SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

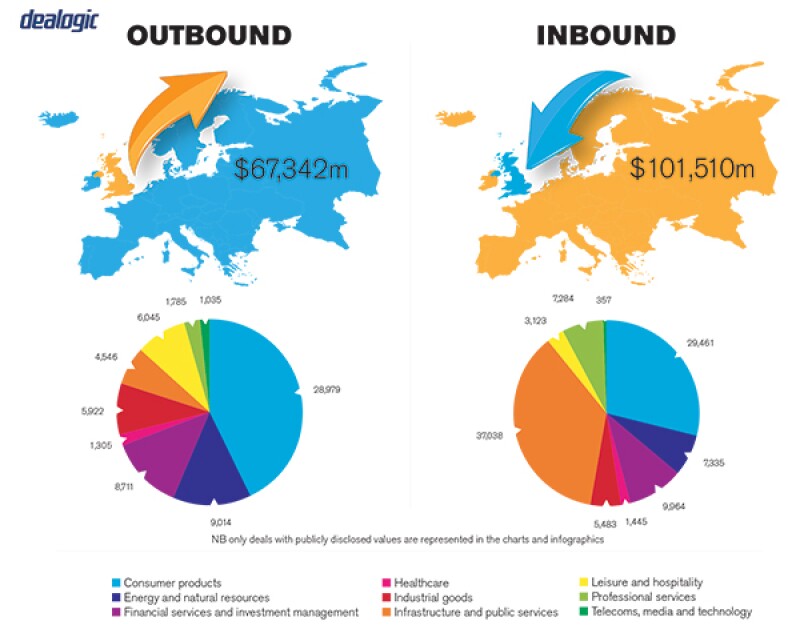

Brexit continues to shape the UK M&A market with the depressed value of sterling helping to drive international interest. Despite uncertainty surrounding Brexit, the UK was the most targeted country for inbound investment in Europe in 2017, indicating that, in addition to favourable currency terms, buyers remain optimistic about UK assets. In addition, UK based companies seeking to minimize their Brexit risk have resulted in an increase in UK originated bids, particularly in the US where UK companies were the top acquirers of US targets, by both deal value and number in the first three months of 2017.

Whilst US/UK deal flow remains generally strong in 2017, with the US remaining the originator for a large proportion of in-bound investment to the UK and the principle market for outbound UK M&A, there has been a more cautious approach taken by US investors who are still trying to understand the impact of recent domestic tax reforms and perceived political uncertainty in continental Europe. 2017 has also seen a substantial fall in in-bound Chinese M&A in Europe and the UK following attempts by Beijing to curb levels of outbound investment, combined with some political concern in Europe about the level of foreign investment in strategic sectors of the economy.

The technology, media and telecommunications sector remains one of the most active sectors for UK M&A in 2017, reflecting the continued strategic importance for companies to acquire data assets and benefit from digital innovation to enhance their business offering. In addition, the energy, mining and utilities sector has also been highly active in 2017, in part due to strengthening energy and commodity prices from a period of sustained weakness.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

UK M&A was resilient in 2017, with 3,458 deals worth £233.9 billion ($325 billion) compared with 3,016 deals worth £306.9 billion in 2016. Although deal value was lower compared to 2016, deal volume was noticeably higher, reflecting a general shift away from large transactions in the private M&A space to more numerous mid-market deals.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

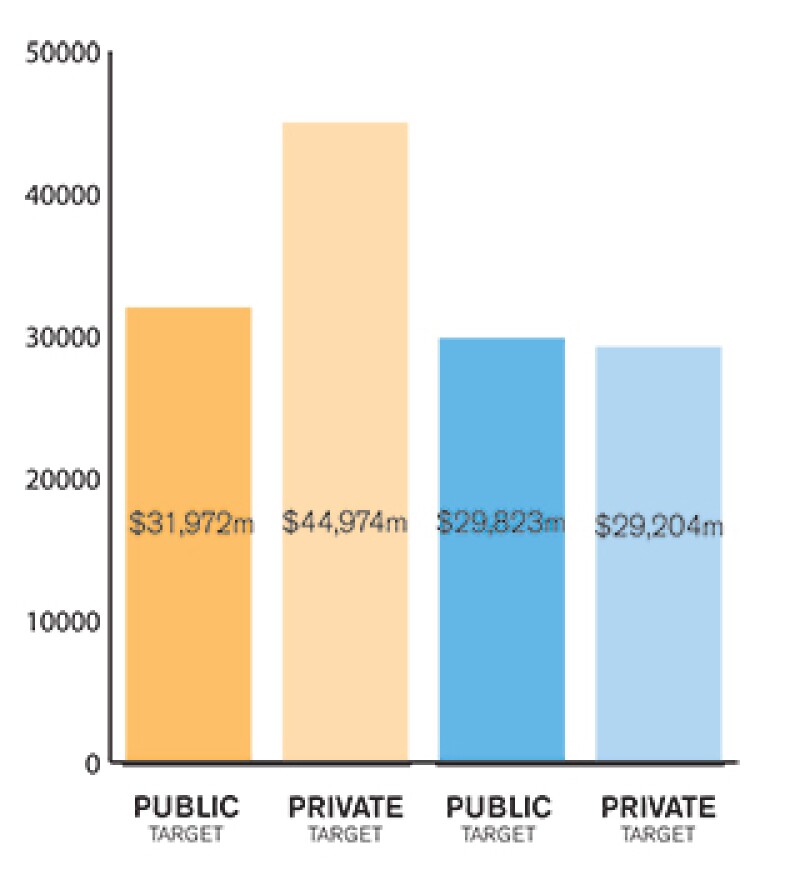

Both public and private M&A play an important role in the UK market. Private M&A deals typically constitute the bulk of UK target deals by volume with approximately 3,331 announced deals worth roughly £116.2 billion in 2017, compared with approximately 113 public M&A deals worth roughly £113.9 billion. Whilst the volume and value of public M&A deals in 2017 was down on 2016, the number of deals with a value of £1 billion or more was significantly higher.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

Financial investors continue to be prominent in the UK M&A market, with an appetite for transactions driven by sterling's continued weakness, relatively low interest rates and record levels of unspent capital commitments. In this context, sponsors have been facing a highly competitive and seller friendly market.

Strategic investors remain active in the UK M&A market as they look to diversify in the face of political and regulatory uncertainty. In certain cases, strategic investors are adopting more aggressive positions in transactions which are more commonly associated with financial investors.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The acquisitions by a consortium comprising Macquarie Group, QIA, China Investment Corporation, Allianz Capital, Hermes Investment Management, Dalmore Capital and Amber Infrastructure of a 61% stake in National Grid's gas distribution business reflects renewed enthusiasm for energy, mining and utilities assets. The investment also attracted considerable media and political interest, suggesting there will be continued political scrutiny and potentially action in relation to investments in strategic assets.

The recent sale by General Motors of its Opel and Vauxhall businesses and its GM Financial European operations to PSA Group is illustrative of a trend of US corporates re-focusing on domestic consolidation and rationalization of their investments and operations overseas.

2.2 What have been the most significant trends or factors impacting deal structures?

Both financial sponsors and strategic buyers use a variety of methods to structure and finance acquisitions. The nature of the financing used will, to a large extent, depend on the sort of transaction that the buyer is entering into (for example, the acquisition of control or a minority interest), as well as its ability to draw on its own reserves to finance the deal.

As noted above, financial sponsors are increasingly faced with a competitive seller-friendly market and have started to adopt different approaches to structuring their acquisitions such as entering into club deals, making more minority investments and are showing an increasing willingness to commit higher levels of equity in the pursuit of better returns.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The Companies Act 2006 applies to public and private companies registered in the UK. The Companies Act does not govern M&A activity directly but its requirements do dictate the way that deals involving UK companies are structured.

The acquisition of private companies is generally a matter of negotiation between the buyer and seller and no regulated offer process is required. In non-regulated industries (i.e. other than financial services, telecoms, media etc.), deals are not typically subject to input from regulatory bodies, save for competition matters.

Public acquisitions are governed by the City Code on Takeovers and Mergers (the Takeover Code), as administered by the Panel on Takeovers and Mergers.

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The regulatory environment for UK M&A remains relatively stable, although regulatory aspects are often at the forefront of bids in certain sectors such as the financial services or energy and utilities sectors.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Historically, the UK Government has not intervened in non-domestic takeovers. However, in 2017 the Government proposed new laws aimed at increasing its power to intervene formally in acquisitions of certain strategic assets (e.g. those related to advanced technology, critical infrastructure and/or military application) on national security grounds.

In addition, the UK Takeover Panel has updated its rules on public takeovers to require bidders to: (i) make clear their intentions regarding the target's employees, headquarters and research and development functions at the outset of the bid process; and (ii) disclose publicly 12 months after a bid has completed whether they adhered to those intention statements or departed from them.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

UK businesses are principally acquired by way of a share purchase (i.e. purchasing shares of the target company) or an asset purchase (i.e. purchasing individual assets of the target company). Unlike many European jurisdictions, it is not possible to implement a transfer of a going concern by the operation of law so parties have to individually identify and transfer appropriate assets and liabilities. In addition, as a matter of UK domestic law, mergers by absorption (where one of the bidders or the target ceases to exist as a result) are generally not available as a structure for M&A transactions between private UK companies. Such transaction structures are only possible where there is a combination of a UK private company with a company incorporated in the European Economic Area, however the use of such structures is not common in practice.

In comparison to many other jurisdictions, the UK has a relatively liberal overseas investment restrictions regime, although as noted above, this position may be changing to an extent in light of political pressure.

The UK has a voluntary merger control regime which means that there is no formal obligation for the notification of mergers in the UK. That said, in reality, many transactions are notified to the Competition and Markets Authority (CMA) to avoid any potential disruption caused by intervention or enforcement. If a transaction has a EU nexus, formal notification will need to be made to the European Commission following the signing and announcement of the transaction.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

See above.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Obtaining a detailed understanding of both the relevant legal markets and applicable regulatory frameworks through early engagement with legal and financial advisors are highly important along with careful transaction structuring. In particular, any investor considering a public company target should take urgent legal advice before taking any steps, as the operation of the Takeover Code may be unfamiliar to many overseas investors.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

A bidder may obtain control of a target company by launching a voluntary offer to target shareholders (in which case it must secure acceptances in respect of at least a simple majority of the target's voting rights to succeed) or by means of a court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act 2006 (which requires the approval of a majority in number, representing 75% in value, of target shareholders who vote at the relevant meeting, but allows the bidder to acquire 100% of the target's shares in a single step). Stake-building in support of an offer is possible but will set a floor price for the offer. Additionally, if the bidder and its concert parties acquire shares carrying in aggregate 30% or more of the target's voting rights, this triggers a requirement to make a mandatory offer at the highest price paid by the bidder and its concert parties in the 12 months preceding the bid. Unlike a voluntary offer, a mandatory offer can be conditional only on the bidder securing acceptances in respect of a simple majority of the target's voting rights (including existing holdings of the bidder and its concert parties).

5.2 What conditions are usually attached to a public takeover offer?

A takeover offer will usually be subject to an extensive set of conditions including: securing acceptances carrying more than 50% of the voting rights in the target, antitrust and regulatory approvals, bidder's shareholder approvals, listing of consideration shares (where appropriate), as well as conditions dealing with the state of the target's business. However, the UK Takeover Code permits a bidder to invoke a condition to cause an offer to lapse only where the circumstances giving rise to the right to invoke the condition are of material significance to the bidder in the context of the bid. The UK Takeover Panel applies a high threshold and, consequently, it is rare for a bidder in a UK bid to rely on any conditions other than the acceptance condition or conditions relating to material regulatory clearances. A bid cannot be subject to a financing condition or to conditions that depend on the subjective judgement of the bidder. On occasion, a bidder will announce a firm intention to bid on a pre-conditional basis, where posting of the bid document is suspended pending satisfaction of stated pre-conditions, often material antitrust conditions where it is anticipated that these will involve protracted processes.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

In public takeover offers, break fees (where the target pays the prospective buyer) and all other forms of deal protection which impose obligations on a target in the UK are subject to a general prohibition under the Takeover Code whereas reverse break fees (where the prospective buyer pays the target) are not prohibited. 2017 saw six firm offers in which a bidder agreed a reverse break fee, up from just one in 2016.

If the bidder is a UK public company and subject to the UK Listing Rules and the total value of the reverse break fee(s) exceeds 1% of the market capitalisation of the bidder, the bidder's directors will need to treat the reverse break fee as a material transaction (which amongst other things, requires shareholder approval). If the bidder controls more than 10% of the target, a reverse break fee may also constitute a related party transaction for the purposes of the UK Listing Rules. If such a bidder already has an equity interest in the target they must also be conscious of related party transaction issues.

2017 also saw the first example since 2013 of a shareholder agreeing to pay a form of break fee to a bidder (Eurovestech plc).

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Roughly half of all private transactions contain a locked box mechanism. This trend reflects the continuing seller friendly nature of the M&A market and the high levels of deal activity involving financial sponsors. Completion accounts are relatively common in trade deals or where business carve outs make it more difficult to accurately define the box. Deals which include some element of contingent consideration tend to be sector specific (for example, pharmaceuticals) or be in circumstances where the parties were unable to reconcile differing financial projections for the target business.

5.5 What conditions are usually attached to a private takeover offer?

The conditions to closing included in a purchase agreement will generally vary based on the circumstances of each transaction. In UK deals, these conditions generally tend to focus on regulatory and anti-trust clearances, however US acquirers in the UK market sometimes request additional conditions such as a requirement for the seller's warranties to be materially accurate at closing, absence of material breaches of the seller's covenants, absence of material adverse change and completion of a marketing period to obtain financing and regulatory and anti-trust clearances. Whilst such US-style conditions are seen in certain UK M&A transactions, they are not common and the competitive nature of sale processes has resulted in a decline in the number of conditions being sought by prospective buyers, even amongst US financial sponsors.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Generally, purchase agreements relating to UK assets will be governed by English law and subject to the jurisdiction of the English courts. For many global transactions, English law is widely perceived as consistent, impartial and commercial so purchase agreements relating to non-UK based companies and assets will commonly also be governed by English law and subject to the jurisdiction of the English courts, particularly where there is a nexus with Eastern Europe, the Middle East, certain parts of Asia or Commonwealth jurisdictions. In some circumstances, however, purchase agreements may be governed by the laws and courts of another jurisdiction, such as New York or France.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

The use of warranty and indemnity (W&I) insurance policies in UK transactions has become increasingly popular in recent years, particularly in connection with sales by financial sponsors. The rise has been driven by falling premiums and increasing flexibility of the insurance products available, in particular a broadening of the type and scope of cover being offered (e.g. zero recourse policies are now commonly available to sellers).

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

The factors and limitations which influence the choice and timing of a financial sponsor's exit strategy in the UK are common to most jurisdictions.

In the context of increasing competition amongst financial sponsors, many sponsors are taking the opportunity to exit portfolio companies through auction sales in a strong seller friendly market. Typically, these will be secondary and tertiary buyouts, although sales to corporates are not uncommon. A number of sponsors are expressing caution that increased market volatility and the possibility of higher interest rates in 2018 may cause such elevated valuations to plateau in 2018.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

UK M&A remained resilient in 2017, despite a level of political and economic uncertainty. Investors and advisors remain hopeful that UK investment activity will remain robust and even accelerate in 2018 as China starts to re-assert itself on the global M&A stage and the political climate in the UK, Europe and the US begins to stabilise. It is likely that highly competitive auction processes will continue to define the M&A market as both strategic and financial investors alike look to spend high levels of cash reserves and capital commitments, although some advisors suspect that high valuations may start to cool during 2018.

About the author |

||

|

|

Simon Jay Partner, Cleary Gottlieb Steen & Hamilton London, UK T: + 44 20 7614 2316 F: + 44 20 7600 1698 Simon Jay advises on all types of mergers and acquisitions, as well as joint-ventures and restructurings. He has represented both corporates and private equity funds on a broad range of public and private M&A transactions, often involving cross-border issues. Jay is recognized as a leading M&A lawyer by Chambers Global, Chambers Europe, Chambers UK, the Legal 500 UK and IFLR1000. His experience includes advising Fidessa in the on-going £1.4 billion recommended takeover offer from Temenos; Google in its tender offer for all the shares of Global IP Solutions (GIPS) Holding AB; TPG in its acquisition of Prezzo; Coca-Cola on the combination of the businesses to form a new Western European bottler, Coca-Cola European Partners; Raine Group as financial adviser to SoftBank in its acquisition of ARM Holdings; Sony in its acquisition of Ericsson's 50% stake in Sony Ericsson Mobile Communications; Warburg Pincus and General Atlantic in the joint acquisition from Banco Santander of a 50% stake in Santander Asset Management and the subsequent divestment; Santander Asset Management in its proposed merger with Unicredit's Pioneer Investments; and Bank of America Merrill Lynch in the sale of its non-US wealth management business to Julius Baer Group. |

About the author |

||

|

|

Michael Preston Partner, Cleary Gottlieb Steen & Hamilton London, UK T: + 44 20 7614 2255 F: + 44 20 7600 1698 Michael J Preston advises a broad range of private equity and corporate clients on mergers and acquisitions, co-investments, joint-ventures and other commercial transactions. He has experience across a range of business sectors, with particular experience in financial services, healthcare, natural resources and technology, and he has worked extensively in the emerging markets. Michael also has significant experience advising clients on issues related to investment funds, acquisition finance and alternative investment structures. Preston joined the firm in 2005 and became a partner in 2011. From 2011 to 2015, he was resident in the Hong Kong office. Preston is recognised as a leading M&A lawyer by Chambers Global, Chambers Asia, Asian Lawyer and IFLR1000. His experience includes advising TPG in a range of transactions including its acquisition of DTZ, Cushman & Wakefield and Cassidy Turley, its equity investment in China International Capital Corporation and its investment in Moroccan schools operator Ecoles Yassamine; Hillhouse in a range of investments in Europe and Asia; Alnair Capital Holdings JSC in the acquisition of an approximately 25% stake in JSC Kazkommertsbank; Mittal Investments in the acquisition of an interest in Ophir Energy; and African Minerals in a $1.5 billion investment by Shandong Iron & Steel Group. |