SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

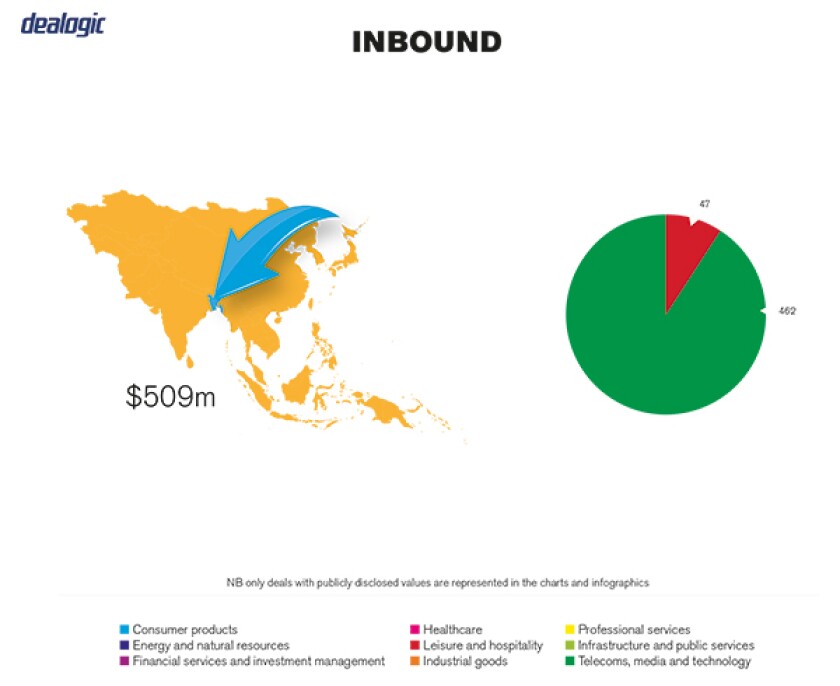

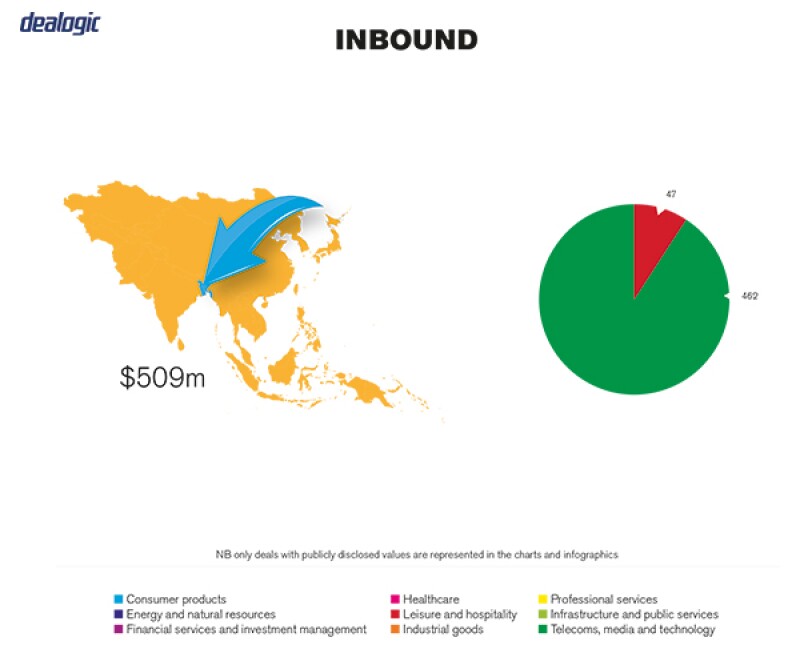

The practice of mergers and acquisitions may be considered to be at a nascent stage in Bangladesh. The lack of clear regulatory guidelines is one of the major impediments in M&A activities. However, despite the corporate and regulatory shortcomings, 2016 witnessed a number of M&A deals in the power and telecommunication sectors, the most notable being the merger between Robi Axiata and Airtel Bangladesh.

Mergers between unrelated domestic entities had been a rarity in Bangladesh, but the approval by the court and other regulators, including the Bangladesh Telecommunication Regulatory Commission and the Government of Bangladesh, of the Robi-Airtel merger may be regarded as paving the way for more mergers between domestic unconnected entities.

With the exception of Robi-Airtel, all other M&A transactions over the past 12 months (as gathered from publicly available data) were mergers between intra-group entities sharing common or related sponsor shareholders.

As most of the private acquisition transactions took place outside the public domain, there is no publicly available data about them.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

According to publicly available data, there were three mergers in 2016. This is indicative of a rising trend in M&A when compared to 2014 and 2015, each of which witnessed only one transaction.

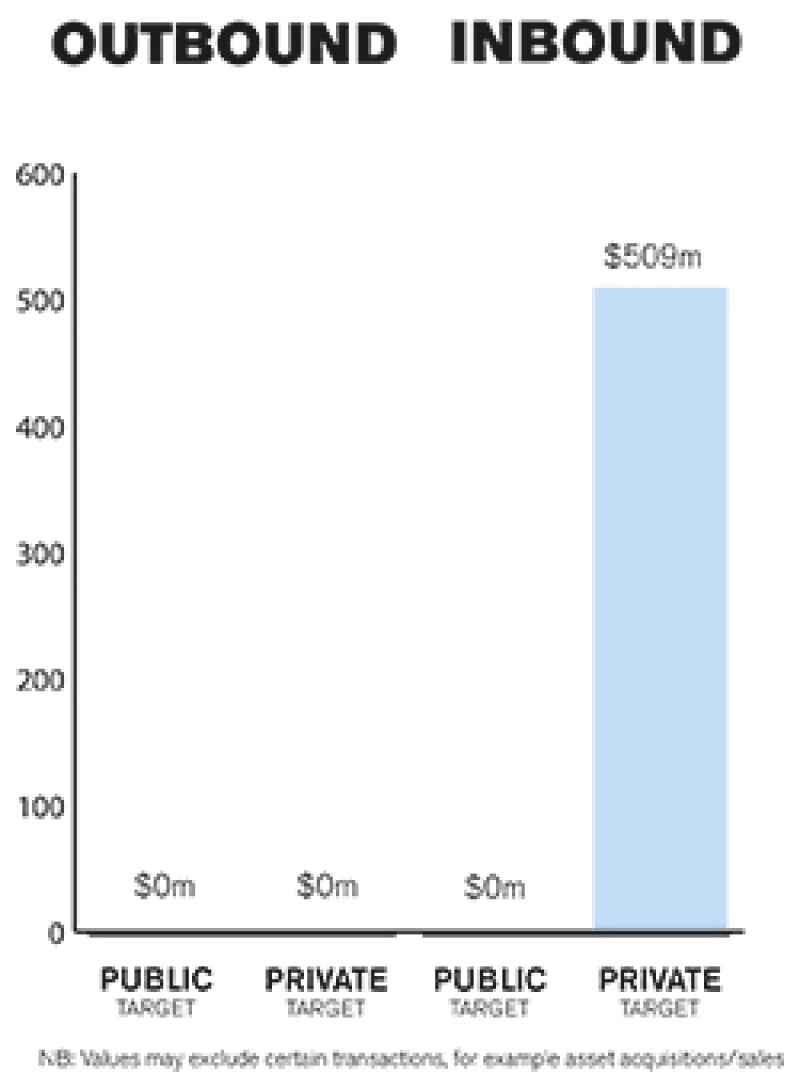

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Though there have recently been a few instances of mergers in publicly listed companies, the market is predominantly driven by private M&A. M&A transactions in private (but unrelated) companies are dictated by acquisitions as opposed to mergers. Various cross-border acquisitions in the telecommunication, energy and banking sectors during the first decade of 21st century, such as acquisitions of AKTEL by Axiata, Warid Telecom by Airtel, Sheba Telecom by Orascom Telecom and Oriental Bank by ICB Financial Group, are testament to this.

On the other hand, restructuring between intra-group entities (regardless of their private or public status) usually takes place by way of merger, as is exemplified by the recent mergers of Summit Narayanganj Power, Summit Uttaranchal Power Company and Summit Purbanchol Power Company (listed) with Summit Power (listed) and of Khulna Power Company Unit II with Khanjahan Ali Power Company and Khulna Power Company (listed).

Bangladesh Securities and Exchange (Substantial Acquisition and Takeover) Rules, 2002 (2002 Rules) caters for takeovers where any person is interested in acquiring ten percent or more shares of a publicly listed company. However, the 2002 Rules are regarded as inadequate for the modern dynamics of the capital markets. Hence, as of now, companies usually seek and obtain an exemption from Bangladesh Securities and Exchange Commission from compliance with the provisions of 2002 Rules. The regulator itself appears to have acknowledged the insufficiency of the 2002 Rules in reaching fair valuation.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Robi-Airtel merger

Robi Axiata and Airtel Bangladesh, both of which are mobile phone operators in Bangladesh, entered into merger talks in September 2015. Upon requisite approvals from the respective boards of directors, on October 14 2015, an application under Section 228 and 229 of the Companies Act 1994 was filed before the High Court Division, Supreme Court of Bangladesh, which was eventually sanctioned by the Hon'ble Court on July 14 2016.

Though the value of the Robi-Airtel merger was undisclosed, in view of the fact that the merger would affect a large consumer base and revenue earnings of the government, it was apparent that a merger of this scale was being proposed for the first time in Bangladesh. Consequently, in sanctioning the merger, the court embarked on a detailed analysis that will be taken into account in considering the merger application. The judgment indicated that public interests comprising a diverse range of socio-economic factors, such consumer interest, government revenue and employment, shall be carefully considered in sanctioning an application for merger.

The Hon'ble Court also elucidated that where necessary, the court would, by resorting to its inherent jurisdiction, devise ways and means to enable various interest groups and stakeholders to air their concerns regarding a proposed merger. Furthermore, the direction of the Hon'ble High Court to formulate retirement plans for the employees of the transferor company, Airtel, goes on to show that in approving a scheme of amalgamation, the court will be mindful of fairness to the employees.

Following the transaction, Axiata, the parent company of Robi, holds a 68.7% controlling stake and Bharti Airtel holds a 25% share in the company. Axiata's old partner NTT Docomo of Japan holds 6.3% of stake. As a consequence of the merger, the transferee company became the second largest operator in the country, both in terms of subscribers and revenues, whereas, in terms of subscribers, in individual capacities, Robi was the third and Airtel was the fourth largest telecom company.

Merger of Summit Narayanganj Power, Summit Uttaranchal Power Company and Summit Purbanchol Power Company with Summit Power

Although this was an intra-group merger, as with Robi-Airtel, in sanctioning this scheme of amalgamation, the Hon'ble High Court has laid down important guidelines as to the extent of the court's power in determining an application filed before it for the approval a scheme of amalgamation under section 228 and 229 of the Companies Act, 1994. The court clarified that its jurisdiction under the section 228 and 229 is of a supervisory nature and that it shall not replace the valuation approved by the shareholders with its own calculation. Overall, the court demonstrated an inclination to defer to the commercial wisdom of the parties to the scheme and a general willingness to approve the proposed scheme, provided the legal requirements are complied with and the proposed scheme is reasonably sound.

2.2 What have been the most significant trends or factors impacting deal structures?

As the market is still developing, strategic investments rarely take place in Bangladesh. With the exceptions of a few acquisition deals, the market is primarily dominated by intra-group mergers. While most such mergers occur on the ground of increased profitability, in many cases, the profits of the entities involved decline, and historically, achieving tax neutral reorganisation has been the primary goal for mergers.

If a company is acquired by way of share purchase, the said transaction will attract stamp-duty of 1.5%, as well as capital gains taxes from the seller; by the same token, if there is a transfer of immovable property, the transaction will attract a hefty tax of 8-11% of the transaction value, on account of stamp duties, registration charges, capital gain tax and advance income taxes. By contrast, any transfer of shares and assets as a result of a merger is deemed to be effective by operation of law, alleviating any need to pay of taxes and stamp duties on such transactions.

Furthermore, in the absence of any provision in the Income Tax Ordinance, 1984, regulating carry forward of losses in the event of amalgamation, presumably, the accumulated loss of the transferor company will be deemed to be the loss of the transferee company. Consequently, the transferee company would be entitled to carry forward such loss, and set off such amounts against its future profits, reducing tax liabilities of the transferee companies.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

Key legislation

The Companies Act 1994 contains the broad conditions for transfer of shares, relevant in an acquisition/takeover transaction. Moreover, where a merger is under consideration, one has to resort to sections 228 and 229 of the legislation, which lay down guidelines for concluding arrangements with shareholders as well as the power of the High Court Division to sanction a scheme of arrangement/ amalgamation.

The Bangladesh Securities and Exchange Commission (BSEC) (Substantial Acquisition of Shares and Takeovers) Rules, 2002, has been promulgated by the capital markets regulator of Bangladesh to regulate public takeover/acquisition activities. But, as has been pointed out in Section 1.3, the 2002 Rules are seldom applied in practice.

As anti-takeover defence, section 15 of the Competition Act, 2012 prohibits direct or indirect execution of any takeover by any person that would have detrimental effects on competition or create monopoly or oligopoly in the market. However, this Act empowers the Competition Commission to deal with complaints under the Act, which has been formed, but yet to be fully functional.

Section 18 of the Foreign Exchange Regulations Act, 1947, mandates that permission be obtained from Bangladesh Bank for any act whereby a company, which is controlled by persons resident in Bangladesh, ceases to be so controlled. However, pursuant to the general permission granted by Bangladesh Bank in Chapter IX, Guidelines for Foreign Exchange Transactions, Volume 1, the requirement to obtain this permission may be deemed to have been waived.

In addition to the above, sector specific laws, rules and regulations, guidelines, and policy decisions may also be applicable. For example, M&A deals in the telecommunication sector will be subject to provisions of Bangladesh Telecommunication Act, 2001, Telegraph Act, 1885 etc.

Key regulatory bodies

BSEC is the key regulatory body for M&A transactions. However, there is no explicit requirement to consult or seek permission from BSEC for undertaking an M&A transaction unless the proposed transaction results in its paid up capital being BDT100 million ($1.25 million) or more (a requirement triggered by the rules regulating issue of capital, as opposed to M&A). Consequently, in mergers involving a cash consideration or paid-up capital of less than BDT100 million, it is possible to disregard BSEC.

As far as public takeovers are concerned, it is worth noting that in the present environment of non-enforcement of 2002 Rules, BSEC has limited scope in scrutinising such transactions.

Besides BSEC, depending on the sector in which the proposed M&A deal is to take place, particular regulators, for instance the Bangladesh Telecommunication Regulatory Commission (BTRC), Bangladesh Power Development Board (BPDB), Bangladesh Bank (BB) and Insurance Development & Regulatory Authority Bangladesh (IDRA), may take up the role of regulating M&A activity.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

In the last 12 months no such changes in the regulation and/or regulator have been made that may impact in M&A transactions or activity in Bangladesh.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Considering the limitations and inadequacies of existing regulatory frameworks, BSEC, the key regulatory authority for capital markets, formed a committee in 2016 to revise the existing rules and formulate new rules for regulating M&A activity in Bangladesh.

It is expected that if BSEC issues its guidelines, M&A transactions will have to comply with certain new rules and it will make the process more transparent, formal and systematic.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Corporate culture is relatively new in Bangladesh and traditionally many of the large businesses are proprietorship or family businesses. In the existing conservative corporate scenario, selling/dissolution of a business is considered a taboo by many established entrepreneurs. Tax neutral reorganisations, let alone strategic mergers, are often overlooked as a viable option for achieving better growth. In the absence of a clear regulatory framework, the practice of M&A is viewed as cumbersome by many.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Valuation: in the absence of any regulatory guideline as to the methods and basis of valuation to be adopted during M&A activities, companies, particularly in intra-group mergers, may opt for methodology yielding higher valuation. As a result, propriety of valuation bears the possibility of becoming a highly contested issue before the court in considering an application for approval of a scheme of amalgamation.

Financial statements: during the planning stage, some companies may overlook financial statements. Consequently, where cash pay-out is involved, there might arise irreconcilability between the amounts available on the balance sheet and the amount agreed to be paid against the shares, creating a gridlock during the post-sanction and post-closing stage.

Regulatory compliance: due to underdeveloped corporate cultures, many companies fail to secure annual regulatory compliances, including filing with Registrar of Joint Stock Companies. This may lead to discovery of several flaws during the due diligence stage requiring rectification. As a result, the proposed M&A may end up being a far more time consuming activity than initially foreseen.

Disclosure to public shareholders: in the absence of any regulatory provisions imposing strict disclosure requirements, listed companies' disclosure is limited to the publication of price sensitive information, which does not mandate giving details to the public of the effects of a proposed M&A transaction or how the interests of sponsors are affected consequent to a merger. Consequently, it becomes difficult for the small investors to reach an informed decision on a proposed M&A. Moreover, without any regulatory prohibition or existence of an overriding supervisory authority (except in a limited way, as discussed in Section 3.1), it may be possible for unscrupulous companies to be wound-up through mergers, to the prejudice of public interest.

Interests of employees: though mergers may involve redundancies of employees, the interests of employees are often overlooked during the planning stage so that companies involved do not take enough precautions, such as preparing voluntary retirement schemes or other compensatory schemes before presenting the proposal for sanction before the Hon'ble High Court Division.

Winding-up of merged company: the transition period is not considered during the planning stage. It is not clear whether the transferor companies should continue to comply with regulatory requirements and file income tax returns, after sanctioning of the scheme.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Setting up a clear regulatory framework should be the first step towards addressing the misconceptions about M&A in Bangladesh. In addition to this, creating awareness about the importance of regulatory compliance, transparent financial reporting and tax structures, as well as improving the overall business cultures, would go a long way towards busting various myths surrounding M&A activities in Bangladesh.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

As has been discussed in Section 1.3, takeovers of public companies by way of public offers are not common. Consequently, there is very limited information available on these transactions. From what can be gleaned from public data, a number of notable takeover transactions during the first decade of 2000 were undertaken to revive a sick company or to enter the Bangladesh market.

Recently there had been several intra-group horizontal mergers between listed companies seeking operational efficiency and cost reduction.

5.2 What conditions are usually attached to a public takeover offer?

Since public offers have hardly been made (see Section 5.1) it is not possible to answer this.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The practice of break fees is absent in Bangladesh.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

These mechanisms are not practised in Bangladesh.

5.5 What conditions are usually attached to a private takeover offer?

Any private takeover offer would usually be associated with the following conditions:

obtaining of approvals from relevant regulatory authorities such as BTRC, BPDB and BSEC;

obtaining No Objection Certificates from the lending banks;

obtaining the latest tax clearance certificate;

rectifying any regulatory defects revealed during the due diligence process, including renewal of licences and approvals.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

This is not a common phenomenon in Bangladesh. Since in acquisition transactions share transfer registrations are to be regulated by local law, it is usual to stipulate Bangladesh law as the governing law of the share purchase agreements.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

There is no such practice of warranty and indemnity insurance in Bangladesh.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

As the Bangladesh economy is growing, it is likely that many companies will seek mergers to achieve inorganic growth by downsizing costs. Prospective sectors for mergers are banks, financial institutions, pharmaceuticals, healthcare, real estate, textiles, cement, steel, power and telecommunication, among others. In the next 12 months, consolidation of a few banks by way of merger is highly probable. It is expected that globalisation and developed corporate cultures will make the new generation of entrepreneurs open to strategic investments through M&A.

Currently, BSEC is working on a draft regulation for M&A. It is hoped that the proposed regulation, when published, will fill in the legislative vacuum and set objective standards against which a proposed M&A transaction can be evaluated. Furthermore, it is expected that the regulation will alleviate many misconceptions surrounding M&A in Bangladesh and bring transparency in the regulatory process so as to create an environment more conducive to M&A.

As demonstrated by the Robi-Airtel and Summit mergers (see Section 2.1), with growing numbers of mergers each passing year, the court will be providing more clarity and guidance on the factors to be considered and role to be played by the court in considering applications for sanctioning of schemes of amalgamation.

About the author |

||

|

|

Farhana Khan Partner, A S & Associates Dhaka, Bangladesh T: 88 02 9561540 F: 88 02 9561476 Farhana Khan is a partner of A S & Associates. She is enrolled as an advocate of the Supreme Court of Bangladesh. She completed her PGDL, LLM and LLB (Hons) program in the UK. Khan is a member of the Honourable Society of Lincoln's Inn (UK), the Supreme Court Bar Association, Dhaka Bar Association and Taxes Bar Association. Her knowledge and areas of expertise include M&A, corporate financing, private equity, telecommunication, and constitutional law. She was part of the high profile consultant team drafting the proposed revision to the Companies Act and the Telecommunication Rules of Bangladesh. |

About the author |

||

|

|

Dewan Faisal Senior associate, A S & Associates Dhaka, Bangladesh T: 88 02 9561540 F: 88 02 9561476 Dewan Faisal is a senior associate of A S & Associates and an advocate of the Supreme Court of Bangladesh. Faisal practises in the fields of restructuring, M&A, corporate financing, real estate, banking and financial matters and taxation. He is the team leader of corporate financing and capital markets, as well as for the energy and power sector at A S and Associates. |