultants. Consequently, it can be difficult to negotiate M&A deals for family-owned businesses. This type of business owner is often quite suspicious when dealing with foreign investors. Tact and a bespoke approach are needed in order to get deals across the line.

Overall, there is weak awareness of the options PE funds offer and the way they do business or enter into M&A transactions. The awareness is growing, especially in Sofia and in other large business centres around the country, but it is still at rather low levels.

An M&A transaction includes a negotiation and a transaction stage. The questions asked during the negotiation stage tend to relate to the status of the other party, the status and the condition of the target, how confidentiality is to be guaranteed, how and when the purchase price will be paid, what are the actions before and after the closing, and what representations and warranties the seller must make. In the transaction stage, the main terms that parties negotiated must be documented in detail and the main questions at that stage are related to both the structure and the wording of the sale agreement. Entrusting the preparation of the transaction documents to inexperienced lawyers usually has a negative consequence for the parties when it comes to receiving the money promised and, equally important, keeping the money received.

As relates to legal practice trends, the use of the cloud service in the organisation of virtual data rooms in the due diligence process has been standard for a very long time. We are also seeing a clear trend in of automatization in document drafting to the extent possible, in particular with standardised closing documents.

Discussions are ongoing about the use of artificial intelligence in the due diligence process, although machine learning in the Bulgarian language is a challenge. The high cost associated with it also poses a challenge. In recent years we have observed an increased interest in the use of deal matching platforms, but we have not seen yet a transaction based on such a match.

PUBLIC M&A

Any person that acquires more than one-third of the votes in the General Meeting of a public company must register, through the Financial Supervision Commission, a tender offer to the remaining voting shareholders to purchase their shares or for exchange of their shares for shares which will be issued by the offeror for this purpose within 14 days of the acquisition date; or, when the threshold has been exceeded due to a conversion or withdrawal of shares, within one month of registering the conversion or capital decrease with the Commercial Register.

The abovementioned tender offer process is there to ensure equal treatment of the shareholders, who enjoy equal status under law; to allow sufficient time and information for an informed assessment of the offer in order to make a reasoned decision; to prevent market manipulation; to ensure full payment or exchange of shares to the shareholders that accept the offer; and to not inhibit the target company's activity for an unjustifiably long period of time. The law provides for mandatory content of the tender offer, including a justification of the proposed price or rate of exchange.

Break fees payable by the target company in a public acquisition are not typical. Contractual break fees can be agreed where a majority shareholder in a public company sells its stake outside of the stock exchange, in which case the deal must simply be registered at the stock exchange.

PRIVATE M&A

One practice that is growing in popularity and becoming increasingly frequent is the inclusion of locked-box mechanisms in deals, over the once prevalent mechanism of price adjustment based on closing accounts.

In many cases, acquisitions provide for a transfer of shares but also for the assignment of the debts owed to the former owner (for which the price of the shares would be adjusted and accordingly reduced). In these cases, we see a consideration clearly split between two elements, and this will normally have positive tax consequences for the transferor.

Also, parties may agree that the leaving shareholder will receive as many dividends as possible, which may also reduce the price for the shares but have beneficial tax effect (dividends are in general taxed at 5% and the capital gains at 10%).

|

|

There is weak awareness of the options PE funds offer and the way they do business or enter into M&A transactions |

|

|

The usual conditions for a private takeover include the scope of the acquisition, price calculation and payment, conditions precedents, including satisfaction with the results of the due diligence and the securing of merger control clearance, covenants between signing and completion, timeline, exclusivity and confidentiality.

If one of the parties to an M&A transaction is a foreign investor, it is common practice to provide for a foreign governing law and jurisdiction in private M&A share purchase agreements. The negotiation of arbitration under the International Chamber of Commerce (ICC) is also common practice. Despite the choice of foreign law, the transfer of the shares in rem is regulated by the mandatory provisions of Bulgarian law (notarisation of the transfer deed is required if the target is an LLC).

In recent years, W&I insurance has appeared in more and more deals. This is particularly relevant in relation to PE funds trying to make a clean exit. However, it would be an exaggeration to say that this has become the market standard. Most deals provide for classic liability solutions.

The Bulgarian market has good liquidity and divestment from Bulgaria is rarely a problem. In many cases in recent years exiting foreign investors have been replaced by Bulgarian ones. IPOs as an exit strategy are available only to investors in joint stock companies (JSC). If invested in another type of company, for example an LLC, the company would need to be converted first. Exits via IPO are rare. An IPO must be completed following the procedure set out by the Public Offering of Securities Act, under which the investee company has to prepare a prospectus. The prospectus must be approved by the Financial Supervision Commission, the investee company needs to be registered as a public company with the Central Depository, the Financial Supervision Commission and the Commercial Register, and its shares must be listed on the Bulgarian Stock Exchange.

LOOKING AHEAD

We expect the M&A market in Bulgaria for the next 12 months to be segmented into large M&A deals with a prominent dominance of foreign investors (both strategic and PE) and small to mid-market M&A deals, where we would see more and more Bulgarian investors trying to expand their businesses. M&A activity is anticipated mainly in the IT sector, in commercial real estate (office space), agriculture and the food industry.

About the author |

||

|

|

Yordan Naydenov Partner, Boyanov & Co Sofia, Bulgaria T: +359 2 8 055 052 F: +359 2 8 055 000 Yordan Naydenov is a partner at Boyanov & Co, and head of the M&A and corporate practice groups. He obtained his master of laws degree from Sofia University and specialised in an international secondment to Clifford Chance, London and Budapest. Yordan has extensive experience across M&A and financing matters. He frequently advises clients in the banking and real estate sectors on local transactions and restructuring issues. Yordan is author of several publications in his area of specialisation. |

About the author |

||

|

|

Mihail Vishanin Senior associate, Boyanov & Co Sofia, Bulgaria T: +359 2 8 055 067 F: +359 2 8 055 000 Mihail Vishanin is a senior associate at Boyanov & Co. He specialises in corporate, M&A, procurement, litigation and alternative dispute resolution. He obtained his master of laws degree from Sofia University and specialised his studies in the Academy of American and International Law, The Centre for American and International Law, Dallas, US. Mihail is author of several publications in his area of specialisation. |