1. Equity capital markets

1.1 Which companies (by industry sector) typically access the equity market? Do domestic companies typically list at home or overseas?

Most banks and government-backed companies in various sectors – real estate, telecommunications, oil and gas, etc – are listed. At present, the listings have all been domestic.

1.2 Are there restrictions on who can invest in publically traded shares on the local exchange?

Yes, there are restrictions on foreign ownership of public companies. Under the Foreign Investment Law, the maximum foreign ownership is 49%. There are exceptions to this. In some sectors the threshold varies, and the restrictions can be different in individual companies where the restrictions are specified in the articles of association.

1.3 Which bodies are responsible for rulemaking and enforcing rules on IPOs?

The primary body is the Qatar Financial Markets Authority (QFMA). The Ministry of Economy and Commerce also plays a role as it regulates companies in general.

1.4 What information must be made available to potential investors?

The QFMA sets out the provisions that must be included in the prospectus. In summary, the QFMA requires the prospectus discloses sufficient information to enable investors and their consultants to assess the costs, benefits and risks of investing in the securities and to estimate a price.

In its offering and listing rules, the QFMA includes a full list of requirements. The following are among the key points that must be included in the prospectus:

Details of issuer (company), its activities, investments and assets

Terms and conditions of offering

Details of issuer's board of directors, senior management, primary shareholders and auditors

Issuer' financial statements and constitutional documents

Details of issuer's risk factors, projections and forecasts

Details of issuer's debt at the time of the offering and its available sources of capital

Details of issuer's related party transactions

1.5 Other than IPOs, which other equity capital raising techniques are popular in your jurisdiction?

Among domestic banks, additional tier 1 and 2 bond issuances, which are treated as capital, have been popular recently.

2. Debt capital markets

2.1 What types of debt instruments are typical in your market?

Bonds are the most recognised form of debt instrument. Debt instruments with the characteristics of commercial paper and notes are also used.

2.2 Outline the regime for debt securities offerings in your jurisdiction?

The Commercial Companies Law (Law 11 of 2015) outlines the steps for the issuance of bonds by a public or private shareholding company. Under the law, the primary requirements for issuing bonds are: the articles of incorporation of the issuer must permit the issuance of bonds; the capital of the issuer must be paid up; the aggregate value of the bonds and any outstanding bonds should not exceed the capital of the issuer; the issuer's shareholders and board must have approved the issuance; and, the Ministry of Economy and Commerce and, if the issuer is a financial institution, the Central Bank, must have approved the issuance.

Additionally, if the bonds are to be distributed to more than 100 potential investors, the issuance would have to be approved by the QFMA.

2.3 Which key documents feature the terms and conditions of debt instruments?

The prospectus would typically feature the terms and conditions. The subscription agreement would feature the terms of the subscription.

2.4 In what circumstances can domestic regulators refuse to approve a public offering of debt instruments?

If the offering did not comply with the QFMA's rules and/or the Commercial Companies Law, it could be refused approval.

3. Bank lending

3.1 What are the most common forms of bank loan facilities in your jurisdiction?

Bilateral and syndicated credit facilities, term loans, working capital facilities, asset finance (including lease finance structures) and project finance.

3.2 What investor types typically participate in bank loan financings?

Local lenders and international banks based abroad. The latter are not permitted to provide financial services in Qatar, so these institutions will typically only participate in syndicated loans arranged by Qatari banks, or structure the transactions off-shore.

3.3 What legislation exists to protect creditor's rights?

The Qatar's Central Bank Law (Law 13 of 2012), requires banks and other financial institutions have simplified procedures and finance agreements that are transparent in regards to pricing and the features of the products.

Under the law, each different type of transaction is required to be governed by a separate contract. The contract must be self-contained and set out information relating to the product or service in simple form, covering the term of the contract and its nature, advantages and prices in addition to other terms and conditions. The contract may not refer to other texts or documents that the customer has not reviewed before signing the contract. Article 145 of the Central Bank Law makes it illegal to disclose customer information, whether personal or information relating to the customer's account, to any third party except with the prior written consent of said customer.

3.4 Explain the role of agents or trustees in bank loan facilities?

No specific distinction is made in the Central Bank Law. Facility agents and security agents are used in the context of syndicated loans and their role is the same as that set out in the loan market association's documentation. In most cases, a locally licensed bank will act as the facility agent if the transaction involves a local currency collection account in Qatar.

4. Islamic finance

4.1 Which Islamic finance products are most commonly used in your jurisdiction?

The commodity murabaha (deferred sale) remains a popular method of providing both term debt and working capital. Other structures in include ijarah (leasing) financing and mudarabah (sponsorship), especially where the transaction is secured against assets.

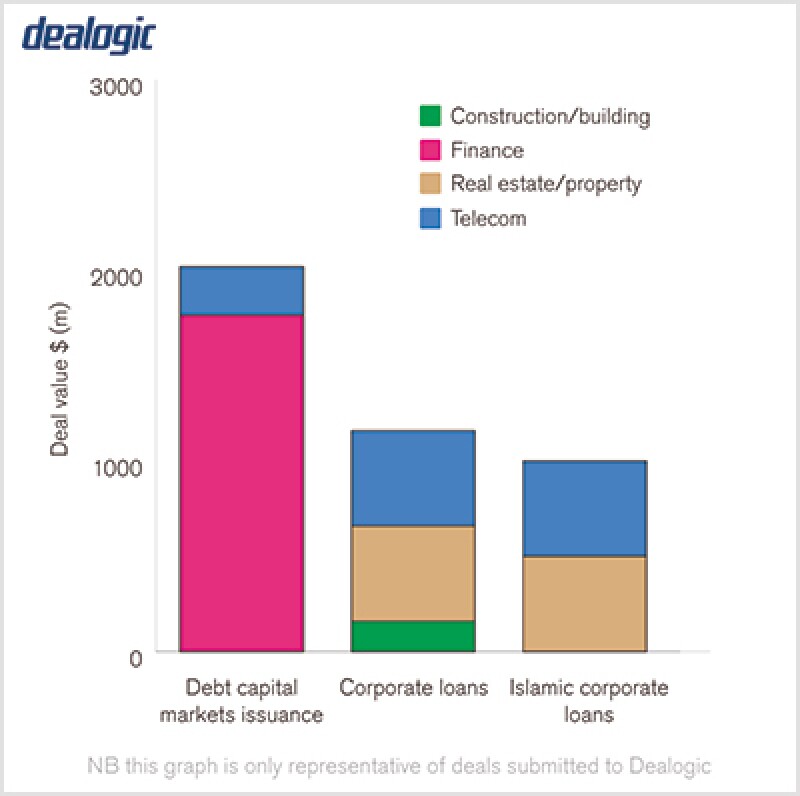

Reported fundraising in 2015: Qatar |

|

4.2 How mature is the market?

There are a number of Qatari Islamic banks and these banks are especially active on local financing arrangements. On the Islamic derivatives side, the number of active banks is still growing.

4.3 Which institutions can supply Islamic products?

Only Islamic banks licensed by the QCB (Qatar Central Bank). The concept of an Islamic window does not exist in Qatar.

4.4 Which regulations govern Islamic finance? When was it implemented?

The Central Bank Law. Additionally, the QCB issues instructions from time-to-time to provide detailed regulations.

4.5 Which bodies are responsible for regulating Islamic finance and enforcing shariah law?

The QCB is the primary regulator. Enforcement of contracts is typically done through the Qatari courts and the parties may also choose arbitration.

4.6 Outline the regime for sukuk offerings in your jurisdiction?

There is no distinction between a bond offering and sukuk offering in Qatar, except that the underlying structure of the sukuk should be shariah-compliant, so the regime is the same as that outlined in 2.2.

4.7 Which key documents feature the terms and conditions of sukuk?

The prospectus, subscription form and underlying Islamic finance documents. The Islamic finance documents would depend on the structure adopted, ijarah, murabaha, etc.

4.8 In what circumstances can domestic regulators refuse to approve a public offering of sukuk?

Providing the offering complies with the rules established by the QFMA and the Commercial Companies Law, it is unlikely there would be any grounds for refusing approval.

5. Project financing

5.1 What are the main project finance trends and developments in your jurisdiction?

Project finance in Qatar has primarily been used in the area of government projects, including those in the oil and gas, power and social infrastructure sectors.

5.2 What types of security are usually seen in project finance transactions?

The most common form of security is an assignment of receivables under off-take agreements. In addition, in some cases a pledge over the equipment is also taken.

5.3 Are there any notable exclusions, including assets which cannot be secured?

None, all assets can be secured. However, the security perfection procedures should be followed properly to ensure that the security is properly created.

5.4 What restrictions, fees and taxes exist on foreign investment in, or ownership of a project?

The type of projects that are financed using project finance are government or quasi-government projects, and there is usually a law that forms and determines the shareholding structure. That said, the Foreign Investment Law imposes a 49% cap on foreign ownership.

5.5 Is English or New York law recognised as a valid choice of law for project finance documentation in your jurisdiction?

The laws of Qatar recognise the principle of freedom of contract, which theoretically also extends to choice of law provisions. In practice, the courts of Qatar are reluctant to recognise the choice of a foreign law as the governing law of an agreement on grounds of public policy. Even if a court in Qatar is prepared to recognise a choice of foreign law, such law must be proven as an issue of fact and might still be ignored by the court. It is likely that a court in Qatar would apply the laws of Qatar in any action brought before it. In addition, the courts of Qatar would assume jurisdiction – in accordance with Law 13 of 1990 (Law of Civil Procedure) – over disputes filed before them relating to transaction documents.

6. Private equity financing

6.1 Explain the typical due diligence undertaken by private equity firms before committing financing in companies within your jurisdiction?

From a legal perspective, the due diligence would typically cover the constitutional documents needed to understand the ownership and management structure and legal restrictions on foreign ownership. Other aspects of the due diligence will include reviewing financing documents and other transactions to confirm if there are any restrictions on change of ownership.

6.2 What are the common valuation methods employed by private equity firms before committing capital?

N/A

6.3 Explain the options for structuring private equity investments in your jurisdiction?

The usual method used in Qatar is for the investor to use a special purpose vehicle to acquire a stake in the Qatari company. The financing available for an investment would typically be a shariah-compliant bank financing.

6.4 If applicable, explain how a private equity firm may invest in a shariah-compliant manner?

The issue of investing in a shariah-compliant manner will primarily rest in the nature of business of the target company. If the target company carries out a business that is not shariah-compliant – for example, an alcohol-related business – it would not be possible to invest in compliance with shariah law.

6.5 What are the documents typically used to conclude a private equity investment?

A sale and purchase agreement notarised and filed at the Ministry of Economy and Commerce.

7. Your jurisdiction

7.1 What capital raising trends have you witnessed in your jurisdiction in the past 12 months?

There have been no IPOs in Qatar recently. The primary activity has related to banks making bond issuances in the form of medium-term note programs and additional tier 1 capital instruments in order to comply with Basel III capital requirements.

About the author |

||

|

|

Rafiq JafferPartner, Al Tamimi & Company Doha, Qatar T: +974 4457 2777 F: +974 4436 0921 Al Tamimi & Company partner, Rafiq Jaffer, heads banking and finance for the firm in Qatar. His primary focusses are trade, asset and project finance, where he advises on both conventional and Islamic transaction structures. Some of his key clients include Commercial Bank of Qatar, Qatar Islamic Bank, Ahli United Bank and Standard Chartered. Jaffer's work highlights include: advising Al Habtoor Leighton Group and Al Jaber of a QAR2.4 billion financing for the construction of the Orbital Route; representing Qatar National Bank in connection with the QAR1 billion financing for the construction of the new Qatar port; and, acting on a QAR 2 billion issuance of additional tier 1 capital instruments program involving Doha Bank and the General Retirement and Social Insurance Authority, on behalf of the Civil Pension Fund. Prior to returning to the firm five years ago (he was previously a lawyer with the Doha office), Jaffer led Barclays' legal team in India and was a member of its senior leadership committee for the country. |