Kudun Sukhumananda and Kom Vachiravarakarn, Kudun & Partners

MARKET OVERVIEW

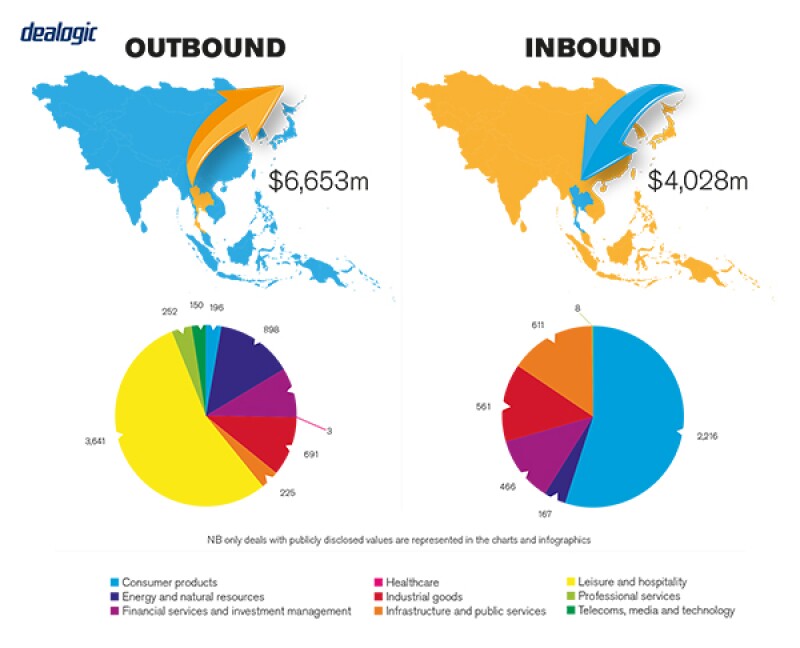

The environment in Thailand for M&A transactions in 2018 was quite steady and did not experience many changes compared to 2017. In terms of industries, the energy and real estate sectors maintained their dominance and should continue to grow in 2019. One major M&A deal was the energy-sector acquisition of Bongkot Project by PTTEP International from Shell, valued at $750 million. A buy-out of GLAND shares by CPN was a key example from the real estate sector. During the second half of 2018, we saw particular movements in projects developed under a business scheme in the Eastern Economic Corridor (EEC). The EEC is still in its initial stages but is expected to stimulate market opportunities during the next few years. In terms of market outlook, we expect Thailand to become an attractive stage for domestic, outbound and inbound M&A deals, which should reach their peak in 2020.

M&A activity

The market refreshed itself in 2018 with an interesting swirl of real estate and lifestyle-related business deals. Mega deals of 2018, after twists and turns of negotiation and pricing, mainly involved real estate, corresponding to a demand for mixed-use development. For example, the famous Mahanakhon was sold to King Power with a value up to THB14 billion ($447 million) followed by a buy-out of GLAND shares by CPN for THB20 billion. Recently, the focus has turned to the finance and banking sectors and there is a key transaction in this field pending completion in the first quarter of 2019 – the merger between TMB and Thanachart Bank, with a total value of THB1.9 trillion. Taking a glance at 2019, we can expect enthusiasm in the market – the government's commitment to the EEC development is expected to result in mega projects.

The Thai M&A market is driven by private M&A transactions and target companies are mostly private companies, however acquirers are a combination of both public and private companies.

TRANSACTION STRUCTURES

Tax and regulatory matters have been key concerns, in particular where a listed company is involved. Most deals were structured to facilitate and ease regulatory concerns.

Financial investors

There are many financial investors investing in start-ups and mid-size businesses, including private equity firms, venture capital firms and high net worth individuals. Some also invested in pre-IPO or at IPO as cornerstone investors. The deals that involved strategic investors were more complicated in terms of structure, tax and other economic conditions.

Recent transactions

One of the deals that caused debate in 2018 was the merger between two ride share service operators. The merger resulted in a significant growth of market share for one of the buyers in Thailand, which may raise an issue under competition regulations.

LEGISLATION AND POLICY CHANGES

The primary legislation that governs private M&A transactions is the Civil and Commercial Code of Thailand. The primary body is the Department of Business Development of the Ministry of Commerce.

The key pieces of legislation governing public M&A transactions are the Public Company Act BE 2535, the Securities and Exchange Act BE 2535 (Notification of the Capital Markets Supervisory Board Rules and Conditions and Procedures for the Acquisition of Securities for Business Takeovers), and the Notification of the Board of Governors of the Stock Exchange of Thailand regarding Disclosure of Information and Other Acts of Listed Companies Concerning the Acquisition and Disposition of Assets, 2004. The primary bodies are the Securities and Exchange Commission, the takeover panel appointed by the Capital Market Supervisory Board and the Stock Exchange of Thailand.

Recent changes in law

New competition legislation, namely the Trade Competition Act BE 2560 (2017) (the New Act), was recently enacted and came into effect on October 5 2017. This New Act repealed and replaced the former legislation (the Trade Competition Act BE 2542 (1999)) in its entirety.

One of the key areas that the New Act focuses on is the supervision of M&A transactions that restrict trade competition or the merger and acquisition of dominant business operators. In this respect, any merger that may "significantly reduce competition" must provide a post-completion notification to the Trade Competition Committee within seven days of the merger date. If a merger may result in a monopoly or the merged business operator may become a dominant operator, the merger must then obtain approval from the Committee.

The notifications that define the terms "significantly reduce competition", "monopoly" and "dominance", and provide the procedures to give notification or apply for approval were promulgated in October 2018. Under these notifications, a merger not causing a monopoly may be considered to "significantly reduce competition" if the sales revenue of any business operator or all business operators combined in any particular market equals THB1 billion or more. Any merger falling under such a definition will be subject to the post-completion notification rule, and the failure to notify is subject to a fine up to THB200,000 and up to THB10,000 per day of violation.

On the other hand, the term "monopoly" means a situation where any single business operator has absolute control over price determination in respect of goods or services and has a sales revenue of THB1 billion or more. And lastly the term "dominant operator" means: any business operator that had a market share in the previous year of 50% or more and a sales turnover of at least THB1 billion; or any business operator falling within the top three operators which together had a market share in the previous year of 75% and sales turnover of at least THB1 billion (unless the business operator had a market share in the previous year of lower than 10% or a sales turnover of less than THB1 billion). If a merger results in a "monopoly" or the merged business operator becomes a "dominant operator", prior approval will be required, and the failure to obtain approval is subject to a fine of up to 0.5% of the transaction value.

Regulatory changes under discussion

We are not aware of any legislation currently under discussion that may impact M&A transactions in the near future.

MARKET NORMS

With regards to standard market practice, there are no significant misconceptions about the M&A market in Thailand. However, the most overlooked area is the foreign ownership limit (see below).

Frequently overlooked areas

The most frequently asked questions for inbound M&A are in regard to foreign ownership restrictions under Thai law. In Thailand, foreign companies are prohibited from engaging in certain restricted businesses. Accordingly, a foreign acquirer may be barred if the target company is engaging in a restricted business and the acquisition of the target company by such foreign acquirer will render the target company a foreign entity.

The main legislation governing the business of foreign entities is the Foreign Business Act (FBA), which limits foreign participation in certain business activities, including wholesale and retail, being a broker or agent and any type of service activities (including lending, leasing and consultancy). The FBA limits foreign ownership to 49.99% of shares in the target company conducting a restricted business. Approval from the Ministry of Commerce is required prior to conducting any such business. The target company may also apply for an investment promotion certificate from the Board of Investment for certain promoted businesses to benefit from a relaxation of this foreign ownership restriction.

Apart from the FBA, certain industries have specific regulations which may have separate requirements on foreign shareholding. For example, the laws governing commercial banking businesses or insurance businesses stipulate a foreign shareholding limitation of 25%, with certain exceptions.

In addition, the Land Code of Thailand prohibits foreign entities from owning land unless, among other things, an investment promotion certificate is granted by the Board of Investment.

PUBLIC M&A

When obtaining control of a listed company, the most important factor is in relation to the tender offer rules under the Securities and Exchange Act (SEC Act) and the Notification of the Capital Market Supervisory Board Rules, Conditions and Procedures for the Acquisition of Securities for Business Takeovers (CMSB Notification). According to the tender offer rules, if an acquirer obtains shares of any listed company which constitute up to or more than 25%, 50% or 75% of the total voting rights of the listed company, the acquirer must make a mandatory offer for all the securities. In the tender offer, an offered price must not be less than the highest price paid for shares during the period of 90 days prior to the date on which the tender offer document was submitted to the SEC.

Another factor is the foreign ownership restrictions under the FBA. Under the FBA, a foreigner is prohibited from participating in certain businesses that fall within any of the restricted categories under the FBA, including the catch-all category of "other services". For this purpose, a "foreigner" includes a company incorporated in Thailand that is majority-owned by foreign individuals/companies. In order to comply with these foreign ownership restrictions, a foreign acquirer may make a partial tender offer (PTO) for less than 50% of the voting shares of a listed company. However, this PTO structure may only work in a friendly acquisition as it requires approval from a shareholders' meeting of the target company by a vote of not less than 50% of the total votes of the shareholders present at the meeting and having the right to vote. Approval of the Office of the SEC is also required, and certain conditions provided under the CMSB Notification need to be satisfied.

Conditions for a public takeover

A mandatory tender offer must be unconditional. However, pursuant to the CMSB Notification, the acquirer is permitted to cancel the tender offer upon the occurrence of one or more of the following events: the occurrence of an event, after submission of the tender offer document to the SEC but within the tender offer period, which causes or may cause severe damage to the status or to the assets of the target company, which does not result from the acts of the acquirer or any act for which the acquirer must be responsible; and any action taken by the target company after submission of the tender offer document to the SEC but within the offer period, which causes or may cause a significant decrease in its share value, provided that these events are stated clearly in the tender offer document.

In a voluntary tender offer, in addition to the above conditions provided under the CMSB Notification, it is common for the acquirer to include a condition that the tender offer can be cancelled if the number of shares tendered is less than the number of shares specified by the acquirer.

Break fees

A break-fee provision can be regarded as one of the main options for deal protection. However, the most common mechanism is an exclusivity arrangement. We note that break fees are regarded as liquidated damages in Thailand and may be reduced by a Thai court if they are considered disproportionately high.

PRIVATE M&A

Both locked-box and completion accounts are common consideration mechanisms for private M&As in Thailand. Neither of them can be regarded as being a dominant approach. In recent years, however, we have noticed a slight increase in the use of locked-box or even fixed price consideration mechanisms, especially for individual sellers who need to speed up negotiations and conclude their deals.

Conditions for a private takeover

Unlike with public M&As, there is no concept of taking over a private company under Thai law. Therefore a private M&A deal must be carried out through a share sale agreement containing terms and conditions as mutually agreed by the parties. The share sale agreement will contain general conditions, including warranties given by the parties being true and accurate; no occurrence of any event resulting in any material adverse change; and necessary corporate approvals being obtained.

Foreign governing law

It is common to use the laws of a neutral jurisdiction as the governing law in a private M&A share purchase agreement.

The exit environment

The most common exit strategy for an owner of a private business is to seek a larger company to buy its business through an M&A transaction. This is a win-win situation for the parties, where the seller can easily cash out and, for the buyer, it is a more efficient way to grow its business than by creating new products from scratch.

OUTLOOK

Trends indicate that 2019 should be a promising year for the M&A market in Thailand. We expect that the government plan to invest and foster a business scheme in the Eastern Economic Corridor will stimulate market opportunities. This should promote both outbound and inbound investments in the next few years.

About the author |

||

|

|

Kudun Sukhumananda Partner, Kudun & Partners Bangkok, Thailand T: +66 02 838 1750 Ext. 1751 Kudun Sukhumananda is the founding partner of Kudun & Partners. His passion for changing the paradigm through serving as a full business advisor armed with substantial legal experience led to the creation of Kudun & Partners in mid 2015. It is now the fastest growing corporate law firm in Thailand, with five partners and a professional support team of 36 professional lawyers serving both Thai and international clients. It has been recognized by IFLR1000 in its first year of listing as "2019 Notable Firm: Capital Markets/M&A". Kudun, personally recognised in 2019 as an IFLR1000 Highly Regarded Lawyer, has a wealth of experience in M&A, representing a variety of sectors in all stages of both domestic and cross-border cases. He advises diverse local and international clients on a wide range of capital market offerings, including on IPOs, debt securities offerings and stock exchange listings, and acts for sponsors, financial advisors and underwriters on real estate and infrastructure funds and REITs across the full spectrum of securities, tax and regulatory issues. |

About the author |

||

|

|

Kom Vachiravarakarn Partner, Kudun & Partners Bangkok, Thailand T: +66 02 838 1750 Ext 1754 Kom Vachiravarakarn is a partner at Kudun & Partners. His principal areas of practice are M&A, capital markets and securities regulatory advice. He has extensive experience advising both domestic and international clients on share offerings (domestic and international), investment and trust units under Rule 144A and Regulation S, corporate restructuring, joint-ventures and commercial transactions, as well as real estate investment trusts and infrastructure funds. His recent transaction highlights include acting as legal counsel and business advisor for the issuer (a power company with plants in Vietnam and Laos) in one of Thailand's largest IPOs in 2017; a Malaysian telecommunications provider in the acquisition of up to 40% of shares in a Thailand-based international network telecoms provider through a partial tender offer; the acquisition of shares in one of the leading property developers in Thailand (a wholly owned subsidiary of a listed company on the Singapore Stock Exchange); and a Thai-listed company on its acquisition of several restaurant chains in Thailand and a joint investment with its business partners to expand its business abroad. |