Luis Pedro del Valle and Florencio Gramajo, Arias

MARKET OVERVIEW

The current environment in Guatemala is generally favourable for M&A transactions, despite the political crisis that has been going on for the past months. In general terms, 2018 saw important transactions take place in different industries in Guatemala, despite the fact that in certain cases targets were in the middle of complex judicial processes regarding essential assets.

The political crisis, however, has reached certain level of stability and with general elections around the corner, M&A activity may suffer a slight deceleration until it is known what type of government will run the country for the next four years.

M&A activity

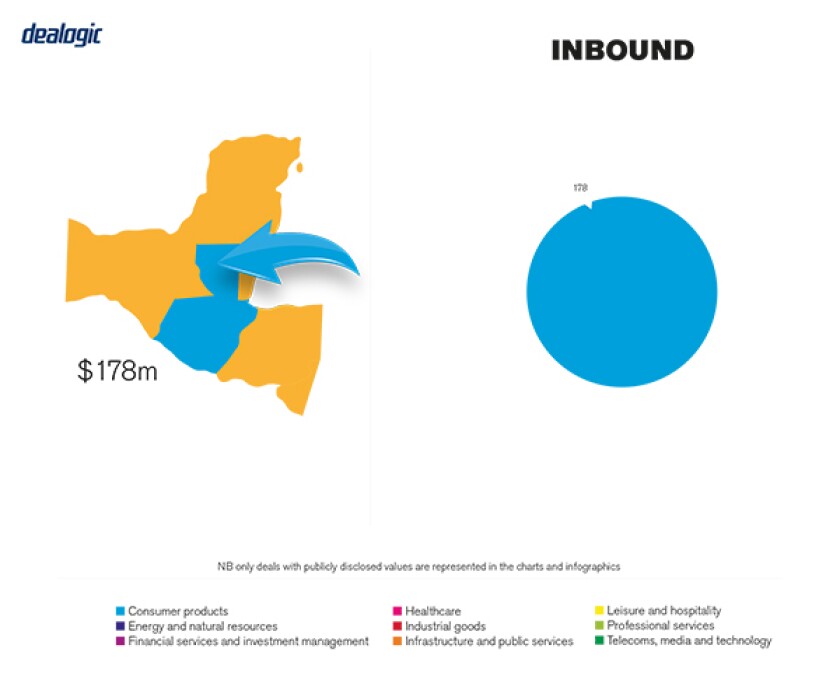

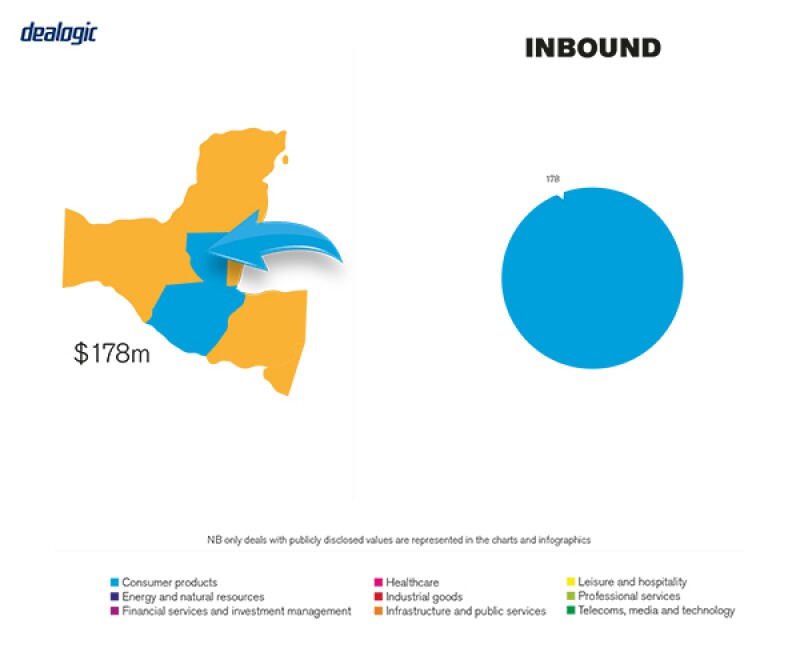

In general, inbound M&A deals have prevailed during the last years. However, there are certain companies in the traditionally key industries that have conducted outbound M&A deals, as they have grown strong during the last decades. Given that key Guatemalan companies that are active in outbound deals are not public, there is no information regarding values.

The Guatemalan market is driven mostly by private transactions. The share of publicly traded companies in Guatemala is small, and thus, M&A transactions as well. However, there have been inbound M&A deals where the acquirers are public entities and these increased the public share of M&A transactions.

TRANSACTION STRUCTURES

The main trend impacting transaction structures has been the prevalence of private M&A deals with the participation of private equity and investment funds. The main deals have occurred in the telecom, banking, mining and energy industries.

Financial investors

The deals where financial investors have taken part have increased the sophistication levels of transactions in the M&A environment. The trend has somehow become a norm.

Recent transactions

There have been several cases of M&A transactions that directly affected consumers, in the sense of the offer available to consumers and market concentration. These deals have rekindled the debate over the need for competition legislation in order to address and/or regulate those transactions through which market concetration is reached.

LEGISLATION AND POLICY CHANGES

Regarding public M&A activity in Guatemala the key legislation includes Decree 34-96, the Securities Market Law (Ley del Mercado de Valores y Mercancías) and its regulation contained in the Government Decree 557-97 (Reglamento del Registro del Mercado de Valores y Mercancías). The main regulatory body in this context is the Stock Exhange Registry (Registro del Mercado de Valores y Mercancías).

With respect to private M&A activity there are no specific pieces of legislation or regulatory bodies that govern it. However, there are some general and sectoral laws that may be relevant to particular transactions such as: Decree 2-70, Code of Commerce (Código de Comercio); Decree 106, Civil Code (Código Civil); Decree 57-2000, Industrial Property Law (Ley de Propiedad Industrial); Decree 1441, Labour Code (Código de Tabajo); Decree 6-91, Tax Code (Código Tributario); Decree 93-96, General Electricity Law (Ley General de Electricidad); Decree 94-96, General Telecommunications Law (Ley General de Telecomunicaciones); Decree 93-2000, Civil Aviation Law (Ley de Aviación Civil); Decree 19-2002, Banks and Financial Groups Law (Ley de Bancos y Grupos Financieros); Decree 25-2010, Insurance Activity Law (Ley de la Actividad Aseguradora); Decree 67-2001, Anti-Money Laundering Law (Ley contra el lavado de dinero u otros activos); Decree 9-98, Foreign Investment Law (Ley de Inversión Extranjera), among other ordinary laws; and any bilateral investment treaties (BIT) to which Guatemala is party.

Recent changes in law

On January 29 2018 Decree 18-2017, the Amendments to the Code of Commerce (Reformas al Código de Comercio), came into force. These amendments look to promote and simplify the registration and management of commercial entities and foreign company branches. Companies can now be registered with a minimum paid capital of Q200 ($26, approximately) and the registration of a company in the Mercantile Registry may be accomplished in three business days. All publications regarding the incorporation of companies, modifications to the deed of incorporation and those ordered by the Code of Commerce, are now made through an electronic communication system run by the Mercantile Registry. It is not necessary to publish the incorporation in the Official Gazette. Shareholders´ meetings, parents´ meetings and any decision or communication between shareholders or directors can be made using long-distance communication methods.

The referred amendments simplify and shorten the process of incorporation, lowering costs and promoting the creation of companies, having an impact on M&A transactions involving the creation of new companies or the modification of existing ones.

Regulatory changes under discussion

Guatemala is the only country in the region that does not have any antitrust regulation. Nevertheless, there are many bills presented in the Congress that seek to fill this existing legal gap. It seems that Bill No. 5074 is the one that has the most chance of being enacted into law, however it is difficult to say whether this will happen this year as 2019 is an election year.

MARKET NORMS

There are several particular aspects of market practice worth noting. In Guatemala, the law requires for at least two shareholders or partners at all times in the mercantile entities, otherwise a dissolution event is triggered. Thus contrary to general perception from abroad, 100% of the paid in capital cannot be directly acquired: there should be at least two purchasers. Also, a change of control would not, by operation of law, entitle employees to receive severance, as this would only be the case if it was expressly convened, which would be exceptional.

Frequently overlooked areas

Often, foreign buyers have difficulty in understanding the labour provisions applicable to the transfer of employees, as well as applicable concepts in the termination of labour relationships, both in the context of M&A transactions.

As to frequently asked questions, they tend to relate more to cases where approval for an M&A deal is required, for example for deals in the finance sector.

PUBLIC M&A

In a public M&A transaction, in order to obtain control of a publicly traded company the interested parties must follow the process stated in the Securities Market Law (specifically, section 39), which requires that a notice is presented to the issuer of the shares, the registry of the securities market and the stock exchange in which the shares are traded.

The relevant stock exchange must state the manner in which this information is disclosed to the public, and it must disclose the: amount of shares to be acquired; price per share; term and payment conditions, and if applicable, whether the proposal is subject to a minimum amount of shares to be acquired; and the percentages of shares owned by the bidder. Once this information is disclosed, the stock exchange may initiate the respective negotiations.

Conditions for a public takeover

Acccording to the law, a public takeover offer must at least contain the points noted above (ie amount of shares to be acquired; price per share; term and payment conditions, and if applicable, whether the proposal is subject to a minimum amount of shares to be acquired; percentages of shares owned by the bidder).

Break fees

There is no market standard and parties are free to stipulate such fees.

PRIVATE M&A

In Guatemala, the use of payment mechanisms such as earn-outs and escrows are relatively common and have become more frequent in recent years. The use of insurance warranties and indemnities is not common.

Conditions for a private takeover

There are no particular conditions that are attached to a private takeover offer. In addition, such takeover offers are not common.

Foreign governing law

It is common practice to provide for a foreign governing law and/or jurisdiction in private share purchase agreements.

The exit environment

From a legal point of view, the exit environment as such is not regulated and thus, is flexible. Most exits are conducted through a direct sale. It is important to note, however, that exit strategies in the form of IPOs or trade sales are not common, except where it concerns a sale to financial sponsors (which may be more likely to occur).

OUTLOOK

Based on outlooks and forecasts that experts have made for the Latin American region, an increase can be expected in the value of M&A transactions, from $83 billion in 2018 to a forecasted amount of $94 billion in 2019. Nevertheless, the volume of these transactions is expected to decrease, compared to Q4 of 2018. For Q1 of 2019, a 5% decrease in the volume of M&As compared to Q4 of 2018, and in Q2 of 2019 a 6% decrease in the volume of M&As compared with Q4 of 2018.

Even though the forecast seems promising for Latin America, in Guatemala the following 12 months will be marked by the 2019 general election where the president and vice-president, 160 congressmen and 340 mayors will be elected. The uncertainty produced by the elections can refrain domestic M&A, with a lower impact on cross-border M&A, as previous experience shows and experience from other countries in the region that recently experienced presidential elections (for example in Mexico, Brazil or Colombia).

About the author |

||

|

|

Luis Pedro del Valle Partner, Arias Guatemala City, Guatemala E: luispedro.delvalle@ariaslaw.com W: www.ariaslaw.com/en/people/del-valle-luis-pedro Luis Pedro del Valle has ample experience regarding corporative advice in general, including the drafting of typical and non-typical agreements and complex corporate transactions. Luis Pedro has experience in finance and stock market transactions. He also possesses experience and knowledge in the fields of telecommunications law as well as information technology law. Luis Pedro has a Law degree from Universidad Francisco Marroquín, Guatemala, and an LLM in information technology law from at Stockholm University in Sweden. He was included in Chambers Latin America 2015 and 2016 as an up-and-coming individual in corporate and commercial matters and is also listed as "Recommended Lawyer" by The Legal 500. |

About the author |

||

|

|

Florencio Gramajo Associate, Arias Guatemala City, Guatemala E: florencio.gramajo@ariaslaw.com W: www.ariaslaw.com/en/people/gramajo-florencio-a Florencio Gramajo joined Arias´ corporate & transactional department in 2016. He has focused his practice mainly on corporate-transactional advice to companies in regulated industries, such as mining, telecommunications and energy. In addition, he has actively participated in due diligence for the acquisition and financing of various projects, as well as in the structuring of guarantees. Florencio has experience in foreign investment, mergers and acquisitions, the incorporation of different types of companies and foreign branches, the registration of satellite facilities, data privacy, the drafting of both typical and atypical contracts, and other related matters. He has a law degree, magna cum laude, from Francisco Marroquín University, Guatemala and a postgraduate in international transactions from the Universidad del Istmo de Guatemala. He participated in the Program in International Commercial Law and Dispute Resolution, University of Pittsburgh School of Law. |