SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

In terms of volume of deals, fintech has been the most active sector over the past 12 months, particularly the peer-to-peer lending business. This is due to issuance by the Financial Services Authority (or also known as the OJK) of peer-to-peer lending business regulation in 2016 and 2017. Public news shows more than 35 registration licences peer lending business issued up to 2018.

In terms of value of the deals, M&A on industry and energy sectors still lead most of the transactions.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

M&A deal volume has increased significantly in 2017 compared to the previous year within the same first semester, reaching up to 2.6% growth or $3.6 billion to $4 billion in value. Out of 81 merger deals, 32% came in the technology sector followed by 17% in agriculture.

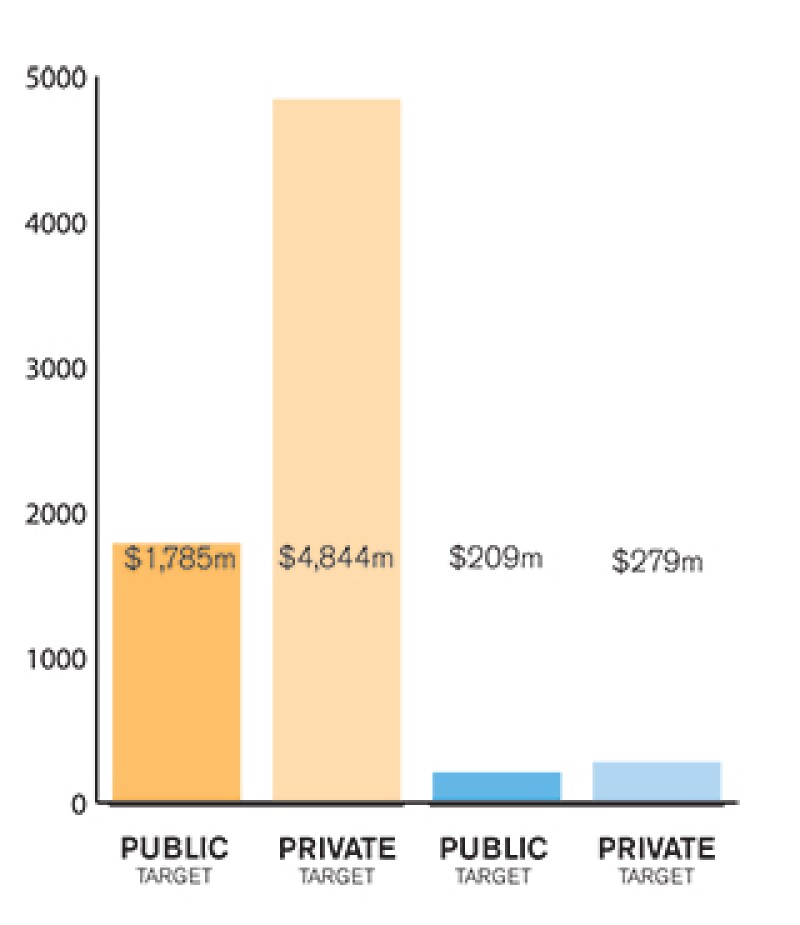

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Private M&A transactions still dominate the market (see also public data from the Indonesian Business Competition Supervisory Commission or KPPU). The most sensible reasons are the complex regulatory framework and procedures for public M&A, which often lead to lengthier period and more costly transactions.

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

The Indonesian M&A market is still relatively driven by strategic investors, as shown by more private company shares acquisition deals until last year rather than portfolio investments through public company.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The proposed acquisition of PT Bank Sahabat Sampoerna and Koperasi Sahabat Sampoerna of an aggregate IDR7 trillion ($550 million) loan portfolio of 80,000 small scale – medium scale loan accounts from another licensed Indonesian bank. The deal is unique as it involves complex structuring and sophisticated multi-layered financing/fundraising structures, and a subsequent plan to service the acquired portfolio loans. If it goes through, the deal will represent a breakthrough acquisition of a loan portfolio from a bank by Koperasi (cooperative).

2.2 What have been the most significant trends or factors impacting deal structures?

Sudden change of government policies and regulations are the most crucial influences to M&A deals, as these would have direct impact to financing strategies and how a deal is structured.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

Indonesia has a quite unique and complex regulatory system, as well as government monitoring system. There are many layers of regulations depending on the type of business, nature of investment, status of companies (private or public company), as well as areas (central or regional). The government supervising authorities are also divided depending on the business characteristic. For example, foreign investment in Indonesia is subject to the regime of Investing Coordinating Board or also known as BKPM, while specific types of businesses, particularly banking and non-bank financial institution sectors as well as public companies, fall within the authority of the OJK. In addition, regional governments also have specific authorisations for specific areas.

The general regulation on M&A, which is applicable for all limited liability companies regardless of the type of business activities, is Law No. 40 of 2007 concerning Limited Liability and its implementing regulations.

M&A relating to foreign investment/foreign investment companies is, in addition, subject to the rules and regulations of Law No. 25 of 2007 concerning Investments and its implementing regulation, as well as the rules and regulations issued by BKPM. BKPM recently issued regulation No. 13 of 2017 concerning Guidelines and Procedures for Investment Licensing and Facilities.

Public companies, bank and non-bank financial institutions are subject to the regime of the OJK and specific OJK regulations, depending on the type of business activity.

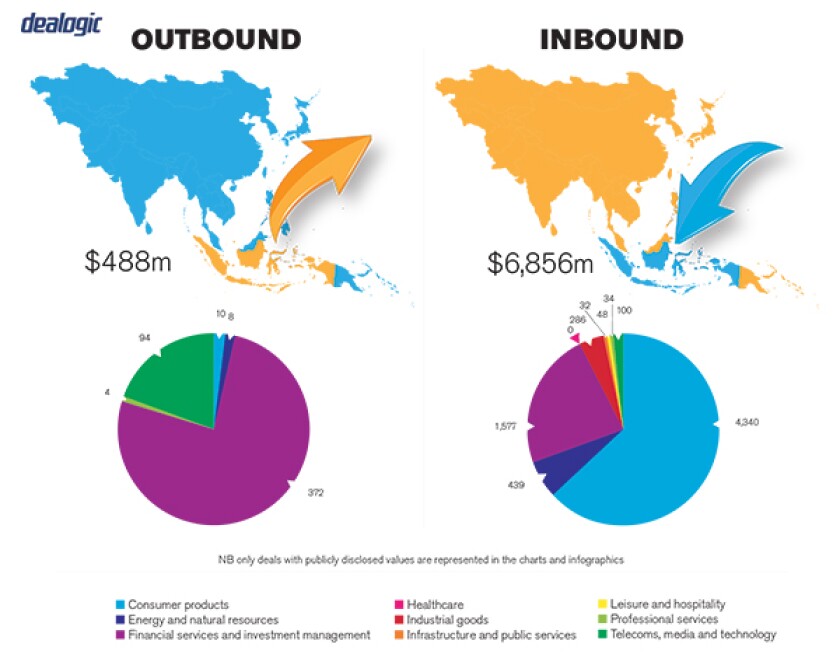

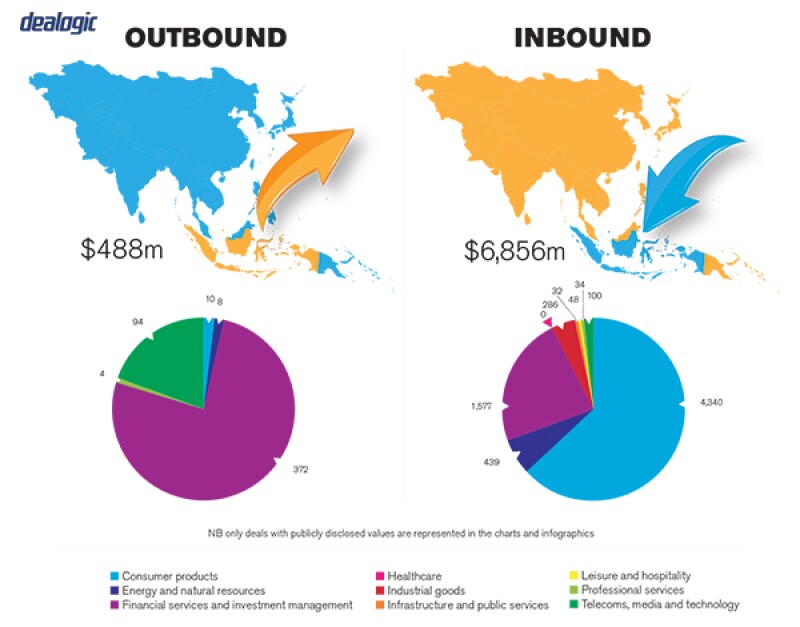

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Yes, one significant regulatory update affecting foreign investment, is the new BKPM regulation No. 13 of 2017 concerning Guidelines and Procedures for Investment Licensing and Facilities, which has the following notable changes:

Service sectors: possibility of a simplified licensing process by allowing certain companies to directly obtain a business licence.

Real Property Development sector: introduction of a more relaxed requirement by allowing property development and management companies to take into account their land and building as part of their minimum investment when applying for investment approvals (applicable only for development works involving a whole building or integrated real estate).

Industrial sector: requiring expansion licence for any change of production capacity; in contrast to the previous regulation where the expansion licence is required only if the production capacity increased more than 30%.

Merger Licensing: simplification from two-stage licensing to one-stage licensing.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The OJK is planning to issue implementing regulation on fintech – peer to peer lending business in 2018, to elaborate the procedures and requirements in a more detailed manner.

Another development is recent news reports about the Government's plan to introduce more flexibility on foreign manpower permits.

In addition, the KPPU is planning to change the merger notification requirement from post-notification to prior approval. The draft regulation is still under discussion but once enacted, this will significantly impact the timeline of Indonesian M&A deals.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Different interpretation and understanding of certain regulatory requirements between practitioners often lead to common mistakes and the omitting of crucial regulatory requirements for M&A, for example the announcement requirements for any change of control or the requirement to sign deed of transfer of shares in notarial deed and Indonesian language.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

This depends on the deal characteristics, but commonly, as suggested in Question 4.1, corporate governance matters are the most overlooked matters; for example, preparation of shareholders register or acquisition announcement.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

It is crucial for practitioners to consult Indonesian M&A experts with extensive knowledge on market changes on how to structure a deal and to ensure it is validly and legally completed.

Alternatives to minimise risks vary, including requiring the seller to provide contractual representation and warranties and indemnification or requiring payment of the purchase price in instalments within a certain period, which can also be structured through payments in an escrow account.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Obtaining control of a public company can be conducted either by acquiring the existing controller's shares or by purchasing shares through a right issue (increase of capital).

Change of control occurs when a party acquires more than 50% of shares in the public company, or acquired fewer than 50% of the shares but can influence or determine, directly or indirectly, the management and/or policies in the public company.

An acquisition of shares from an existing shareholder will trigger a mandatory tender offer (MTO) if there is a change of control, with certain exemptions set by the regulations. Voluntary tender offers (VTO) and mergers are also ways to obtaining control. However, these structures are less popular since a VTO is often used for delisting and privatisation and due to the intricacies of a merger.

5.2 What conditions are usually attached to a public takeover offer?

The MTO – the acquirer undertakes for the existing shareholders (minority shareholders) receive a fair price for their shares in accordance with the provisions of the regulation.

Post-merger notification.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are not regulated under Indonesian law and the arrangement is purely a contractual matter.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

This really depends on the characteristics of the business of the target and negotiation circumstances of the parties.

Locked box mechanisms are more common for deal characteristics involving companies with dynamic business activities and a wide range of customers portfolios, such as banks or multi-finance companies.

Escrows are common for specific deals when certain conditions or procedures are to be fulfilled by the buyer and seller sides within the same timeframe; in interconnection deals which require payment to be fully paid up/made before completion of the other deal completion; or where there is a price adjustment agreed by the parties after the completion.

Another alternative is price adjustment mechanism, giving rights to parties for purchase price adjustment after completion, if for example valuation of the assets/shares decreases.

5.5 What conditions are usually attached to a private takeover offer?

Fundamentals pre-closing conditions, depending on the characteristics of the deal and business, are government approvals (if required by specific regulations), internal corporate approval of the parties and acquired company, creditors' consent under the existing agreements and newspaper announcement to creditors and employees.

Post conditions are more administrative requirements by nature and include, for example, notification to authorised government, to creditors and newspaper announcement. Other contractual conditions between shareholders would be non-competition (between business of shareholders and the acquired company), and price adjustment conditions.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Yes. It is common to include foreign jurisdiction in the conditional share purchase agreement, although for the deed of transfer it must be governed by Indonesian law.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

There have been a few examples, although it is not yet common practice.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

In a public company takeover, the new controller is required to make an offer to purchase the remaining shares of the public company through the MTO. The MTO is also an exit for the existing shareholders (minority shareholders) who disagree with the acquisition; whereby their shares will be purchased at a fair price by the new controller.

In addition, Indonesian company law provides rights to shareholders to request the company for a share buy-back if the shareholder(s) disagree with, among others, a merger, consolidation or acquisition that causes losses to the shareholder(s) of the company.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Trends and developments would most likely involve the fintech/technology-related sector. We would expect tightened supervision from the OJK in this sector and consequently the issuance of more implementing regulations. As a result, one would expect banks and multi-finance companies to have some market reactions.

About the author |

||

|

|

Luky Walalangi Founder and managing partner, Walalangi & Partners Jakarta, Indonesia T: +62 21 5080 8600 F: +62 21 5080 8601 Luky Walalangi is an expert and a leading lawyer in M&A, banking and finance and real estate, with more than 17 years of experience. Asialaw Profiles cites him "one of the best corporate lawyers in Indonesia". He is well-respected and highly-regarded among leading M&A and finance practitioners, including by the top legal surveys, and continues to be recognised by international law journals such as IFLR1000, Asia Pacific Legal 500 and Asialaw. Walalangi has been assisting various foreign companies in their complex investments and acquisitions (including assets and portfolio loans acquisitions), real property projects and corporate restructurings in Indonesia. He has also represented leading global banking and financial groups on major finance transactions, bond issuance, sophisticated fund-raising projects as well as number of major electricity projects in Indonesia. Walalangi advises on major strategic acquisitions in Indonesia in various sectors, from traditional company acquisitions to complex assets and portfolio loans acquisitions. |

About the author |

||

|

|

Miriam Andreta Partner, Walalangi & Partners Jakarta, Indonesia T: +62 21 5080 8600 F: +62 21 5080 8601 Miriam Andreta is an Indonesian qualified lawyer, expert and has extensive knowledge in M&A, banking and finance, oil and gas and antitrust matters. Before joining W&P, she was a partner in one of the biggest firms in Jakarta, with 13 years of experience acting for both foreign and domestic lenders in high profile syndication financing to Indonesian companies (including issuance of bonds and medium-term notes). She also represents reputable foreign investment companies in upstream and downstream oil and gas projects, multinational companies (including various Japanese companies) in their investment Indonesia, as well as Indonesian state-owned companies on various legal matters. On Antitrust matters, she has been advising clients both local and foreign companies on various antitrust issues relating to their business, as well as assisting their merger notification process. |

About the author |

||

|

|

Fiesta Victoria Senior associate, Walalangi & Partners Jakarta, Indonesia T: +62 21 5080 8600 F: + 62 21 5080 8601 Fiesta Victoria is an Indonesian qualified lawyer and expert in M&A, corporate restructuring, real property investment and employment issues with over 10 ten years of experience, focusing on finance companies and fintech businesses. She obtained her law degree from Pelita Harapan University, majoring in business law and received an award as "the Best Law Graduate Student of the year 2007", with cum laude predicate. Before joining Walalangi & Partners, she pursued her career in one of the largest corporate law firm in Indonesia for over 10 years. Victoria has been assisting various foreign companies (including Japanese trading and multi-finance companies) and one of the largest Indonesian state-owned banks on their complex investments, M&A (including assets and portfolio loans acquisitions), real property projects, and corporate restructurings. She has also represented leading global banking and financial groups on major transactions, from traditional acquisitions to complex assets and portfolio loans acquisitions, bond issuance, as well as sophisticated fundraising projects. |