Markus Fellner, Paul Luiki and Andrea Demanega, Fellner Wratzfeld & Partners

MARKET OVERVIEW

Though the volume and value of M&A with target companies in Austria declined in 2018, the Austrian M&A market remains stable. According to the Ernst & Young market analysis for 2018, of 324 transactions that took place in 2018, 81 concerned the industry sector followed by 73 transactions in the technology sector and 72 transactions in real estate. For foreign buyers particularly, the Austrian technology sector and in particular software companies are highly sought after.

M&A activity

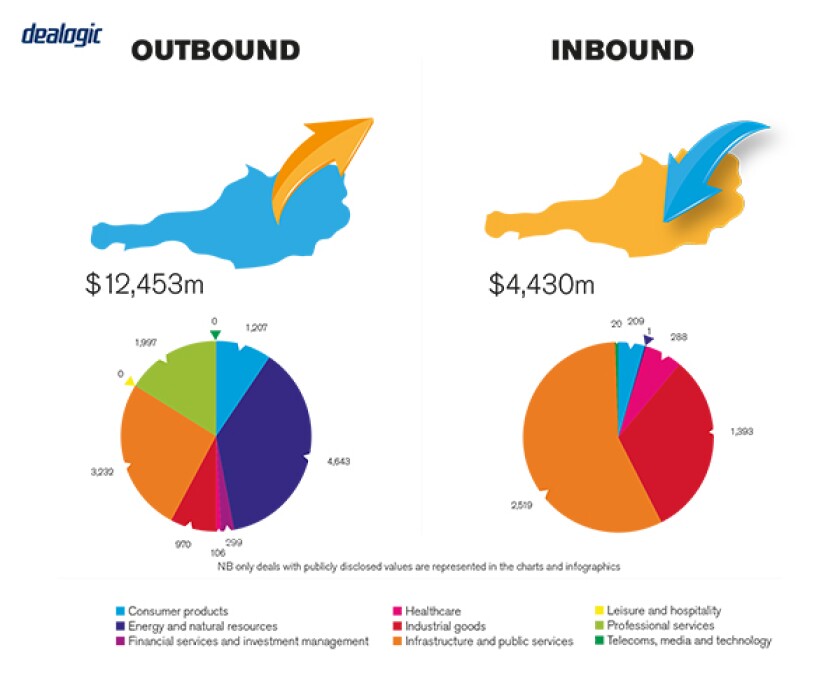

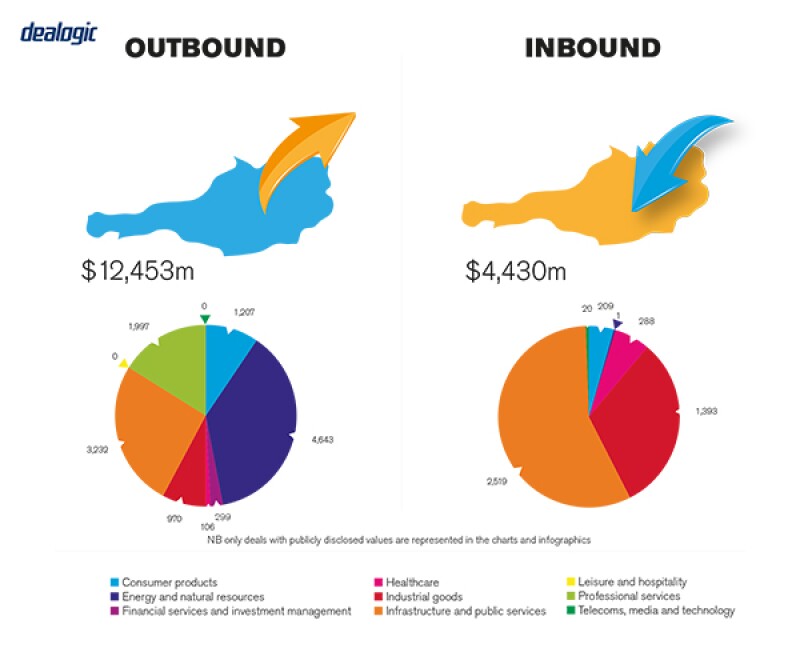

The number of M&A transactions completed in the Austrian market has decreased compared to the previous two years. In 2018, according to the Ernst & Young market analysis for 2018, 324 transactions took place, which represents a decline of 6.1 %. M&A deals in Austria reached an aggregate transaction value of €7.9 billion ($8.9 billion) in 2018, which is a decrease of 46 % as compared to 2017. The main reason for this is the halving of so-called mega deals and the fact that Austrian companies are investing significantly more abroad. Last year, Austrian companies bought targets in foreign companies much more frequently: the number of takeovers in the outbound category rose significantly in 2018 by 13.8%. The number of takeovers by foreign investors (inbound) fell by 6.8%. Within Austria (domestic deals), the decline was larger: 29 %.

Most transactions in the Austrian market are private M&A transactions, whereas public M&A deals have not played a big role in the last few years. The most significant sectors currently are telecommunications, media and technology as well as consumer goods.

TRANSACTION STRUCTURES

Most investments in the Austrian M&A market are by strategic buyers, though private equity (PE) is a frequent bidder in the technology sector. As compared to the prior two years, industrial targets and technology companies have gained more importance for investors.

Financial investors

Private equity investors are becoming increasingly important in the Austrian transaction market. This is reflected in particular in the scope of inbound investments. One-third of inbound investments are made by foreign financial investors. In the outbound market, financial investors play a subordinate role, as this area is largely occupied by strategic investors.

Recent transactions

The most significant transaction in 2018 was the sale by Steinhoff of Kika/Leiner to the Signa Group. Kika/Leiner is a leading Austrian furniture company with over 5,000 employees across more than 70 locations in Austria and Eastern Europe, along with a substantial real estate portfolio. Kika/Leiner was part of the Steinhoff Group since 2013. This transaction was a landmark-transaction in terms of timing (the transaction was completed in an extremely short timeframe) as well as value-wise and involved the securing of thousands of jobs. This sale marked highlight for Fellner Wratzfeld & Partners, which provided months of restructuring advice to the Steinhoff Group following allegations of accounting inconsistencies. The KIKA/Leiner transaction is considered a major contribution towards the stabilising of the Kika/Leiner Group.

LEGISLATION AND POLICY CHANGES

Austrian law does not have one specific law regulating all issues on the acquisition of companies, but rather various different statutes apply, depending on the specific type and form of an acquisition.

For asset deals, the regulations of Sec 1409 of the General Civil Code and Sec 38 of the Commercial Code are the most pertinent. Sec 1409 of the General Civil Code provides that a purchaser generally is jointly and severally liable with the seller towards the seller's creditors for any liabilities of the acquired business having their origin prior to the acquisition. The purchaser's liability is limited to the current net asset value of the acquired assets and applies in case the purchaser knew or should have known at the time of the purchase of the pre-existing liabilities. Sec 1409 of the General Civil Code is a mandatory law and cannot be waived or amended by contract. Liability can be reduced if the purchase price payable by the buyer is used to pay off the debts of the sold business. Sec 38 of the Commercial Code provides that a legal entity, which acquires and continues a commercial business, is liable for all debts the former owner incurred in the course of business conduct, meaning even those which are not contractually agreed to be taken over by the buyer. Unlike liability under Sec 1409 of the General Civil Code, liability under the Commercial Code is not limited to the value of the acquired assets. Nevertheless, under Article 38 of the Commercial Code the seller and the buyer can agree to limit liability of the seller, such limitation of liability, however, being only valid if a timely notification to the commercial register is submitted or otherwise made public.

A key regulatory authority with regard to M&A transactions is the Federal Competition Authority (Bundeswettbewerbsbehörde), which is responsible for the clearance of mergers where a transaction value does not exceed the thresholds of the EC Merger Control Regulation, but exceeds the thresholds under Austrian competition law. Further relevant authorities are the Commercial Register Courts (Firmenbuchgerichte), which register and publish transactions and reorganisations in the Austrian commercial register, and the Financial Market Authority (Finanzmarktaufsicht), which reviews banking acquisitions. Public M&A transactions regarding listed joint stock corporations (Aktiengesellschaft) are also subject to the supervision of the Austrian Takeover Commission (Übernahmekommission), which monitors compliance with the Austrian takeover regulations and decides on all matters related to the Takeover Act.

Recent changes in law

A significant change that has affected public M&A transactions since January 3 2018 was the introduction of the possibility of delisting from the Stock Exchange Act (BörseG), which was introduced to incorporate new EU investor protection and capital market transparency regulations. A prerequisite for such a delisting is the positive resolution of the Annual General Meeting with a qualified majority and the prior active official listing over a period of three years. In addition to this regular delisting, a so-called "cold delisting" (ie delisting under company law) measure under company law such as mergers were also introduced. The motivation for such a delisting could be based on economic factors such as conflicts between the supply and demand sides or internal company initiatives to avoid the transparency rules and competitive disadvantages associated with stock exchange regulation.

The change in data protection law under the General Data Protection Regulation, Regulation (EU) 2016/679 (GDPR), which came into effect on May 25 2018, has also had a significant impact on the due diligence process of M&A transactions. During due diligence, there are potential risks of data and privacy breaches when the seller is disclosing data to the buyer. There are a plethora of data protection issues under GDPR that especially the seller needs to take into consideration, including in particular safeguarding the non-disclosure of personal data. Fines can be for the higher of €20 million or up to 4% of the breaching company's world-wide turnover.

Regulatory changes under discussion

In many countries laws are being discussed to prevent foreign buyers from taking over companies in sensitive industries. Austria already has a law in place that allows the government to prevent purchases in sensitive industries: Section 25a of the Foreign Trade Law. It remains to be seen whether and to what extent the Austrian government will make use of this in the future.

MARKET NORMS

As regards market practice, the Austrian legal system has a few peculiarities that are commonly misunderstood. As most M&A deals in Austria are private M&A transactions where the target company is an Austrian limited liability company, the share deal must be made in the form of a notarial deed in front of an Austrian notary public. One misconception is that the notarial requirement poses a large hurdle. This is not true as share purchase agreements can also be done in the English language with notaries so qualified. With the increasing foreign involvement in Austrian M&A transactions, it indeed has become more and more common that such notarial deeds are drawn up in English.

Frequently overlooked areas

An area that requires specific attention is Austrian stamp duty tax. Typically, stamp duty tax can become payable based upon the simple fact that a written document is being drawn up in Austria. Though a share purchase agreement itself is not subject to stamp duty tax, suretyship arrangements whereby one company is obliged to step in and fulfil a liability if, for example, a subsidiary does not perform can trigger stamp duty.

For real estate transactions care needs to be taken in the structuring so as not to trigger real estate transfer tax, which also can apply to share deals.

PUBLIC M&A

Most factors regarding the acquisition of a controlling stake in a public company are regulated in the Austrian Takeover Act. A compulsory public offer has to be made to the other shareholders when a shareholder acquires a stake of 30 % or more. Different rules do not apply to hostile bids. While in a friendly bid, the bidder is commonly given the opportunity to carry out due diligence, in a hostile bid the bidder is generally restricted to publicly available information. In hostile takeovers the management board is obliged to remain neutral. Due to the limited number of Austrian listed companies hostile bids are rather unusual in Austria.

Conditions for a public takeover

Pursuant to Sec 5 para 2 of the Austrian Takeover Act the intention to acquire a stake in a public company needs to be communicated as soon as there are rumours that could alter the stock price. The bidder that intends to place an offer also has to inform the target's representatives immediately, notifying them that the executive board and the supervisory board have decided to place such offer, or that conditions have been met that oblige them to place an offer. Public takeover offers need to be executed in a way that minimize market manipulation and insider trading. The members of the target company also have corresponding secrecy and transparency duties. A further condition is the notification of the workers council pursuant to Sec 11 para 3 of the Austrian Takeover Act. A financial expert must also be included in the public takeover offer process.

Break fees

In public M&A transactions, such fees are rather uncommon, which is partly due to legal restrictions.

PRIVATE M&A

One of the biggest developments in private M&A transactions is that warranty and indemnity insurance is no longer pure theory, but has seen increasing use in the Austrian market. Private equity buyers are at the forefront of this development. Given the bridge function warranty and indemnity insurance serves between buyers needing increased contractual protection and sellers for various reasons not willing to provide this, we expect a further increase in the use of warranty and indemnity insurance.

Earn-outs and escrows have also become more common, but whether a buyer can successfully negotiate these is very deal specific. Whereas locked-box mechanisms are common in auction settings, closing accounts often are agreed upon in one-on-one negotiated deals.

Conditions for a private takeover

Typically, private takeover offers prior to the signing of definitive agreements are conditional upon a satisfactory due diligence, the completion of transaction documentation and the approvals of internal boards.

Foreign governing law

Generally the parties of a private M&A share purchase agreement agree on Austrian substantive law and dispute resolution in Austria. For the mode of transfer, which is necessary for the transfer of shares in a limited liability company, Austrian law is mandatorily applied. This means that the share purchase agreement for such transfers needs to be in the form of a notarial deed.

The exit environment

IPOs do not play a significant role in the Austrian market. Generally, a shareholder interested in selling its shareholding will either seek potential purchasers and negotiate exclusively or will initiate a structured bidding process to which interested parties are invited. As the Austrian market is rather small, the shareholder will very often be aware of potentially interested parties in the domestic market and address them directly.

OUTLOOK

We expect the Austrian M&A market to remain robust. Though Austria is a relatively small market, Austrian companies have a strong reputation worldwide for having excellent expertise especially in the high-end technology area. Another reason for optimism is the strong economic position of Austria generally, which also is firmly embedded in the EU. Persistently low interest rates and the existing high liquidity in the market will also continue to push the M&A market forward. Sector-wise we expect further M&A growth for technology and industrial targets. Industrial targets are in the middle of a digital transformation and need to reposition themselves to implement digital manufacturing technologies and evolve their business models. The absolute strength of Austrian companies lies precisely in this area and they will consequently continue to pose attractive targets.

About the author |

||

|

|

Markus Fellner Partner, Fellner Wratzfeld & Partners Vienna, Austria T: +43 1 53770 311 F: +43 1 53770 70 W: www.fwp.at Markus Fellner is a founding partner and head of the firm's corporate and M&A practice who also specialises in banking and finance, insolvency law and restructuring. He was admitted to the Austrian bar in 1998 and lectures at various institutions, having been awarded a law degree from the University of Vienna and a business degree from the Vienna University of Economics and Business. |

About the author |

||

|

|

Paul Luiki Partner, Fellner Wratzfeld & Partners Vienna, Austria T: +43 1 537 315 F: +43 1 53770 70 W: www.fwp.at Paul Luiki is a US native partner at fwp specialising in the full range of M&A transactions and has a specific focus on cross-border transactions, in particular in the CEE and US regions. His other fields of specialisation are banking and finance, contract law and arbitration. Paul is also a frequent lecturer at the University of Vienna on M&A and joint-ventures. |

About the author |

||

|

|

Andrea Demanega Associate, Fellner Wratzfeld & Partners Vienna, Austria T: +43 1 537 70 F: +43 1 53770 70 W: www.fwp.at Andrea Demanega is an associate at fwp specialising in corporate and M&A, company law and healthcare. She obtained her law degree from the University of Vienna. |