Omar Bassiouny and Islam Saeed, Matouk Bassiouny and Hennawy

MARKET OVERVIEW

For the past 12 months the Egyptian market has been monitoring the progress of the implementation of the Government's economic and social development plan in light of the $12 billion Egypt-IMF loan agreement and which was associated with a number of important measures including the change in the deposit/lending interest rate announced by the Central Bank and most importantly the removal of all FX controls and the free flotation of the Egyptian pound and which was followed by a severe currency devaluation.

In 2018, the market was getting prepared for series of IPOs of state-owned companies, however, due to the severe volatility in emerging markets in August 2018, the Cabinet decided to postpone its ambitious IPO plan until 2019.

The Financial Regulator Authority (FRA) introduced several regulations to regulate the financial market including but not limited to sale by instalment, micro-finance, factoring and enshrined a number of new approvals that must be obtained when acquiring financial services companies.

Considering the continuity of application on the regulatory restrictions introduced by the Central Bank on the provision of acquisition finance by Egyptian banks and the relatively high interest rate, private equity remains one the key players in the M&A market.

With respect to merger control, although the Competition Law does not provide explicit stipulations that allow the Egyptian Competition Authority (ECA) to impose a previous consent approach, in 2018 the ECA published an official decision addressed to the potential acquisition of Careem by Uber in which it said that the parties to such a transaction should obtain the prior consent of the ECA, even if the transaction were to be concluded at the level of Careem's UAE holding company. This is a new approach by the ECA and the market now is anticipating more ECA involvement.

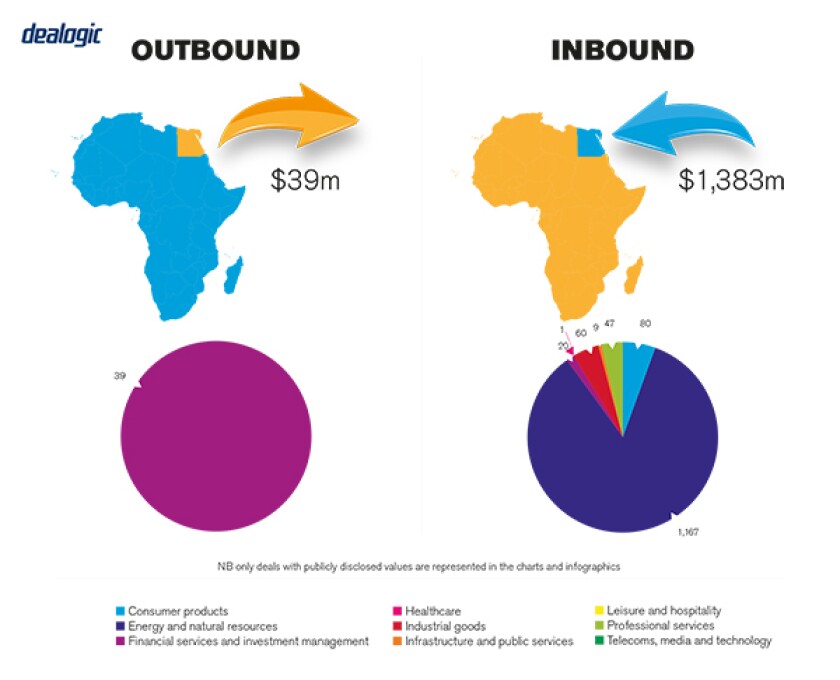

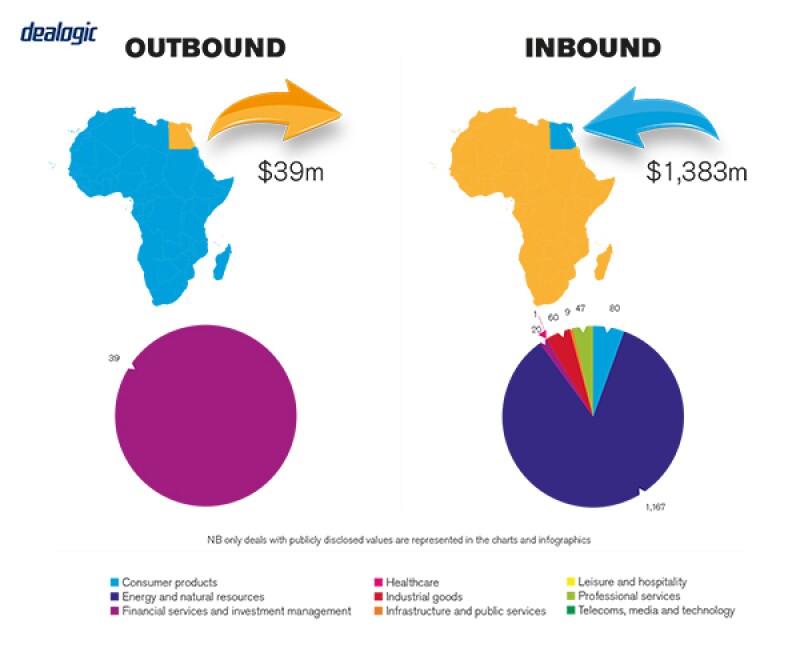

M&A activity

Overall, 2018 was a progressive year for M&A in Egypt. Private equity, investment managers and financial institutions become more active in terms of the number of deals and their value. In 2018, M&A transactions were closed in several sectors including: media, education, oil and gas downstream, petrochemicals, telecommunications, renewable energy, manufacturing, food processing, fintech and healthcare.

Private and public M&A both drive the market, but private transactions remain dominant. In Q1 2018, it was expected that public transactions (in terms of value and volume) would overcome private transactions upon the implementation of the Government's IPO plan, but due to the delay in implementing the plan private transactions remained dominant.

TRANSACTION STRUCTURES

The most significant trends include (where applicable) structuring a deal in form of horizontal layers, where the direct offshore layer establishes an SPV in one of the jurisdictions which has a double taxation agreement with Egypt.

The key factors that influence deal structures in general include: local nationality restrictions applicable to certain activities (for example higher education, vehicles imports and commercial agencies); the timing for transferring regulatory licenses; employees and government contracts in asset deals; the timing for governmental approval on direct or indirect change of control, as provided under certain industries or concessions granted by the government; mitigating the effect of any unforeseen fluctuation in the forex rates; and switching from a stock deal to an asset deal to meet banking and finance requirements imposed by the Central Bank.

Financial investors

Financial investors remain the key players in the Egyptian M&A market. This has been inherited from 2017 and previous years. We believe this will remain the case for 2019. However, the market may change once the Government's IPO plan is implemented and as large enterprises make public offerings on the Egyptian Stock Exchange.

Recent transactions

Notable recent transactions include the acquisition by Mubadala Petroleum of a 10% stake in the Shorouk concession in Egypt's Zohr gas field. The deal was closed in March 2018 for $934 million.

Another transaction saw EFG Hermes acquire a New Cairo-based elementary schools' portfolio from Talaat Moustafa Group Holding (TMG Holding), Egypt's largest listed real estate developer, for EGP1billion ($57 million) in May 2018. Following the closing, EFG Hermes and GEMS effected their 50%/50% partnership in the ownership of the schools.

In addition, Matouk Bassiouny and Hennawy represented Tag El Melouk (a market leader in the production of baking powder, vanilla and salt, among other products) as local counsel in connection with selling 100% of its shares to Dr Oetker. Instructions included conducting a vendor legal due diligence, deal structuring, preparation of transaction documents and managing the deal closing process. The deal closed in July 2018.

Solvay Alexandria Sodium Carbonate (CCI) also sold 100% of its shares to three state-owned companies in a $15 million buyout in October 2018 of CCI by State-owned companies Egyptian Ethylene and Derivatives Company (Ethydco), Sidi Kerir Petrochemicals Company (SIDPEC) and the Egyptian Petrochemical Holding Company (ECHEM).

Matouk Bassiouny and Hennawy acted in all these transactions.

LEGISLATION AND POLICY CHANGES

M&A transactions are regulated in Egypt by diverse legislation. Key rules pertaining to M&A can be found under the Egyptian Companies Law No. 159 of 1981 and its executive regulations, as amended, the Capital Market Law No. 95 of 1992 (Capital Markets Law) and its executive regulations, as amended and the Egyptian Exchange Listing Rules, as amended.

The key regulatory authorities are the Egyptian Exchange; the Financial Regulatory Authority (FRA); the General Authority for Investment and Free Zones (GAFI); and the Egyptian Competition Authority (ECA). Other sector specific authorities might be involved depending on the relevant target's activities.

Acquisitions involving transfers of shares in joint stock companies and quotas of limited liability companies are the most common acquisition structures in Egypt.

Recent changes in law

Similar to 2017, 2018 witnessed several legislative amendments that have impacted the M&A market; this includes increasing the mandatory tender offer trigger from a 2% to 5% increase in the shareholding of a public company. Further, the FRA introduced special regulations regarding acquisition of notable stakes in financial services companies, and those new regulations require the FRA's previous consent for an acquisition.

Regulatory changes under discussion

As discussed above, the Egyptian Competition Authority (ECA) started in 2018 to adopt a new approach in its interpretation of the Competition Protection Law and its executive regulations. As a result, M&A transactions between dominant companies in a market must obtain the prior approval of the ECA, even if the transaction is concluded offshore. The ECA is trying to introduce an amendment to the Competition Protection Law and its executive regulations to give it more power in more merger control.

MARKET NORMS

There are several issues to watch for. Sometimes the negotiation phase takes more than usual due to lack of experience of the sell side or buy side in negotiating M&A deals. Some principals do not read English and comment on draft transaction documents based on poor Arabic translations. Organised virtual data rooms (VDRs) exist mainly in big deals, where the sell side appoints an investment bank or M&A experienced firm and assigns to it the task of opening the VDR. Unfortunately, in medium and small sized deals, it is rare to have an organised VDR. When closing is conditioned to the securing of governmental approval, the issuance of such approval often takes more time than usually expected and factored into the transaction documents. The volume of disclosure by the sell side is sometimes much more limited than it should be.

Frequently overlooked areas

The FAQs are usually made during the structuring phase and parties are always keen to use the structure that gives them the best tax result. When an investor is foreign, frequent questions are about the rules and practice of repatriation of dividends and investment proceeds, associated taxes and available exit options.

PUBLIC M&A

Pursuant to the executive regulations of the Capital Market Law, any investor wishing to acquire more than one third of the capital of a listed company or unlisted company whose shares have been offered to the public, must submit a mandatory tender offer (MTO) addressed to all shareholders of the target company for the acquisition of up to 100% of the share capital of target company.

Exemptions from conducting an MTO may be granted by the FRA on a case-by-case basis. An MTO waiver can be potentially obtained, inter alia, in the following cases: a capital restructuring among related parties (as defined in the regulations) and/or related group companies; where there is participation in a rights issue; or where the approval of all the shareholders of the target company on the acquisition has been obtained. It is permissible for any third party to apply for conducting a competitive MTO.

Conditions for a public takeover

The MTO application usually includes a number of undertakings by the offeror; including, inter alia, undertakings related to the employees of the target company and its intention in connection with the listing of the shares at EGX, among others.

In the event an MTO is initiated by an offeror, the following rights will be granted to the minority shareholders:

In case the offeror acquires 90% or more of the company's share capital, any remaining shareholders with 3% or a minimum number of 100 shareholders representing at least 2% of the free float shares may request the FRA (within 12 months of the MTO/or the exemption from the MTO) to notify the offeror to purchase the minority shareholders' shares.

In practice, the FRA obliges the offeror (through an undertaking in the MTO application) to acquire any shares which are offered to it by any of the minority shareholders who have not responded to the MTO. The duration of such obligation is six months from the date of execution the MTO.

The offeror is prohibited from initiating another tender offer for a period of six months following the MTO, except with the approval of the FRA.

Break fees

The offeror cannot revoke or amend the terms of the MTO draft as approved by the FRA during its effective term. However, pursuant to the Capital Market Law, the offeror may withdraw the MTO draft only if a fundamental harmful incident occurs after publishing the MTO draft, which adversely affects the target company, its activities or the value of its shares, provided the FRA approve the withdrawal or the amendment of the terms of the MTO. No break fees should be involved in cases of withdrawal pursuant to the terms of the Capital Market Law.

However, in private M&A transactions, break fees are commonly mutually agreed between the parties as a percentage of the purchase price, which is usually covered in the transaction documents. However, under Egyptian law, there is room to claim reduction in case of excessive break fees. Based on the principle of Egyptian Civil Code pacta sunt servanda, break fees are applicable when and if there has been a contractual arrangement to that end.

PRIVATE M&A

The most commonly used pricing adjustment mechanism is the completion account, which is based on the estimated accounts provided usually by the seller. Locked-box mechanisms are also used but not as commonly as completion accounts, due to leakage indemnity claims. However, there has been a tendency to deduct leakage from deferred payments instead of resorting to an indemnity claim. The foregoing has recently helped in growing an appetite for locked-box mechanisms. Nevertheless, some parties still prefer the completion accounts mechanism as it covers any deviation from agreed upon figures (for example net debt, net cash or normalised working capital), as opposed to locked-box which protects the buyer only from leakage, which basically encompasses money withdrawn by the seller or its related parties.

Though resisted by sellers, deferred components are commonly used in relation to the adjustment mechanisms so that the purchase price is adjusted through the deduction from the deferred component. The deferred component is usually deposited in an escrow account to give the seller certainty and avoid any trust issues. However, earn-outs are not commonly used.

Conditions for a private takeover

It is customary that each transaction includes a certain number of conditions that govern the sale of a private entity and once satisfied the deal is deemed closed. These conditions depend on the share/asset subject to the sale. Typically, conditions may include prior governmental approvals, payment of certain debts and non-competition restrictions, among others. This being said, there is no standard practice in this regard.

Foreign governing law

It is common to provide for a foreign governing law in private M&A share purchase agreements. However, the share purchase agreements must not include any provision that does not comply with the mandatory laws applicable on the target to ensure smooth application of the share purchase agreements.

Consequently, the overwhelming majority of M&A share purchase agreements refer any disputes that arise to arbitration, which is a much faster and more efficient process than going through normal courts, albeit more expensive.

The exit environment

Since private equity firms are still dominant in the Egyptian M&A scene, we usually provide for broad exit provisions that include options for exit by sale of shares or initiating IPOs. As mentioned, we have been seeing more IPOs in the last few years that means that investors are comfortable now to use this as an exit strategy

OUTLOOK

Taking into consideration that Egypt has achieved an economic GDP growth rate of 5.5% for the second-half of 2018 (the highest in the middle east according the IMF), implemented more than 90% of the medium term reform plan agreed upon with the IMF, stabilised the Egyptian pound forex rate, and secured a notable increase in the forex reserves at the Central Bank, we remain optimistic insofar as foreign direct investment and M&A activity are concerned.

We expect further reforms in connection with the regulatory framework for antitrust and expect that these will strengthen the role of the regulator. We expect the following sectors to have the majority of the M&A transactions in the coming 12 months: renewable energy, oil and gas, petrochemicals, education, food processing, financial services, telecommunications and real estate development.

About the author |

||

|

|

Omar S Bassiouny Partner and head of corporate and M&A, Matouk Bassiouny and Hennawy Cairo, Egypt T: +202 2796 2042 F: + 202 2795 4221 E: omar.bassiouny@matoukbassiouny.com Omar S Bassiouny is the founding partner and head of corporate and M&A in Matouk Bassiouny and Hennawy in both offices: Dubai and Cairo. He is consistently ranked in the top tiers and bands by legal periodicals in the areas of corporate law and M&A and known for his considerable expertise in setting up joint-ventures and new projects in Egypt and Dubai, as well as ensuring compliance with local laws and corporate governance. Omar is also recognised for his negotiations skills and business sense, which enabled Matouk Bassiouny and Hennawy's reputation to float globally and maintain a substantial degree of efficiency and ethics. Omar focuses on all corporate matters including M&A, public takeovers, restructuring and cross-border transactions. In addition to corporate, Omar has significant experience on all aspects of investing and doing business in Egypt. |

About the author |

||

|

|

Islam Saeed Counsel, Matouk Bassiouny and Hennawy Cairo, Egypt T: +202 2796 2042 F: +202 2795 4221 E: Islam.saeed@matoukbassiouny.com Islam Saeed has longstanding expertise in assisting local and multinational clients in commercial and real estate with the preparation and negotiation of M&A transactional documents, including all related documentation and procedures. He is well versed in conducting legal due diligence. Islam handles other corporate transactions such as joint-ventures and corporate restructurings, as well as corporate and capital markets advisory work. |