Wendy Saunders, Clive Cunningham and Richard Woods of Herbert Smith Freehills explore stablecoins and how they may influence fintech regulation

The payments sector is one of the fastest growing sectors within the financial services industry. It is underpinned by consumers' widespread move away from physical cash and towards electronic payments. Whether consumers are using payment cards or apps, the result has been a continual increase in the volumes of payments being processed electronically. This has created an enormous opportunity for payments businesses such as FIS and Fiserv (in the US) and Nexi and Klarna (in the EU) to establish themselves as key players in the payment chain, with the potential to become systemically important.

These businesses participate in a well-developed and very active area of the payments sector. So, what comes next?

The use of distributed ledger technology (DLT), and the associated use of cryptocurrencies and other cryptoassets, has long been discussed as a potential means for making global payment systems more efficient and more secure. For many years, payment processing has relied on centralised channels to transfer money, by established participants such as card issuers, clearing banks, and merchant acquiring banks and card schemes. By contrast, DLT involves a decentralised, shared ledger, with no need for central intermediation. It is considered immutable.

The question is, to what extent will cryptoassets become more widely used in the payments sector, including their potential use by central banks. Stablecoins, a relatively recent and topical sub-class of cryptoassets, may play a key role here. It will be interesting to see what types of stablecoins emerge and how they fit into the broader UK regulatory framework applicable to cryptoassets. Another important issue derives from two key aspects of stablecoins that are designed to facilitate payments: (i) in relation to the asset itself – concerns raised by private stablecoins, and whether a central bank digital currency could be an alternative; and (ii) in relation to the technology underlying it – its possible utility as a private payment system and question marks over whether it can co-exist with or link into public payment systems.

Stablecoins: how are they categorised and why does it matter?

"Bitcoin, the first and still the most popular cryptocurrency, began life as a techno-anarchist project to create an online version of cash, a way for people to transact without the possibility of interference from malicious governments or banks." (The Economist, August 30 2018)

|

|

Cryptoassets cannot be exempt from the application of law and regulation just because they are a technological construct |

|

|

Sadly for the original creators of cryptocurrencies – and despite their anarchistic intentions, cryptocurrencies and other types of cryptoassets cannot be exempt from the application of law and regulation just because they are a technological construct. The tone for the UK regulatory approach was set in the UK Cryptoassets Taskforce report, where the government stated its ambition for the UK to be the world's most innovative economy and to maintain its position as one of the leading financial centres globally, to be achieved in part by "allowing innovators in the financial sector that play by the rules to thrive". The message is clear: innovation is encouraged, but only where it complies with high standards of regulation.

The genesis of stablecoins, a relatively recent sub-category of cryptoassets, was an attempt to address the high price volatility exhibited by many cryptoassets so far. Stablecoins are, in short, cryptoassets that are backed by other assets, including fiat, commodities or other cryptocurrencies (a fuller definition is contained in the Financial Stability Board's (FSB) 'Regulatory issues of stablecoins', October 18 2019).

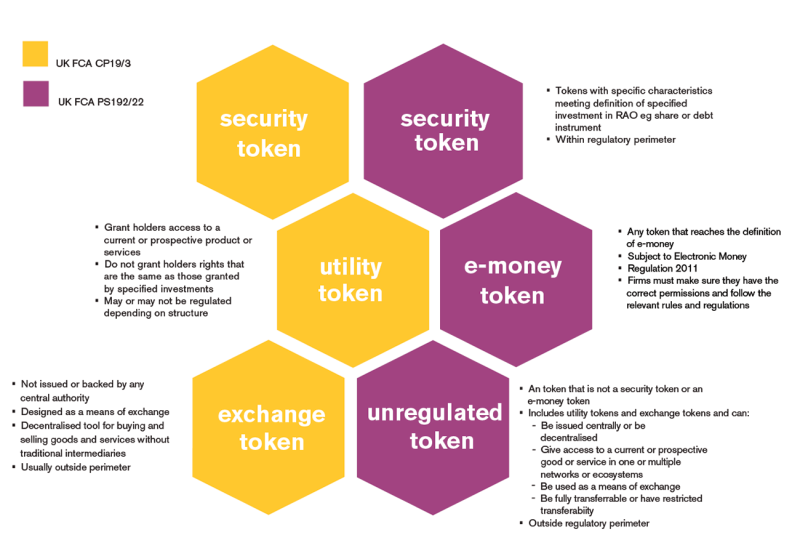

There are many types of stablecoin, each with different structures, functions and uses. Despite the word 'coin', a stablecoin could constitute a financial derivative, a unit in a collective investment scheme (fund), a debt security, e-money, or another type of specified (regulated) investment. They could potentially fall within any of three broad categories of cryptoassets as described by the UK Financial Conduct Authority (FCA), the categories having been revised in July 2019 following an earlier consultation. The diagram in Figure 1 compares the prior and current UK FCA categories of cryptoassets.

The position could change. During 2020 UK HM Treasury is expected to consult on expanding the regulatory perimeter. The EU Commission is also consulting on an "EU framework for markets in crypto-assets".

It was the prospect of a stablecoin achieving, in a very short timescale, widespread adoption for transactions currently processed by retail and wholesale payment systems, particularly if integrated into existing online platforms or social media, that brought stablecoins into the sharp focus of national and international regulatory bodies. In a Bank of England speech (Responding to leaps in payments: from unbundling to stablecoins), Christina Segal-Knowles noted that: "In India, Google Tez reported having 50 million users 10 months after its launch in September 2017. In China, Alipay and WeChat Pay by some measures handled more than $37 trillion in mobile payments in 2018".

The UK and other regulators consider that an appropriate regulatory framework needs to be adopted for stablecoins prior to their launch.

Global stablecoins as a payment asset

Key drivers for the creation of stablecoins as an alternative payment asset include improving cross-border payments, to increase speed and reduce costs; assisting with financial inclusion and providing payment tools for people who are underbanked or underserved by financial services; and the growing preference in society for peer to peer interactions.

However, there are significant challenges and risks arising from use of stablecoins. These include difficulties with legal certainty, sound governance, AML/CFT compliance, operational resilience (including cyber security), consumer/investor and data protection and tax compliance. If stablecoins reach a global scale, they could pose challenges and risks to monetary policy, financial stability, the international monetary system and fair competition.

Here are a selection of key policy points identified by the G7 Working Group on Stablecoins, highlighting why regulators are so concerned about global stablecoins:

Competition: global stablecoin arrangements could achieve market dominance due to their strong existing networks and the large fixed costs that a potential competitor would need to implement large-scale operations, and the exponential benefit of access to data.

Stability mechanism: the mechanism used to stabilise the value of a global stablecoin must address market, credit and liquidity risk. If these are not adequately addressed, it could trigger a run, where users would all attempt to redeem their global stablecoins at reference value. Other triggers for a run could include a loss of confidence resulting from a lack of transparency about reserve holdings or if the reporting lacks credibility.

Credit risk: global stablecoins whose reference assets include bank deposits may be exposed to the credit risk and liquidity risk of the underlying bank.

Increased cost of funding for banks: if users hold global stablecoins permanently in deposit-like accounts, retail deposits at banks may decline, increasing bank dependence on more costly and volatile sources of funding.

Change in nature of deposit: in countries whose currencies are part of the stablecoin reserve, some deposits drained from the banking system when retail users buy global stablecoins may be repaid to banks by way of larger wholesale deposits from stablecoin issuers. If banks were to counter this by offering products denominated in global stablecoins, they could be subject to new forms of foreign exchange risk and operational dependencies.

Exacerbation of bank runs: easy availability of global stablecoins may exacerbate bank runs in times when confidence in one or more banks erodes.

Shortage of high-quality liquid assets (HQLA): purchases of safe assets for a stablecoin reserve could cause a shortage of HQLA in some markets, potentially affecting financial stability.

Reduced impact of monetary policy: this could happen in several ways. If, for example, there were multiple currencies in the reserve basket, the return on global stablecoin holdings could be a weighted average of the interest rates on the reserve currencies, attenuating the link between domestic monetary policy and interest rates on global stablecoin deposits. This would be particularly true where the domestic currency is not included in the basket of reserve assets.

The FSB is due to submit a consultative report on stablecoins to the G20 Finance Ministers and Central Bank Governors in April 2020, with a final report in July 2020.

Central bank digital currencies: alternative, interoperable or additional solutions?

Central bank digital currencies (CBDCs) are new variants of central bank money that differ from physical cash or central bank reserve/settlement accounts. There are two potential types of CBDCs: (i) a "wholesale" or "token-based" CBDC – restricted-access digital token for wholesale settlements (for example, interbank payments or securities settlement); and (ii) a general-purpose variant available to the public and based on tokens or accounts, allowing for a variety of ways of distribution.

So how would a CBDC act as an alternative to global stablecoins? A general-purpose CBDC would essentially give effect to a disintermediated currency of which the central bank, rather than a private entity, would keep control. The view of the UK central bank, which first raised the possibility of CBDCs in 2015, seems to be evolving. Back in 2018, in his 'The Future of Money' speech (March 2 2018), Bank of England Governor Mark Carney identified that a general-purpose CBDC could mean a much greater role for central banks in the financial system. He noted that central banks could find themselves disintermediating commercial banks in normal times and running the risk of destabilising flights to quality in times of stress.

An independent report commissioned by the Bank of England on the Future of Finance noted that there was no compelling case for CBDCs and that the focus should be on improving current systems to allow for private sector innovation. However, in January 2020 the Bank of England announced that it would be participating in a central bank group with six other banks to assess potential use cases on CBDCs.

Payments systems and the transfer technology underlying stablecoins

In his 'The Future of Money' speech in 2018, Carney noted the potential for underlying technologies to transform the efficiency, reliability and flexibility of payments by increasing the efficiency of managing data; improving resilience by eliminating central points of failure, as multiple parties share replicated data and functionality; enhancing transparency (and auditability) through the creation of instant, permanent and immutable records of transactions; and expanding the use of straight-through processes, including with smart contracts that on receipt of new information automatically update and if appropriate, pay.

|

|

If stablecoins reach a global scale, they could pose challenges and risks to monetary policy, financial stability, the international monetary system and fair competition |

|

|

An European Central Bank (ECB) Occasional Paper ('In search for stability in crypto-assets: are stablecoins the solution?') notes that: "A platform for the recording of stablecoins and other assets using DLT and smart contracts may either benefit interoperability and competition among different DLT-based infrastructures and issuers – if its governance aims at harmonising the business and technological standards adopted by different operators and issuers competing in the market –, or lead to increased fragmentation if multiple initiatives emerge that compete for the market."

The Bank of England confirmed in July 2018 that its renewed real-time gross settlement (RTGS) service would support DLT settlement models following a successful proof of concept.

Cryptoassets are a daily reality

The prevailing market views seems to be that in the short to medium term, DLT will augment rather than replace RTGS. Interoperability remains a key challenge, as do the technological and energy requirements of a successful and permanent DLT-based payments system.

Nevertheless, it no longer seems fanciful to talk of cryptoassets forming a daily part of the mainstream payments system. They are no longer only the preserve of speculators, or of payors seeking anonymity. The number of transactions in cryptoassets continues to grow rapidly, and regulators are focused on managing their increasing role in day-to-day financial services. It will be fascinating to see how central banks and regulators continue to respond to the growth of cryptoassets, and where this sector will go next.

About the author |

||

|

|

Wendy Saunders Senior associate, Herbert Smith Freehills London, UK T: +44 20 7466 2373 W: www.herbertsmithfreehills.com/our-people/wendy-saunders Wendy Saunders is a senior associate specialising in financial services law and regulation. Wendy draws on four years of experience within the Financial Services Authority's Enforcement Division to provide informed and strategic advice and guidance to clients. Her banking experience includes secondments to the group regulatory team of a leading retail bank and as a senior regulatory risk lawyer to the central compliance team of a global investment bank. Wendy has advised a range of clients in relation to outsourcing, payment services regulations, ringfencing and operational continuity in resolution, client money, and more generally on Mifid II. She also advised on the Salz Review concerning culture and governance at Barclays. Wendy has developed a particular interest in cryptoassets and was a key contributor to the Financial Markets Law Committee working group on initial coin offerings. She has also co-authored several articles on related topics published on Thomson Reuters. |

About the author |

||

|

|

Clive Cunningham Partner, Herbert Smith Freehills London, UK T: +44 20 7466 2278 W: www.herbertsmithfreehills.com/our-people/clive-cunningham Clive Cunningham is a partner specialising in financial services law and regulation. He heads the non-contentious practice in London. With over 25 years' City experience, including time as a banking regulator with the Bank of England and in-house at Merrill Lynch (wealth management), Clive advises banks, asset managers and other financial institutions on a wide range of regulatory and compliance matters. Areas of special sector expertise are banking, asset management and securities regulation. Clive is recognised as a leading lawyer in IFLR1000, Chambers and Legal 500. |

About the author |

||

|

|

Richard Woods Senior associate, Herbert Smith Freehills London, UK T: +44 20 7466 2940 W: www.herbertsmithfreehills.com/our-people/richard-woods Rich Woods is a senior associate in the London corporate team of Herbert Smith Freehills. He has a focus on fintech and on the broader financial services sector, and particularly on M&A and fundraising for fast-growing businesses. His experience includes advising fintech businesses such as Tandem Money, LendInvest and EML Payments, and investors including Goldman Sachs and DEG. In 2018, he spent 10 months on secondment to LendInvest as its acting general counsel. He has also spent time seconded to Goldman Sachs' European Special Situations Group, and between 2011 and 2013 worked in Herbert Smith Freehills' private equity team in Moscow. |