SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The last 12 months have seen a relative revival of public M&A activity with the acquisition by Gulf Hotel Group of Bahrain Tourism Company and the acquisition by Solidarity Group Holding of Al Ahlia Insurance Company. A clear trend in the banking industry is the entry by UAE-based investors in the capital of local investment banks, such as the acquisition by Abu Dhabi Financial Group, through its capital markets arm, of over 10% of the share capital in GFH Financial Group and the acquisition by Mubadala of 20% of the share capital in Investcorp.

Consolidation in the banking sector in the wake of the implementation of Basel III has taken place at a slower pace than was expected at the beginning of the year and this may be ascribable to both shareholders' reluctance to part with control and to the depressed valuations of banking assets. Other sectors that saw an increase in M&A activity were the education and retail sectors.

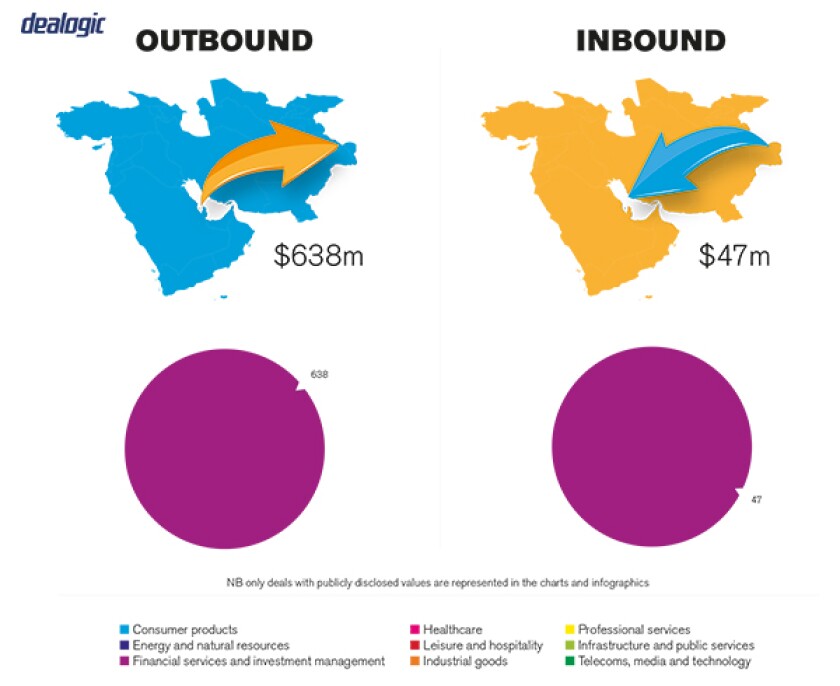

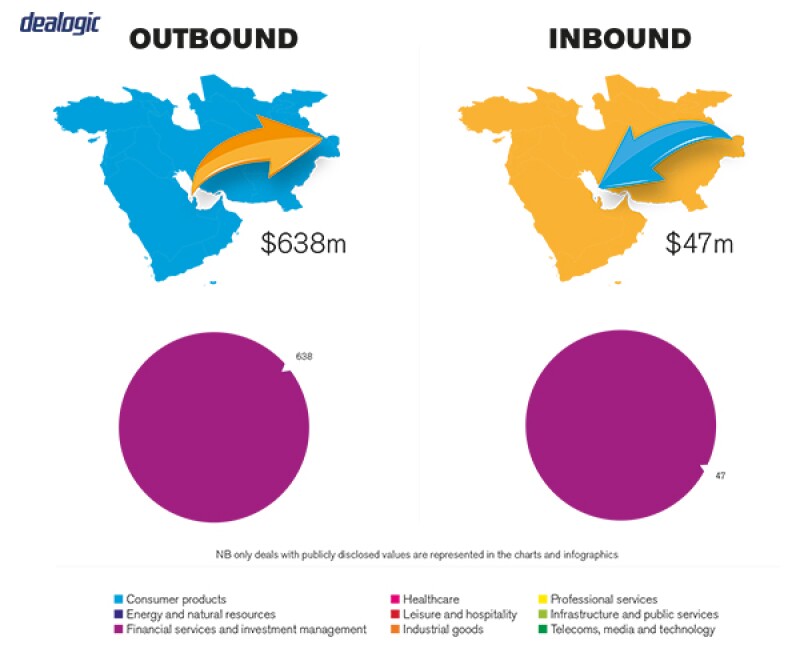

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

There has been a steady increase in the number of publicly disclosed M&A deals during the preceding three years. This has resulted from various factors including consolidation efforts by financial institutions as Bahrain rolls out regulations aligned with Basel III and mergers in the tourism industry such as between Gulf Hotel Group and Bahrain Tourism Company. We anticipate continued increase in the number of M&A transactions in Bahrain over the next 12 months.

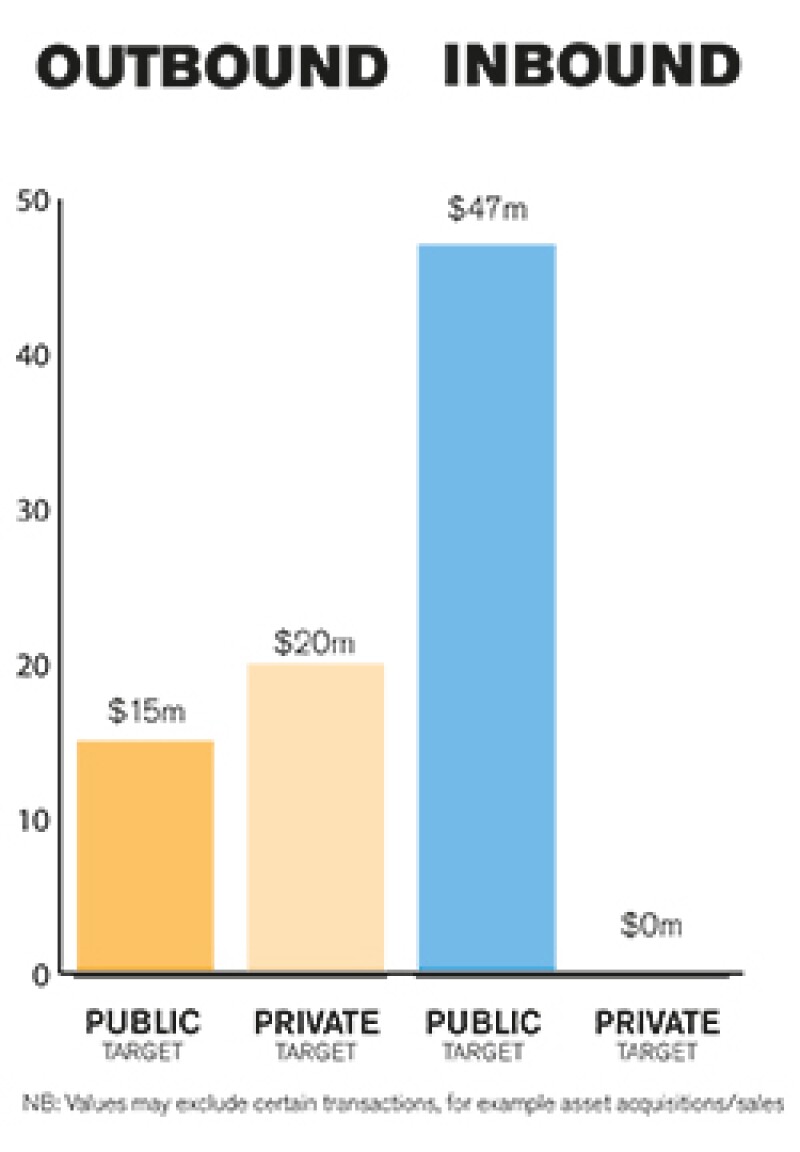

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The market is driven primarily by private M&A transactions as public M&A activity remains barely existent. The reasons underpinning such dynamics may be related to the high ownership concentration in most of the listed companies and the scarce liquidity of the stock market. A significant change of these dynamics could be triggered by a partial privatisation by the government of certain companies, which would at the same time boost market liquidity and reduce ownership concentration with positive effects on public M&A activity.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The acquisition by Gulf Hotel Group of Bahrain Tourism Company has been a notable transaction on two accounts: it was the first instance of competing offers having been put forth for the control of a Bahraini listed company and one of the few instances where a squeeze-out of non-adhering shareholders has taken place. The transaction took place by means of a swap of one newly issued share of Gulf Hotel Group share for every 2.261 shares of Bahrain Tourism Company. The issue of the new shares by Gulf Hotel Group occurred within the framework of a capital increase with a waiver of subscription rights by existing shareholders approved through the extraordinary general assembly of Gulf Hotel Group.

2.2 What have been the most significant trends or factors impacting deal structures?

Liquidity shortage and the ensuing credit crunch have impacted deal structures by decreasing the number of cash-settled transactions and increasing the number of transactions where securities are used (either alone or in combination with cash) as a form of consideration.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The main body of regulation governing public M&A is the Take-over, Mergers and Acquisitions Module (TMA Regulation) of Volume 6 of the Rulebook (Rulebook 6) issued by the Central Bank of Bahrain (CBB). It applies where there is an acquisition or consolidation of control of a Bahrain domiciled publicly listed company, or an overseas company whose primary listing of equity securities is on a Bahrain exchange. Rulebook 6, including the TMA Regulation, is administered by the Capital Markets Supervision Directorate at the CBB.

Key aspects of Bahraini regulation on public M&A include: an obligation to launch a mandatory tender offer on passing 30% of the voting share capital of a listed company (or, where the acquirer already owns more than 30% but less than 50%, upon procuring a 1% capital increase in any six months); the presence of board neutrality; and mandatory squeeze-out rules (having a 95% trigger). Unlike public M&A, private M&A is not regulated by a specific set of legislation or regulations but takes place within the broader framework of civil and commercial laws.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

There have been no recent changes that may directly impact M&A transactions. An indirect impact, however, may be caused by the recent enactment of new legislation in respect to protected cell companies and investment limited partnerships.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The CBB has recently released for consultation a revised Module TMA of Rulebook 6. The consultation document does not appear to contain substantial reforms versus the existing module; however, it reorganises and clarifies the regulations to overcome some uncertainties that have arisen under the existing regulations.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

The most common mistake made by practitioners is to import legal structures and documentation developed in other jurisdictions without a proper adaptation to the peculiarities of the local legal system. This can lead to complications in the execution phase of the transaction and in the enforcement of rights arising under M&A documents.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Due diligence remains an overlooked area. In particular, appropriate translation of due diligence findings into contractual protections, whether by means of pre-closing remedial actions, associated variation of commercial terms, special indemnities or other methods, is deficient. This often arises because the lawyers carrying out the due diligence (which are necessarily from a Bahraini licensed law firm) are not leading the negotiation of the contracts. A related uncommon item is the seller's disclosure letter, which is rarely used by sellers as an effective risk mitigation tool.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

In order to overcome the issues described above, it is advisable for clients to retain a single law firm to perform legal due diligence and contract drafting and negotiation so as to maintain a close connection between the two phases of the process and to ensure that due diligence findings translate into commensurate contractual protections. Moreover, it is crucial to ensure that transaction documents properly comport with the Bahraini legal system.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

There are two principal ways to effect a takeover of a Bahraini public company: a friendly or hostile contractual takeover offer by the bidder for the shares of the target; or a merger of the target by consolidation or by absorption into the bidder or a subsidiary or associate of the bidder (or vice versa in case of a reverse merger), noting that a merger structure would likely be unavailable in a hostile acquisition as it requires cooperation of the target's board of directors.

Key factors involved in obtaining control of a public company include some cooperation from the target's board (hostile takeovers are almost non-existent), capability of attracting passive shareholders in light of persistent uncertainties as to squeeze-out mechanics and successfully navigating regulatory approvals where implicated.

5.2 What conditions are usually attached to a public takeover offer?

Conditions normally attached include minimum acceptance levels and regulatory approvals where implicated. A mandatory tender offer cannot involve other conditions. Other conditions precedent may include bring-down of certain representations relating to key patrimonial or financial metrics and non-violation by the target of certain management covenants applicable pending the offer.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are not normally contemplated and it is highly debatable whether the board of directors of the target has the capacity and authority to agree upon break fees, especially in light of its stringent duties vis-à-vis the shareholders and particularities of the authority allocation between the board and the general assembly. For example, break fees of the naked no vote type, imposing a financial penalty on the target (and indirectly the shareholders of the target) for not accepting an offer, would very likely fall beyond the authority of the board of directors under the existing legal and regulatory framework. Similar limitations and considerations may also be applicable to break fees triggered by acceptance of alternative offers.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

The use of price adjustments mechanics connected with completion accounts-type of transactions is still the prevailing structure used in private transactions, although locked box type structures are gaining popularity especially in vendor-driven auction processes. Earn-outs are still rarely used notwithstanding their potential for bridging widening valuation gaps between vendors and buyers. Escrow or price hold-backs are instead relatively common features of private M&A transactions.

5.5 What conditions are usually attached to a private takeover offer?

The conditions precedent normally include obtainment of all regulatory approvals, bring-down of certain key representations and warranties, non-default on interim-management covenant. Also material adverse change is sometimes found amongst the conditions precedent to a private acquisition.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Yes, this remains quite common, albeit to a lesser extent versus past practice. This reduced use of foreign governing law is linked to difficulties and uncertainties connected with proving a foreign law in front of a Bahraini court in case of litigation. It should also be noted that the formal share transfer instrument must always be governed by Bahrain law and notarised in Bahrain.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

This is highly uncommon.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

We expect the revised TMA Module of Rulebook 6 to be issued by the CBB. We expect a modest increase of M&A activity (mostly private transactions) driven generally by the improved liquidity generated by higher oil prices compared to 2016 and, in respect to certain sectors, driven also by regulatory reforms and policies.

About the author |

||

|

|

Simone Del Nevo Senior associate, ASAR – Al Ruwayeh & Partners Manama, Bahrain T: 973 17 533 182 F: 973 17 533 185 Simone Del Nevo is a senior associate with ASAR-Bahrain and has been with the firm since December 2014. Del Nevo currently practises in the areas of banking, finance, securities and capital markets. Del Nevo received his law degree from Bocconi University of Milan, Italy, in 2004. He was admitted to the Milan Bar Association as a qualified lawyer in 2007. Del Nevo's practice languages are English and Italian. |