SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The past 12 months have shown a growing trend in M&A transactions with view to Luxembourg-based target entities as well as acquisitions outside of Luxembourg that were started from a Luxembourg structure. Luxembourg-based targets are typically not the centre of high profile M&A targets.

The last large M&A transaction with view to a Luxembourg target entity was the €30 billion successful takeover bid by Mittal Steel for Arcelor, resulting in the biggest steel producing entity worldwide. Other local M&A transactions were the investment by Qatar into Cargolux, a worldwide leading cargo airline operating from Luxembourg and their investment into KBL Bank (Banque Internationale à Luxembourg), as well as other investments by Qatar and Chinese investors into Luxembourg-based banks and asset managers. Another transaction was the sale by Lufthansa of their stake in the Luxembourg civil airline Luxair.

Nevertheless, Luxembourg remains a core jurisdiction in the EU as a hub from which M&A transactions are guided into other European jurisdictions. A large portion of the M&A transactions in Europe and also in relation to other continents (in particular Asia) are implemented using Luxembourg structures. Over the last three years, Luxembourg has also experienced a growing interest by China-based investors to carry out their M&A transactions into the EU or Latin America via Luxembourg investment structures.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

No official figures of the volume and value of M&A deal flow in Luxembourg are yet available for 2017. However, during the last 12 months, the number and value of assets under management of private equity buy-out funds has strongly risen in Luxembourg. Around €80 billion in assets under management were committed in 2017 and fundraising is ongoing for further multi-billion euro PE funds in Luxembourg. These funds have been investing in and will further deploy M&A transactions aiming at mostly European-based target entities. The outlook for M&A activities launched in and from Luxembourg remains very good.

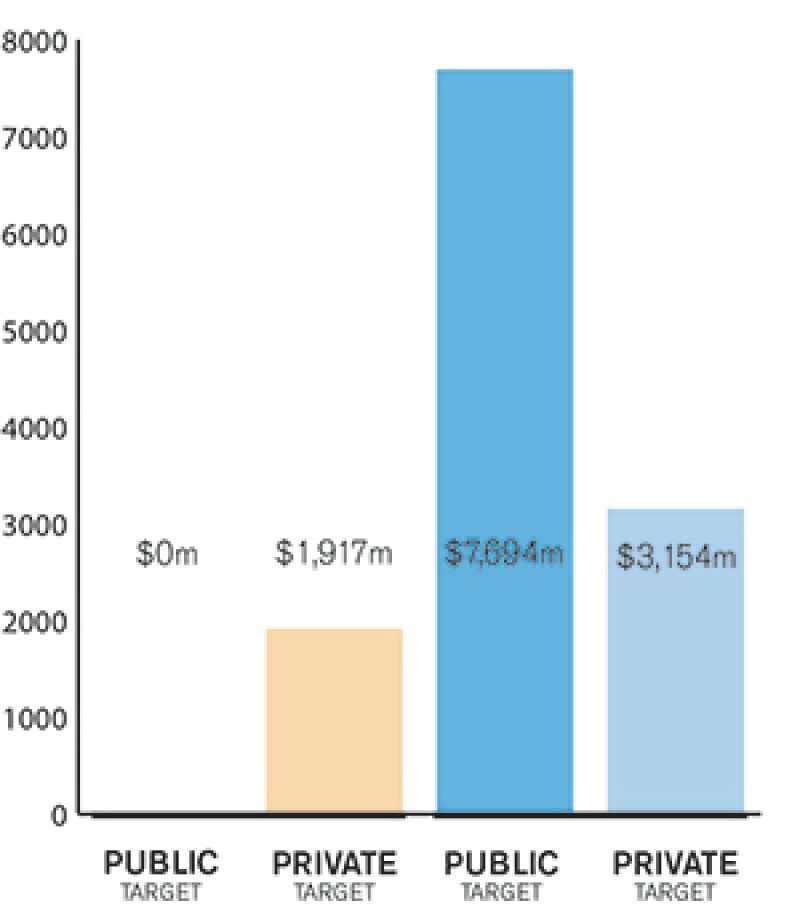

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The market is characterised by a mix of private and public M&A transactions. Again, in both instances the target is often not located in Luxembourg itself but in another jurisdiction. However, due to the positive legal and business environment in Luxembourg, we often see M&A transactions in Europe being orchestrated from the base of a Luxembourg structure (investment fund or other).

1.4 Describe the relative influence of strategic and financial investors on the M&A environment in your market.

Strategic and financial investors alike use Luxembourg as M&A hub to approach target entities in Luxembourg or abroad. In addition, investor groups increasingly chose Luxembourg as their investment platform. This results from the stable and investor-friendly business environment for which Luxembourg is well-known amongst investor and asset managers around the world. The flexible investment fund and corporate law regime allows for tailor-made solution for all kinds of investment platforms and asset classes. Furthermore, the multi-linguistic workforce in Luxembourg (private and public sector) allows investors to communicate with their advisors, administrators and even the supervisory authority in English, German or French. Advisory firms typically also have native speaking staff in Luxembourg with view to many other countries worldwide and in particular China, Russia, Middle East and Latin America regions.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Notable M&A transactions in Luxembourg are mentioned in Section 1.1. Other transactions, which were managed through Luxembourg structures but had their target entity in other countries, are numerous. In particular, acquisitions in German target entities seem to be predominantly carried out through Luxembourg investment structures. It was reported that the M&A transaction into Pirelli had a Luxembourg element, as did the investment into the Kuoni Travel Group and the acquisition of the Building and Facility Management segment of Bilfinger.

2.2 What have been the most significant trends or factors impacting deal structures?

The most significant increasing trend is in the establishment of PE buy-out funds in Luxembourg. Whilst in the past most of these funds were established on the Channel Islands, in the UK or the Netherlands, there is now clearly a trend driven by certain PE players to move their core business base to Luxembourg and enhance their teams in Luxembourg with additional staff and expertise. The most recent example is the set-up of the €10 billion new buy-out fund by EQT in Luxembourg. Also, an increasing number of venture capital funds investing into start-up and venture capital firms were established in Luxembourg over the last two years.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key legislation is the law on commercial companies dated August 10 1915, as amended (the Corporate Law). It provides for all kinds of corporate structures and corporate instruments to create tailor-made corporate structures useable for M&A transactions. In addition, numerous treaties on the avoidance of double taxation allow Luxembourg to support the worldwide M&A activities of Luxembourg private equity funds and M&A interested parties.

There is also the takeover law of May 19 2006, as amended (Takeover Law). The Takeover Law includes squeeze-out and sell-out rights, which assist M&A activities into Luxembourg-based target entities. Any voluntary bid for the takeover of a Luxembourg company and any mandatory bid will be subject to the Takeover Law, which has implemented the Directive 2004/25/EC of the European Parliament and of the Council of April 21 2004 concerning takeover bids (the Takeover Directive) into Luxembourg law. A natural or legal person, alone or with persons acting in concert with it, acquiring control over a company by holding 33.33% of the voting rights is required to make a mandatory takeover bid to all the holders of shares in the Luxembourg company. As far as the competent authority is concerned, the Takeover Law states that if the target company's securities are not admitted to trading on a regulated market in the Member State in which the company has its registered office, the competent authority to supervise the bid shall be the authority of the Member State responsible for the regulated market on which the company's securities are admitted to trading.

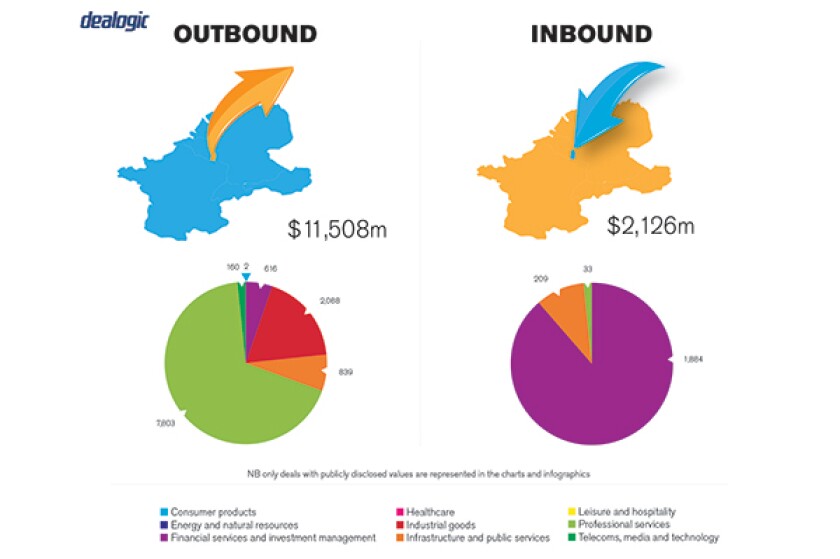

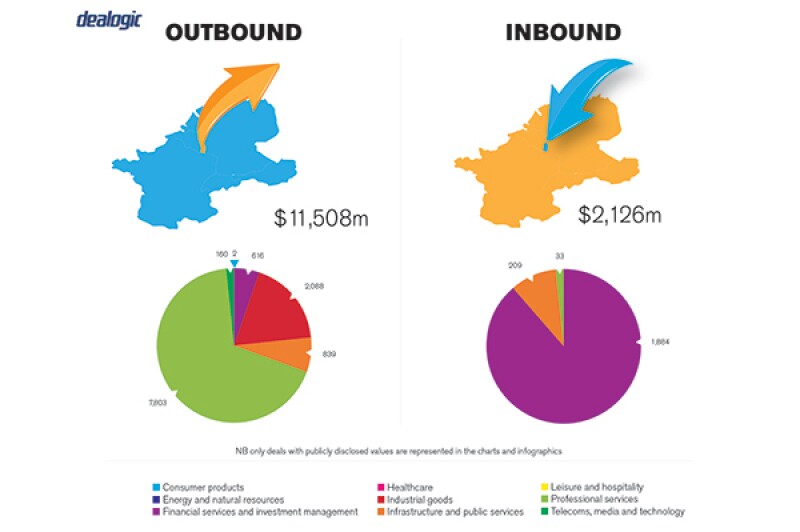

Inbound Outbound |

|

NB: Values may exclude certain transactions, for example asset acquisitions/sales |

Matters relating to the consideration offered in the case of a bid, in particular the price, and matters relating to the bid procedure, in particular the information on the bidder's decision to make a bid, the content of the offer document and the disclosure of the bid shall be governed by the law of the Member State responsible for the regulated market on which the company's securities are admitted to trading. If a mandatory or voluntary offer is made to all of the holders of securities carrying voting rights in a company, which has listed its securities at a regulated market and if, after such offer, the offeror holds 95% of the securities carrying voting rights of the respective company and 95% of the voting rights, the offeror is entitled to squeeze-out the minority shareholders, if any, according to the provisions of the Takeover Law. Under the Takeover Law, when a mandatory or voluntary offer is made to all of the holders of securities carrying voting rights in a company and if, after such offer, the offeror holds more than 90% of the securities carrying voting rights and more than 90% of the voting rights, the minority shareholders may require that the offeror purchase the remaining securities of the same class.

Finally, the law of July 21 2012 on mandatory squeeze-out and sell-out of securities of companies currently admitted or previously admitted to trading on a regulated market or having been offered to the public (the Luxembourg Squeeze-Out and Sell-Out Law) governs the squeeze-out and sell-out of minority shareholders of a company that has its registered seat in Luxembourg by a majority shareholder. The Luxembourg Squeeze-Out and Sell-Out Law applies if all or part of a company's securities (i) are currently admitted to trading on a regulated market in one or more EU Member States, (ii) are no longer traded, but were admitted to trading on a regulated market and the delisting became effective earlier than five years ago or (iii) were the subject of a public offer which triggered the obligation to publish a prospectus in accordance with the Prospectus Directive or, if there is no obligation to publish according to the Prospectus Directive, where the offer started during the previous five years. The Luxembourg Squeeze-Out and Sell-Out Law does not apply during and for a certain grace period after a public takeover, which is or has been carried out pursuant to the Takeover Directive.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The Corporate Law was recently amended to further enhance corporate structuring. It now provides for yet better structuring of share classes and characteristics (voting or non-voting shares / shortening of the period for exercising preferential subscription). Also, new corporate forms were created, as well as more flexible provisions pertaining to the issue of bonds and holding of general meetings of shareholders. In additional, new investment fund forms were created (e.g. the unregulated reserved alternative investment fund or RAIF), which allows to swiftly set up private equity and other alternative funds to allow a time to market investment activity.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

As well as in other EU jurisdiction, Luxembourg is currently implementing several European-based legislations. Mifid (The Markets in Financial Instruments Directive) II is already implemented and currently the most recent EU directive on know-your-customer (KYC) and anti-money laundering (AML) transposed into Luxembourg law. The element of creating a register of beneficial owners is still in preparation as this entails complicated legal issues and needs further review. A final law is expected in the middle of 2018.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

To our knowledge no common mistakes or misconceptions about the Luxembourg M&A market exist.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Frequently asked questions refer to the best choice of the PE fund vehicle aiming at the M&A activities. In addition, tax is always an important element when setting up a structure. The structure needs to be tax compliant and take into view the upcoming legislative initiatives of the European Union to this regard.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

The most important measure to prepare for market's idiosyncrasies would be to seek legal, economic and tax advice at an early stage of the M&A process. All three areas should be covered right from the start of an M&A project to increase the likeliness of success.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The key factors involve complying with the provisions of the Takeover Law (described above). This includes complying with the notification and reporting requirements under such law as well as with other elements related to such activity. In particular, it needs to be assessed how the managing bodies of the takeover target are to be approached and what governmental authorities need to be notified. As explained above it is important to draw a line between the jurisdiction of registered office of the target entity and the jurisdiction where the shares are listed at the regulated market. In Luxembourg, regularly the registered office and administrative seat of the target is located in Luxembourg however the shares are admitted for trading on a regulated market not being the Luxembourg Stock Exchange. Hence, the legal impact of such discrepancy must closely be analysed before any public takeover bid is launched.

5.2 What conditions are usually attached to a public takeover offer?

The main conditions and features were mentioned already above in section 3.1

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The current market practice in Luxembourg shows that break fees are regularly negotiated at the beginning of the transaction. So this is common in Luxembourg and it is also accepted by Luxembourg service providers that a breakup fee can include a certain discount given the economic downside of an unsuccessful bid.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

There are no new current trends to this regard. The concepts mentioned above also apply in Luxembourg private M&A transactions. Completion accounts need to be presented and they may be audited or not. The locked-box mechanism might see a minimum period of six months and go up to two years.

5.5 What conditions are usually attached to a private takeover offer?

Typically, no specific provisions for a private takeover offer exist. The Corporate Law provisions apply as well as the constitutive documents of the privately owned target entity. Most likely also a shareholders' agreement might be in place, which contains provisions pertaining to drag-along, tag-along and pre-emptive rights in case of private transactions.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Share purchase agreements with view to Luxembourg-based target entities are typically drafted under and made subject to Luxembourg law. English law is also apparent on certain occasions however especially due to the current Brexit negotiations clients seem to query the risks and necessity of using English law (for private M&A transaction and in general for legal documents). This has given Luxembourg law a certain growing dominance in legal agreements and documents for Luxembourg- related transactions.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance has become more and more important over the last years and it seems to be standard at the moment to apply such insurance to private M&A transactions in Luxembourg.

5.8 Discuss the exit environment in your jurisdiction, including the market for IPOs, trade sales and sales to financial sponsors.

Exit strategies remain the standard ones. We see few IPOs as they are often prepared for an exit however in last instance a sale is then preferred over an IPO. Sales to financial sponsors are rare, however sales to or amongst PE firms seem to become more and more common.

SECTION 6: Outlook 2018

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

The outlook is positive for 2018. We expect a growing number of M&A transactions in Luxembourg itself however even more so for M&A transactions being launched from Luxembourg vehicles into other EU jurisdictions. After China tightened regulations on outbound M&A a few months ago, it now seems these regulations are again being relaxed, so we expect growing M&A activity from China via Luxembourg into other EU member states and into Latin America.

Marcus Peter |

||

Equity partner, GSK Stockmann Luxembourg Luxembourg T: +352 2718 0200 F: +352 2718 0211 Marcus Peter heads the funds and private equity practice at GSK Stockmann Luxembourg. Peter is a lawyer in Germany (since 2004) and Luxembourg (since 2005) and obtained his LLM and PhD degrees from the European Institute in Saarbruecken, Germany. Prior to GSK Luxembourg, Peter worked for a Luxembourg law firm from 2004 to 2016. Since 2017 he is a partner at GSK Stockmann in Luxembourg. Peter is an expert in Luxembourg investment funds and private equity law, M&A and corporate and real estate law. He speaks German, English, French and Russian. Peter is a member of the Luxembourg Private Equity Association (LPEA), Chinese-Luxembourgish Chamber of Commerce, DAV Luxembourg, EVER and CBBL (Cross Border Business Lawyers). |

||