SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The last 12 months has seen a continued trend towards more normalised M&A activity with both domestic and international buyers undertaking strategic acquisitions, including the acquisitions of Fyffes by Sumitomo Corporation for €750 million in cash and Fleetmatics Group by Verizon Communications for $2.4 billion in cash.

2018 has begun on a positive note with the announcement on February 1 2018 that Total Produce has entered into a binding agreement to acquire a 45% equity stake in Dole Food Company for cash consideration of $300 million.

Other high profile and innovative public company M&A transactions include:

the merger between Praxair and Linde to form a new $73 billion Irish holding company which will be listed on the New York Stock Exchange and the Borse Frankfurt;

the merger of Kennedy Wilson Europe Real Estate with Kennedy-Wilson Holdings to create a $8 billion global real estate company; and

the acquisition of Nexvet Biopharma by Zoetis and Zoetis Belgium for $85 million in cash.

In the private M&A space, Ireland continues to be an attractive destination for foreign buyers with both private equity and trade buyers active in the Irish market. The financial services sector was particularly active with 17 transactions for a total aggregate consideration of €7.3 billion, while the energy sector was also active with eight transactions for a total aggregate consideration of €1.6 billion. In addition, Irish telecommunications and broadband company Eir announced on December 20 2017 that a consortium led by NJJ Telecom Europe, alongside Illiad, had acquired a majority stake in Eir at an enterprise value of approximately €3.5 billion.

The number of deals was also greatly assisted by the growing strength in both the domestic and international capital markets.

There has been an increase in partial rather than full acquisitions in the Irish market over the last 12 months. This is driven by new players, often private equity firms, seeking to enter the Irish market in partnership with established businesses.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

During 2017, there were over 163 private M&A transactions in Ireland, with an aggregate value of €13.1 billion (an increase from 2016 figures of 136 with an aggregate value of €40.9 billion). After a period of uncertainty following the Brexit vote and changes in the US administration, purchasers have taken a proactive approach during the last 12 months.

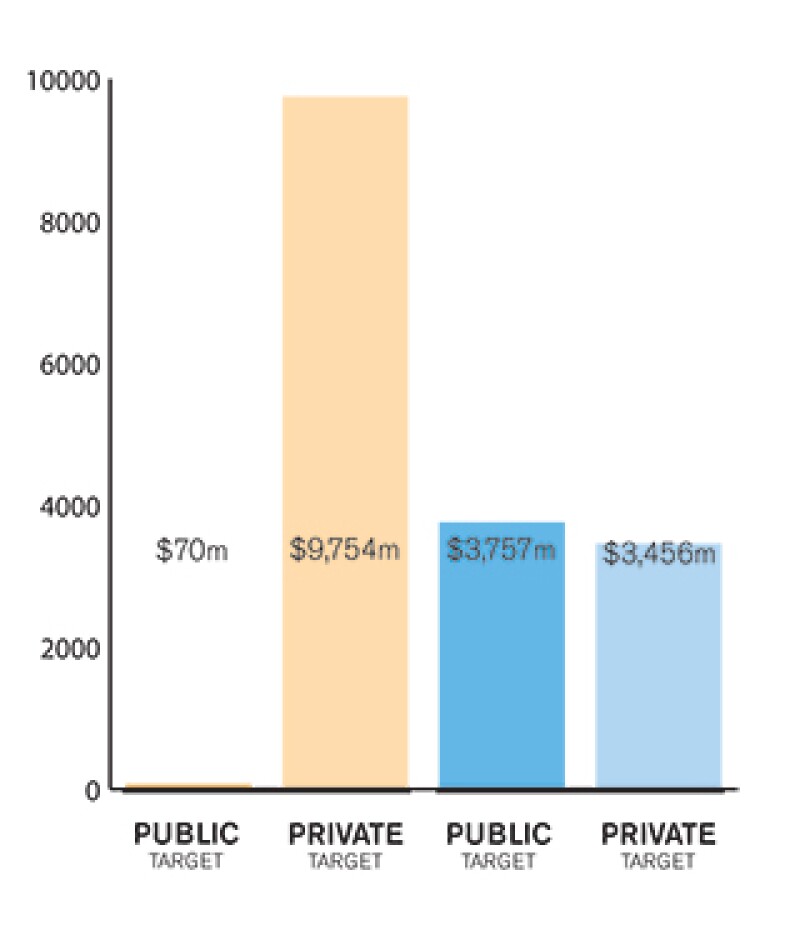

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Both private and public M&A activity has been strong in recent years and this trend continued in 2017, as demonstrated by the volume and value of the transactions during the last 12 months. The private equity (PE) sector also gained prominence, with greater international investment into Ireland and an increased role for Irish PE funds.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

The demand for private equity investment continues to grow in Ireland and it has been reported that private equity funding may account for up to 25% of M&A funding over the next 12 months. This reflects greater visibility of PE in the market together with increased availability of funding. However, despite this increased demand, traditional business debt remains the main source of M&A funding in recent years.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

As stated above, there have been a number of high profile and innovative public company M&A transactions over the last year, including:

the Praxair – LindeAG merger;

the Kennedy Wilson Europe Real Estate – Kennedy-Wilson Holdings merger;

the acquisition of Fleetmatics Group by Verizon Communications; and

the acquisition of Nexvet Biopharma by Zoetis and Zoetis Belgium SA.

Notable private M&A transactions over the past year include:

the acquisition of a majority stake in Eir by a consortium led by NJJ Telecom Europe, alongside Illiad SA, at enterprise value of approximately €3.5 billion;

Pilgrim's Pride $1 billion acquisition of Moy Park Group;

Intas Pharmaceuticals/Accord Healthcare's acquisition of Actavis UK and Actavis Ireland from Teva Pharmaceutical Industries for enterprise value of approximately £600 million in cash;

AMP Capital's acquisition of a majority stake (78%) in Enet (valuing the target between approximately €150-200 million);

The acquisition of Voxpro by Telus International for estimated €150 million;

The acquisition of Inver Energy by Greenergy International;

the acquisition of the Carechoice group by InfraVia European Fund III for approximately €70 million;

Fortuna Entertainment Group's acquisition of Hattrick Sports Group from Presidio Group for an undisclosed sum;

CIP Capital's acquisition of The MoneyMate Group.

2.2 What have been the most significant trends or factors impacting deal structures?

In private M&A deals, share sales remain the most common structure, especially in light of recent changes to the stamp duty regime (detailed below), while cash is the most common consideration. Deferred consideration remains a common feature of Irish private M&A deals, in particular for high growth companies.

Price adjustment mechanisms are almost invariably used, with no strong trend towards either completion accounts or locked box mechanisms, both of which are commonly used.

In public transactions, the scheme of arrangement remains the favoured transaction structure as purchasers may acquire 100% of the shares in the target on completion, including from minority shareholders. Schemes of arrangement were used in the Fyffes/Sumitomo, Nexvet/Zoetis and the Fleetmatics/Verizon transactions.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The primary laws and regulations that govern M&A transactions include:

The Irish Takeover Panel Act 1997 (the Act), the Irish Takeover Panel Act 1997 Takeover Rules 2013 (the Irish Takeover Rules), the Substantial Acquisition Rules (Sars) and the European Communities (Takeover Bids) Regulations (the Regulations), together regulate the M&A activity relating to certain public companies. The provisions of the Act, Rules and Regulations are enforced by the Irish Takeover Panel (the Panel), which is established under the Act;

The Companies Act 2014 governs various aspects of both private and public M&A activity;

The Competition Acts 2002 to 2014 require certain M&A transactions to be reported to the Competition and Consumer Protection Commission for approval;

Market Abuse Regulation (EU 596/2014) (MAR) and the Market Abuse Directive (Directive 2014/57/EU) (CSMAD) implemented in Ireland through European Union (Market Abuse) Regulations 2016 (S.I. 349 of 2016) imposes obligations on companies whose security is listed on regulated markets;

The Irish Listing Rules or ESM Rules apply if the company is listed on the Irish Stock Exchange.

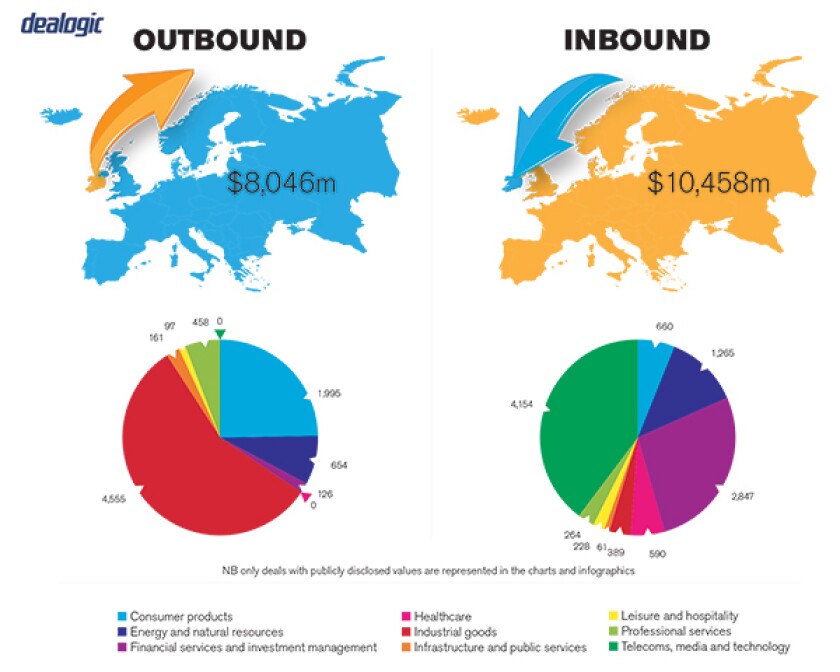

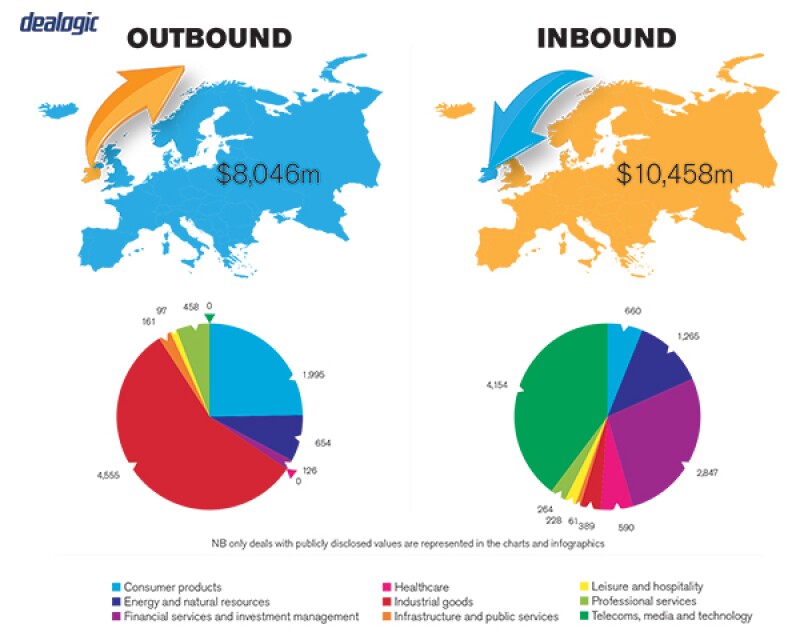

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

From October 2017, the rate of stamp duty on business and asset sales has increased from 2% to 6%. Stamp duty on the transfer of shares in Irish companies remains at 1% except for transfers of shares in companies listed on the Irish Enterprise Securities Market (ESM) (equivalent to the AIM market) and Irish companies that are listed in the US whose shares are traded through the Depository Trust Company (DTC) which in each case are in general exempt from stamp duty.

Therefore, share purchase structures will continue to be the most common structures for M&A deals and business and asset sales will need to be carefully structured.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The Companies (Statutory Audits) Bill was introduced to the Irish Parliament by the Minister for Business, Enterprise and Innovation on January 23 2018. When enacted, it is expected that the facility for certain existing Irish incorporated but US listed companies to use US GAAP for financial reporting requirements in Ireland (in lieu of IFRS or Irish GAAP) will be extended for a further 10 years from the current deadline of end 2020.

BEPS and the EU Commission's Anti-Tax Avoidance Package may have a material impact on M&A activity across Ireland and the EU.

Brexit and the ongoing negotiation of the UK withdrawal from the EU is likely to impact M&A (positively from an Irish perspective in our view), however until greater clarity is brought to the specific details of the UK exit, it is difficult to be definitive on the impact. Similarly, it is too early to assess the impact of recent US tax reforms on the Irish M&A market.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

No common mistakes or misconceptions exist about the M&A market in Ireland. The Irish market is broadly similar to the UK and US common law systems with the public takeover framework quite similar to the UK Takeover Code. One issue to be aware of is that the Irish Takeover Rules apply to any Irish incorporated company with an equity listing on the London Stock Exchange, New York Stock Exchange (NYSE) or Nasdaq.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

As mentioned above, Irish incorporated companies listed on the London Stock Exchange, Nasdaq or NYSE may be subject to the Irish Takeover Rules and other Irish regulations. A foreign acquirer of an Irish incorporated, US or London listed entity, will invariably require advice on the applicability of the Irish Takeover Rules and its impact on transaction structure and timetable.

While not unique to Ireland, the provision for warranty and indemnity insurance is increasing, in circumstances where the sellers are private equity firms and/or where the sellers are trying to de-risk their position.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Local Irish law advice should be sought in advance of a potential buyer agreeing to a transaction structure or timetable – particularly if the target is a public company.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

In friendly deals, a scheme of arrangement is most often used and shall require approval from:

the target company's shareholders (being a majority in number and representing at least 75% in value of those voting at the relevant shareholder meeting); and

the Irish High Court.

A scheme of arrangement is usually structured so no stamp duty is payable on acquisition and is the most favoured structure as it has the advantage of acquiring 100% of the target's shares on completion.

Where a takeover is hostile, a tender offer from buyer to the target's shareholder is more commonly used as the buyer may use a statutory procedure to compulsorily acquire the shares of dissenting shareholders (i.e. a squeeze out). If the target is listed on a regulated market in any EU/ EEA member state, the buyer must obtain consent from the holders of 90% of the issued share capital in order to avail of the squeeze out. The threshold is 80% for Irish public companies quoted on secondary markets. In a tender offer, stamp duty on the transfer of shares is payable at one percent of the deal value.

5.2 What conditions are usually attached to a public takeover offer?

Whilst it is commonplace for offerors to include a list of conditions in the terms of an offer, the practical effect of such conditions is limited by the Irish Takeover Rules. The Irish Takeover Rules restrict the use of subjective conditions in public takeover offers and, other than with the consent of the Panel, an offer may not be made subject to any condition the satisfaction of which depends solely on the subjective judgment of the bidder, or which is solely within its control. Typically, public takeover offers are conditional upon antitrust clearance (as applicable), the acceptance of at least 50% of the target's shareholders and necessary regulatory approvals being granted.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are subject to the Irish Takeover Rules, which prohibit a target company from agreeing to compensate the bidder or indemnify the bidder for the costs of the transaction, if the payment or indemnification is contingent upon the offer lapsing or not being made, except with the prior consent of the Panel. The Panel will normally only consent to reimbursement of specific quantifiable third-party costs, subject to an upper limit of one percent of the value of the offer. When seeking the Panel's approval, the board of the target company and its financial adviser must confirm to the Panel in writing that they consider the proposed arrangement to be in the best interests of the shareholders of the target.

The Panel generally only approves expense reimbursement (subject to the one percent limit) in circumstances where the target board withdraws or modifies its recommendation of the transaction, or where a competing bidder causes the original bidder's acquisition to fail.

Please note that a number of recent transactions involving Irish companies have been structured as reverse takeovers. The Irish Takeover Rules do not automatically apply in their entirety to a reverse takeover and, accordingly, the Panel has been more flexible in relation to applicability of the rules relating to break fees in such transactions.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Completion accounts remain the most commonly used consideration mechanism in Irish M&A transactions. A locked box mechanism is used more frequently in circumstances where the seller has the stronger negotiating position (e.g. an auction process).

Escrow accounts are commonly put in place for a one to two-year period following completion of a private M&A transaction to deal with potential warranty and indemnity claims or to settle accounts owing to a buyer.

Earn outs are more frequently used where the target company is non-revenue generating but has significant growth potential and/or valuable intellectual property.

5.5 What conditions are usually attached to a private takeover offer?

The approval of the Competition and Consumer Protection Commission and other regulatory bodies (which depend upon the industry sector of the target company) are usually included as conditions. Depending upon the nature of the target company and the transaction, a buyer may require certain third-party consents to have been granted prior to closing and may also require a condition that no material adverse change has occurred between signing and completion.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It would be standard for Irish law to govern, and the Irish courts to have jurisdiction in respect of any disputes arising out of, private M&A share purchase agreements involving an Irish target company. However, from time to time and depending upon the location of the buyer and seller, a foreign governing law and/or jurisdiction can apply.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is not yet commonplace in private M&A transactions in Ireland, but it is being used more frequently in recent times. Consistent with international trends, it is often used in private equity transactions where the private equity seller is not willing to provide warranty protection to the buyer or where the sellers are individuals.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

Strategic/trade buyers are seen as the preferred exit strategy in Ireland, but interest in MBOs continues to rise with increased levels of debt financing. The last 12 months has also seen a number of significant IPOs including Allied Irish Banks, p.l.c., and Glenveagh Properties and remains a viable exit route.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Whilst the full extent of Brexit and the recent US tax reforms is yet to be determined, we believe that there will be significant M&A activity in Ireland over the coming 12 months. The Irish economy continues to expand at one of the fastest rates in the eurozone and we expect that this will encourage domestic businesses to continue to expand by way of acquisition, as evidenced by the recent acquisition of Dole by Total Produce.

About the author |

||

|

|

Maeve Moran Partner, Arthur Cox Dublin, Ireland T: + 353 1 920 1000 F: + 353 1 920 1020 Maeve Moran is partner in the corporate department. Moran advises on public and private mergers and acquisitions, joint-ventures, private equity investments, equity capital markets and corporate reorganisations. She has advised on domestic and cross-border transactions across various industries. Moran was previously based in the London and New York offices of Arthur Cox and she has advised international clients on cross-border transactions, inward investment and corporate governance matters. |

About the author |

||

|

|

Cian McCourt Partner, Arthur Cox Dublin, Ireland T: + 353 1 920 1000 F: + 353 1 920 1020 Cian McCourt is a partner in the corporate department. McCourt specialises in mergers and acquisitions, advising on public and private transactions as well as corporate finance and equity capital markets transactions. He has experience advising on domestic and cross-border transactions in a number of industries including the pharma/healthcare, financial services and technology sectors, as well as advising on corporate migrations, holding company structures, schemes of arrangement and cross-border mergers. McCourt was previously a partner in another Irish law firm and was based in London and New York for a number of years. He has advised international clients and boards of directors on investing in Ireland and Irish based acquisitions including advising on some of the largest and most high profile public transactions in Irish corporate history. McCourt is a member of the firm's management committee. |