Miguel Ishii Yokoyama and Alejandro Creel Ysita, Jáuregui y Del Valle

MARKET OVERVIEW

We believe that 2019 will be a year of uncertainty for investors in Mexico. However, we anticipate an increase in M&A transactions involving distressed assets and in opportunistic acquisitions.

M&A activity

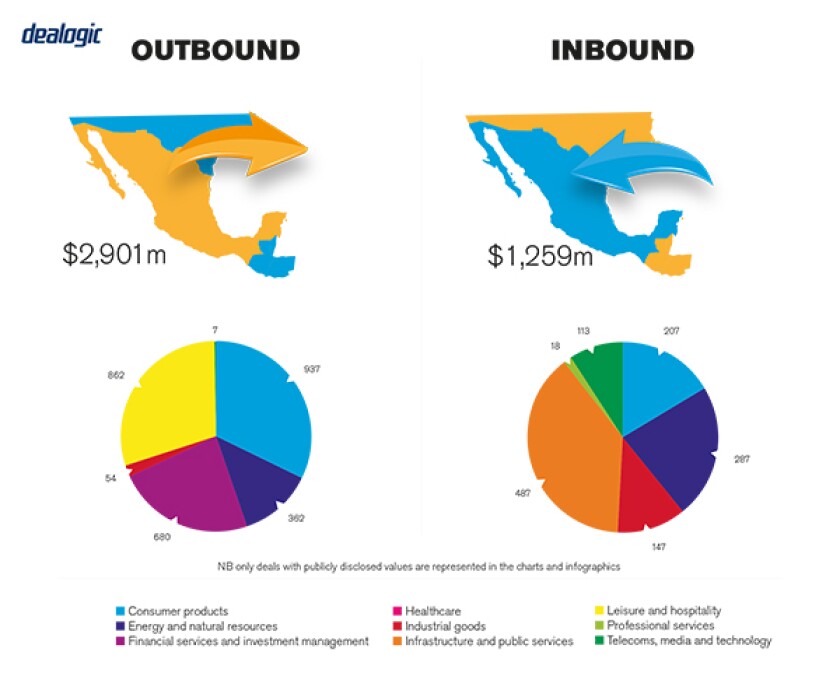

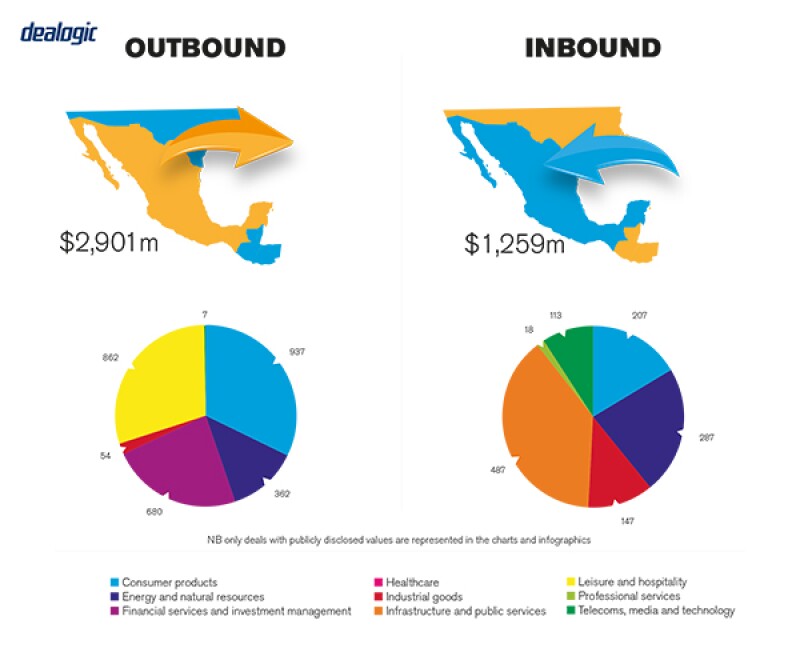

We believe that the volume of deals in Mexico (including foreign and national investment) will not decrease in 2019. However, the value and size of the transactions may be smaller. Regarding outbound M&A transactions, we believe that Mexican companies will not be looking to expand their businesses abroad, but wealthy Mexican individuals will most likely be looking to invest in foreign companies as a diversification strategy, most likely with a focus on real estate assets.

The number of publicly traded companies in Mexico is still small, hence public transactions tend to be dominated by acquisitions of private companies by publicly traded funds. Private capital transactions represent a large portion of our work.

TRANSACTION STRUCTURES

One of the trends we have seen lately is private equity funds and family offices investing in sectors such as retail and real estate, primarily in retail and mid-high residential. Another trend has been the acquisition of strategic assets by large corporations in order to gain an edge over their competitors.

Financial investors

Private equity funds and family offices have been playing an increasingly important role in the Mexican M&A environment.

Recent transactions

2018 was a year of uncertainty in Mexico due to the NAFTA renegotiation and the presidential elections. What we saw in 2018 was a number of transactions that involved the acquisition of real estate. We participated in one of these transactions involving a complex structure for the acquisition of real estate assets and we believe we will continue to see this type of transaction in the near future.

LEGISLATION AND POLICY CHANGES

The main regulatory body for M&A transactions is the Federal Comission of Economic Competition (Comisión Federal de Competencia Económica – COFECE). This is a constitutional autonomous body encharged with the following: to promote, protect and guarantee free market access and economic competition, but also to prevent, investigate, combat, effectively prosecute, severely punish and eliminate monopolies, alongside monopolistic practices, unlawful concentrations, barriers to entry and to economic competition, and other restrictions to the efficient operation of markets overseeing, promoting and guaranteeing free competition whithin Mexico.

The COFECE is regulated by the Constitution (Art. 28) and the Federal Economic Competion Law and the Organic Statue of the COFECE.

Recent changes in law

There have not been any recent changes to regulations or regulators that have an impact on M&A transactions or activity, however there have been a number of interesting initiatives filed by the new leftist government. These initiatives are aimed at curbing or prohibiting banks from charging commissions on a number of services; they had an impact on investor confidence and hence on M&A activity. In recent years, anti-money laundering laws and regulations have been reinforced and important players in the market have had to be more careful in their compliance and reporting obligations.

Regulatory changes under discussion

Currently there are no intiatives to change rules, legislation or policy frameworks that may directly impact M&A in Mexico. There is however some degree of uncertainty related to the direction that the new government will take in regards to foreign investment in strategic areas such as energy and infrastructure.

MARKET NORMS

A key practice to consider, which jars with market norms, is that there have been cases where parties introduce in contracts elements taken from other jurisdictions that are not properly regulated in Mexican law, and these could cause enforcement issues.

Frequently overlooked areas

Our law firm has a very strong tax practice that works hand in hand with our M&A practice. This is important because we structure our deals from the begining both from a tax perspective and a transactional perspective. We believe that many of our competitors overlook the tax perspective or at least do not give it the importance that it deserves.

PUBLIC M&A

The size of the public market in Mexico limits the amount of transactions involving obtaining control of a public company.

Break fees

While we have seen cases when the seller requests a break fee, cases where the break fee goes beyond payment of transaction expenses are rare.

PRIVATE M&A

Locked-box mechanisms are common in financial deals but rare in M&A; earn-outs and escrows are present in almost every transaction; insurance is still new to M&A in Mexico.

Conditions for a private takeover

Depending on the size of the transaction and the participants, approval from the COFECE may be needed.

Foreign governing law

Multinational companies tend to prefer a foreign governing law in private M&A transactions. However, some aspects of a transaction must be regulated by Mexican law, such as intellectual property rights and corporate governance of Mexican entities. Also, multinational companies tend to prefer the jurisdiction of their national courts; however, our advice for election of jurisdiction depends largely on the location of assets, availability of international enforcement of judgments and possible violations of Mexican public policy.

The exit environment

IPOs as an exit strategy for private equity investors has been a growing trend in the last few years in Mexico. However, this trend halted in 2018 due to the uncertainty created by the renegotiation of NAFTA and the presidential elections. We believe that IPOs will pick up pace again in the following years. Many family businesses are actively seeking investors and private equity funds constantly look out for family businesses to purchase, with the ultimate goal of being sold to public funds or to more consolidated competitors.

OUTLOOK

We believe that the conclusion of the NAFTA renegotiation and the end of the presidential election may dissipate the doubts among investors and reactivate some projects. However, much will depend on the signals that the market will receive in the next few months from the government of President Lopez Obrador. If President Lopez Obrador gains the confidence of the investors, M&A transactions will return to a path of growth; if he shows hostility towards investors, and especially foreign investors, we may see a rise in distressed asset acquisitions and purchases of opportunity.

About the author |

||

|

|

Miguel Ishii Yokoyama Partner, Jáuregui y Del Valle Mexico City, Mexico T: +52 555 267 4500 E: mishii@jaureguiydelvalle.com Miguel Ishii has been a partner at Jáuregui y Del Valle since 2014. He has led many practice areas in the law firm, including corporate, M&A, banking and finance and real estate. Miguel has advised his clients for over 20 years on relevant M&A transactions. Clients emphasise the quality of his legal counsel, his availability and his capacity to propose creative solutions in complex negotiations. He is actively involved in the structuring, negotiation and documentation of loans and financings. Miguel was a professor of commercial law at the law school of the Center for Economic and Research and Education (CIDE) from 2009-12. He is ranked in Chambers & Partners' Global Guide 2018 and Latin America Guide 2018 and is member of the Mexican Bar Association (Barra Mexicana) and National Association of Business Lawyers (ANADE). His academic qualifications include: Escuela Libre de Derecho, Attorney at Law (1993); Universidad Panamericana, postgraduate degrees in corporate law and tax Law (1997); and Kyushu University, LLM in international economic and business law (1999). |

About the author |

||

|

|

Alejandro Creel Ysita Senior associate, Jáuregui y Del Valle Mexico City, Mexico T: +52 555 267 4500 E: acreel@jaureguiydelvalle.com Alejandro Creel is a senior associate at Jáuregui y Del Valle with experience in the acquisitions and leasing sectors as well as on project financings, real estate, M&A and commercial transactions. Alejandro is a member of the Mexican Bar Association (Barra Mexicana Colegio de Abogados). His academic qualifications include: the Instituto Tecnológico y de Estudios Superiores de Monterrey Campus Santa Fep, post-graduate diploma in business administration (2010); Instituto de Empresa (IE) Madrid, Spain, master in laws (LLM) in international legal practice (2009); the Universidad Iberoamericana, México City, law degree (JD equivalent) (2001-06); Université Jean Moulin (Lyon 3), Lyon, France, academic exchange program for European business and economics (2004); and Instituto Cumbres, Mexico City (1990-01) / Saint Andrews College, Aurora, Ontario, Canada (1995-97). |