Jorge Bleck and Maria da Cunha Matos, Vieira de Almeida

MARKET OVERVIEW

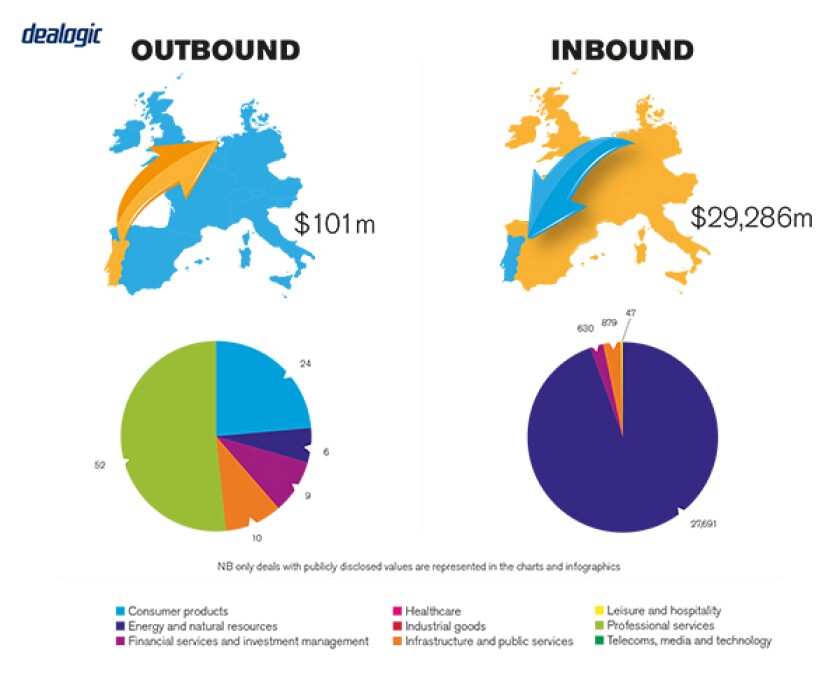

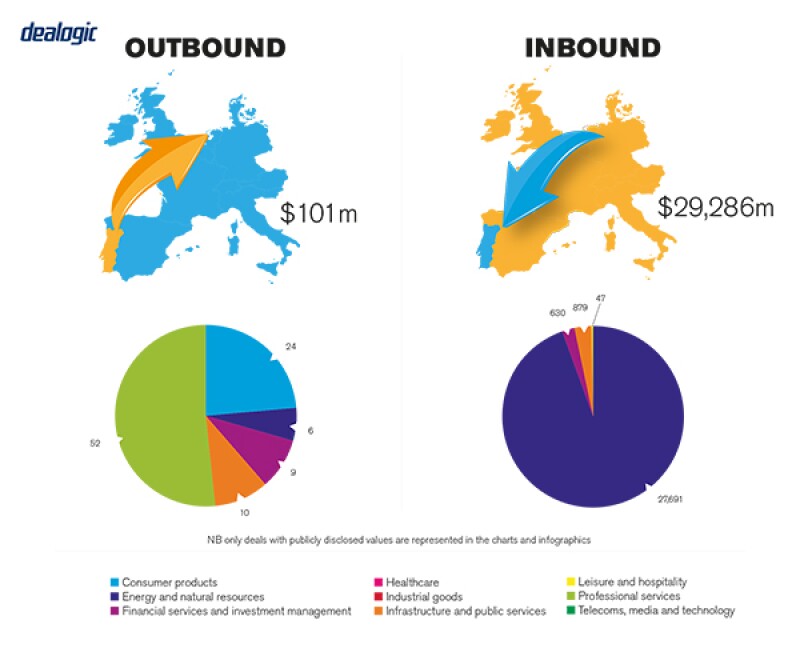

During 2018 and the first months of 2019, the M&A market in Portugal continued a consistent upward trend in what can be described as a "post-crisis period".

After the stabilisation of new regulatory measures created in the aftermath of the economic and financial crisis, banks are now in a sounder financial position that enables them to finance a greater number of M&A transactions and buyouts in general.

In 2018, we witnessed the steady growth in deal value despite a slight decrease in deal count, differently to 2017, where the number of M&A transactions in Portugal increased in number but total value decreased. This shift in trend is particularly tied to a significant number of transactions in the real estate, financial, technology and internet, energy and infrastructure sectors, with the insurance and tourism sectors also being particularly active and with an important role in the M&A scene. The increase in the number of private equity (PE) transactions in the Portuguese M&A market is also a noteworthy development (see below for more).

Overseas investors continue to seek opportunities in Portugal and although Spain remains the main source of foreign direct investment, UK, US, French and Chinese investors are now all becoming important players.

M&A activity

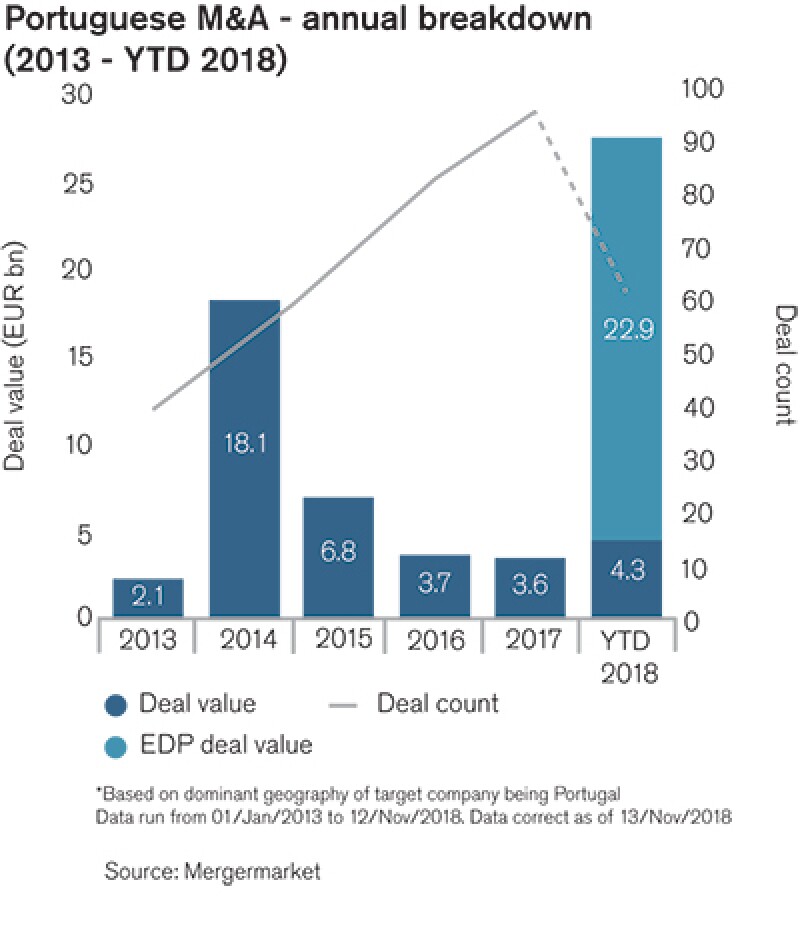

The pivotal comparison to be made with previous years is the increase in total deal value of M&A transactions.

According to Transactional Track Record's (TTR) 4Q18 M&A Report, the value of M&A in the Portuguese market totalled €22.6 billion ($25.5 billion) in 2018. This was mostly due to political stability and the enthusiasm over the prevailing economic environment that helped boost the Portuguese M&A market after the economic and financial crisis. This demonstrates that the total value of transactions in the Portuguese M&A market has significantly increased, particularly as there was a decrease of 7.41% in the total number of transactions.

Meanwhile in the venture capital sector, 2018 achieved the best results of the last four years, with inbound transactions involving acquisitions by predominantly US, Spanish, French and UK venture capital firms into Portugal, and outbound transactions directed mainly at investments into Spain, Brazil and France.

The Portuguese market is driven mainly by private M&A. Given the size of the market, public M&A activity tends to be more volatile than the more prolific and varied-in-size private M&A activity. In other words, the M&A market is predominantly private, with exceptional but very significant public M&A transactions, such as the acquisition of the majority of the share capital of BPI by Caixa Bank, which allowed the buyer to gain full control of BPI for an estimated €392 million.

However, an example of how certain public deals can have an enormous impact on M&A figures for a particular year is the ongoing takeover bid by China's state-owned China Three Gorges for Portuguese power company EDP. This may enter history as the largest M&A transaction ever in Portugal. China Three Gorges currently owns 23.27% of EDP's share capital and has offered €9.1 billion for the remaining shares.

Although private M&A transactions by nature vary in size, 2018 also saw a number of large deals close (more on this below).

TRANSACTION STRUCTURES

Regarding transaction structures, the Portuguese M&A market tends to develop in line with the rest of the European market, with a steep learning curve of what is available in the market and what bespoke solutions can be set up for specific transactions.

The level of activity in the energy sector and in the wider infrastructure sector suggests that there is still a fair amount of consolidation waiting to take place (similar to the banking sector which is yet to be achieved) and we expect to see continued deal flow. As European and North American PE, infrastructure and pension funds continue to seek investment opportunities and familiarise themselves with Portugal, some have partnered with domestic funds with a high level of local expertise to make their investments.

Financial investors

There has been an increase in the number of PE transactions in the Portuguese M&A market. PE was involved in several major transactions, such as, at the beginning of 2018, the acquisition by Axa Investment Managers of Dolce Vita Tejo for €230 million from the North American Baupost Group (90%) and Eurofund Investments (10%).

Overall, in recent years both strategic and financial investors have increased their positions in the Portuguese market and it is common to see them join forces to pursue large M&A transactions. The Portuguese M&A market is also very active in secondary deals, i.e., between PE firms.

Recent transactions

The most notable M&A transactions in 2018 were the acquisition by Tiekenveen Holding of the shopping centers Fórum Sintra, Fórum Montijo and Retail Sintra Park (estimated value €400 million), as well as the acquisition by Merlin Properties of Almada Fórum, a shopping center, both from Blackstone Group (estimated valued €450 million); the sale of state-owned bank Caixa Geral de Deposito's businesses in Spain and in South Africa for an aggregate estimate value of €570 million; the sale of a 75% stake in the telecommunication tower company Omtel (the first tower company in Portugal) to a consortium comprising Morgan Stanley Infrastructure Partners and Horizon Equity Partners by Altice Europe, through its subsidiaries MEO – Serviços de Comunicações e Multimédia and PT Portugal (estimated value €660 million).

LEGISLATION AND POLICY CHANGES

M&A transactions in Portugal follow the general principle of Portuguese Civil Law, which allow contracting parties to establish a wide range of clauses, covenants and conditions that they deem convenient, provided that they do not conflict with the law, morals and what is defined as public order.

When it comes to specific key legislation for M&A transactions in Portugal, transaction parties must consider the Código Civil (Portuguese Civil Code), Código das Sociedades Comerciais (Portuguese Companies Code) and Código dos Valores Mobiliários (Portuguese Securities Code). The main regulatory bodies that govern M&A transactions are the Comissão do Mercado de Valores Mobiliários (Portuguese Securities Market Commission – CMVM); Banco de Portugal (Bank of Portugal); Autoridade da Concorrência (Competition Authority); Autoridade de Supervisão de Seguros e Fundos de Pensões (Supervision Authority of Insurance and Pension Funds); ANACOM (National Authority for Communications); ERSE (Energy Services Regulatory Authority); and ERC (Regulating Entity for the Media). Depending on the target and the relevant sector of activity, other laws and regulations may apply.

Recent changes in law

The implementation in Portugal of EU anti-money laundering and ultimate beneficial owner directives has had an impact on disclosure requirements and formalities. This affects the engagement of counsel, with additional know-your-client (KYC) obligations, and also requires the disclosure of certain ownership/control-related information. While certain players may see this as an additional hurdle in getting a transaction over the line, we believe a greater requirement for transparency and certainty will increase the Portuguese market's credibility for foreign investment and at the same time, enable Portuguese players to be as prepared as any international competitors when it comes to compliance.

Regulatory changes under discussion

Decree-Law No. 19/2019, published on January 28 2019, which is still under assessment regarding its immediate impact in the Portuguese M&A market, establishes a regime for real estate investment and management companies in the Portuguese legal system. This is intended to correspond to the commonly designated real estate investment trusts (REITS). With this new framework, real estate funds now have the centre stage as the sole players within the real estate market with publicly traded units.

REITS are clearly one of the mechanisms perceived by investors as critical to attract long term capital. There was a great deal of pressure from all real estate related sectors to push for the approval of this regime in Portugal so as to reinforce the credibility of the sector that has lately been a fulcrum for M&A transactions and foreign investment.

The possible impacts of the recent approved regulation by the European Parliament to scrutinise direct investments by third countries in the EU are yet to be assessed.

MARKET NORMS

The common misconceptions about Portuguese market practice naturally reside in the differences between common-law and Portuguese civil law. As an example, unlike in the UK, there are no schemes of arrangement in takeovers of public companies in Portugal. Moreover, it is worth enhancing that although the CMVM showed openness to the idea of due diligence procedures being treated as a preparatory/confirmatory act prior to a decision to announce a public offer, this is yet to be tested.

Frequently overlooked areas

Based on the above, seeking local legal advice and involving legal advisors at an early stage is crucial, namely at the preliminary negotiation stage (including MOUs and letters of intent (LOI)) all the way through to completion of the relevant post-closing formalities. Even in cases where the transaction is not fully subject to Portuguese law, there are certain mandatory legal provisions that will apply to any deal that takes place in Portugal.

PUBLIC M&A

The key factors in obtaining control of a public company depend on the way control is obtained, namely through public offer, legal merger or shareholders' agreement.

There is no legal concept of a hostile takeover in the Portuguese Securities Code; however, market practice points to an offer in which the price does not comply with the target board's opinion to be regarded as hostile.

Notwithstanding, hostile bids are allowed and are common. In fact, the public takeovers announced by Sonae and by Banco Comercial Português, which were the two major public takeovers announced in recent years, were both hostile. On the other hand, companies whose holdings in a public company exceeds, directly or indirectly, one third or one half of the voting rights of the target share capital, must launch a tender offer for the totality of the shares issued by the company and other securities issued by the company that grant the right to their subscription or acquisition

Conditions for a public takeover

Control of a public company is regulated by the Portuguese Securities Code as well as the regulations established by the Portuguese Securities and Exchange Commission, and other legislation which, among other obligations, defines the structure, content and procedure for formalising a takeover offer.

The main conditions normally attached to an offer are the disclosure of the key bidding rules regarding the characteristics of the operation and the form and other conditions of the public takeover offer, namely: acquisitions or share exchanges or a combination of both; equal treatment of security holders that are in the same position; description of the offer, amount, nature and category of the securities that are object of the offer; security deposit or guarantees offered to secure payment of the price; prior authorisation from the CMVM; acceptance statements, voting rights and shares of the targeted company owned by the offeror; and head of investor relations.

Break fees

When it comes to transactions in the Portuguese public M&A sector there is no common practice for break fees and the agreement of break fees with a bidder may be considered an unlawful favour to the bidder. This is a highly contentious point among legal scholars.

PRIVATE M&A

With regard to consideration mechanisms in private M&A, the use of some transaction risk management solutions such as the ones insurance companies provide in order to guarantee adequate protection in a transaction have become more common in recent years, especially when it comes to more complex transactions. Consequently, this trend is driving insurance companies to offer new and more price-competitive products to the market.

Earn-out covenants are normally agreed when the seller and buyer price expectations do not match or there is a potential upside valuation of the target companies due to unpredictable or uncontrollable events.

On the other hand, escrows are seldom used as security for claims for a breach of warranties as well as no leakage undertakings. The use of locked-box mechanisms has increased significantly over the past five years. This is especially true in larger deals carried out through bid auctions or in regulated sectors.

Conditions for a private takeover

There is no formal or standard structure for private takeover offers; they vary case by case depending on several factors, such as the legal and tax information gathered from the target company and the due diligence process, applicable legislation and in particular, the interest and negotiating power of the parties.

On the other hand, when it comes to competitive tender processes, it is possible to identify some common features such as: the bidders being granted access to some information in order to carry out the due diligence procedures; the possibility to draft a non-binding offer, indicating some of the terms, namely: price and valuation of the target, price adjustment mechanisms, funding sources and/or guarantees for the offered price and potential conditions precedent; the binding offer and exclusivity with preferential bidder towards agreement on SPA terms.

Foreign governing law

Although the Portuguese M&A sector is based on civil law, common law jurisdictions such as the UK and US have a large influence on cross-border transactions and an example of this is precisely when it comes to warranty and indemnity insurance. Therefore, even though the majority of deals involving Portuguese companies remains subject to Portuguese Law, parties can choose to submit the transaction documents to a foreign law, especially when overseas investors are involved.

Furthermore, it is common for a dispute resolution provision in share purchase agreements and other acquisition documents to be subject to arbitration, which may sometimes impose recourse to institutionalised arbitration centres.

The exit environment

There is a limited market for exits through IPOs. The most frequent form of exiting is through a private sale process, on an exclusive basis with one-on-one negotiations or in a competitive process, with multiple bidders. As noted above, the secondary market for PE investors is something we expect to see develop over the next couple of years.

OUTLOOK

During 2018 and the first two months of 2019, the M&A market in Portugal has been active. It is hard to know whether this will be sustainable in the long-term but there are signs that the next few months will continue in this manner. The interest of investors in energy, infrastructures and real estate assets turned in a number of excellent mandates for seasoned M&A teams in Portuguese law firms.

Generally, the real estate, financial, technology, energy and infrastructure sectors are key drivers of M&A activity in Portugal, building on the pattern of previous years. In addition, there are some transactions that may be of interest to large ticket investors and that are rumoured for this year, with telecoms, energy, large-scale real estate projects and tourism as the most active sectors.

About the author |

||

|

|

Jorge Bleck Senior partner, Vieira de Almeida Lisboa, Portugal T: + 351 21 311 3400 E: jb@vda.pt W: www.vda.pt/en/people/partners/jorge-bleck/8964/ Jorge Bleck joined Vieira de Almeida & Associados in 2013. He is a partner and head of the M&A practice. Jorge has been involved in several transactions in Portugal and abroad and has a focus on M&A, private equity and joint-ventures, particularly those with an international component, as well corporate restructuring and corporate finance. Before joining the firm Jorge was partner in Linklaters London and the managing partner of Linklaters Lisbon. Some of his recent transactions include advising Bank of Portugal in connection with the sale of the bridge bank – Novo Banco; Altice Europe through its subsidiaries MEO and PT Portugal on the sale of equity stakes in its telecommunication tower businesses in Portugal, creating the first independent tower company in Portugal; and Carlsberg on the acquisition of a participation in Viacer, by means of which Carlsberg's ownership in Super Bock Group, both directly and indirectly, increased up to 60%. |

About the author |

||

|

|

Maria da Cunha Matos Managing associate, Vieira de Almeida Lisboa, Portugal T: + 351 21 311 3400 E: mam@vda.pt W: www.vda.pt/en/people/associates/maria-cunha-matos/12382/ Maria da Cunha Matos joined Vieira de Almeida & Associados in September 2017 as a managing associate in the M&A practice. Prior to joining VdA, Maria was a managing associate at Linklaters São Paulo. Maria has over 16 years' experience advising international clients, focused on cross-border M&A, joint-ventures and restructurings and international capital markets transactions. Some of her recent transactions include advising: Altice Europe and MEO, on sale of its international wholesale voice carrier operations in Portugal to Tofane Global SAS; Altice Europe through its subsidiaries MEO and PT Portugal on the sale of its telecommunication tower businesses in Portugal, creating the first independent tower company in Portugal; Coty in matters relating to Portuguese law and its Portugal operations on their global corporate restructuring in connection with its $12.5 billion acquisition of the P&G Specialty Beauty business; and the refinancing of a major international group engaged in fleet management and financial investments in helicopter operators. |