SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Hong Kong experienced a healthy increase in M&A activities in 2017 compared to the previous 12 months. The increased deal flow was driven partly by mainland firms and private equity investors buying into Hong Kong listed companies. The most active sectors have been real estate, financial services and energy/infrastructure, although there has also been significant interest in the consumer and telecom/technology sectors.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

Hong Kong saw an uptick in both M&A deal volume and deal value in 2017. We have noticed heightened interest in large cap public M&A transactions with a value of over $1 billion. Both regional and global private equity investors were particularly active and participated in some of the most notable deals in 2017 (as described below).

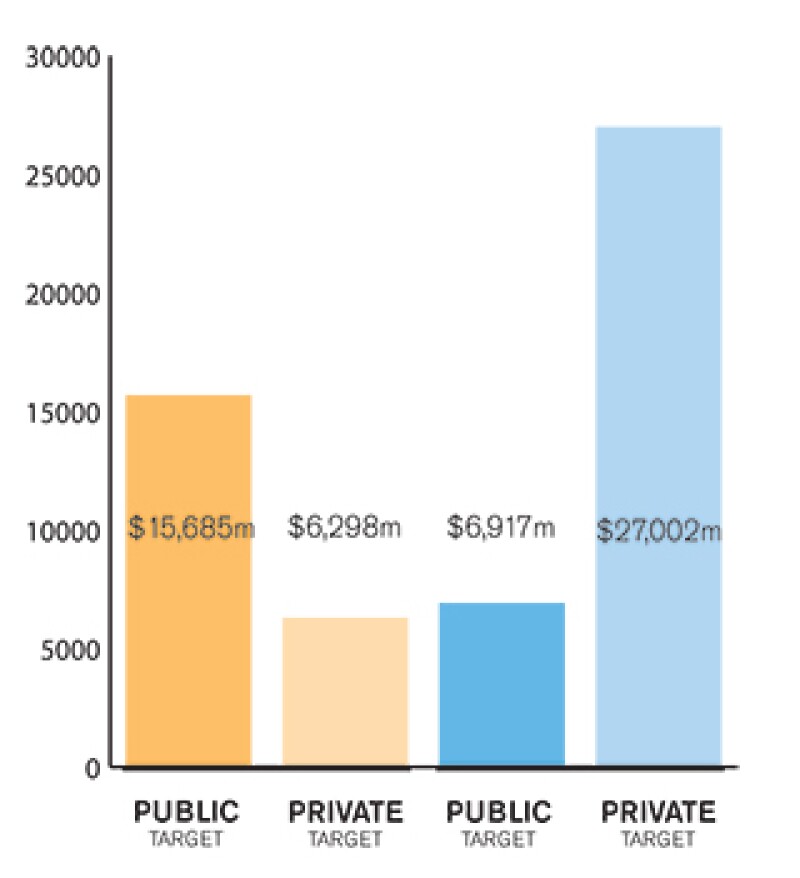

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The market in Hong Kong is driven by both private and public M&A transactions. However, given the nature of the market, where a large number of businesses are or become listed, M&A activities tend to involve listed companies. In previous years, take-private transactions were relatively rare, but it is becoming increasingly common to see both conglomerates and private equity-backed consortiums involved in such transactions.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

Both strategic and financial investors are active in the Hong Kong M&A market. Traditionally, strategic buyers have been more dominant in buyout transactions, whereas financial investors have been more involved in minority investments. However, in recent years, against a backdrop of record levels of dry powder available to Asia-focused fund managers, we have seen an increasing number of financial investors acquiring control of both public and private companies and participating in large privatisation transactions.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Notable M&A transactions include: the sale by McDonald's Corporation of a majority stake in its Greater China business to a consortium comprising CITIC Limited, CITIC Capital Holdings and The Carlyle Group, which was undertaken by way of a very competitive auction process; the take-private of Belle International Holdings by a consortium led by Hillhouse Capital and CDH Investments, which was one of the largest privatisations of a Hang Seng Index constituent stock; and the takeover of Yingde Gases Group Company by PAG Asia, which was a rare example of a contested takeover of a Hong Kong listed company and was implemented through a general offer and privatisation by way of compulsory acquisition. These transactions illustrate the continued appetite for large acquisitions, the increased activities of private equity investors, and the growing willingness of strategic and financial buyers to form partnerships to pursue complex transactions.

2.2 What have been the most significant trends or factors impacting deal structures?

We have noticed three main trends/factors: the increasing use of leverage in public and private M&A transactions, including the resurgence of mezzanine financing; the readiness of private equity investors to club together with other private equity investors or strategic players to undertake consortium deals; and the growing appetite of fund investors to have direct exposure to investments through co-investment arrangements.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key regulations that may be applicable to M&A transactions are:

The Code on Takeovers and Mergers (the Takeovers Code), which is administered by the Securities and Futures Commission of Hong Kong (SFC) and governs the takeover of public companies and companies with primary listing in Hong Kong.

The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (HKSE), which are administered by the HKSE and are relevant when one of the parties to a transaction is, or is proposed to be, listed on the HKSE.

The Companies Ordinance, which regulates general corporate matters in respect of Hong Kong companies, including compulsory acquisitions.

The Securities and Futures Ordinance, which contains, among other things, provisions on insider dealing and disclosure requirements in respect of listed companies.

Sector-specific regulations, which govern investments in certain regulated industries (e.g., banking, insurance and communications).

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

There have been no major changes in 2017.

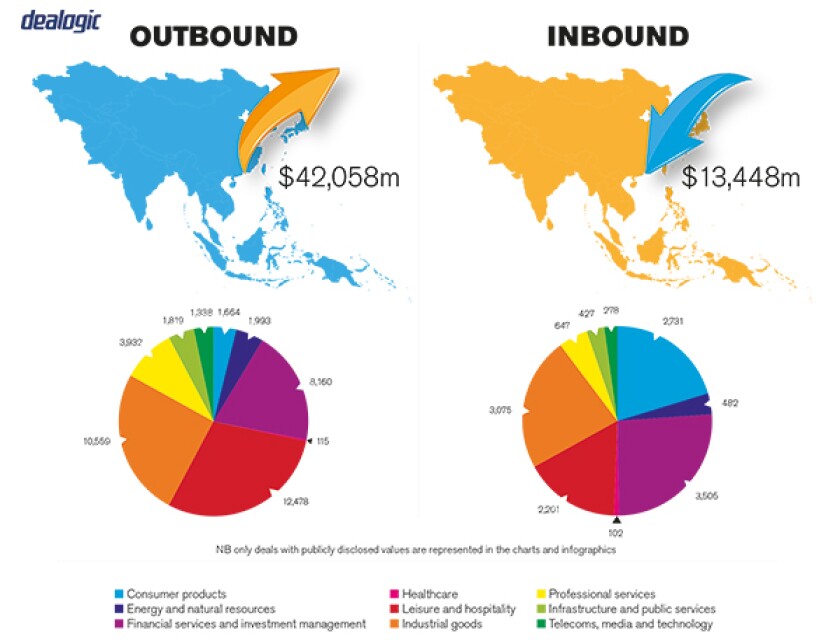

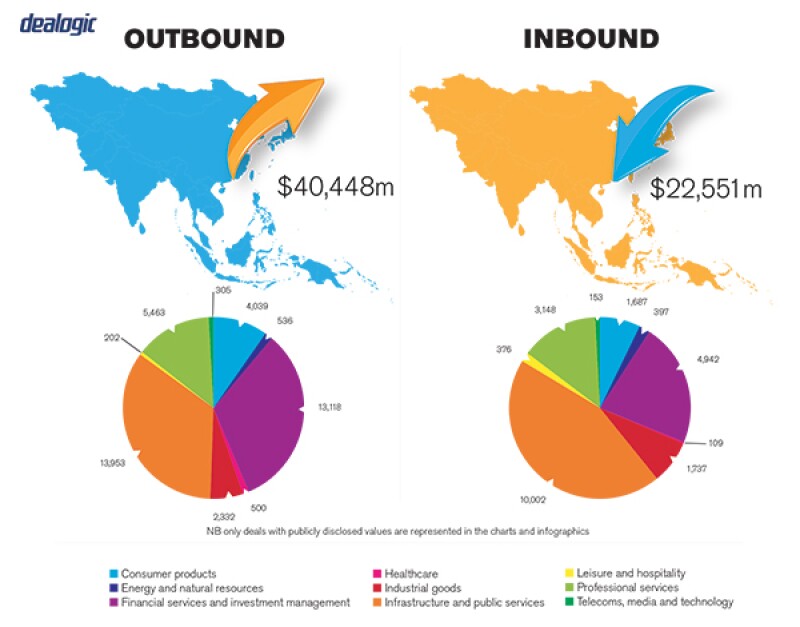

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

In a consultation paper dated January 19 2018, the SFC proposed to amend the Takeovers Code to raise the voting approval threshold for whitewash waivers from a simple majority of independent shareholder votes to 75%. If this proposal is adopted, it will be more challenging to implement whitewash transactions (i.e., the issue of securities resulting in the subscriber and the parties acting in concert with it holding 30% or more of the voting rights of a listed company without triggering a mandatory offer). The consultation period will end on April 19 2018.

In addition, the HKSE has announced its intention to allow the listing of (i) biotech issuers with no revenue or profit track record, and (ii) "innovative" and high growth issuers with weighted voting right structures, subject to additional disclosures and safeguards. These changes, which are subject to consultation but are expected to become effective in the second half of 2018, are likely to result in a strong IPO pipeline with a corresponding increase in pre-IPO investments.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

In many jurisdictions, M&A transactions may be structured as mergers or amalgamations through a combination of two entities into one single entity. A court-free statutory amalgamation procedure is available in Hong Kong, but only in respect of the amalgamation of wholly-owned Hong Kong incorporated companies within the same group. As a result, M&A transactions involving Hong Kong companies or assets are implemented by way of share acquisitions or asset acquisitions rather than through mergers or amalgamations.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

We are often asked to advise on the utilization of warranty and indemnity insurance (W&I insurance) in the context of private M&A transactions. This tool is increasingly used for bridging liability gaps between the transaction parties and can be structured as a sell-side policy (to allow the seller to achieve a clean break) or a buy-side policy (to allow the buyer to be more competitive in an auction and/or get sufficient recourse). Often, the main factors for determining whether W&I insurance is appropriate for a particular transaction are premiums and coverage/exclusions.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Early engagement with advisors, careful transaction planning and understanding of the Hong Kong market are key. Particularly in a public M&A context, where it would be necessary to navigate through the Hong Kong regulatory framework, it is advisable to instruct experienced advisors to engage with regulators throughout the process to avoid delays in the deal timetable and ensure a smooth transaction.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

In Hong Kong, listed companies are often controlled by families or one or more shareholders holding 30% or more of the voting shares. As a result, hostile offers are very rare, and acquisitions are normally conducted on a friendly basis. Any person acquiring 30% or more of the voting shares is also required to make a mandatory offer for all of the target's outstanding shares.

Takeovers are usually implemented by way of a general offer or a scheme of arrangement. A general offer is an offer for all of the outstanding shares of the target. If the target is a Hong Kong company and the offer is accepted in respect of at least 90% of the shares to which the offer relates, the offeror has the right to compulsorily acquire the remaining shares. A scheme is a court-approved process based on an "all or nothing" approach – if successfully implemented, the offeror acquires 100% of the target. A scheme relating to a company listed on the HKSE must be approved by at least 75% of the votes of disinterested shareholders, with no more than 10% of the votes of the disinterested shareholders against the proposed scheme. Additional requirements may apply depending on the law of the place of incorporation of the target.

Other possible transaction structures include whitewash transactions and, less commonly, partial offers. Both of these structures require approval of the SFC and a majority of the independent shareholder votes. They are particularly useful where the offeror intends to acquire control while maintaining the listing status of the target.

5.2 What conditions are usually attached to a public takeover offer?

Except with the consent of the SFC, all offers (except for partial offers) must be conditional upon the offeror receiving acceptances in respect of shares which, together with shares acquired or agreed to be acquired before or during the offer, will result in the offeror (and persons acting in concert) holding more than 50% of the voting rights of the target. This is the only condition permitted in a mandatory offer. A voluntary offer may be conditional on a higher acceptance threshold, as well as other conditions so long as they do not depend on the offeror's judgment and are not within the offeror's control.

All conditions must be satisfied within the time limits imposed by the Takeovers Code. If there is limited visibility as to the timing required to satisfy certain conditions (e.g., anti-trust approvals), the offeror may – after consultation with the SFC – structure the transaction as a pre-conditional offer, whereby the offer is only made once such conditions are satisfied.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees in public M&A transactions are uncommon. The Takeovers Code provides that break fees payable by the offeree should be de minimis (normally no more than 1% of the deal value) and the offeree's board of directors and financial adviser must confirm to the SFC that the break fee is in the best interest of the shareholders. Reverse break fees are not subject to these limitations.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

The completion accounts mechanism is still the most common pricing model, particularly in transactions involving a carve-out element. However, we have noticed an increasing use of the locked box mechanism, which reflects the seller friendly nature of the M&A market. Earn-out structures are relatively uncommon, including in the context of venture capital and growth investments, given the uncertainties such structures create for the parties involved. Escrow arrangements and signing deposits are sometimes featured, usually to secure the payment of a reverse break fee where the buyer is an onshore Chinese entity.

5.5 What conditions are usually attached to a private takeover offer?

Closing conditions vary depending on the circumstances of each transaction. However, in Hong Kong, there is a general movement towards the US approach to conditionality, which means that we are seeing conditions beyond regulatory approvals. Prospective buyers may be able to negotiate more extensive and bespoke closing conditions, including no material breach of the seller's representations and warranties and/or pre-closing covenants and no material adverse change.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Purchase agreements relating to Hong Kong targets are typically governed by Hong Kong law. However, where one of the parties to the transaction is foreign, it would not be uncommon to see the purchase agreement governed by the laws of New York, England or another common law jurisdiction depending on the home jurisdiction or preference of such party. Increasingly, private equity and other investors are designating Hong Kong or, occasionally, Singapore arbitration (rather than Hong Kong courts) as the preferred form of dispute resolution.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Parties are increasingly considering the use of W&I insurance in private M&A transactions, particularly in competitive auctions or private equity deals. Some of the most notable deals completed in 2017 involved the use of buy-side W&I insurance. Hong Kong is generally viewed as a low risk jurisdiction, which means that insurance underwriters are typically able to offer competitive terms (e.g., premiums are typically 1% to 1.5% of the insured amount).

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

IPOs and subsequent block trades remain the preferred exit options in the Hong Kong M&A market, while trade sales and sales to financial sponsors are less common.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

As noted above, with the greenlight for listing of pre-revenue companies and dual-class share structures and the Hang Seng Index reaching its all-time high in January 2018, we expect a strong IPO pipeline in 2018 and consequently robust pre-IPO investment activities. We also expect that M&A activity will remain strong in 2018 and private equity investors, particularly those who completed successful mega fundraises in the last year, will continue to seek large investment opportunities.

About the author |

||

|

|

Gabriele Antonazzo Partner, Cleary Gottlieb Steen & Hamilton Hong Kong T: + 852 2532 3701 F: + 852 2845 9026 Gabriele Antonazzo is a partner based in the Hong Kong office of Cleary Gottlieb. Antonazzo's practice focuses on mergers and acquisitions, joint-ventures, private equity transactions and early stage investments, with an emphasis on pan-Asia transactions. He has extensive experience representing private equity funds and corporates in a broad range of M&A transactions in various sectors, often involving complex multijurisdictional issues. |

About the author |

||

|

|

Raymond Lam Counsel, Cleary Gottlieb Steen & Hamilton Hong Kong T: + 852 2532 3766 F: + 852 2845 9026 Raymond Lam is a counsel based in the Hong Kong office of Cleary Gottlieb. Lam's practice focuses on public and private mergers and acquisitions, private equity, joint-ventures, corporate restructurings and IPOs on the Hong Kong Stock Exchange. |

About the author |

||

|

|

Grace Yuen Associate, Cleary Gottlieb Steen & Hamilton Hong Kong T: + 852 2532 3718 F: + 852 2845 9026 Grace Yuen is an associate based in the Hong Kong office of Cleary Gottlieb. Yuen's practice focuses on mergers and acquisitions and corporate finance, particularly pan-Asia private equity transactions. Yuen regularly advises Asian and international clients on a broad range of domestic and cross-border M&A, joint-venture, growth capital and private equity investments. |