Harsh Pais and Clarence Anthony, Trilegal

MARKET OVERVIEW

Dealmaking in India touched the $100 billion mark in 2018, driven by relative macroeconomic stability, progressive liberalisation of government policies and sale of distressed assets. The technology sector accounted for 32.2% of all deal activity, followed by energy, mining and utilities (14.4%), industrials and chemicals (14.1%) and financial services (11%). M&A in India accounted for 13% of all M&A activity in the Asia Pacific region.

The key drivers for M&A activity in 2018 were the prominence of strategic acquirers (such as Walmart and Schneider) and consolidation deals, and increased activity in the distressed assets space on account of India's new insolvency regime.

M&A activity

2018 was a record-breaking year for M&A activity in India as compared to previous years. The aggregate deal value was $100.1 billion across 416 deals (compared to 2017, which saw a total deal value of $77.6 billion across 614 deals).

Historically, the Indian M&A market has been driven by private deals. Nonetheless, public M&A has been boosted by activity in the stressed assets space and consolidation deals across sectors such as technology, financial services, energy, industrials and chemicals and healthcare. Public M&A is likely to gather momentum in 2019 on account of sustained interest in distressed assets and consolidation/ divestment amongst government companies.

TRANSACTION STRUCTURES

Among the key trends influencing deal structures has been a spate of consolidations across several sectors, including technology, financial services, energy, industrials and chemicals and healthcare; deal activity driven by insolvencies (which has forced sales by distressed promoter groups); and market penetration by foreign investors in the e-commerce and technology sectors. These have been amongst the most significant trends.

Financial investors

India continues to attract financial investors, as borne out by a steady stream of strategic acquisitions and exits. Private equity (PE) investors, historically active in sectors such as energy, real estate and infrastructure, are now making large strides in the technology / e-commerce space (marked by strategic acquisitions by investors such as Berkshire Hathaway and Softbank) and healthcare (which has witnessed numerous asset acquisitions by PE-backed hospital chains). PE and sovereign wealth funds are also increasingly targeting distressed assets that are on the block as a result of the Reserve Bank of India (RBI)'s push to clean-up banks' distressed assets portfolios.

Recent transactions

Walmart's acquisition of a 77% stake in Flipkart (which has a 40% share in the Indian e-retail space) for $16 billion is the world's largest acquisition in the e-commerce sector. Following this deal, there has been a tremendous uptick in M&A in the technology space, with technology deals accounting for 32.2% of the 2018 M&A deal activity in India. This deal trigged tremendous debates around it being a back-door entry for Walmart into India's multi-brand retail space, and its consequent impact on India's brick and mortar retailers. The Indian government has recently amended the regulations on foreign investment / ownership in the e-commerce space to restrict such a back-door entry.

The acquisition of the Ostro energy platform by ReNew Power for an enterprise value of $1.6 billion was recorded as India's largest M&A deal in the renewables space – this sector continues to see significant deal activity, driven by consolidation strategies of well-established players.

LEGISLATION AND POLICY CHANGES

The key legislation that governs M&A in India includes:

Companies Act, 2013: Administered by the Ministry of Corporate Affairs (MCA), the Companies Act is the primary legislation governing companies and mergers in India.

Securities Regulations: The securities markets are regulated by the Securities and Exchange Board of India (SEBI). The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 govern M&A transactions which involve the acquisition of a substantial stake in a publicly listed company. The SEBI (Delisting of Equity Shares) Regulations, 2009 govern take-private transactions.

Foreign Exchange Management Act, 1999 (FEMA): Administered by the RBI, FEMA and the regulations issued by the RBI thereunder regulate all capital inflows and outflows.

FDI Policy: The Foreign Direct Investment Policy issued by the Central Government comprises the framework for regulating foreign investment into India, including sector-specific restrictions.

Competition Act, 2002: The Competition Commission of India, the regulator established under the Competition Act, accords anti-trust approval to transactions above prescribed thresholds.

Income Tax Act, 1961: Administered by the Income Tax Department, the Income Tax Act along with double tax avoidance treaties entered into by the Indian government govern the tax treatment of M&A transactions.

Insolvency and Bankruptcy Code, 2016 (IBC): Administered by the National Company Law Tribunals, the IBC regulates auction sales under a corporate insolvency resolution process.

Recent changes in law

Recent legislative changes include:

IBC, 2016: Recent amendments to the IBC have introduced sweeping changes to both substantive and procedural aspects of the insolvency resolution process, perhaps none more significant than the insertion of Section 29A, which is intended to restrict existing promoters of an insolvent entity from exploiting the insolvency resolution process by participating as bidders and potentially regaining control of such entity. Interpretation by the courts has radically enlarged the scope of this provision beyond the conventional understanding of promoters – this may have the effect of severely limiting the pool of potential bidders for stressed assets.

FDI in e-commerce: The Indian government has also recently amended the regulations for foreign investment into e-commerce by imposing significant restrictions on the ability of an e-commerce marketplace to sell products sourced from its affiliated entities.

Enforcement of contracts: In a significant departure from its earlier position, the Specific Relief (Amendment Act), 2018 amended the Specific Relief Act, 1963, to make specific performance of contracts more accessible to litigating parties. Litigants are now permitted to seek specific performance of all contracts, unless the contract falls under one of the exceptions identified in the law.

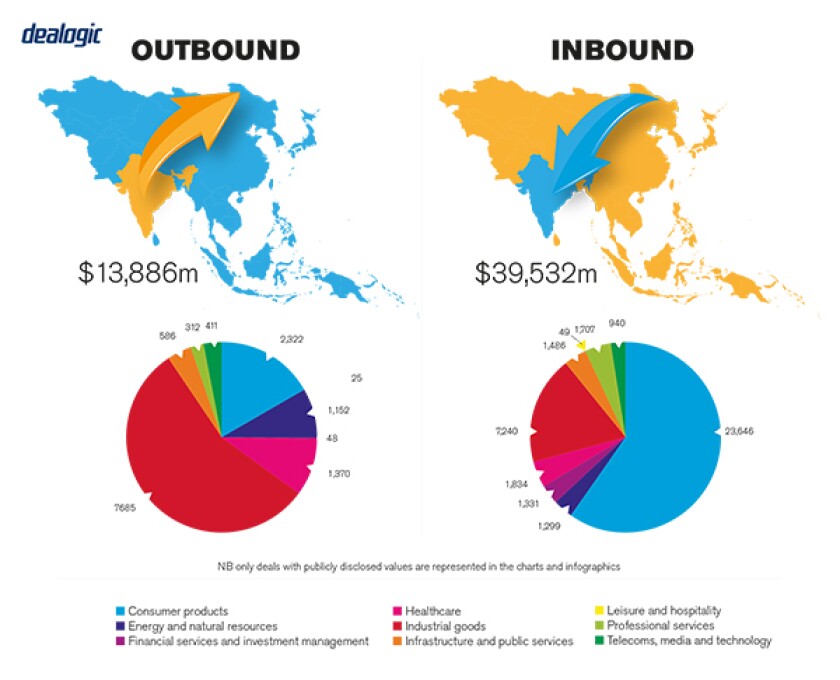

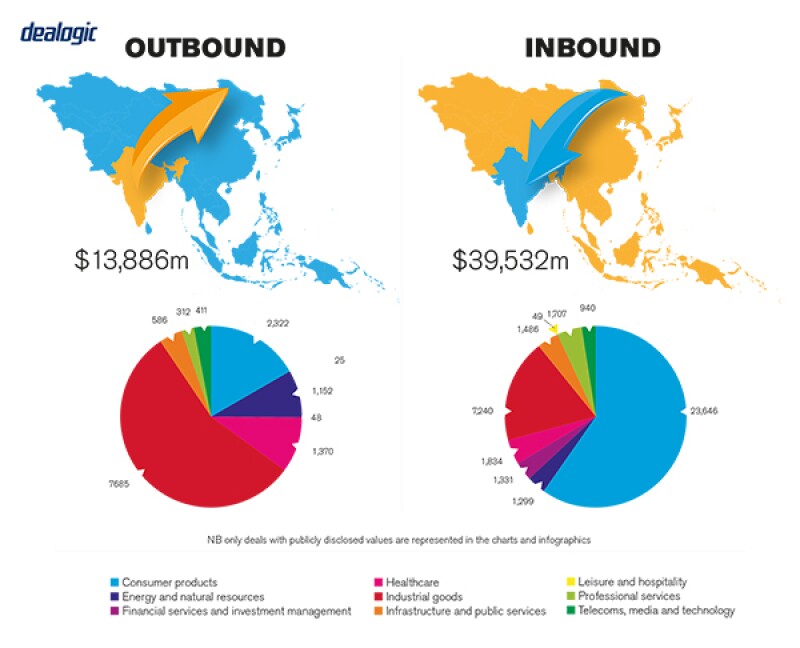

Cross-border mergers: Previously, completion of any inbound or outbound merger was a complicated process, requiring approval from both the RBI and the Indian courts. The RBI has now simplified the process by introducing a deemed approval construct for inbound / outbound mergers that meet prescribed parameters. However, this is a relatively nascent and untested area.

Delisting Regulations, 2009 (Delisting Regulations): The delisting regime contemplates a reverse book building process for delisting price discovery. The process itself was susceptible to speculation-based inflation, without logical recourse for an acquirer who found the discovered price unviable. The Delisting Regulations were amended in November 2018 to plug this loophole – an acquirer is now permitted to make a counter offer to public shareholders if the discovered price is not acceptable.

Regulatory changes under discussion

The Central Government has announced that its draft e-commerce policy will be released in 2019. The policy aims to create a level playing field for overseas and Indian entities and restrict foreign players from directly or indirectly influencing prices of commodities sold on e-commerce platforms. The Government is also considering establishing a separate regulator for the e-commerce sector.

In relation to the disclosure of significant beneficial ownership, the MCA has recently introduced rules imposing disclosure obligations on individuals who are the ultimate holders of beneficial interest in Indian entities. Given the ambiguities around the scope of the rules, compliance with these disclosure requirements in the coming months may prove onerous, particularly in case of multi-tiered holding structures.

MARKET NORMS

There are several common mistakes and misconceptions that relate to standard market practice in India. Transacting parties tend to opt for foreign law-governed transaction documents – this stems from the belief that choosing Indian law may expose a transaction to the delays and uncertainties usually associated with the Indian court system. However, the Indian government is continuously taking steps to encourage arbitration (including amendments to Indian arbitration law and promoting Mumbai as a hub for international commercial arbitration), revamp the court system and facilitate the enforcement of foreign arbitral awards, to address these concerns.

Frequently overlooked areas

Regulatory and tax advice should be sought at the outset to identify regulatory hurdles before transaction terms are crystallised. Specifically, India has exchange control laws which regulate how the securities of an Indian company may be transferred. Administered by the RBI, these regulations are prone to frequent amendments and often give rise to questions that may alter proposed transaction structures. Importantly, any transfer of shares of an Indian company where either, or both, of the buyer and seller is an Indian resident must be consummated through an Indian rupee-denominated transaction.

Overseas deals which involve the sale of an Indian business should be consummated at the India level through a stand-alone transfer agreement to avoid exposing the larger global transaction to scrutiny by Indian tax authorities. Similarly, Indian anti-trust and securities laws provide for 'long arm' jurisdiction with respect to overseas deals which involve indirect sale of an Indian business.

Acquisitions with respect to publicly listed companies are required to adhere to the Takeover Code. Delisting Regulations impose additional challenges in consummating take-private deals.

PUBLIC M&A

Under the Takeover Code, a person who enters into an agreement to acquire substantial stake (25%) or control of a publicly listed company is required to make a public tender offer to acquire at least an additional 26% of the target entity's shares. However, the acquirer must ensure that the prescribed minimum public float (25%) is maintained at all times, unless the company is delisted as part of the transaction.

However, delisting has proved to be challenging in India – a successful delisting requires a minimum acceptance level of 90% (of public shareholders of the listed target company) and is consummated through a reverse book building process to determine the offer price, which often yields a significant premium. In a recent move aimed at easing the latter requirement, the Delisting Regulations were amended in November 2018 to permit an acquirer to make a counter offer if the discovered price is not acceptable to the acquirer.

Conditions for a public takeover

Public takeovers may attract the requirement of obtaining mandatory regulatory approvals, such as those of sector-specific regulators or anti-trust approval from the CCI. Such approvals, when issued, may prescribe additional conditions. Other than this, there is limited scope to incorporate specific conditions in a public tender offer.

If the transaction underlying a takeover offer is terminated because an essential condition (previously disclosed in the offer documents) over which the acquirer has no control, is not satisfied, the acquirer is permitted to withdraw the offer.

Break fees

Break fee provisions are not common.

PRIVATE M&A

When it comes to consideration mechanisms in private M&A transactions, the majority of private M&A are consummated through completion accounts, though the locked-box mechanism has become prevalent in recent times. Earn-out and escrow structures have also become more common – however, exchange control regulations impose limitations on such escrows and earn-outs in cross-border transactions. The ever-increasing volumes of cross-border deals have resulted in the penetration of W&I insurance into the Indian market, though it is yet to gain widespread traction.

Conditions for a private takeover

There is no practice of private takeover offers in India, as private companies impose restrictions on the transfer of shares, and each instance of transfer must be approved by the board of directors. Exceptions are transactions involving the exercise of tag-along and drag-along rights by the selling majority investor, which effectively allows squeeze-out of minority investors, or the sale of pledged shares by lenders. In absence of such contractual rights, a squeeze-out of the minority is challenging under Indian law.

Foreign governing law

Private M&A transaction documents are usually not governed by foreign law – however, cross-border transaction documents generally provide for foreign-seated arbitration (in London, New York or Singapore).

The exit environment

The first half of the year saw a succession of IPOs and tender offers, which petered out in the second half. However, 2018 marked tremendous growth for tender offers, PE buyouts and exits. Buyouts increased by 102.3% (at $16 billion) compared to 2017 ($7.9 billion), whereas PE exits saw a sharp rise in value ($35.8 billion in 2018, compared to $5.7 billion in 2017).

OUTLOOK

Given factors such as the upcoming Indian general elections, fallout of the mid-2018 liquidity crisis amongst Indian non-bank financial institutions, the depreciating rupee, volatile oil prices and ongoing global trade tensions, the Indian M&A market in 2019 may be less buoyant compared to the past couple of years. That said, as at the end of January 2019, M&A activity has not shown signs of slowing down. We expect M&A activity to be driven by: the sale of distressed assets; divestments of non-core assets; consolidation in the financial services sector; and increased participation of PE and sovereign wealth funds.

About the author |

||

|

|

Harsh Pais Partner, Trilegal Mumbai and New Delhi, India T: + 91 22 4079 1062, + 91 11 4259 9290 Harsh Pais is a partner in Trilegal, focusing on M&A and private equity. Harsh advises extensively on cross-border acquisitions and joint-ventures. In addition, Harsh provides strategic counsel to clients on matters involving change of control transactions, corporate governance, securities laws, troubled joint-ventures and crisis management. Harsh is also experienced in providing transactional and regulatory advice to clients in regulated industries, including financial services; energy; and telecom, media and technology. Harsh was involved in reviewing the initial drafts of the bankruptcy code developed by the Bankruptcy Law Reforms Committee. As a member of FICCI's national committee on corporate laws, Harsh has been invited to advise SEBI on a proposal to liberalize the regime to de-list publicly traded companies in India. Harsh is ranked as a Leading Lawyer – Highly Regarded for Corporate M&A by the IFLR1000 Corporate & Finance Guide 2019. Focusing on M&A, Harsh garners recognition from clients for his "high quality of documentation," as well as his knowledge of regulatory issues relating to corporate transactions. Further sources praise his "depth of knowledge, quick fast and comprehensive advice," and ability to "think out of the box, in doing so providing creative solutions." He has past experience at a major international law firm in New York and is additionally qualified in the UK and New York. Harsh is an alumnus of Columbia Law School and the National Law School of India. |

About the author |

||

|

|

Clarence Anthony Counsel, Trilegal New Delhi, India T: + 91 11 4163 9393 E: Clarence.Anthony@trilegal.com Web: www.trilegal.com Clarence Anthony is a counsel in Trilegal with a focus on M&A, private equity and funds. He regularly advises on transactions in regulated sectors such as insurance, aviation, financial services and real estate. In the past year, he has also acted on a number of prominent deals in the manufacturing, technology and renewables space. His clients include some of the largest PE funds, development finance institutions and multinational corporations. Clarence is an alumnus of Government Law College, Mumbai and is a solicitor registered with the Bombay Incorporated Law Society. Clarence is also qualified to practice in England and Wales. |