SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The Egyptian economy is currently seeing major M&A activity mainly fuelled by regional, international and local private equity and financial institutions. The general expectation is that such activity is likely to increase during the second part of 2018 after the completion of the upcoming presidential election.

The renewable energy sector and consumer focused sectors, such as food and beverage, healthcare and education, have been the most active sectors during the last period.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

In 2017, the Egyptian market aimed to recover from factors that have severely affected its conduct, such as the flotation of the Egyptian pound, which translated into clearer market outlooks, and consequently, more M&A deals.

Q4 2017 also saw a bit of a decrease in the rate of inflation. Though a good sign for the people's purchasing power, we shall wait and see how this may affect the financial positions of companies and producers of different commodities, and how, in turn, this may impact M&A activity.

Hence, we have seen a higher number of transactions in 2017, especially in the renewable energy sector and consumer focused sectors such as food and beverage, healthcare and education, as mentioned above. However, the value of these transaction is less than those of the previous year because of the devaluation of the Egyptian pound.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

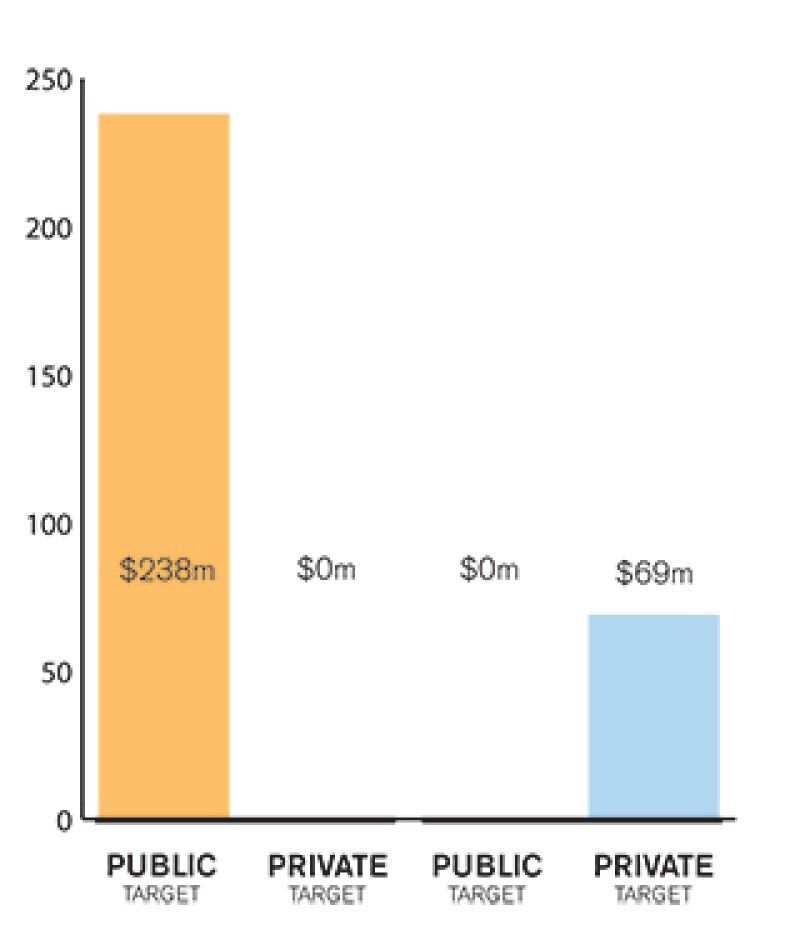

Private M&A transactions are more common in the Egyptian market. However, in the past few years, the Egyptian market has started to witness more IPOs, mainly for exit purposes.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

This year we have seen a deal flow of 30% in favour of strategic investors and 70% for private equity firms. Hence, private equity firms still dominate the private M&A scene in the Egyptian market.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Matouk Bassiouny has acted on a number of notable M&A transactions over the past few months, including the following:

Representing Amazon.com – along with the international counsel – in its acquisition of the Middle East-based e-market platform Souq.com for $580 million. This is an addition to Matouk Bassiouny's history of being retained to act in transactions that are taking place worldwide.

Representing Neptune Energy Group Holdings in its $3.9 billion acquisition of Engie S&P. Matouk Bassiouny has also represented Alcazar Capital in the acquisition of two renewable energy SPVs.

Moreover, the firm continues to represent clients in a number of M&A transactions in the energy, oil & gas, pharmaceuticals, and FMCGs.

2.2 What have been the most significant trends or factors impacting deal structures?

The most common factors that impact deal structures are restrictions on direct foreign ownership in relation to certain sectors, inter alia, higher education, importing vehicles and commercial agents. Such restrictions are usually overcome through restructuring and adding multiple SPVs. Furthermore, financing can be a challenging factor for acquisitions. However, the constraints of securities and restrictions adopted by financial institutions may prevent closing the deal.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

M&A transactions are regulated in Egypt by diverse legislations. Key rules pertaining to M&A can be found under the Egyptian Companies Law No. 159 of 1981 and its Executive Regulations, as amended, the Capital Market Law No. 95 of 1992 (Capital Markets Law) and its Executive Regulations, as amended and the Egyptian Exchange Listing Rules, as amended.

Concerned key regulatory authorities are:

The Egyptian Exchange;

The Financial Regulatory Authority (FRA); and

The General Authority for Investment and Free Zones.

Other sector specific authorities might be involved depending on the relevant target's activities.

Acquisitions involving transfer of shares of joint stock companies and quotas of limited liability companies are the most common acquisition structures in Egypt.

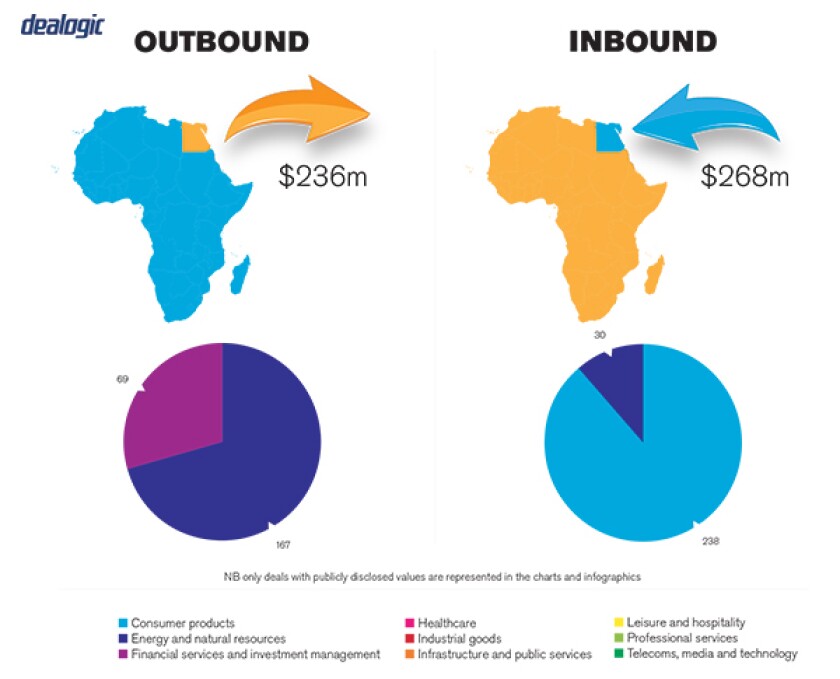

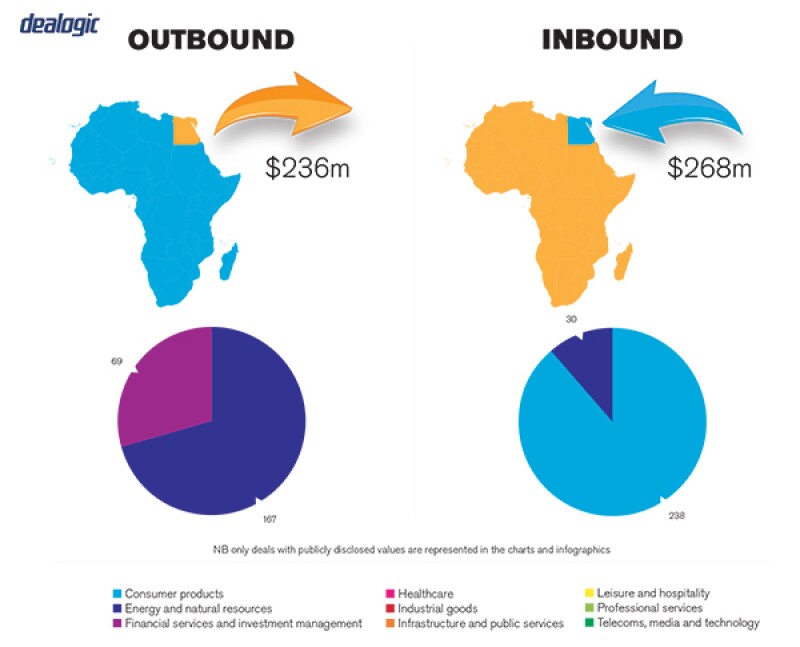

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Over the last year, some legislation has been amended, including the Investment Guarantees and Investment Law by virtue of law No. 72 of 2017. The Egyptian Companies' Law No. 159 of 1981 and its executive regulations were subject to few amendments that included the introduction of sole shareholder companies and more regulations in connection with preferential shares.

The Capital Markets Law has recently been amended by virtue of Law No. 17 of 2018 and the most distinct amendments are the introduction of new provisions concerning issuance of bonds, debentures and futures exchange. The Executive Regulations to the Capital Markets Law was subject to amendment. It is worth noting that investment fund provisions were significantly amended as well as adding chapter 14 to the executive regulation concerning financial auditors.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

In February 2018, the law for restructuring and bankruptcy was issued. The new Bankruptcy Law introduces a new approach to dealing with persons and entities that are facing financial or administrative trouble. For instance, the Law introduces, for the first time in Egypt, the concept of mediation and restructuring, giving both debtors and creditors a higher degree of flexibility in dealing with debts. The Law states that its executive regulations and other related implementing decrees are to be issued within three months from the date of its coming to effect (determined as thirty days following the Laws publication); i.e. prior to June 21 2018.

It is also worth noting that the mandatory tender offer chapter of the Executive Regulations to the Capital Market Law is under discussion and the market is anticipating the issuance of said amendment soon, following the publication of the Law No. 17 of 2018 amendment to the Capital Markets Law.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Determination of governing law in shareholders' agreements and share purchase agreements and its relation with the applicable law on the target. Many clients think that in cases where English law is the governing law for the documents, parties may agree on some provisions which are contrary to the mandatory provisions of the Egyptian law (e.g. in connection with convention of general assemblies and Board meetings); but this is not permissible in Egypt).

In due diligence exercises, sellers do not prepare all required documents and the data rooms usually lack organisation. Some sellers require that the lawyers review the documents physically at the target for confidentiality reasons, which causes delays in finalising the due diligence exercise and closing the transaction.

Further, in few cases, sellers tend to provide misleading information or abstain from disclosing specific information during the diligence process and disclose all accurate information in the disclosure letter immediately before executing the transaction documents. It is also common that, while negotiating the deal and before the due diligence phase, the parties do not conclude the key terms of the said deal in a letter of intent.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Sellers may overlook designating a financial advisor, which may give rise to commercial disputes. Furthermore, non-strategic buyers may omit to appoint a technical advisor during the diligence process. Also, in the event the potential buyer is a foreign entity, its main concern would usually be related to the market's stability and growth, the payment mechanism of the purchase price and, more importantly, the repatriation of funds post acquisition in relation to dividends distributions.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

It is highly recommended to conduct a proper legal due diligence over the target. More importantly is to conduct a tax, commercial and technical diligence to avoid last-minute findings that may hinder going further with the envisaged deal. Selection of a tax advisor is crucial as the Tax Authority's practice may vary from time to time.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The acquisition of at least one-third of the share capital of companies listed on the EGX or companies that are unlisted but offer their shares to the public, triggers a mandatory takeover offer (MTO). Pursuant to the Capital Market Law, any entity that acquired or wishes to acquire, whether individually or through related parties, one-third or more of the issued share capital or voting rights of a target company shall notify the FRA and undertake an MTO to purchase 100% of the target company's shares addressed to all shareholders of the respective company. In case the offeror the entity launching the MTO has already acquired the stake, the MTO should be launched within 30 days of the date of acquisition.

Pursuant to the Capital Market Law, if an entity acquired, whether individually or through related parties, 90% or more of the issued share capital or voting rights, other shareholders who have at least 3% of the share capital may request from the FRA within the next 12 months to the acquisition to notify the majority to submit an MTO to buy the minority shares.

5.2 What conditions are usually attached to a public takeover offer?

Pursuant to the Capital Market Law, the MTO should not be unconditional. However, subject to the FRA's approval, the MTO may be exceptionally conditional on the acquisition of at least 51%, to ensure control, or 75%, in case of acquisition with ultimate purpose of merger of the target company's shares. In such case, if the MTO does not result in the acquisition of at least 51% or 75% (as the case may be) of the target company's shares, the offeror may elect to not perfecting the purchase of the offered shares, without the need to obtaining the FRA's prior approval.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The offeror cannot revoke or amend the terms of the MTO draft as approved by the FRA during its effective term. However, pursuant to the Capital Market Law, the offeror may withdraw the MTO draft only if a fundamental harmful incident occurs after publishing the MTO draft, which adversely affects the target company, its activities or the value of its shares, provided the FRA approves the withdrawal or the amendment of the terms of the MTO. No break fees should be involved in case of withdrawal pursuant to the terms of the Capital Market Law.

However, in private M&A transactions, break fees are commonly mutually agreed between the parties as a percentage of the purchase price, which is usually covered in the transaction documents. Though, under Egyptian law, there is room to claim reduction in the case of excessive break fees. Based on the principle of Egyptian Civil Code pacta sunt servanda, break fees are applicable when and if there has been a contractual arrangement to that end.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

The most commonly used pricing adjustment mechanism is the completion account, which is used on the basis of the estimated accounts provided usually by the seller. Locked box mechanisms are also used but not as commonly as completion accounts, due to leakage indemnity claims. However, there has been a tendency to deduct leakage from deferred payments instead of resorting to an indemnity claim. The foregoing has recently helped in growing an appetite for locked box mechanisms. Nevertheless, some parties still prefer the completion accounts mechanism as it covers any deviation from agreed upon figures (for example net debt, net cash or normalised working capital), as opposed to locked box which protects the buyer only from leakage, which basically encompasses money withdrawn by the seller or its related parties. Though resisted by sellers, deferred components are commonly used in relation to the adjustment mechanisms so that the purchase price is adjusted through deduction from said deferred component. Such deferred component is usually deposited at an escrow account to give the seller certainty and avoid any trust issues. However, earn-outs are not commonly used.

5.5 What conditions are usually attached to a private takeover offer?

It is customary that each transaction includes a certain number of conditions that govern the sale of a private entity and once satisfied the deal is deemed closed. Such conditions depend on the share/asset subject to the said sale. Typically, conditions may include prior governmental approvals, payment of certain debts and non-competition restrictions, among others. This being said, there is no constant practice in this regard.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Yes, it is common to provide for a foreign governing law in private M&A share purchase agreements. However, the share purchase agreements shall not include any provision that is not in compliance with the mandatory laws applicable on the target to ensure smooth application of the share purchase agreements.

Consequently, the overwhelming majority of M&A share purchase agreements refer any disputes arising thereof to arbitration, which is a much faster and efficient process than normal courts despite being more expensive.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Insurance companies in Egypt do not provide their services over warranties or indemnities, so the parties insisting on having insurance in relation to warranty and indemnity coverage would resort to offshore insurers, which is not a common trend.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

Since private equity firms are still dominant in the Egyptian M&A scene, we usually provide for a broad exit provisions that include options for exit by sale of shares or initiating IPOs. As mentioned, we are seeing more IPOs in the last few years that means that investors are comfortable now to use this way for exit.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

We predict that 2018 will be one of the best years in terms of M&A transactions in Egypt. We can see that a lot of transactions are on the way for the following reasons:

The stabilisation of the Egyptian pound;

The issuance of new laws with the aim of supporting investment in Egypt; and

The Egyptian demographic, with a population of is over 100 million, which makes the market more interesting for new investors.

Further, the Egyptian government is growing in willingness and with blatant attempts to attract international and local investments that contribute to increasing employment opportunities and economic growth.

About the author |

||

|

|

Omar S Bassiouny Founding partner & head of corporate/M&A, Matouk Bassiouny Cairo, Egypt T: +202 2796 2042 F: +202 2795 4221 E: omar.bassiouny@matoukbassiouny.com Omar S Bassiouny is the founding partner of Matouk Bassiouny. He heads the firm's corporate/M&A group, and is consistently ranked in top tiers and bands by legal periodicals in the areas of corporate law and mergers and acquisitions. He has considerable expertise in setting up joint-ventures and new projects in Egypt, as well as ensuring compliance with local laws and corporate governance. Bassiouny is also recognised for his negotiations skills and business sense. |

About the author |

||

|

|

Sahar Badran Of counsel, Matouk Bassiouny Dubai, United Arab Emirates T: +971 566 010 440 F: +202 2795 4221 E: Sahar.badran@matoukbassiouny.com Sahar Badran's legal expertise includes providing legal advice to multinational and national clients across a range of industries including Emaar Properties KSA, Emirates Integrated Telecommunications Company (du) and to various local and international listed companies and authorised persons on the UAE securities laws and regulations. Prior to joining the firm, Badran was with Linklaters Dubai. |