Ana Mercedes López and Rafael Burgos, Arias

MARKET OVERVIEW

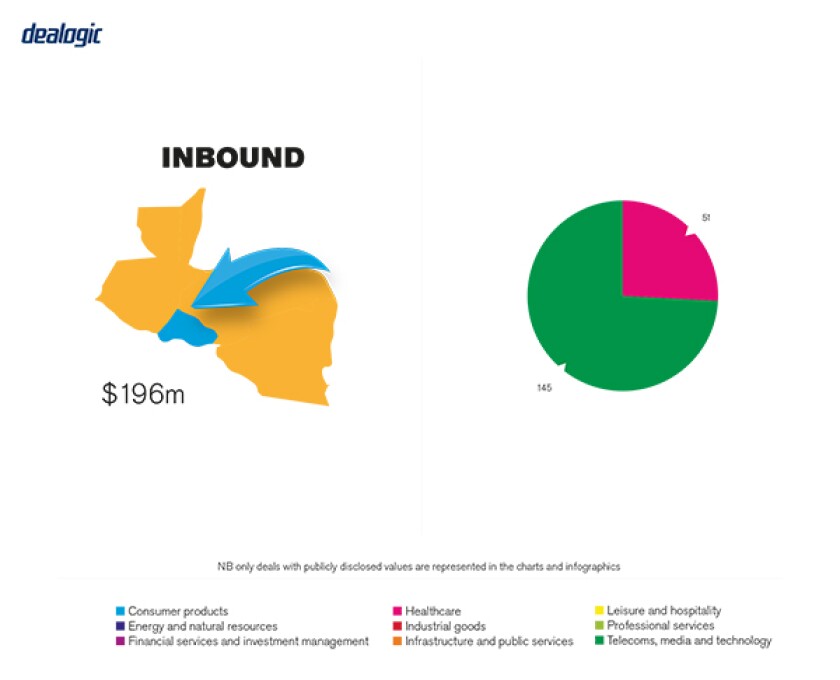

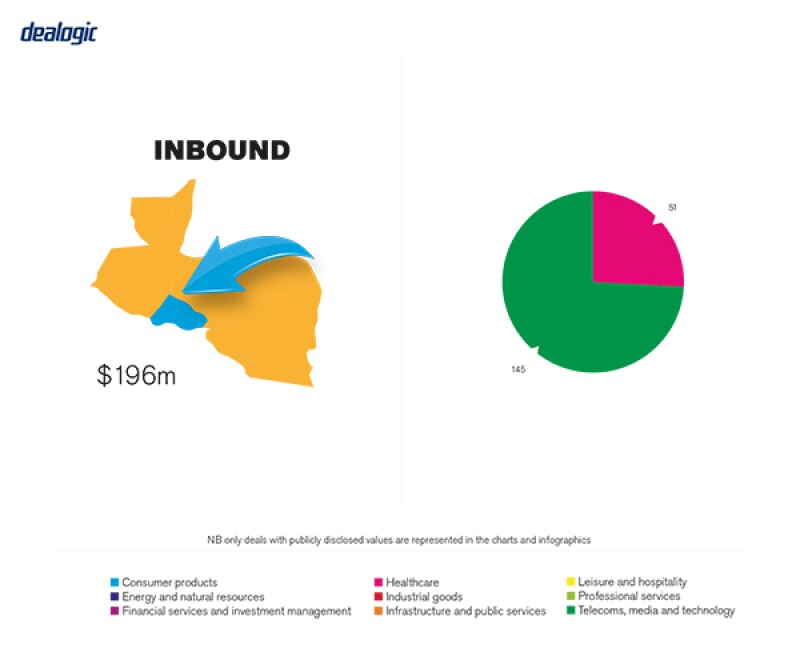

El Salvador has just held a presidential election and emerged from it with a new president who ran for a political party that has never before been in government. Given this backdrop, the market has been cautious with regards to executing M&A transactions. Notwithstanding this, there have been some relevant M&A transactions in the first two months of 2019.

Economic growth in El Salvador over 2018 was held in check by the political landscape and a lapse in security compared to previous years and the flow of M&A transactions did not change noticeably.

As the Salvadoran stock market is still under development, there are few companies that are required by law to be listed in the public market. As a result, Salvadoran companies are in their majority held privately and M&A acquisitions are largely private.

TRANSACTION STRUCTURES

The most significant transaction structure trends derive from M&A transactions between competitors driving industry consolidation without the entrance of new players. There has also been some interest from foreign private equity funds to invest in recently developed energy projects.

Financial investors

Financial investors are starting to review Salvadoran market conditions in order to participate in local M&A, especially related to the energy market. We expect to see major participation of private equity funds once the most recently adjudicated energy projects begin commercial operations.

Recent transactions

The most recent major M&A in El Salvador was The Bank of Nova Scotia's sale of its banking and insurance business to a Panamanian investor who is also the majority owner an important financial group (Grupo Cuscatlán). The transaction has yet to be approved by the regulatory authorities (Superintendence of the Financial System/ Superintendence of Competition).

Elsewhere, Telefonica has agreed to sell its operations in El Salvador to America Móviles, which is also the owner of CTE-Claro in El Salvador (another relevant player in the telecom sector). The transaction is subject to the applicable regulatory approvals. This transaction is part of a joint deal which included the operations of Telefónica in Guatemala, where the transaction was a simultaneous sign and close as no regulatory approvals were required in this jurisdiction.

In both cases, the market is focused on the resolution that the Superintence of Competition will either authorise, allow with conditions or reject the transactions.

LEGISLATION AND POLICY CHANGES

The Salvadoran Commerce Code is the principal regulation that governs M&A in El Salvador. Also, depending the amount of the transaction, the Competition Law may be applicable. Finally, depending on the industry, other relevant regulations may be applicable (or instance the Banking Law, Telecommunications Law, General Electricity Law, etc.)

Recent changes in law

There have not been relevant changes in regulations related to M&A transactions.

Regulatory changes under discussion

The Superintendence of Competition has announced that will file a proposal before the Salvadoran Congress to amend the Competition Law, with the purpose of decreasing the monetary thresholds in which an M&A transaction needs to request authorisation from the Superintendence of Competition, among other aspects of the law.

MARKET NORMS

One common mistake made in the Salvadoran market is that seller's budget does not always contemplate the execution of a vendor's due diligence, which aims to identify, treat, solve and/or disclose the relevant contingencies, and therefore fails to avoid a decrease in the purchase price during the negotiation of the SPA.

Another mistake is to underestimate the petition to be filed before the Superintendence of Competition. Even though not all transactions require authorisation (for instance when the economic thresholds of the transaction do not exceed those established by law), in practice it may be convenient to obtain the written opinion of the Superintendece, even if it only refers to the Superintendece's non objection. The closing of a transaction is sometimes delayed for not having taken this aspect into consideration.

Frequently overlooked areas

As described above, some of the overlooked areas include vendors due diligence, regulatory approvals (including, but not limited to competition filing) and tax planning and structuring.

PUBLIC M&A

As described above, the stock market in El Salvador is under development and public companies are not common on the Salvadoran market, thus, transactions are mostly conducted privately. Nevertheless, in public transactions a key factor is to obtain the applicable regulatory approvals before the Stock Exchange and Superintendance of the Financial System.

Conditions for a public takeover

The shares of Salvadoran public companies may also be transferred privately, therefore, public takeover offers are not common locally.

Break fees

Break fees are not a common practice in El Salvador market, for public or private transactions.

PRIVATE M&A

To address the more sensitive contingencies, buyers often request sellers to provide bonds issued by local financial institutions in a private M&A transaction in the market, in view that the payments are easier to execute than escrow or other agreements. Insurance for representations and warranties is not common in local M&A transactions, but it is a trend to consider taking into account that a significant portion of M&A transactions are submitted to foreign laws rather than local law.

Conditions for a private takeover

Key conditions include the purchase price, reps and warranties, regulatory approvals and any conditions to closing.

Foreign governing law

Using a foreign governing law is common practice, as long as either the seller or buyer is a foreign company. M&A transactions between local companies are usually submitted to Salvadoran law.

The exit environment

An exit on the local market is usually executed as a result of private negotiations between a buyer and a seller. Investment bankers have an active role in seeking business opportunities.

OUTLOOK

In view of El Salvador's new government, which will take office on June 1 2019, we believe that investors will act cautiously until they are able to understand what approach the President-elect will take in relation to private investment. The legal sector will always be prepared for any opportunity and requirement from the market.

About the author |

||

|

|

Ana Mercedes López Partner, Arias San Salvador, El Salvador T: +503 22570900 F: +503 22570901 E: anamercedes.lopez@ariaslaw.com Ana Mercedes has participated in financing projects for the aviation and energy industries, among others. She has advised internationally renowned companies on the execution of power purchase agreements (PPA), EPC agreements, O&M agreements and on obtaining all regulatory approvals in El Salvador. Her experience includes advising multinational companies on mergers and acquisitions, regulatory analysis related to concentrations and legal corporate matters. She has a degree in law from Dr Jose Matías Delgado University and a master's in entrepreneurial law from Navarra University, Spain. Ana also has a diploma in family education from the European Institute of Education and a master's degree in bioethics, from the Universidad del Istmo, Guatemala. Ana has been recognised as best finance lawyer in Latin America by Euromoney Legal Media Group's "Americas Women in Business Law Awards". She was awarded Central America Lawyer of the Year by Chambers Women in Law Awards 2018 and is ranked in Chambers Latin America for her corporate and commercial practice, as well as for her active role and expertise in banking and finance. She is also listed as "Recommended lawyer" by The Legal 500. |

About the author |

||

|

|

Rafael Burgos Associate, Arias San Salvador, El Salvador T: +503 22570900 F: +503 22570901 Rafael Burgos is member of Arias´corporate team, where he has been providing legal advice to national and international companies involved in complex multi-jurisdictional transactions and leading them to their successful completion. Currently, Rafael advises internationally renowned companies in the local and international execution of their projects, with a special emphasis on the development of their investments in the energy industry through the drafting and review of power purchase agreements (PPA), engineering, procurement and construction agreements (EPC) and operation and maintenance agreements (O&M) and the securing of all required permits and authorisations for the execution of projects in El Salvador. Rafael has also been involved in the financing of projects, as in the incorporation and acquisition of companies dedicated to diverse matters within the energy industry. He has a law degree cum laude from Dr José Matias Delgado University and an LLM in corporate law from Pontificia Universidad Católica de Chile. |