Vo Ha Duyen, VILAF (Vietnam International Law Firm)

MARKET OVERVIEW

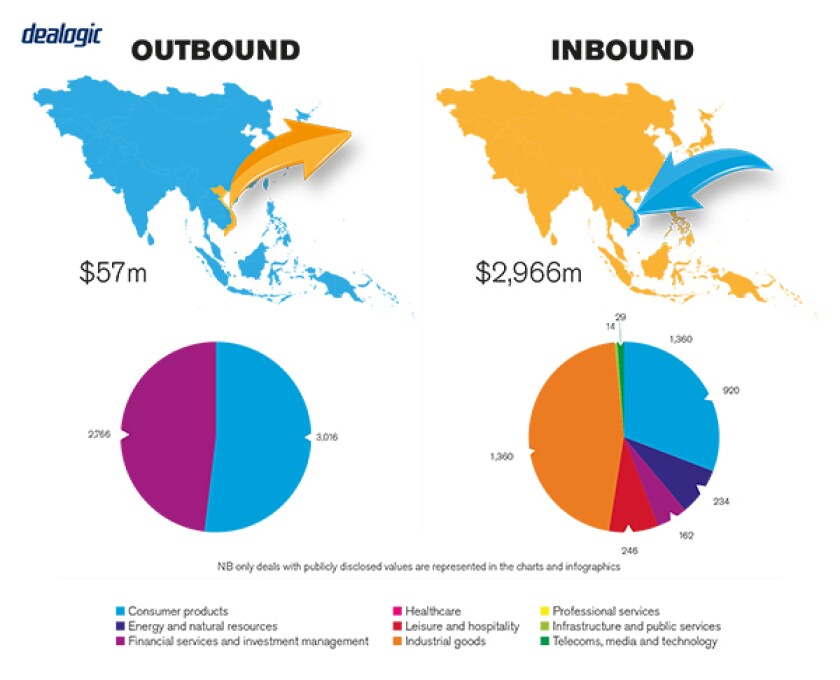

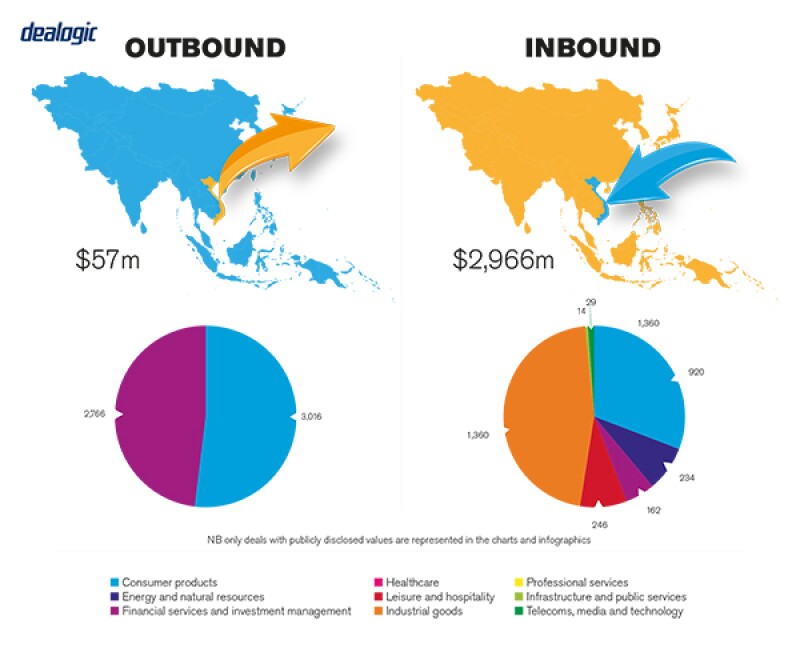

The Vietnamese market has been a dynamic M&A environment. We have also seen that inbound M&A activity is increasing in both deal volumes and deal values faster than domestic M&A. According to public data, by dollar value, inbound M&A occupied more than 75% of total deal value in 2017 and the first half of 2018. Inbound mega-deals explain this shift in the balance, for example the investment by the Singapore sovereign wealth fund GIC in Vinhomes alone was $1.3 billion, while Warburg Pincus's investment in Techcombank was $370 million. Real estate and financial services M&A activity has been most prominent in 2018.

TRANSACTION STRUCTURES

In M&A involving public companies and conditional business sectors including fintech, e-commerce, retail, education, financial services etc., the continued evolution of investment laws and enterprise laws has driven complex acquisition structures. Meanwhile, onshore bank financing for private M&A is still uncommon in Vietnam due to regulatory prudential restrictions on commercial banks.

Financial investors have been greatly helpful in boosting momentum and growth. For local companies that have not had a strong executive management team or that are not experienced in building systems, financial investors have been effective in assisting them to make better preparation for future M&A and capital raising.

LEGISLATION AND POLICY CHANGES

The primary laws governing M&A are the Investment Law, Enterprises Law, Competition Law, and Securities Law along with their sub-law regulatory guidance (for example, decrees issued by the Government and circulars issued by ministries).

In summary, a foreign buyer wishing to acquire shares in a company incorporated in Vietnam has to obtain approval from the local Department of Planning and Investment (DPI) prior to proceeding with the acquisition; except in a few cases where the target company is not considered as operating in a "conditional business for foreign investors" and where the acquisition does not cause foreign ownership of a target company to reach 51%. There are then two key considerations after M&A approval has been secured. First, if the target company is a foreign direct investment company operating under an investment registration certificate (IRC), the target company may need to apply for amendments to the IRC to record the respective change in investors or capital, if applicable. Second, after completing the transaction, the target company has to apply for amendments to the enterprise registration certificate (ERC) to record the respective change of members or capital, if applicable, or to file a report to the DPI regarding the change in founding shareholders or foreign shareholders resulting from the acquisition, if applicable.

Recent changes in law

The National Assembly has passed a new Competition Law, which will become effective in July 2019, and the Government is considering a draft decree on competition to guide the implementation of the Competition Law.

Under the old Competition Law, merger filing for an M&A transaction was required when the combined market share of the participating parties in the relevant market reaches 30%. The new Competition Law expands the circumstances where a merger filing is required, to cover the following considerations:

Total asset value of a participating party in Vietnam;

Total revenue in Vietnam of a participating party;

Transaction value; or

Market share of a participating party.

The draft decree currently proposes the following thresholds for the above:

Total asset value of a participating party in Vietnam is VND1,000 billion (approximately $43 million) or more pursuant to audited financial statements of the preceding fiscal year;

The total revenue in Vietnam of a participating party is VND1,000 billion or more pursuant to audited financial statements of the preceding fiscal year;

The transaction value is VND500 billion or more; or

The combined market share of the participating parties is 30% or more in the relevant market for the preceding fiscal year.

A 30 day-period preliminary review is introduced in the new law, during which time the competition authority decides whether the transaction can proceed or an official merger evaluation is required. If an official merger evaluation is required, the evaluation may take another 90 days or longer in a complex case.

According to the draft decree, a transaction can proceed after the preliminary review in the cases specified in this decree, such as when the combined market share of the participating parties in the relevant market is less than 20% or when any participating party after the economic concentration is not in the group of five enterprises that have an aggregate market share of 85% or more in the relevant market.

Regulatory changes under discussion

Vietnam is considering amendments to the Investment Law and the Enterprises Law and looking at introducing a new Securities Law. Among important changes being proposed under these draft laws is the simplifying of the procedures for M&A transactions by removing the M&A approval requirement for transactions that do not raise the foreign ownership ratio in the respective target companies. The laws also propose to expand the scope of the concept of "foreign investor equivalent" to require more companies incorporated in Vietnam and which are controlled by foreign investors to apply procedures and conditions applicable to foreign investors when they conduct investments or M&A transactions in Vietnam. They propose to lift the foreign ownership ratio in public companies to 100%, except in business sectors having explicit statutory foreign ownership caps, and to not retroactively apply investment conditions that are less favourable under the new law to an existing project which has been approved pursuant to the current law.

MARKET NORMS

Foreign investors new to Vietnam may prefer a straight-forward transaction structure. In many cases, however, a more complex transaction structure may result in many simplifications and modifications to avoid any future burdens.

Additionally, newer foreign investors may underestimate certain critical elements in conducting due diligence of Vietnamese targets that may have arisen due to the dynamic nature of the relevant laws affecting the targets' operations. One example is the historically prevailing practice of underpayment of the registered charter capital by local companies, which in recent years could lead to significant risks in an M&A process including possible difficulties in the completion of relevant M&A registration procedures, a possible requirement to pay investment security deposits upfront as a condition for the completion of further investment procedures and the possible rejection of VAT refunds during project development periods.

PUBLIC M&A

If an investor wishing to acquire shares in a public company falls under a category subject to the tender offer requirement, it will have to conduct a tender offer or otherwise obtain a waiver of the tender offer requirement from the GMS of the public company. The tender offer requirement is triggered when the investor falls under any of the following categories:

(a) the acquisition of voting shares may result in ownership of 25% or more of the outstanding voting shares in the public company;

(b) the investor and its related persons, which together hold 25% or more of the outstanding voting shares in the company, offer to purchase a further 10% or more of the outstanding voting shares in the public company;

(c) the investor and its related persons, which together hold 25% or more of the outstanding voting shares in the company, offer to purchase additional shares representing at least 5% but less than 10% of the outstanding voting shares in the public company within less than one year from the date of completion of the previous tender offer.

The draft Securities Law is proposing to revise the thresholds in limbs (b) and (c). In particular, under this draft law, the tender offer requirement may be triggered if the purchase might cause the ownership of voting shares to cross each of the thresholds of 35%, 45%, 55%, 65%, and 75%.

There are no squeeze-out provisions under Vietnamese law. However, if an investor acquires 80% or more of the outstanding share capital of a public company, it is obliged to offer to acquire the balance of the outstanding share capital of the public company at the announced tender offer price. The draft Securities Law proposes to reduce this 80% threshold to 75%.

Break fees

Break fees are not a common practice in Vietnam.

PRIVATE M&A

Local vendors usually strongly prefer simple price structures. However, subject to various factors, especially sector factors, a variety of complex price structures have been seen and these vary from deal to deal. We have seen completion accounts more often than locked box structures.

Foreign governing law

Both foreign governing law and Vietnamese law transaction documents have often been seen where one of the parties is a foreign incorporated entity.

International Chamber of Commerce (ICC), Singapore International Arbitration Centre (SIAC), and Vietnam International Arbitral Centre (VIAC) arbitrations have been the most often seen dispute resolution forums in share purchase agreements. VIAC is growing in popularity since it is cost efficient and a VIAC arbitral award is enforceable as a court judgment in Vietnam, while a foreign arbitral award has to go through a local court proceeding process for recognition, which may last for one year and with uncertain outcome, before it may be enforced in Vietnam.

The exit environment

Initial public offerings (IPOs) have increasingly become the most achievable exit strategy for private equity investors. Trade sales are the second most achievable strategy.

In 2018, Vietnam became Southeast Asia's top grossing market for IPOs, with total proceeds of $2.6 billion. This put the market ahead of Singapore, which achieved a total IPO value of $500 million.

OUTLOOK

Most experts predict 2019 will continue to be a promising year for M&A in Vietnam. Attractive sectors include consumer goods, real estate, financial services, and energy.

About the author |

||

|

|

Vo Ha Duyen Partner and chairwoman, VILAF (Vietnam International Law Firm) Ho Chi Minh City, Vietnam T: +84 28 3827 7300 F: +84 28 3827 7303 Vo Ha Duyen is co-head of VILAF's M&A and finance practices and has advised foreign investors and financial institutions in cross-border M&A and financing transactions in Vietnam for over 15 years. She has a prominent presence in financial services, energy, infrastructure and regulated services sectors as well as in debt and equity transactions involving public companies. Duyen is recommended as a Leading Lawyer in Vietnam by IFLR1000 and Legal500 and a Market-Leading Lawyer in Vietnam by Asialaw. She is admitted to practice law in both Vietnam and New York State. Recent prominent M&A deals include advising SCG Chemicals on the acquisition of equity interests from Quatar Petroleum and PetroVietnam in the $5.4 billion Long Son Petrochemical Project; ANZ on the sale of its retail banking business in Vietnam to Shinhan Bank Vietnam, which involved 125,000 customers and $600 million in deposits; Mondelez International on its $370 million acquisition of the food business of Kinh Do Corporation; and Warburg Pincus on the $200 million JV with Becamex IDC to develop industrial and logistic properties. |