SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

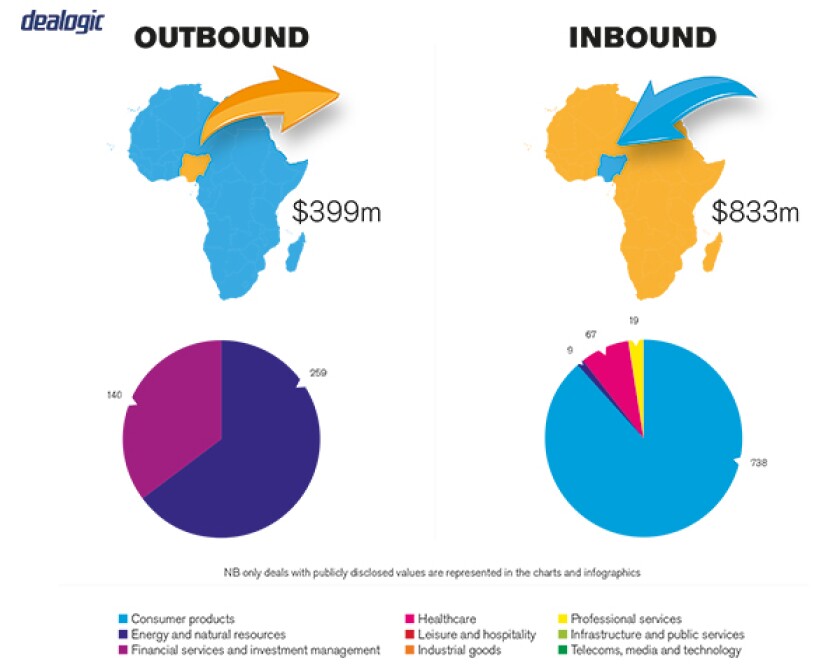

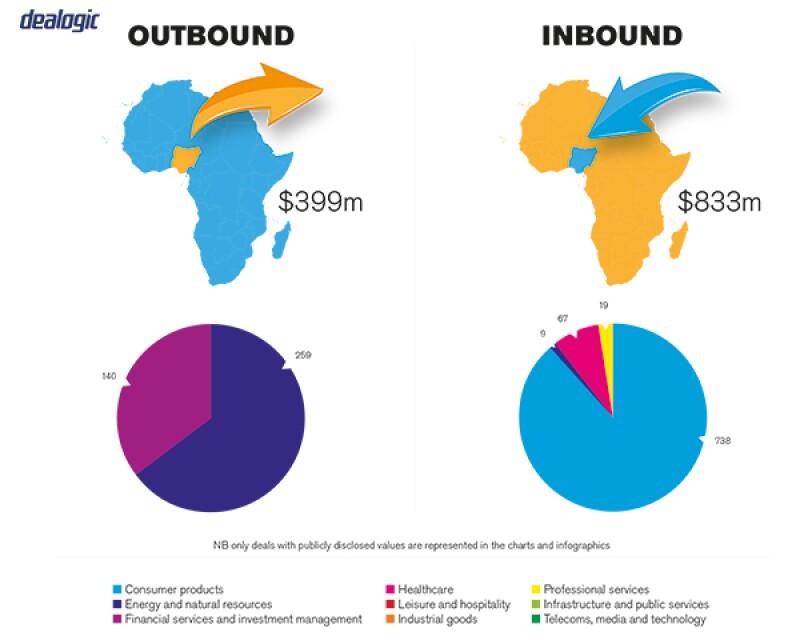

The impact of the global decline in oil prices on Nigeria's foreign exchange earnings and reserves, the resulting currency depreciation, a degree of regulatory uncertainty early in 2016, a decrease in home remittances by Nigerians abroad and lingering forex liquidity challenges contributed to a discernible decrease in foreign direct and portfolio investment and in M&A activities in Nigeria in 2016.

Notwithstanding this, however, and in addition to an increase in restructuring and consolidation activity to address the economic challenges, Nigeria continued to attract in excess of $1.9 billion in reported M&A and investment (including private equity) deals in 2016 across diverse sectors including, notably, in the financial services, financial technology, power, FMCG, food and beverage, insurance, travel, TMT, real estate and agricultural sectors.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

The decline in the number and value of M&A deals in Nigeria following the 2014 high continued in 2016, with global volatility in crude oil prices, the resulting drop in forex earnings and uncertainty about the economy contributing to the trend. Notwithstanding this, however, and based on publicly available data, at least 18 concluded M&A and investment transactions accounted for at least $1.9 billion in Nigerian deal value in 2016, compared with 25 deals reportedly accounting for $3.2 billion in 2015.

Nigeria remains an important investment destination, accounting for 43% of deal volume and 64% of reported private equity deal value in West Africa between 2010-2016 H1. M&A activity in the financial services, consumer discretionary, real estate, consumer staples and energy sectors reportedly accounted for 76% of the volume and 56% of the value of deals in Nigeria from 2010-2016 H1.

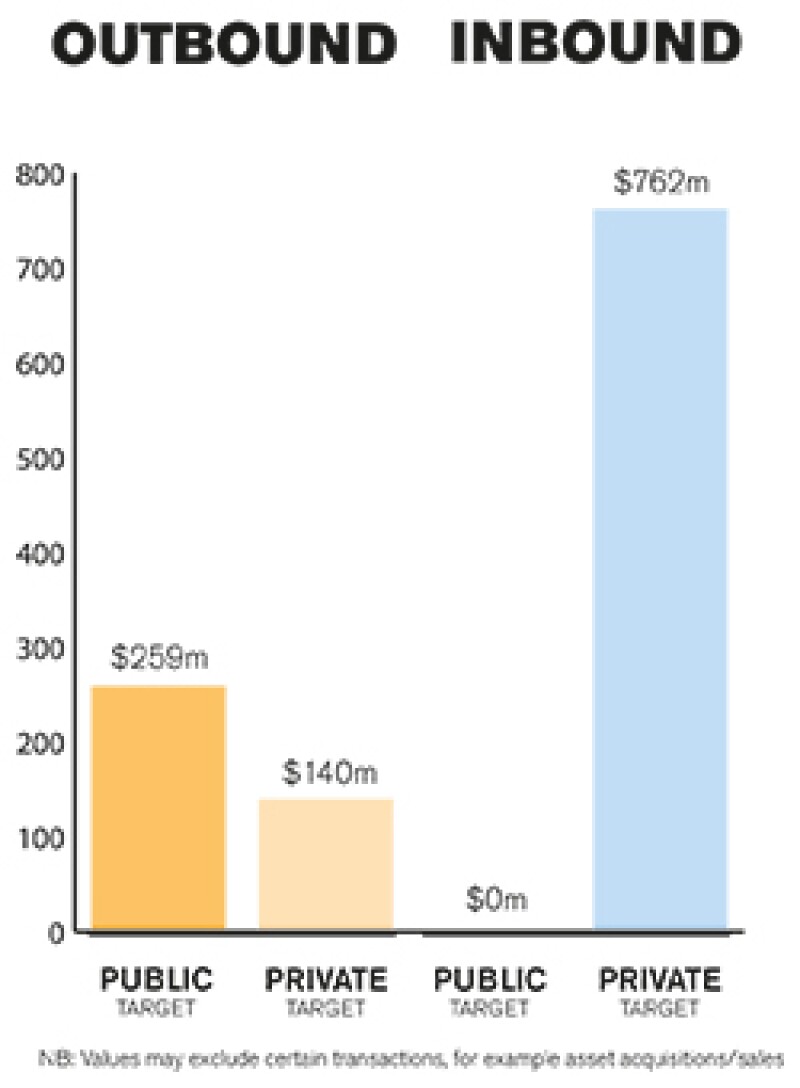

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Both public and private M&A transactions drive the Nigerian market, although weak capital markets and private equity activity may explain the ascendancy of private transactions in 2016.

The Investment and Securities Act 2007 (ISA) empowers the regulation of securities and of competition in public and private M&A deals by the same regulator, the Securities and Exchange Commission (SEC). There is little distinction in the treatment of public and private M&A transactions – for instance, regulatory approvals are required for both, and processes for business restructuring and consolidation by or between related or group entities are more streamlined than for unrelated entities in both contexts.

Notably, however, the ISA only imposes the obligation to make mandatory takeover offers in public takeover transactions, subject to prescribed thresholds. Acquisitions via subscription rather than transfer are treated differently and listed entities are subject to additional regulation by the stock exchanges on which they are listed.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

As indicated in 1.1, the diversity of the sectors in which M&A activity was prevalent is interesting. For instance significant investments were made in the agricultural sector (Abraaj's investment in Indorama Fertilisers); in the food and beverage sector (Olam's acquisition of BUA Flour and BUA Pasta, 8 Miles, ACA and DEG's co-investment in Belloxi, CocaCola's investment in CHI and Suntory Beverages Investment in GSK Beverage Business); in the FMCG sector (Ajinomoto's investment in Promasidor); in the TMT sector, MTN invested in Visaphone; IHS Holdings' in HTN Towers, and Synergy in Africa Terminals, MSY Analytics Group, and Suburban Fiber Company respectively; in the insurance sector, MMI Holdings invested in UBA Metro Insurance and SwissRe invested in Leadway Assurance. ACRF (and AFIG fund) acquired a minority stake in FSDH Merchant Bank, Helios invested in Oando Gas & Power and the IFC invested in Hygeia – illustrating an increasing focus on health sector related M&A activity that appears to be continuing into 2017.

2.2 What have been the most significant trends or factors impacting deal structures?

In relation to structures, M&A and investment transaction structures appear to have evolved and to have been devised to address, or at least mitigate, potential exposure to current economic challenges. Certain transactions utilised convertible note and convertible equity-linked note structures (both secured and unsecured) in preference to traditional equity acquisitions, signalling the increasing interest in mezzanine finance and alternative capital structures.

The adoption of offshore structures and use of special purpose vehicles registered in countries with which Nigeria has double tax treaties continued, for tax efficiency and presumably to facilitate exit planning, to mitigate exposure to currency volatility and strengthen secured debt and equity investments.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

Key legislation regulating M&A activity in Nigeria include the ISA, the SEC's Rules and Regulations (SEC Rules) and the Companies and Allied Matters Act (Chapter C20) Laws of the Federation of Nigeria, 2004. The SEC regulates M&A activity together with sector-specific regulators depending on the target's business. Nigeria does not yet have a competition-specific law or regulator. The listing rules of the Nigerian Stock Exchange (Listing Rules) apply to M&A deals involving listed companies.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

In 2015, the SEC made extensive amendments to the SEC Rules governing M&A transactions, the most significant being the streamlining reduction of the filing process from a three-stage to a two-stage procedure to fast track approvals of such transactions. Thresholds for transactions requiring regulatory approval and penalties for non-compliance were also increased.

In a bid to stabilise the forex market and mitigate liquidity challenges, the Central Bank of Nigeria (CBN) introduced a flexible forex market in 2016, one consequence of which is that foreign investors are now able to convert their capital into naira at a market-determined exchange rate.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The National Assembly is reviewing another Competition and Consumer Protection Bill, which seeks to establish the Federal Competition and Consumer Protection Commission to promote and maintain competitive markets in Nigeria and to prohibit restrictive business practices that prevent, restrict or distort competition or constitute an abuse of a dominant position of market power in Nigeria.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Due to the dual role of the SEC as both a competition and securities regulator with respect to M&A transactions, there is no real distinction in the process and procedure for public and private M&As and as such, non-Nigeria investors will find that they are required to appoint a full suite of professional advisers for private M&A transactions. The SEC, in reviewing transaction documents for M&A transactions, can purport to regulate commercial terms for parties - and the timing of its statutorily-required prior review and approval of M&A transactions is subject to its discretion following submission, which investors sometimes find unusual.

Certain language in the ISA has also led to some confusion as to when an asset sale will constitute a merger and, separately, whether a merger can be concluded by any means other than through a scheme of arrangement.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Parties' questions typically relate to the regulatory regime and structuring advice. Investors frequently request confirmation on whether offshore transactions involving foreign entities that have interests in Nigerian companies require regulatory approval in Nigeria. In addition, investors are increasingly concerned about ESG, ethical integrity and political due diligence, which could have adverse reputational implications.

With respect to overlooked areas, parties may not typically consider the fact that a merger could arise from a contractual sale of a company's assets and, as such, may be subject to SEC review. The timing for mandatory pre-transaction regulatory review and approvals, which can vary widely in Nigeria, is often overlooked or underestimated, as well as the extent of the regulator's power to require additional information and documents to facilitate such reviews must be factored into deal timelines to ensure that they are realistic.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Given the current legal framework, parties should engage experienced advisers in Nigeria at the earliest stages of the structuring and deal process – even for transactions in which Nigerian transactional elements will be indirect or are secondary to the main offshore transaction – in order to identify and address potential issues and to avoid pitfalls.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Key factors in obtaining control of a public company in Nigeria include: the willingness of majority shareholder(s) to sell their shares or to procure the issuance of shares conferring majority control to the investor; whether the transaction is one driven by the need for liquidity in order for the target to be bound as a counterparty; the willingness of the target and its management to facilitate meaningful due diligence reviews; and conflicting interests in the management of the company and where the transactions involve key shareholders' voting and other governance agreements, the integrity and commitment of the counterparties – particularly founders who remain in the business post-transaction – to the control arrangements.

Other factors include compliance with mandatory takeover requirements, viability of schemes of arrangement to acquire control and in relation tom listed companies, free float requirements.

5.2 What conditions are usually attached to a public takeover offer?

The Nigerian market has not witnessed many public takeover offers; mandatory public takeovers – which have not been many – have been more common in Nigeria than voluntary takeovers and limited in the extent to which conditions may be attached to them. Such conditions have included prescribed minimum thresholds for shareholding.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are now not uncommon in Nigerian M&A deals particularly in public M&A deals where the investor provides liquidity to a company and in public company merger implementation agreements.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Locked box mechanisms, completion accounts and escrow arrangements appear to be more common in private M&A agreements. Outside of the private equity space, earn-out arrangements are not as common as sellers and targets are seldom amenable to earning part of the consideration based on the performance of the business.

5.5 What conditions are usually attached to a private takeover offer?

The ISA does not recognise – and expressly excludes from its application – takeover offers in the context of private company acquisitions. A takeover bid is not required and cannot be made to acquire shares of a private company under section 133(4) of the ISA.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It is not unusual to have M&A share purchase agreements governed by foreign – usually English – law, particularly to expedite dispute resolution. Any mandatory provisions of Nigerian law including regulatory approvals, governance and compliance issues applicable to the Nigerian target will, however, apply irrespective of the choice of foreign law.

The Nigerian Supreme Court has asserted however that a choice of foreign law will not, however, be regarded as conclusive where such foreign law has no relationship to, or connection with, the realities of the contract as a whole. In certain limited circumstances, therefore, Nigerian courts may, in exercising their discretion, assume jurisdiction notwithstanding the express choice of another jurisdiction by the contracting parties based on a consideration of various factors including the applicability of the foreign law and its difference in material respects from Nigerian law and whether the plaintiffs would be prejudiced by having to sue in the foreign court.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is gaining traction in M&A acquisitions involving foreign entities, particularly private equity investors in particular sectors, but is not yet wholly prevalent and appears to be offered only to a limited extent for specific risks. Parties to private M&A transactions commonly escrow a portion of the purchase consideration to address or mitigate warranty or covenant risks.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Various factors suggest that there will be improvement in M&A deal flow in terms of value and number in 2017 as measures to address forex liquidity challenges are implemented and the resilient market adopts long term strategies and alternative capital structures to address the economic challenges. M&A activity in specific sectors may be spurred by legal and regulatory policies targeting struggling businesses in certain sectors. Such deals may create or lead to stronger entities emerging from ongoing mergers, consolidations and restructuring initiatives aimed at buoying struggling businesses.

About the author |

||

|

|

Folake Elias-Adebowale Partner, Udo Udoma & Belo-Osagie Lagos, Nigeria T: 234 1 4622307 10 W: www.uubo.org Folake Elias-Adebowale is a corporate partner and head of the firm's private equity and oil and gas teams. She currently acts as co-chair of the legal and regulatory committee of the African Venture Capital Association. |

About the author |

||

|

|

Ogonna Chinedu-Eze Senior associate, Udo Udoma & Belo-Osagie Lagos, Nigeria T: 234 1 462 2307 10 F: 2341 462 2311 E: Ogonna.Chinedu-eze@uubo.org W: www.uubo.org Ogonna Chinedu-Eze is a senior associate in the firm's corporate and commercial practice. Her specialisations include capital markets, corporate law, mergers and acquisitions, corporate restructuring and funding, insolvency and Islamic finance. |