SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The M&A market in Spain over the past 12 months has experienced a sharp increase that consolidates the upward trend initiated in previous years. The robust economic environment and political stability have helped boost this process, although conversely the political turmoil in Catalonia has been the main concern.

The most active sectors in the M&A field during this period have been real estate, technology and internet businesses

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

According to Transactional Track Record (TTR), 2,185 M&A transactions have been reported during 2017 for an aggregate amount of €113 billion. This represents an increase by 8.01% in the number of transactions and by 44.22% in volume as compared to 2016.

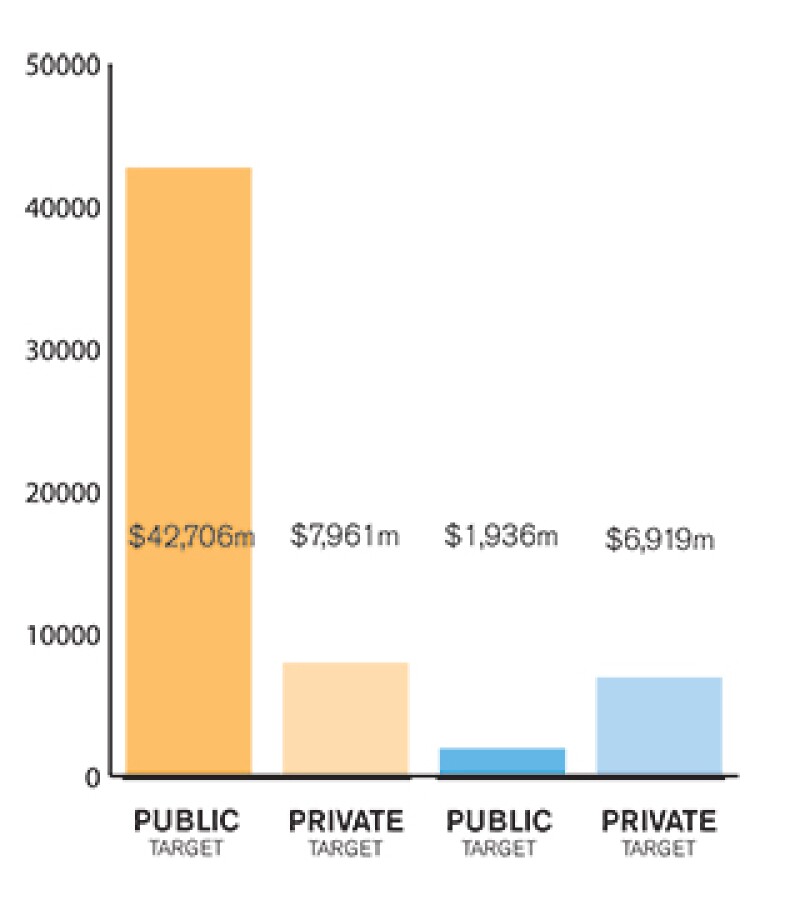

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Spanish market is usually driven by both private and public M&A transactions. Even though the public market has been at a standstill over the last few years, 2017 has seen a substantial recovery with 25 IPOs and 48 share capital increases in public companies.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

In recent years, both strategic and financial investors have increased their positions in the Spanish market and are key players in M&A investment deals in Spain. It is frequent to see them join forces to pursue large M&A transactions.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Some of the most notable M&A transactions during 2017 are:

The acquisition by Blackstone of 100% of HI Partners Holdco Value Added from Banco Sabadell.

The takeover bids for Abertis by Hochtief (ACS) and Atlantia.

The acquisition of Banco Popular by Banco Santander.

The acquisition of Banco Popular by Banco Santander has been especially relevant from a legal perspective as it was realised for the symbolic price of €1 and is the first transaction carried out pursuant to the single resolution mechanism approved by the European authorities.

2.2 What have been the most significant trends or factors impacting deal structures?

The Spanish M&A market has become more and more sophisticated and complex over the last few years. Not only new actors, but also more complex deal structures and financing formulas have driven the main transactions. This complexity obliges investors to seek high-skilled, imaginative and versatile advisors who understand their needs and design an ad-hoc, specific structure to protect their interests.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

Key legislation of M&A transactions in Spain are:

Ley de Sociedades de Capital (the Corporate Enterprises Act or CEA) 1/2010 of July 2;

Ley de Modificaciones Estructurales (the Corporate Restructuring Act or CRA) 3/2009 of April 3; and

Ley del Impuesto sobre Sociedades (the Corporate Income Tax Act or Cita) 4/2004 of March 5.

Also, when strictly referring to public M&A activity:

Ley del Mercado de Valores (the Securities Market Act or the SMA) 4/2015 of October 23; and

Real Decreto sobre Régimen de las Ofertas Públicas de Adquisición de Valores (the Royal Decree on the Public Acquisition of Securities or the PAS) 1066/2007 of July 27.

The main regulatory bodies that govern M&A transactions are:

The National Securities Market Commission (Comisión Nacional del Mercado de Valores or CNMV); and

The National Markets and Competition Commission (Comisión Nacional de los Mercados y La Competencia or CNMC).

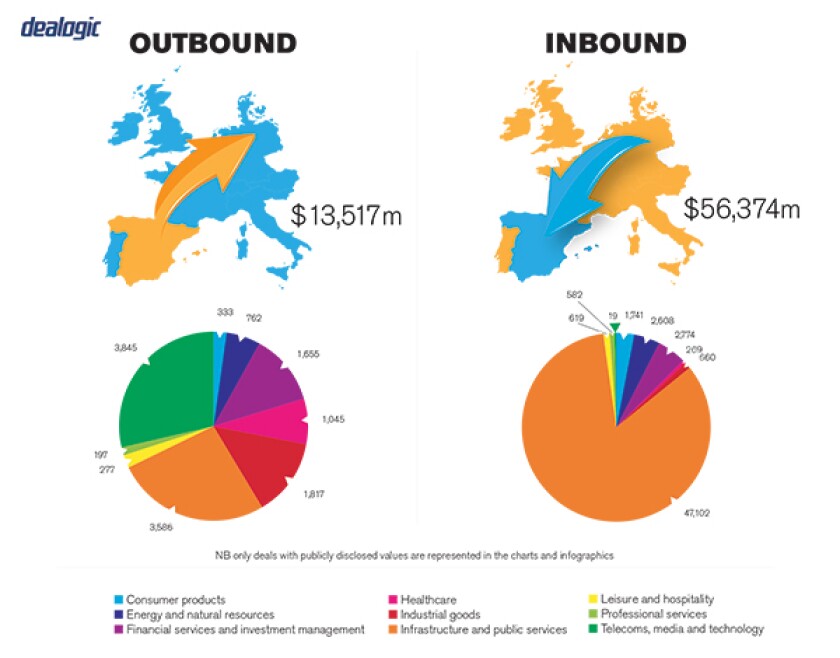

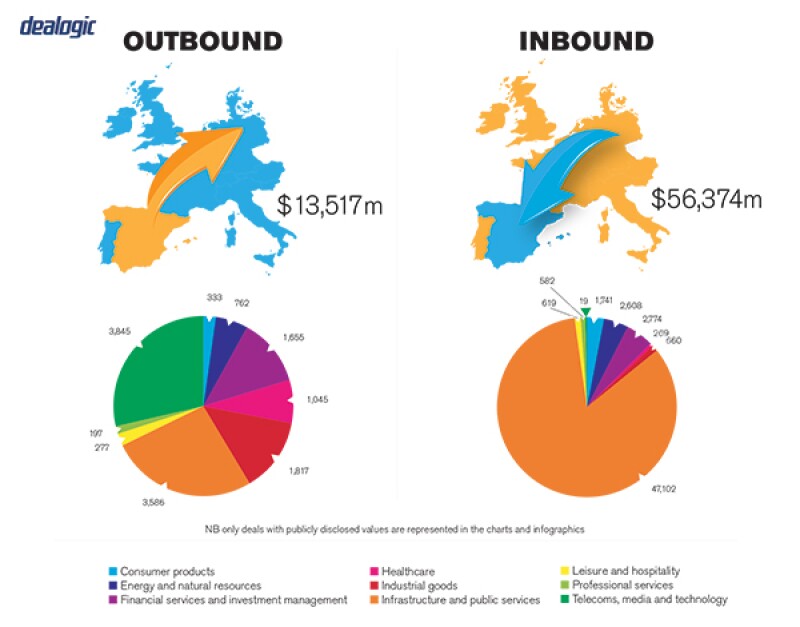

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

At the end of December 2017, in a royal decree the Spanish Government approved the transposition into the Spanish legal system of the regulations of Markets in Financial Instruments Directive II (Mifid II), the European directive on markets in financial instruments that seeks to make the European markets fairer, more competitive, and less likely to collapse.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The Spanish legislative body is currently highly atomised, with no political party or political alliance holding a stable majority to pass relevant legislative resolutions. We do not foresee major legal modifications to be passed in the near future.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

It is notable that most foreign investors tend to approach investments in Spain from a common law perspective. This leads to some misconceptions about alternatives for structuring or negotiating M&A transactions in Spain. The best way to avoid potential inconsistencies or ex-post weaknesses in a deal is to involve legal counsel at the earliest stage possible. It is commendable that more and more foreign investors in Spain tend to realize this and the need to seek proper advice during the whole process.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

From a strictly legal standpoint and without prejudice to the previous comments about planning in Section 4.1, an overlooked area in transactions in Spain concerns the formalities to be observed. Spanish legal tradition is very formalistic and consequently not only the content but also the formalities for documenting any transaction in Spain need to be strictly observed. The consequences of not observing these provisions rank from the imposition of fines to the potential nullity of an agreement.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Based on the foregoing, seeking local legal advice and involving the local counsel in all the phases of the deal (i.e. from the preliminary negotiations until completion of the relevant post-closing formalities) is crucial. Even if the transaction is not subject to Spanish Law, there are certain mandatory legal provisions that will apply to any deal that takes place in Spain.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

a) Control of a listed company in Spain is deemed to take place in the following scenarios:

i) direct or indirect acquisition of a percentage of voting rights equal to, or in excess of 30%; or

ii) holding any interest carrying less than 30% of the voting rights but appointing, within 24 months following the acquisition, a number of directors which, together with those already appointed by the bidder, if any, represent more than one-half of the members of the board of directors.

b) Whenever a person gains control of a listed company according to the parameters mentioned above, that person will be obliged to launch a takeover bid for all the securities of the target at a price that may be considered equitable.

c) Control of a listed company may be gained by any of the following means:

i) Acquisition of securities that grant direct or indirect voting rights in the company;

ii) Shareholders´ agreements; or

iii) Indirect or unexpected takeovers described in PAS.

d) Hostile bids are permitted.

5.2 What conditions are usually attached to a public takeover offer?

The structure, content and procedure for formalising a public takeover offer are regulated by Spanish Law. The most relevant conditions that need to be observed are the following:

a) They may be placed in the form of acquisitions, share exchanges or a combination of both;

b) The offer must ensure equal treatment of security holders that are in the same position;

c) Collateral shall be provided to secure the obligations assumed in the offer.

d) The manner in which the offer is filed, along with its content and requirements, are ruled by PAS.

e) Submission of the offer is subject to prior authorisation of the CNMV.

f) The term to accept the offer is determined by the offeror. However, it must be between 15 and 70 days.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are common in public M&A transactions in Spain.

However, they are governed by Spanish Law and specifically subject to the following conditions:

a) They can only be agreed with the first offeror;

b) The break fee may not exceed an amount equivalent to 1% of the total amount of the offer;

c) The break fee needs to be approved by the management body of the target company;

d) The financial advisors of the target need to pass a favourable report on the break fee; and

e) The break fee needs to be explicitly detailed in the offer document.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

As already mentioned, private M&A deals have become more and more complex over the last few years. This process has led to a plethora of different structures and especially of mechanisms to determine the price of the transaction. Differences between sectors in this regard are also increasing. Hence, it is difficult to determine general trends in the whole M&A market.

In any event, earn-outs and escrows continue to be the most recurrent mechanisms for buyers to secure part of their investment, while locked box or completion account mechanisms are more frequently seen in specific sectors such as M&A transactions related to project companies.

5.5 What conditions are usually attached to a private takeover offer?

As opposed to public takeover offers, private offers are not governed by Spanish law and consequently the parties may choose the mechanism they find most appropriate to initiate a negotiation. Based on the foregoing, there is no formal or standard structure for private takeover offers. It will vary on a case by case basis depending on multiple factors such as the profile of the parties, the size of the transaction, the urgency to close the deal or any other characteristics of the transaction.

Nevertheless, when it comes to competitive tender processes, and notwithstanding the preceding paragraph, some common features of the process for launching a private takeover offer are:

Bidders are granted access to certain information and documentation of the target to carry out a high level due diligence.

Bidders draft a tentative offer in the form of a head of terms, letter of intent or any other similar document describing the main terms of its offer (e.g. price and valuation of the target, price adjustment mechanism, funding sources and/or guarantee for the offered price, potential conditions precedent).

The bidder that has made the best offer is granted an exclusivity period by the seller(s) to negotiate the terms of the transaction.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

On the one hand, M&A transactions in Spain are seldom subject to a foreign law. There are many reasons for this, such as the fact that Spanish Law provides for a secure, balanced, fair and stable legal environment that investors can completely rely on.

There are provisions of Spanish law, particularly those related to the structure and governance of limited liability companies such as those that most frequently constitute the target companies in M&A deals, which are mandatory and cannot be waived by mutual consent of the parties. Hence, submitting a deal to a foreign law could give rise to various conflicts of laws disputes.

On the other hand, it is more frequent to submit M&A deals to a foreign jurisdiction. In this case, it is particularly recurrent for a transaction to be subject to arbitration and specifically to the jurisdiction of international, unbiased, well reputed arbitrators. The main reasons for this are to avoid the delays that Spanish Courts experience nowadays and to ensure that the members of the Court who will decide on the specific controversy are individuals with reputed experience and long-term background on the particular subject matter.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance on private M&A transactions is also gaining ground lately. Especially in cases where the sell side is formed by an institutional investor that is looking for a clean exit, the parties agree to insure any liability that could arise for the seller in connection with the transaction.

This increasing trend is also driving insurance companies to offer new, more specialised and price competitive products to the market.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

The robust economic environment and the strong dynamics that currently characterise the M&A market in Spain have provided liquidity and eased the exit environment, which is also positively regarded by the market. The venture capital sector in particular has experienced this process, along with institutional markets such as public M&A or financial investors.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

We expect the growing trend initiated two years ago to continue in 2018 and even increase. Real estate, technological and also financial sectors could be the most dynamic, following the trend of previous years.

The main indicators for these conclusions may be the predictions of a stable political background during these years for the reasons explained above, the consolidation of Spain as one of the strongest economies in the Eurozone and the fact that Spanish companies have gained interest for foreign investors due to the restructuring and consolidation decisions adopted during the years of the crisis.

About the author |

||

|

|

Fernando de las Cuevas Castresana Partner, Gómez-Acebo & Pombo Madrid, Spain T: +34 91 582 91 32 F: + 34 91 582 91 14 Fernando de las Cuevas specialises in M&A, banking law, securities market law, collective investment institutions and family and private equity businesses. He is consistently recognised in all prestigious legal directories, including Best Lawyers, Chambers and Partners and Legal500. He is particularly renowned for his commendable M&A and financial knowledge. De las Cuevas joined Gómez-Acebo & Pombo Abogados in 1983. He was a foreign associate at Shearman & Sterling in New York from 1985 to 1986. He has been a partner of Gómez-Acebo & Pombo Abogados since 1990 and managing partner from 1998 to 2000. He is currently head of M&A. He holds a master of law, a bachelor of business science and a diploma in European studies from the Universidad de Deusto (1981), and a diploma in higher European studies from the College of Europe, Bruges (1982). He received a research scholarship from the European Free Trade Association, Geneva (1982-1983), and graduated from the PIL course at Harvard Law School (1990). He is fluent in Spanish, English and French. |

About the author |

||

|

|

Ignacio de la Fuente Muguruza Associate, Gómez-Acebo & Pombo Madrid, Spain T: + 34 91 582 93 87 F: + 34 91 582 91 14 Ignacio de la Fuente graduated in law and business sciences from the Universidad Pontificia de Comillas in Madrid and obtained a scholarship from the University of Texas at Austin where he developed his studies in business sciences. De la Fuente is an associate at Gómez-Acebo & Pombo Abogados, and his specialisations include M&A, family and private equity businesses and insolvency proceedings. He has also worked as foreign associate at the New York office of the firm. He is fluent in Spanish, English and German. |