SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Record levels of capital held by financial sponsors and strategic acquirers looking to offset low growth prospects prompted fierce competition in 2017 for quality assets, forcing buyers to offer higher premiums.

Buyer enthusiasm has also resulted in more seller-favourable deal terms. Deal structures that originated with private equity (PE) sellers, involving limited or no post-closing indemnification and the use of representations and warranties insurance (RWI) as the primary source of post-closing recourse for buyers, have become commonplace in private deals in recent years. At the same time, forced to pay high prices, buyers have become more discriminating, placing increased pressure on due diligence.

According to Mergermarket, telecom, media and technology led all industries by volume, accounting for 23% of total deals, while energy, mining and utilities dominated activity by value with 20% of total value.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

2017 ended strong with December announcements of the year's two largest deals, CVS Health's $67.8 billion acquisition of Aetna, followed by Walt Disney's $68.4 billion acquisition of certain assets of 21st Century Fox, not to mention Broadcom's hostile bid to acquire Qualcomm for $130 billion. Despite these high-profile deals, according to Mergermarket, the aggregate value of deals involving US targets fell to $1.3 trillion from $1.5 trillion in 2016 and a record-setting $1.9 trillion in 2015.

Deal volume, however, actually increased slightly from 5,325 deals in 2016 to 5,347 deals in 2017. This uptick suggests 2017 did not see an overall decline in M&A activity but rather fewer mega deals, likely driven by uncertainty over tax policy and deregulation following the 2016 US presidential election.

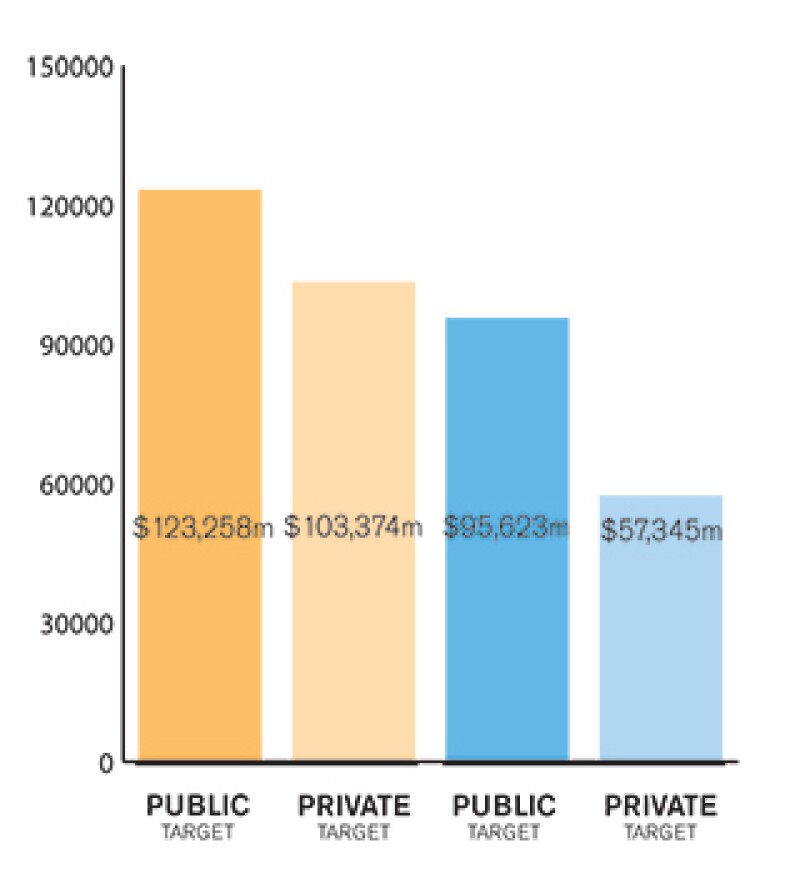

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Both are prevalent in the US. In recent years, however, private deals have been increasingly driven by PE sellers with greater sensitivity toward post-closing risks, which has caused private deals to be structured more like public deals, with limited or no post-closing seller exposure.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

Strategic investors, many with surplus cash and looking to M&A to offset low growth, typically drive competition for deals, but record levels of dry powder made well-funded financial investors formidable rivals to their strategic counterparts in 2017. In particular, according to Mergermarket, PE buyouts of domestic targets rose 12.3% by value and 10.4% by volume compared to 2016.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Several notable 2017 M&A transactions involved splitting-up the surviving company after closing to unlock additional value. Following the closing of the Dow Chemical/DuPont merger in August 2017 after a 21-month regulatory approval process, the combined business will be split into three independent public companies. Similarly, Humana's partnership with two PE firms to acquire Kindred Healthcare, announced in December 2017, will result in the consortium splitting Kindred into two businesses at closing, with the resulting hospital company 100% owned by the PE firms and the resulting homecare company owned initially by all three, but with put/call arrangements allowing Humana to take out the financial sponsors over time.

General Motors' sale of its Opel/Vauxhall automotive business to Groupe PSA in August 2017 was also notable for having been designed to address certain regulatory hurdles, as the accompanying sale of Opel/Vauxhall's financing operations was structured to close separately in October 2017 due to longer regulatory approval timelines.

2.2 What have been the most significant trends or factors impacting deal structures?

See Questions 1.1 and 1.3.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

US M&A activity is governed by both federal and state law.

Applicable federal laws and regulation may include:

Federal securities laws enforced by the US Securities and Exchange Commission

Antitrust laws enforced by the US Department of Justice and Federal Trade Commission

Federal tax laws enforced by the Internal Revenue Service

Foreign investment laws enforced by the Committee on Foreign Investment in the US (CFIUS) which reviews transactions that could result in a foreign investor holding significant influence over a US business

State laws typically address corporate governance matters, including fiduciary duties, stockholder rights, voting requirements and state taxes. M&A transactions are usually governed by the laws of the state in which the target company is incorporated, although targets incorporated outside of Delaware or New York often elect for their transaction to be governed by Delaware or New York law given the more extensive caselaw in those states.

Stock exchange listing requirements may also be implicated in transactions involving listed companies.

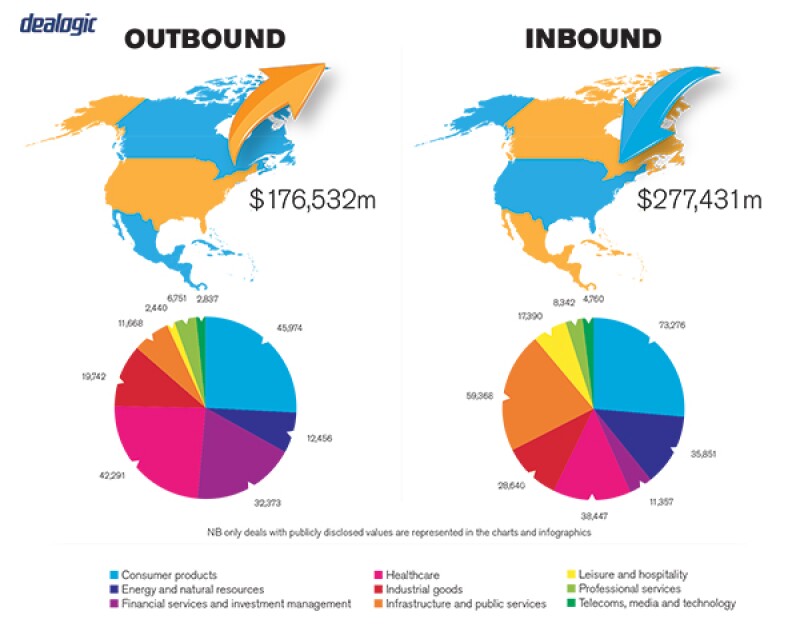

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Among the most watched M&A developments on the regulatory front in 2017 were: (1) federal tax reform, (2) antitrust enforcement and (3) CFIUS practices.

Although the highly anticipated Tax Cut and Jobs Act (TCJA) did not go into effect until January 1 2018, uncertainty surrounding tax reform throughout 2017 likely put many deals, especially mega deals, on hold. See Question 6.1 for more details on the TCJA's potential impact.

With respect to antitrust enforcement, recent developments suggest only a modest shift away from the aggressive merger enforcement of the Obama administration. The administration has nominated mainstream enforcers to lead antitrust agencies and has shown its willingness to block some deals deemed to be anticompetitive, such as the Department of Justice's suit to block AT&T's $85 billion acquisition of Time Warner. However, it's still too early in Trump's tenure to identify how much antitrust enforcement may change.

With respect to CFIUS, the Trump administration has shown its willingness to block transactions that it deems a threat to national security, including barring the proposed sale of Lattice Semiconductor to a Chinese PE firm in September 2017 and MoneyGram's proposed sale to a Chinese acquirer in December 2017.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

See Question 3.2 for a discussion of federal regulations.

At the state level, Delaware courts have continued to transform the landscape of stockholder litigation in public M&A.

Two key appraisal decisions were issued in 2017 that granted significant weight to the market-based merger price in determining "fair value" where a public company is sold pursuant to a competitive arms-length bidding process, indicating that appraisal claims will likely become limited to controller transactions, management buyouts and transactions involving a flawed sale process.

Delaware courts also continue to dismiss post-closing fiduciary duty actions based on a 2015 ruling that change-of-control transactions will be reviewed under the highly deferential "business judgment rule" (BJR) once approved by a majority of disinterested shareholders in a "fully-informed" and "uncoerced" vote. Following that ruling, 2017 decisions applied BJR even when the directors approving the transaction were not independent and disinterested and found it inapplicable only in egregious instances of coercion, making future challenges to mergers much more difficult once ratified by stockholders.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

In the US, information disclosed through due diligence only limits the seller's liability to the extent that it is also disclosed in the corresponding disclosure schedules to the acquisition agreement and, contrary to what many foreign acquirers expect, information provided in the data room typically does not qualify a seller's representations and warranties.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Foreign buyers in markets that use a locked box approach to purchase price often have questions regarding post-closing purchase price adjustments commonly used in the US (see Question 5.4).

The trend toward using RWI as a backstop or substitute for seller indemnities is also sometimes unfamiliar to non-US buyers (see Question 5.7).

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Buyers and sellers should consult with US M&A counsel early to understand what practices are typical for the US market.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

In order to close a negotiated public company merger in the US, the transaction must typically be recommended by the target board and approved by a majority vote of the target's stockholders. This stockholder approval requirement poses a closing risk because it is usually satisfied after public announcement and state law generally requires the target to have a "fiduciary out" to permit consideration of unsolicited competing offers.

Activist investors may sometimes quietly acquire influence over a US public company without board or stockholder approval by accumulating shares through trading in the market and entry into swaps or other derivative transactions as a means to press for board representation or change in company policy.

5.2 What conditions are usually attached to a public takeover offer?

Common closing conditions in public deals include:

Bring-down of representations and warranties and compliance with pre-closing covenants, usually subject to a materiality standard

No material adverse effect since signing

Receipt of any necessary shareholder approval and required regulatory approvals

Absence of any governmental order or legal impediment preventing the transaction

Once common, financing conditions are now very rare in US public deals and were included in only 2% of 2016 deals according to the ABA's 2017 public M&A study.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The average fiduciary termination fee paid to buyer, typically as a result of taking certain actions in respect of competing offers, decreased slightly in size to 3.39% of equity value in 2016 from 3.51% in 2015 according to the 2017 ABA study. Break fees or expense reimbursement is sometimes also payable upon a "naked no vote" (i.e., where target stockholders vote down the deal or the minimum tender condition fails in the absence of a competing offer); such fees appeared in 26% of deals in 2016, 3% more than in 2015.

Reverse break fees (RBFs) paid by buyer to seller are often used to address the risk of financing failure, particularly where the buyer is a financial sponsor, or to address significant regulatory or antitrust risks. RBFs to address financing failures usually range from 5-7% of equity value, while regulatory or antitrust RBFs vary widely.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Unlike locked box mechanisms, which are more common in Europe and provide for a fixed purchase price at signing using a historical target balance sheet, completion accounts are predominately used in US private company transactions and allow the final purchase price to be adjusted based on the balance sheet as of closing to account for changes in the target's financial position since signing. The purchase price is typically determined on a cash-free, debt-free basis with an adjustment for closing net working capital, against an agreed "normalised" level of working capital. As a result, interim results are generally considered to be for the benefit of the seller, whereas under a locked box approach, the buyer generally obtains the benefit, and bears the risk, of interim operations.

Earn-out provisions are rarer, as they are often difficult to negotiate, necessitate periodic monitoring and usually require continued seller involvement in the business.

5.5 What conditions are usually attached to a private takeover offer?

Other than stockholder approval, which is frequently obtained at signing in private deals, most of the closing conditions for public deals discussed in Question 5.2 also apply to private company M&A.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

No. Such agreements are typically governed by Delaware or New York law.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

RWI policies continue to rise in popularity. The ABA's 2017 private M&A study found that 29% of transaction agreements contemplated RWI, with 23% using it as the sole source of recovery for breaches of representations.

Relatedly, indemnity escrow size fell from an average of 9.15% in 2014 to 6.66% in 2016/2017, possibly because many deals used small escrows for sellers to bear the first dollars of loss until the deductible under the RWI policy was met.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

Financial sponsors often utilise dual track processes for their exits, exploring sales while simultaneously preparing for an IPO. In the M&A track, there's a robust market for sales from one PE sponsor to another, typically on seller-friendly deal terms.

Financial sponsors will generally prefer an M&A exit as pricing is agreed and the seller can liquidate its entire position at the time of the sale. In an IPO, pre-IPO investors are typically unable to participate fully or at all in the IPO and are only able to sell down their block over time following the IPO.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

US tax reform under the TCJA, effective January 1 2018, will likely have a significant impact on US M&A activity. The considerable corporate tax rate reduction from 35% to 21% is expected to make US investment more attractive while the tax holiday on repatriating overseas earnings will provide additional sources of capital to already cash-heavy corporates. However, new limits on the deductibility of interest expense and net operating losses may temper target valuations and disfavour highly leveraged deals.

With tax reform a reality, a robust economy and the Trump administration's trade and antitrust policies leaning less radical than initially feared, there's general consensus that US M&A in 2018 is poised to move past the uncertainty that characterised much of 2017. In particular, PE investors with record amounts of capital will likely continue to play a big role in 2018 deals.

About the author |

||

|

|

Glenn P McGrory Partner, Cleary Gottlieb Steen & Hamilton New York, US T: +1 212 225 2686 W: www.clearygottlieb.com/professionals/glenn-p-mcgrory Glenn P McGrory is a partner in Cleary Gottlieb's New York office. His practice focuses on public and private mergers and acquisitions, private equity investments and corporate governance matters. In 2016, The National Law Journal named him a "Mergers & Acquisitions and Antitrust Trailblazer". McGrory joined the firm in 2000 and became a partner in 2009. He was resident in the Frankfurt office in 2001 and the London office from 2003-2005. He received a JD from Yale Law School, and an MS and a BS, magna cum laude, from Georgetown University. |

About the author |

||

|

|

Paul M Tiger Partner, Cleary Gottlieb Steen & Hamilton New York, US T: +1 212 225 2495 W: www.clearygottlieb.com/professionals/paul-m-tiger Paul Tiger is a partner in Cleary Gottlieb's New York office. His practice focuses on public and private merger and acquisition transactions and private equity investments. He also provides advice regarding stockholder activism, corporate governance matters, and fiduciary duties of officers and directors to corporations and their boards. Tiger is recognised as a "Rising Star" in M&A by IFLR1000 (2018) and Law360 (2015), and as a "Next Generation Lawyer" for Private Equity by Legal 500 US (2017). Tiger is licensed as a certified public accountant in Oregon (inactive). He received a JD, with distinction and Order of the Coif, from Stanford Law School and a BA, summa cum laude, from the University of Oregon. |