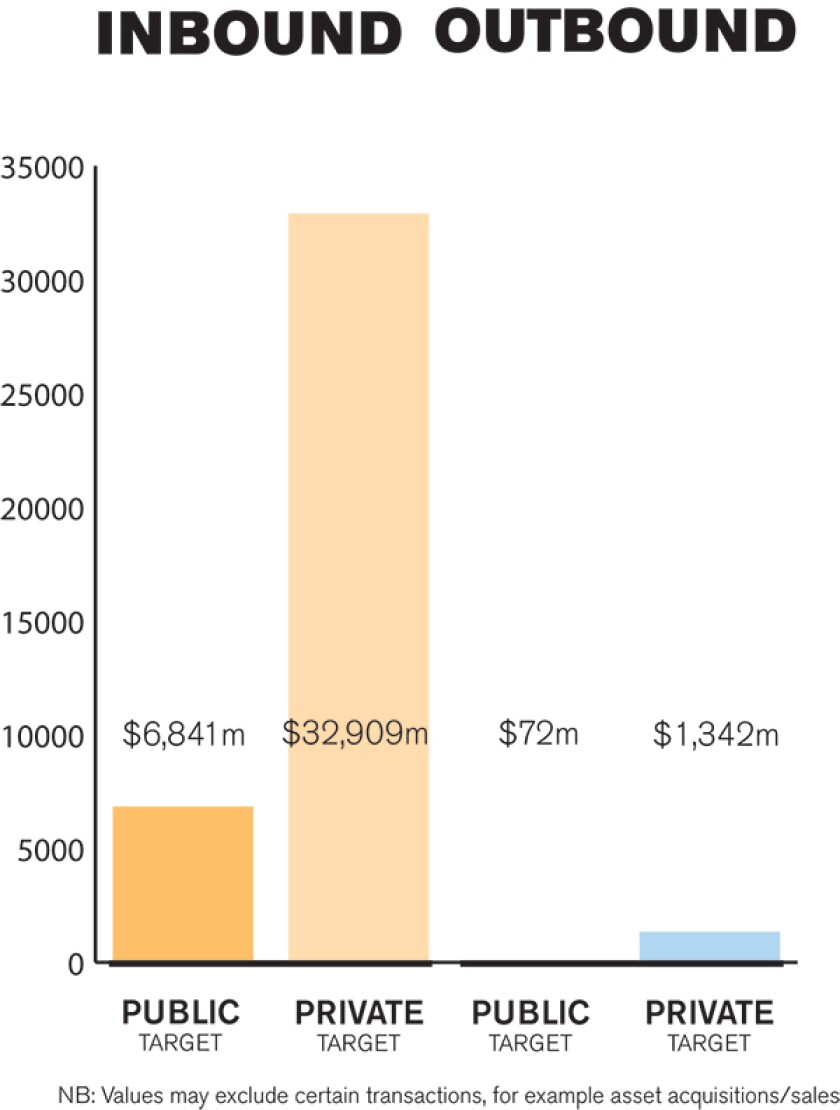

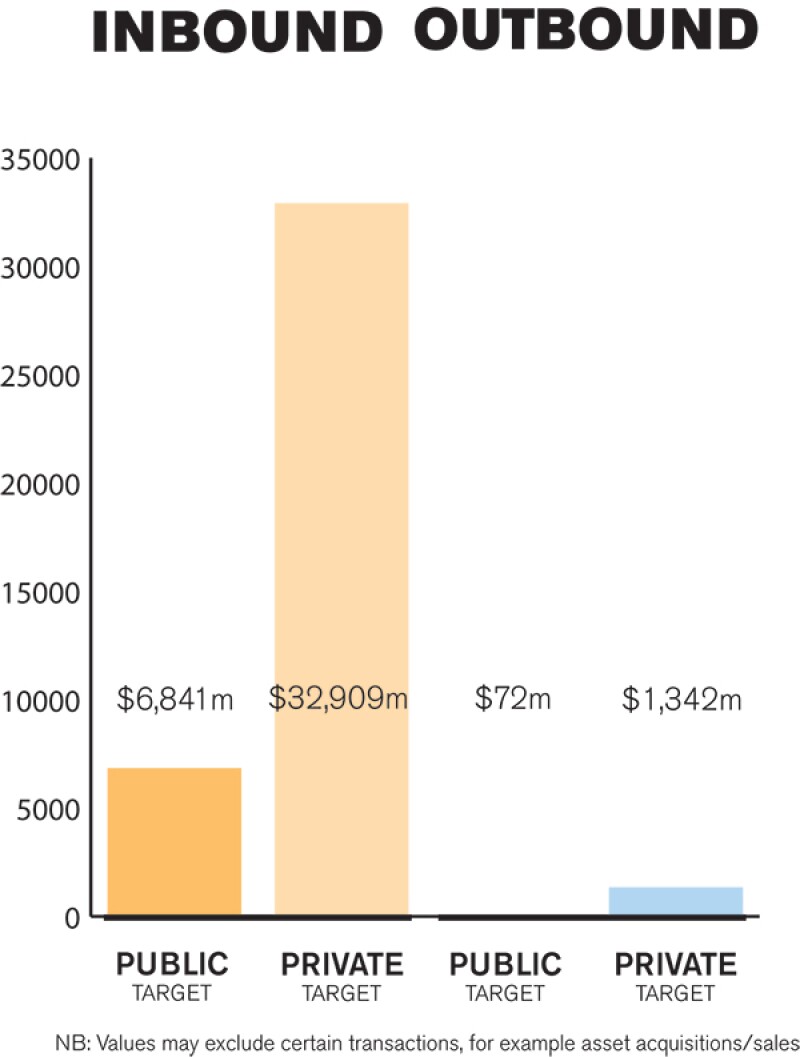

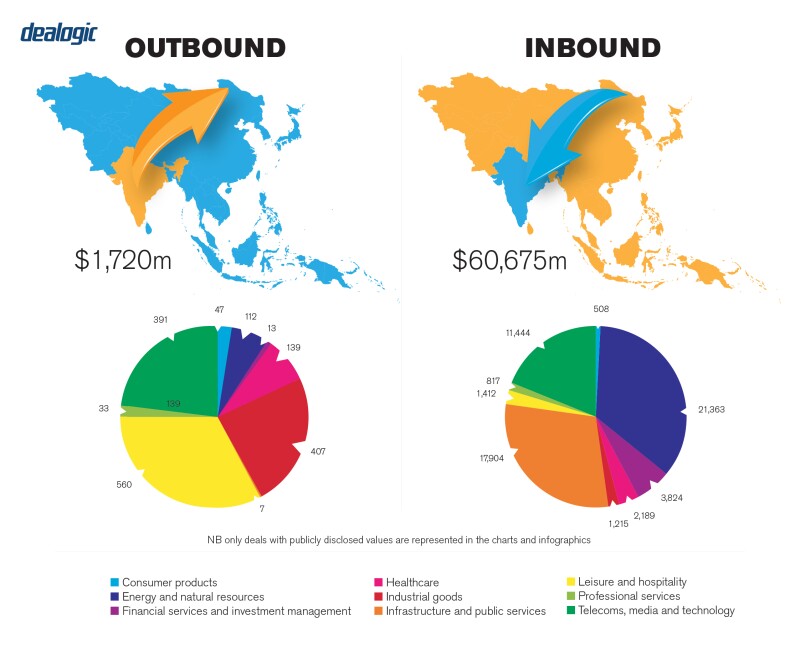

Indian M&A activity during 2019 surpassed $67 billion in aggregate deal value. This meant that 2019 was India's second-best year for deal activity despite a 34.4% slowdown in deal value from 2018. Deal activity in 2019 was driven by platform deals, portion buyout deals, distressed asset acquisition opportunities and the continued attractiveness of the technology sector.

Despite a decrease in deal value, inbound M&A activity remained strong with $37.9 billion in aggregate deal value. On the other hand, outbound M&A activity fell sharply to $1.9 billion. Private equity (PE) buyouts surpassed their 2018 levels and reached $19.6 billion in deal value, while PE exits fell to $7.9 billion. Domestic M&A activity halved in value from $56.4 billion in 2018 to $29.1 billion in 2019.

Historically, private M&A deals have led the Indian market. In recent years, however, public M&A has accelerated, and public market exits in 2019 were up approximately 45% from 2018.

Consolidation across sectors has been a key feature of M&A activity in 2019. India's rapidly evolving distressed asset regime has also contributed significantly to consolidation opportunities. Another key trend was a preference for platform transactions, especially in the infrastructure sector. Infrastructure investment trusts (InvIT) were the platform of choice in two of the largest M&A deals of 2019. Real estate investment trusts (REIT) matured as an investment platform, with the listing of India's first REIT. More REITs are expected in 2020. Control transactions and buy-outs are gaining more popularity, with better governance, consolidation, enhancing value and deleveraging being the key drivers.

PE influence on M&A activities has been on the rise, driven primarily by deals in technology, financial services, energy, and infrastructure sectors. 2019 was partial to PE buyout deals with fewer PE exits being registered. Sovereign welfare funds and pension funds have shown continued interest in renewables and infrastructure in addition to late stage start-ups, e-commerce, pharmaceuticals and logistics.

Among the notable transactions, Arcelor Mittal together with Nippon Steel Corporation acquired Essar Steel India under the insolvency resolution process for $6 billion, making it the largest deal by value for 2019. This highlights the positive impact of India's revamped insolvency regime on investor confidence on distressed assets. A consortium led by Brookfield Infrastructure Partners invested $3.7 billion to acquire the telecom tower assets of Reliance Jio through Reliance Tower Infrastructure Trust, an InvIT. With the increased appetite for platform transactions, this deal is a significant milestone towards establishing InvITs as a viable platform structure.

LEGISLATION AND POLICY CHANGES

The key legislation and regulations governing Indian M&A activity include:

Companies Act, 2013: Administered by the Ministry of Corporate Affairs (MCA), the Companies Act is the primary legislation governing companies and mergers.

Securities Regulations: The securities markets are regulated by the Securities and Exchange Board of India (SEBI). The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Code) governs substantial stake acquisitions in publicly listed companies. The SEBI (Delisting of Equity Shares) Regulations, 2009 governs take-private transactions.

Foreign Exchange Management Act, 1999 (FEMA): Administered by the Reserve Bank of India (RBI) and the Government of India, FEMA, the rules issued by the Government of India thereunder as well as the associated RBI regulations regulate capital inflows and outflows.

Competition Act, 2002: The Competition Commission of India (CCI), the regulator established under the Competition Act, accords anti-trust approvals.

Income Tax Act, 1961: Administered by the Income Tax Department, the Income Tax Act along with double tax avoidance treaties entered into by the Indian government govern the tax treatment of M&A transactions.

Insolvency and Bankruptcy Code, 2016 (IBC): Administered by the National Company Law Tribunals, the IBC regulates auction sales under a corporate insolvency resolution process.

Recent legislative changes include a reduction in corporate tax rates. The standard corporate tax rate in India is 30%, however, tax laws now permit companies to opt for a lower corporate tax rate of 22% subject to certain conditions. Separately, a concessional rate of 25% has been extended to companies with a turnover of up to INR4 billion (~$56 million) (as compared to the earlier ceiling of INR2.5 billion). Further, a preferential tax rate of 15% has been introduced for new domestic manufacturing companies (set up and registered on or after October 1 2019 and commencing manufacturing on or before March 31 2023).

The government has removed foreign investment caps in insurance intermediaries. The existing cap of 49% on foreign ownership of insurance intermediaries (such as insurance brokers) has been done away with.

Approval from CCI is required for Indian M&A deals above certain thresholds. A 2019 amendment has introduced a 'green channel' merger control route which affords deemed approval for certain transactions having a low impact on competition.

Going forward, there are a few other recent legislative and regulatory changes that may impact M&A activity. One is the imposition of stamp duty on transfer and issuance of dematerialised shares – such transfers and issuances were previously exempt from stamp duties. This change will impact transaction costs for M&A deals (particularly public M&A). Another is the introduction of the Personal Data Protection Bill, 2019 (PDP Bill). When passed, the PDP Bill will regulate the collection, disclosure, sharing and processing of personal data in India and the processing of personal data outside India with respect to goods/services offered to individuals located in India. The PDP Bill is expected to have a significant impact on fintech, e-commerce, financial services, and healthcare sectors. A third development is the inclusion of private unlisted InvITs under SEBI's existing InvIT regime. Private unlisted InvITs enjoy significant business flexibility and are subject to significantly lower regulatory compliance as compared to listed InvITs. Private unlisted InvITs are expected to feature prominently in Indian deals going forward.

MARKET NORMS

Some common mistakes made by foreign investors dealing with the Indian M&A market are: (i) the failure to undertake detailed due diligence, especially in highly regulated sectors; (ii) inadequate mapping of expectations (commercial or legal) in transaction documents, specifically with respect to governance structures; (iii) significant shareholders being categorised as 'promoters' under Indian securities laws, which leads to onerous compliance and liability exposure; (iv) disengaging advisors at the end of the negotiation stage, rather than the last mile, which could expose investors to closing and post-closing compliance complications; and (v) excluding recourse to the Indian courts for interim relief in case of dispute resolution through foreign arbitration.

With constant risk of overnight insolvencies, pending and potential material litigations, as well as corporate fraud – a detailed due diligence exercise and an assessment of corporate governance standards in acquisition targets (particularly deals involving legacy related party transactions) becomes indispensable.

Legal, regulatory and tax advice should be sought at the outset to identify regulatory hurdles and approval processes before transaction terms are crystallized, specifically the impact of anti-trust and exchange control regimes. Information exchanged should be within the bounds of anti-trust law especially when the deal is negotiated between competitors. Handling of unpublished price sensitive information in case of publicly listed targets is also a major pain point.

In PE control transactions, taking warranties on holding cost/period of acquisition of sale shares (supporting tax deduction claims), adoption of new accounting standards, insolvency risk in group companies, and sectoral compliance is imperative. Representation and warranty insurance is also more frequent in M&A deals. For cross-border M&A, exchange control regime limits (on floor price and deferred payments, and recourse to escrows/indemnities) are vital considerations.

In the future, data analytics and document automation tools coupled with artificial intelligence are expected slash timelines for completing due diligence. Digital technology could also be a game changer for post-merger integrations (workforce, operations, corporate processes, etc.).

PUBLIC M&A

Mergers and amalgamations require sanction of the National Company Law Tribunal.

An acquirer can choose two ways to secure control in a publicly listed company, by triggering either a voluntary or mandatory tender offer. Under the Takeover Code, barring certain exemptions, an agreement for the acquisition of 25% or more voting rights or control of a publicly listed company requires the buyer to tender a public offer to further acquire at least an additional 26% of target shares. Acquirers should also ensure that minimum public float (prescribed at 25%) is maintained at all times, unless the target is delisted pursuant to the transaction. Delisting has proved to be challenging in India and is consummated through a reverse book-building process to determine offer price, yielding a significant premium. If the discovered price is unacceptable, an acquirer may make a counter-offer which must not be lesser than the book value (which comes with its own set of challenges).

Customarily, hostile takeovers of publicly listed entities in India have been scarce. However, 2019 witnessed India's first hostile takeover in the IT space when Larsen & Toubro successfully launched a bid to take over Mindtree.

Public takeovers may require mandatory regulatory approvals, including from sector-specific regulators and anti-trust approvals. These regulatory approvals may be conditional or may prescribe additional compliance. While there is limited scope to attach specific conditions in a public tender offer, the Takeover Code permits offers to be conditional upon a minimum level of acceptance (subject to deposit of the offer amount in an escrow), and acquirers may also make takeovers subject to receipt of statutory approvals.

Further, if the transaction underlying a takeover offer is terminated because an essential condition is not met for reasons outside the acquirer's control, the acquirer is permitted to withdraw the offer subject to such condition having been disclosed in the offer documents.

Break fee provisions are at a nascent stage in India. Payments of break fee and reverse break fee do not have an origin in the legal framework but can be contracted upon. Lack of legal backing may impose regulatory hurdles such as a requirement of prior approvals from the RBI and SEBI.

PRIVATE M&A

The completion accounts mechanism is commonly used for price adjustments in private M&A transactions in India, though an increase in the use of locked-box pricing mechanisms has been seen in recent years. Earn-out and escrow structures are also gaining popularity – however, in case of cross-border deals, exchange control regulations impose certain limitations on these structures.

Warranty and indemnity insurance is not very common in India and both enforcement timelines and premiums on insurance coverage are substantially higher than in matured markets. However, due to an increase in cross-border transactions, difficulties in estimating litigation durations, and buyers seeking seller credit-risk mitigation, the market for such insurance products is growing rapidly.

There is no practice of private takeover offers in India, as private companies are required to impose restrictions on the transfer of shares. Transactions involving the exercise of contractual rights, such as tag-along and drag-along rights by the selling majority investor or the sale of pledged shares by lenders, are notable exceptions. The MCA has recently (February 2020) notified rules for operationalizing National Company Law Tribunal driven private takeovers. The rules enable shareholders having a 75% or more stake in a company to buyout the minority subject to certain conditions, including compliance with specified pricing norms.

Indian law usually governs private M&A transactions – however, cross-border transaction documents for dispute resolution generally provide for foreign-seated arbitration (in Singapore, New York or London).

LOOKING AHEAD

Despite global headwinds and weak macroeconomic indicators, M&A activity in India is expected to show resilience this year due to recent business-friendly reforms such as attractive tax policies, the removal of certain sectoral caps on foreign investment and other proposed regulatory reforms. Continued divestment of state-owned assets, growing confidence in the insolvency regime, growing appetite for buyout deals and domestic consolidation are likely to fuel M&A activity, while new investment vehicles such as InvITs and REITs are likely to feature more prominently in 2020.

About the author |

||

|

|

Harsh Pais Partner, Trilegal Mumbai and New Delhi, India T: +91 22 4079 1062, +91 11 4259 9290 Harsh Pais is a partner at Trilegal with a focus on M&A. Harsh advises extensively on cross-border acquisitions (involving public and private targets) and joint-ventures. In addition, he provides strategic counsel to clients on matters involving change of control transactions, corporate governance, securities laws, troubled joint ventures and crisis management. Harsh has been ranked as a leading lawyer for M&A and private equity in India by Chambers and Partners, IFLR1000 and RSG. He has experience at a major international law firm in New York and is additionally qualified in the UK and New York. |

About the author |

||

|

|

Clarence Anthony Partner, Trilegal Bengaluru, India T: +91 80 4343 4610 E: Clarence.Anthony@trilegal.com Clarence Anthony is a partner at Trilegal. He focuses on M&As, JVs and advisory mandates in highly regulated sectors such as insurance and banking. Clarence has advised on numerous complex cross-border transactions, including HIG Capital's acquisition of Medusind, Aon's exit from its India JV, Macnica's strategic investment in Crowdanalytix and DEG's investment in Suryoday Small Finance Bank. Clarence was previously seconded as head of legal and compliance at Embassy Office Parks REIT, India's only real estate investment trust. Clarence is an alumnus of GLC, Mumbai, a solicitor admitted by the Bombay Incorporated Law Society and is additionally qualified in the UK. |

About the author |

||

|

|

Varun Agarwal Senior associate, Trilegal City, Country: New Delhi, India T: +91 11 4163 9393 Varun Agarwal is a senior associate at Trilegal. His primary focus is public and private mergers and acquisitions, joint-ventures and private equity transactions. Varun has advised several funds, development finance institutions and multinational corporations such as Ontario Teachers' Pension Plan Board, DEG, LGT Lightstone Aspada, Kois Invest SA, The Coca-Cola Co, CFLD International, Wilmar Sugar Holdings and Franklin Templeton on their India-facing transactions, operations and regulatory matters. Varun is an alumnus of NALSAR University of Law, Hyderabad. He is a member of the Bar Council of Maharashtra and Goa, India. |