Tommy Tong and Nicky Cardno, Herbert Smith Freehills

MARKET OVERVIEW

2018 saw a downturn in M&A activity in Hong Kong amid global market turbulence impacted by factors including the US/China trade war and Brexit. Hong Kong's stock market also had a volatile year, with Hong Kong stocks dropping 13.6 % during 2018. This affected investor confidence and dampened M&A activity slightly compared to recent years, despite opening privatisation opportunities.

Even with China's tightened control on outbound investment, Hong Kong companies continue to be targeted by Mainland Chinese acquirers as well as by private equity funds and overseas players looking to gain exposure to China through Hong Kong.

M&A activity

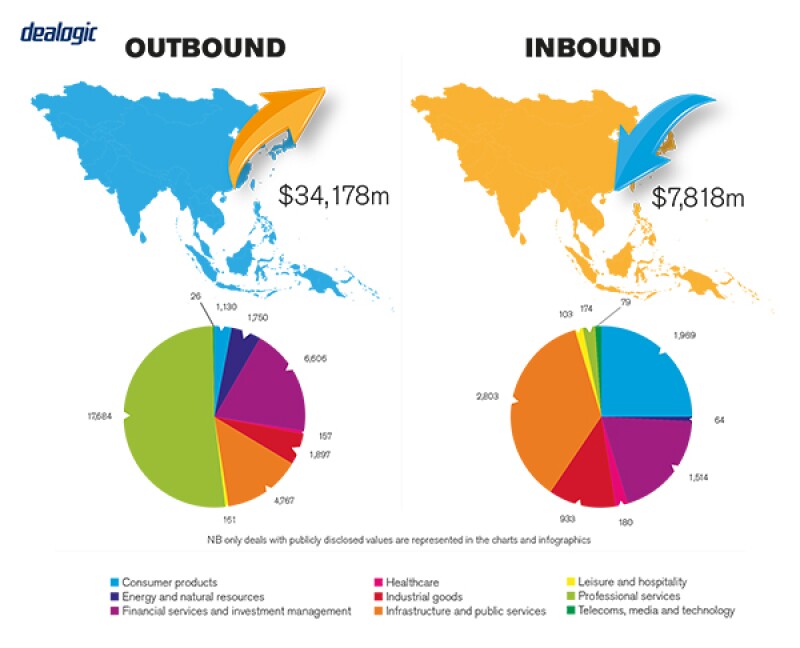

Overall, M&A activity in Hong Kong declined in 2018 with deals targeting Hong Kong listed companies slightly down by number but significantly down by value due to the absence of the mega deals seen in 2017. Outbound M&A activity was down but remained solid, with European businesses being popular targets. Transactions targeting technology-related assets stood out in 2018, with deals across a variety of sectors. Other active sectors included infrastructure and logistics, financial services and media.

Both public and private deals drive the Hong Kong market, with private equity (PE) participation in public company acquisitions a growing trend in recent years. Hong Kong-listed companies frequently feature as either buyers or sellers in private M&A transactions. The stock market therefore impacts deal activity, which generally increases with market performance and confidence. The state of the overall capital markets also heavily influences deal pricing and values, particularly for public transactions.

Many Hong Kong-listed companies are controlled by founding families or have a significant controlling shareholder. Public M&A therefore requires the support of the controlling shareholder, particularly for privatisation bids or where control is sought.

TRANSACTION STRUCTURES

We are seeing a continuing trend of transactions by consortia, with groups of investors coming together to share the investment risk. The consortia are made up of both PE funds and financial investors and, increasingly, in combination with strategic investors.

Auction use has increased as sellers seek to achieve value through a competitive sale process. Similarly, locked-box mechanisms are becoming more common in the secondary buyout market with sellers pursing purchase price clarity and control.

Financial investors

Financial investors are active in the Hong Kong market, both as buyers and sellers and increasingly participating as part of consortium groups to spread their investment risk. The large stockpile of private equity funds in Asia ready to be deployed is likely to continue to bolster M&A activity in the year ahead. Given this, and the competitive market for the best deal opportunities, auction deals have become much more common.

As discussed below, in 2018 we saw a rare hostile takeover attempt by a private equity firm seeking increased control to effect management changes. This could mark the start of greater public shareholder activism by financial investors in the Hong Kong market.

Recent transactions

Hong Kong's largest outbound deal proposed in 2018 was CK Group's $9.4 billion consortium bid for Australia's APA Group Limited. This deal was vetoed by the Australian government on national interest grounds and illustrates the growing risk of regulatory intervention impacting deal certainty. We also saw a rare hostile bid for Spring Real Estate Investment Trust by one of its substantial unitholders, PAG (an Asian alternative investment fund) in an attempt to increase its control over the REIT to replace its manager. The bid ultimately failed, but this is an interesting development that could signify the rise of public shareholder activism in Hong Kong where, to date, it has been relatively uncommon.

LEGISLATION AND POLICY CHANGES

The Code on Takeovers and Mergers (Code) governs the conduct of public M&A in Hong Kong and is administered by the Securities and Futures Commission (SFC). It applies to takeovers and mergers affecting public companies in Hong Kong and companies (and real estate investment trusts) with a primary listing in Hong Kong.

The Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (SEHK), overseen by the SEHK, apply to listed companies and require compliance with the Code and regulate disclosure and shareholders' approval for transactions by listed companies depending on the transaction's relative size.

The Companies Ordinance (Cap. 622) applies to Hong Kong incorporated companies and regulates schemes of arrangements and compulsory acquisition procedures, together with general corporate matters.

Industry-specific legislation also applies to the ownership and control of companies in certain regulated sectors, for example banks, insurance companies and companies in the telecommunications industry.

Recent changes in law

In April 2018, the SEHK introduced new rules to enable the listing of pre-revenue biotech companies and innovative and high growth companies with weighted voting right structures. Applicants are required to have obtained meaningful external funding prior to listing and this has fuelled pre-IPO investments in companies preparing to list under the new regime.

In July 2018, the SFC introduced various changes to the Code, including raising the shareholder approval threshold for the whitewash procedure from a simple majority to at least 75% of independent votes, with separate independent shareholder approval for the underlying transaction. These changes create greater execution risk for whitewash transactions.

Regulatory changes under discussion

The SEHK is proposing to tighten restrictions on backdoor listings, for instance by extending the aggregation period for a transaction series from 24 to 36 months. This will bring more transactions within the reverse takeovers regime and make structuring transactions to fall outside the regime more challenging.

Hong Kong is considering extending its merger control regime to industries beyond telecommunications but the scope and timing for this are currently unclear.

MARKET NORMS

As discussed below, there are certain structuring challenges commonly encountered in Hong Kong, particularly in the context of cross-border M&A involving China entities.

Frequently overlooked areas

Parties sometimes underestimate the impact of overseas anti-trust and merger control regimes in multi-jurisdictional transactions. Post completion integration issues can also be overlooked, for instance organisational culture and employee harmonisation.

The impact of China's indirect offshore disposal rules can also be overlooked when structuring a disposal of Chinese assets through an interposed Hong Kong holding company to minimise tax liability in China. The rules apply to prevent tax avoidance in circumstances where there are no reasonable business purposes for the offshore structure.

PUBLIC M&A

There are two main methods to obtain control of a public company: a general offer or a scheme of arrangement.

In a general offer, a bidder makes an offer to the target's shareholders to acquire all of the shares not already held by it. A general offer can either be voluntary or mandatory. A mandatory offer obligation arises where a person acquires 30% or more of the voting rights in the target, or it holds between 30% and 50% (both inclusive) of voting rights and increases its total holding by more than 2% from the lowest percentage held in the preceding 12 months (known as the 2% creeper).

The Companies Ordinance contains a compulsory acquisition procedure where a bidder has acquired 90% of the shares to which the offer relates can acquire the remaining shares. An equivalent buy-out right extends to the dissenting minority. For target companies incorporated outside Hong Kong, relevant local legislation may also enable compulsory acquisition.

A scheme of arrangement is a statutory process through which a court can sanction proposed arrangements between a company and its shareholders, typically to cancel all the shares in the target (except those owned by the bidder) in return for cash or non-cash consideration from the bidder.

The Code requires that a scheme of arrangement used to effect a privatisation must be approved by at least 75% of the votes of disinterested shareholders voting in a general meeting, with no more than 10% of the total disinterested shares being voted against. The company law relevant to the target will also apply and the Companies Ordinance contains broadly equivalent requirements. Once approved, the scheme is binding on all shareholders (subject to filing formalities).

A scheme of arrangement must be acceptable to both the bidder and the target as the target board coordinates the shareholder approval process. By comparison, takeover offers are made by a bidder and can be either friendly or hostile.

Stake building is generally permitted but, depending on the timing and extent of shares purchased, may set a minimum price for the offer and determine the form of consideration.

Conditions for a public takeover

Unless the SFC agrees otherwise, all offers must be conditional on the bidder receiving acceptances that, together with the shares already held, result in the bidder and its concert parties holding more than 50% of the voting rights in the target. A voluntary offer may, however, be made conditional on a higher percentage acceptance level. Voluntary offers may also be made subject to other conditions, provided that such conditions must not depend on judgements by the bidder or the target nor fulfilment be in their respective hands. Common conditions include that all consents have been obtained and there having been on material adverse change impacting the target group.

For a mandatory offer, the only condition which will normally be permitted is the 50% acceptance condition.

Pre-conditional offers are used where regulatory conditions cannot be satisfied within the timetable set out in the Code.

Break fees

Break fees are not common in Hong Kong public M&A transactions. The Code requires that a break fee is no more than 1% of the offer value and requires the target board and its financial adviser to confirm that it is in the best interests of shareholders.

PRIVATE M&A

Completion accounts are a commonly-employed consideration adjustment mechanism in Hong Kong. Due to the uncertainty resulting from earn-outs, these are less popular but are still used in the Hong Kong, particularly where there is a value gap between the parties. Locked-box mechanisms are less common but we have noticed a gradual increase in their use recently.

The use of escrow arrangements is also a common feature particularly in deals where deposits are paid or there are post completion adjustments with funds flowing cross-border.

Warranty and indemnity insurance is still relatively unusual in Hong Kong deals compared to jurisdictions such as the UK and Australia. However parties seeking to achieve a clean exit are increasingly considering it as part of deal structuring.

Conditions for a private takeover

Regulatory approvals and merger control (for transactions involving targets in the telecommunications sector or groups with overseas operations) will be included where required, together with conditions to cater for specific issues such as third party consents. Other closing conditions are generally limited but this will vary depending on the transaction.

Where there is a prolonged period between signing and completion, depending on the relative negotiating strengths, the purchaser may seek contractual protections such as repeated warranties at closing or the ability to terminate upon a material adverse change event occurring.

Foreign governing law

Hong Kong law is the usual governing law clause for private M&A, although parties based outside Hong Kong may seek to negotiate other commonly accepted laws such as those of England and Wales or New York. For dispute resolution, Hong Kong courts are commonly selected, with arbitration (frequently either in Hong Kong or Singapore) preferred for cross-border or China-related transactions.

The exit environment

Generally, the preferred exit route, particularly for financial investors, is through a listing. However, with the recent capital market downturn, trade sales and secondary sales between private equity players have increased as listing timetables are delayed.

OUTLOOK

Despite global challenges, Hong Kong's M&A activity is expected to remain steady. We expect private equity-led transactions to continue to feature strongly, with PE investors able to quickly deploy large reserves of unspent capital to take up investment opportunities. Chinese outbound investment, even with China's tightened regulatory oversight, will continue to target Hong Kong companies. However, the increasing trend of protectionist policies by international governments is likely be a challenge for cross-border transactions involving sensitive industries and result in extended deal timetables whilst approvals are sought.

For legal advisers, technological advances which offer more effective due diligence tools and data analytics, together with document automation, will change the way and the speed at which deals are done.

About the author |

||

|

|

Tommy Tong Partner, Herbert Smith Freehills Hong Kong SAR, China T: +852 2101 4151 F: +852 2845 9099 W: www.herbertsmithfreehills.com Tommy Tong advises on a broad range of corporate and commercial matters, specialising in public and private M&A, private equity and equity capital markets transactions. Tommy has advised numerous international and domestic corporates, financial institutions and private equity funds in relation to mergers and acquisitions, corporate restructuring and regulatory compliance matters. He also has substantial experience in advising issuers, sponsors and underwriters in relation to international offerings of securities and their listing on the Hong Kong Stock Exchange. Tommy is fluent in English, Cantonese and Putonghua. |

About the author |

||

|

|

Nicky Cardno Professional support consultant, Herbert Smith Freehills Hong Kong SAR, China T: +852 2101 4137 F: +852 2845 9099 W: www.herbertsmithfreehills.com Nicky Cardno has experience in a wide range of company and corporate finance transactions including private M&A, public takeovers, IPOs, rights issues, management buyouts and international joint-ventures. She has advised a range of listed and non-listed companies. In her current role as a professional support consultant, Nicky focuses on providing technical advice to colleagues and clients on issues of substantive law and regulation, analysing new legal and regulatory developments and preparing internal and external briefings to ensure the firm and its clients are updated on important corporate and corporate finance developments. |