SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The Annual Turkish M&A Review 2017 by Deloitte reports that around 298 transactions were realized in 2017 with a total value of $10.3 billion. Leading sectors for the M&A market in 2017 were the technology, internet and energy sectors. While the internet and technology sectors hosted the deal activity in terms of deal number, the energy sector was leading in terms of deal value. European investors were the most active buyers and took part in 36 transactions and represented 55% of the foreign investors' annual deal volume.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

M&A value increased significantly by 41% compared to 2016. The total deal number reached an all-time high with an increase of 21%.

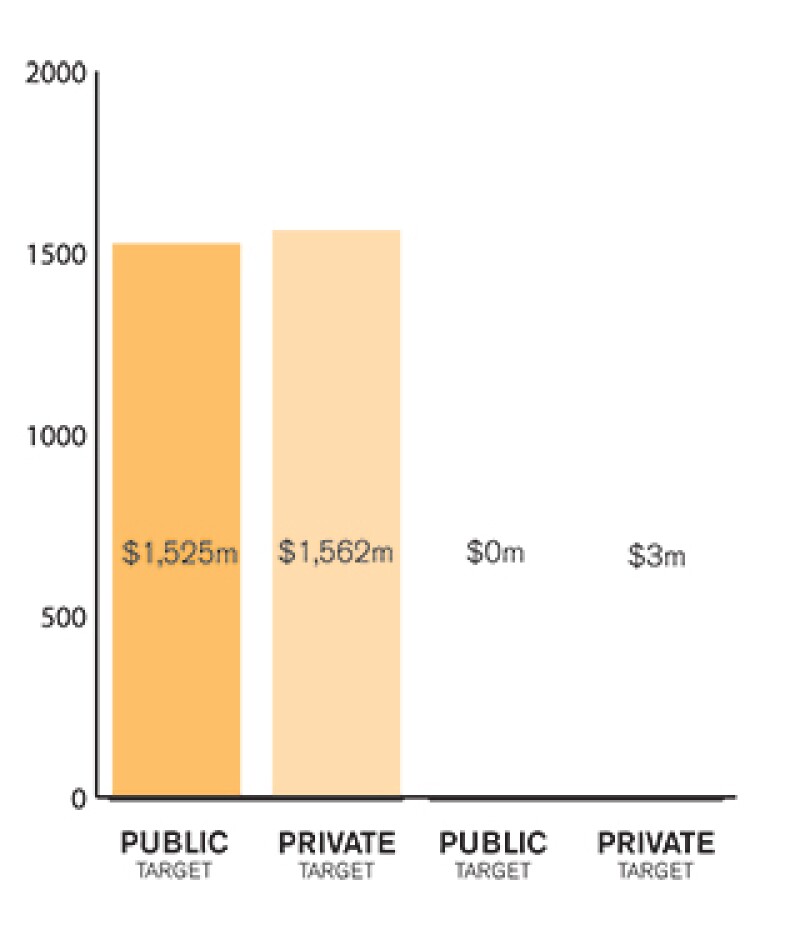

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The market has been dominated by private M&A transactions in 2017 similar to 2016. Fourteen privatisations at the total value of $700 million were completed in the energy, infrastructure, chemicals and mining sectors, while private transactions had a total value of $9.6 billion. Privatisations corresponded to 7% of the total transaction value.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

The Annual Turkish M&A Review 2017 by Deloitte reports that total deal volume generated by financial investors stood at $2.6 billion, private equity was involved in 20 acquisitions in 2017 corresponding to $2.15 billion and 12 exits took place, mostly to strategic investors in entertainment, manufacturing, food and beverage and education sectors through sales to strategic or financial sponsors and public offerings.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The acquisition of Mersin Uluslararası Liman İşletmeciliği was one of the most significant deals due to the deal value and the fact that it was the largest financial investor transaction of the year in Turkey.

2.2 What have been the most significant trends or factors impacting deal structures?

IPOs are expected to increase significantly in 2018. Additionally, locked box and earn-out mechanisms are common in M&A transactions where buyers are cautious.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key legislation governing M&A activity is the Turkish Commercial Code No. 6102, published in the Official Gazette dated February 14 2011 and numbered 27846 (Turkish Commercial Code) for privately held companies; and the Capital Markets Law numbered 6362, published in the Official Gazette dated December 30 2012 and numbered 28513 (Capital Markets Law) for the public companies.

The Law on Protection of Competition No. 4054, published in the Official Gazette dated December 13 1994 and numbered 22140 also governs certain M&A transactions depending on volume of transactions and the dominance of the parties involved. Accordingly, certain transactions regulated under the Communique on Mergers and Acquisitions are subject to the clearance of the Turkish Competition Authority No. 2010/4.

In this regard, depending on the sector involved in the transactions, approvals of different regulatory bodies would be required.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Capital markets regulation concerning crowd funding is legislated in 2017. Such alternative financing method is expected to activate the market for start-ups.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

An amendment concerning the Law on Enforcement and Bankruptcy No. 2004 is expected to be introduced in 2018 with respect to bankruptcy and debt restructuring (konkordato) procedures. Additionally, various incentive packages for investors are expected to be granted similar to recent years.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

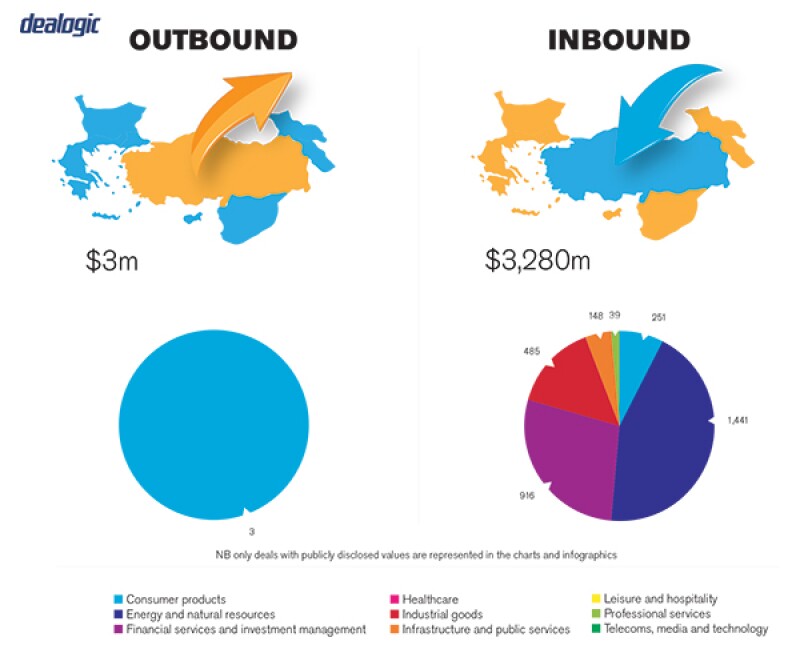

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

The discrepancies between common law and civil law give rise to various misconceptions in the Turkish M&A market. The use of some boiler plate provisions of Turkish law (such as good faith and fair dealing, frustration or force majeure) in an English law governed agreement creates problems of interpretation.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Usually, dispute resolution is overlooked during the negotiation of deals. Consequently, in the event of a dispute between the parties, the delay in the decision-making process of the courts causes parties to face additional financial losses.

Competition requirements and administrative requirements, such as workplace opening and operating licence and additional benefits granted to employees of target companies, are usually overlooked.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

The abovementioned idiosyncrasies may be handled through obtaining well-experienced legal consultancy services.

Choice of arbitration as a means of dispute resolution between parties may be suggested in order to resolve such disputes diligently and eliminate the risk of financial losses arising from disputes.

Turkish legislation allows international arbitration in the event that the dispute involves a foreign element (such as having the business places or habitual residences in different states, or one of the parties having a foreign shareholder bringing foreign investment or the disputed contractual relationship creates a flow of investment from one country to another). Turkey is party to the New York Convention and foreign arbitral awards are enforceable in Turkey in accordance with the New York Convention. As regards the enforcement procedure, Turkey is an arbitration-friendly country.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The main legislative text governing public companies is the Capital Markets Law. According to the Capital Markets Law, public companies which either have more than 500 shareholders or are publicly traded are joint stock companies.

Pursuant to Article 12 of the Communiqué on Takeover Bids No. II-26.1, published in the Official Gazette no 28891 dated January 23 2014 (Communiqué on Takeover Bids) issued by the Capital Markets Board, control is defined as holding either or both of: over 50% of the voting rights of a corporation directly or indirectly; and/or privileged shares enabling their holder to appoint the simple majority of the members of the board of directors or to nominate such majority of directors in the general assembly meeting.

5.2 What conditions are usually attached to a public takeover offer?

Pursuant to Article 11(4) of the Communiqué on Takeover Bids, a mandatory takeover bid cannot be subject to any conditions. However, under Article 20 of the Communiqué on Takeover Bid, a voluntary takeover bid may be submitted for all or some of shares of a publicly held corporation. If a voluntary takeover bid is submitted for some of the shares and the number of shares covered by the demands for participation in the takeover bid is greater than the number of shares covered by the takeover bid, then the voluntary takeover bid process is conducted in accordance to a pro rata distribution method; in order to eliminate any inequality between the demanding shareholders. Since the form to be submitted to the Capital Markets Board requires the bidder to submit information on the conditions of a bid, it is implied that certain restrictions may be imposed on voluntary takeover bids upon the approval of the Capital Markets Board.

Furthermore, under the Communiqué on Material Events Disclosure No. II-15.1 published in the Official Gazette dated January 23 2014 and numbered 28891, tender offers and public takeovers are subject to certain disclosure requirements.

It is also noteworthy that following the enactment of Law No. 6728, a 10% threshold has been determined for purposes of defining a related party with regards to transfer pricing requirements. In the meantime, the threshold for the rate of shareholding that can be subject to buyback by a company with regards to its own shares is 10%, under the Turkish Commercial Code.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

There is no specific regulation as per break fees under the capital markets legislation. Therefore, the Turkish Code of Obligations, numbered 6098 published in the Official Gazette dated February 4 2011 and numbered 27836 (TCO), will be applicable. There is no restriction with regards to a break fees under the TCO between merchants.

Especially in private deals, where the target is sold by means of a tender, break fees are frequently used for violation of exclusivity or lack of closing, for instance unsuccessful tenders. However, break fees are not very commonly seen for public M&A deals.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

As per the Turkish private M&A markets, purchase price adjustments have been the most popular mechanism for pricing and payment.

Recently, the locked box mechanism was offered by a greater number of sellers, where a correspondingly increasing number of buyers accepted such alternative consideration mechanism.

On the other hand, the earn-out method was not as commonly resorted to as the aforementioned and used generally for partial share acquisitions where one of the parties maintains its presence in the target.

Finally, an escrow mechanism has been seldom come across in the Turkish M&A market, since Turkish banks are not very enthusiastic about the application of such a mechanism and its facilitation.

5.5 What conditions are usually attached to a private takeover offer?

The most used conditions precedents for a private takeover offer are regulatory authority clearances and approvals from regulatory authorities. Among these clearances and approvals, the most ubiquitous condition precedent is merger clearance to from the Turkish Competition Authority. There might also be regulatory authority clearances required from other regulatory authorities, such as the Energy Market Regulatory Authority and Information and Communication Technologies Authority designated as conditions precedent depending of the activities of the target companies.

Another often used type of condition precedent is the approval or consent of third parties, where a change of control clause requires such approval or consent, with regard to the contracts, where the buyer will become a party. In relation to such consent / approval, if the target company holds certain licences or permits, such as an electricity distribution licence, approval must be obtained for certain changes in the shareholding structure of the licence-holder target company.

Among other examples of conditions precedents are the resignation of the current board structure of the target and its replacement with new members appointed by the buyer; undertakings with regard to the post-signing and pre-closing interim period; disclosure of transactions out of ordinary course of business during such interim period; transfer of loan agreements and the security agreements in connection with such loans; exclusivity and break fee with regard to such exclusivity and non-occurrence of material adverse events.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Under Turkish law, parties to an agreement with a foreign element can choose the governing law for the agreement. Choice of Turkish law as governing law for Turkish target companies is general market practice. However, during the recent years, it has been more frequently seen that a foreign, non-Turkish, jurisdiction was designated as the governing law in order to eliminate the difficulties of recognition and enforceability of court decisions. In addition, arbitration became more preferable as the means of dispute resolution, including both international commercial arbitration, such as ICC and Uncitral arbitration, and arbitration by the recently established Istanbul Arbitration Centre.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Professional liability insurance and director's and officer's liability insurance is available under the Turkish Commercial Code. However, warranty and indemnity (W&I) insurance is not available under Turkish law.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

IPOs are the most common exit strategy foreseen for the transactions in which financial investors are involved. Additionally, option agreements are common. However, enforceability of option agreements under Turkish law is quite questionable.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Almost 20 public offerings are expected to be realised in 2018. The privatisation of Eskişehir coal reserve field and renewable energy resource projects are likely to bring significant activity to the energy sector in 2018. Additionally, 14 sugar refineries are expected to be privatised.

About the author |

||

|

|

Ercüment Erdem Founder and senior partner, Erdem & Erdem Law Office Istanbul, Turkey T: +90 212 291 73 83 F: +90 212 291 73 82 Professor Dr H Ercüment Erdem is the founder and senior partner of Erdem & Erdem. He has more than 30 years of experience in M&A, international commercial law, privatisations, corporate finance and arbitration. He serves international and national clients in a variety of industries including energy, construction, finance, retail, real estate, aerospace, healthcare and insurance. Erdem is a member of Istanbul Bar Association, the co-chair of the ICC Commercial Law and Practice Commission and a member of the ICC Court of Arbitration, ICC Institute Council, ICC Incoterms Expert Group, and ICC Turkish National Committee Arbitration Council, as well as a member of several ICC task forces. He is a member of the Association Suisse de l'Arbitrage (ASA), International Bar Association (IBA), Association Henri Capitant des amis de la culture juridique française, and the Research Institute of Banking and Commercial Law. Erdem has strong academic background. He is an emeritus professor and still continues to lecture in leading universities such as Galatasaray University, Turkey and Fribourg University, Switzerland. He has authored books on M&A, international trade law, competition law, commercial law, CIF sales etc. In addition, he has authored numerous articles in national or international publications related to commercial law, competition and antitrust law, contracts law, arbitration, complex business litigation issues, dispute resolution etc. |

About the author |

||

|

|

Özgür Kocabaşoğlu Partner – head of corporate, Erdem & Erdem Law Office Istanbul, Turkey T: +90 212 291 73 83 F: +90 212 291 73 82 E: ozgurkocabasoglu@erdem-erdem.av.tr Özgür Kocabaşoğlu is a partner and the head of corporate of Erdem & Erdem Law Office. Kocabaşoğlu has nearly 20 years of experience in national and multijurisdictional complex M&A, structuring, banking, capital markets transactions, corporate and project finance. He has extensive experience of international transactions involving a number of overseas jurisdictions in a variety of business sectors including energy, mining, transportation, ports, airports, construction, finance, retail and real estate. He focuses on privatisations and public private partnership models and complex cross-border transactions involving commercial banks, corporate entities, public and private companies. In recent years, he has led M&A deals in a wide geography including Europe, Latin America, Russia, CIS countries, Africa and Asia. Moreover, he regularly provides consultancy to multinational corporations on every aspect of commercial law, contract law, capital markets and merger and acquisitions. He is a member of Istanbul Bar Association and International Bar Association (IBA). |