SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

A significant number of private equity firms have been seeking exits from their investments in Egypt and new ones penetrated the Egyptian market for the first time (for example NBKC).

The majority of M&A transactions tend to occur in sectors such as food and beverage, retail, healthcare and education. Also, heavy industry has been one of the most attractive overall sectors for corporate M&A activity.

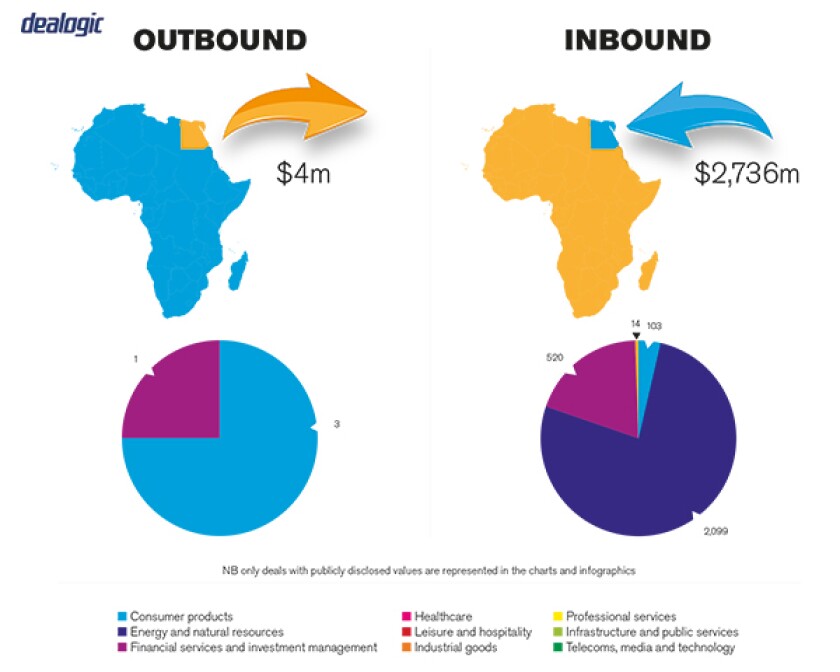

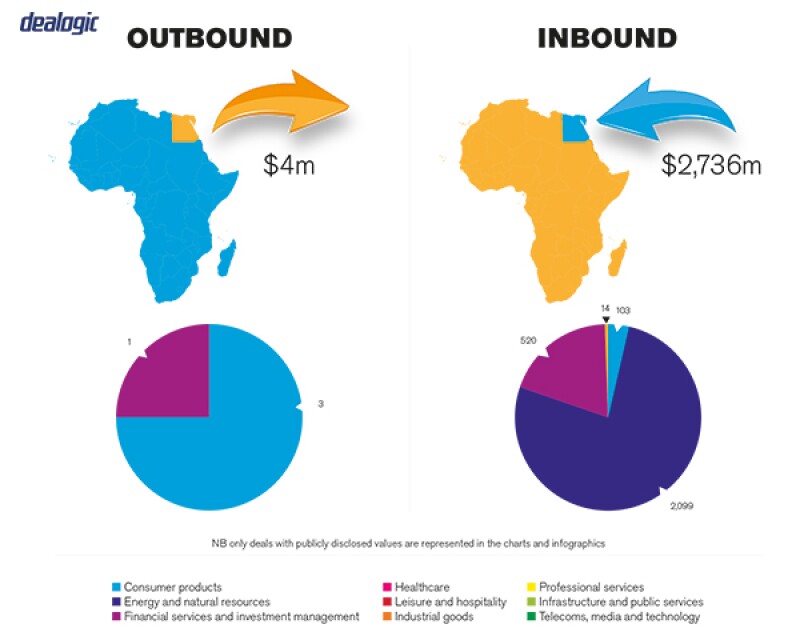

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

There is no doubt that M&A deal flow in 2016 has been adversely affected by the recent economic policies which the government has embarked on and accordingly, the aggregate transaction value has decreased compared to 2015. Q4 2016 was impacted by the floating of the Egyptian pound, which hindered the completion of a number of pre-arranged deals.

Nevertheless, 2016 ended strongly with several deals, the biggest of which was the National Service Authority and Litat Group's majority acquisition of Solb Misr. The transaction value was $1.2 billion, which was the highest value deal announced in 2016.

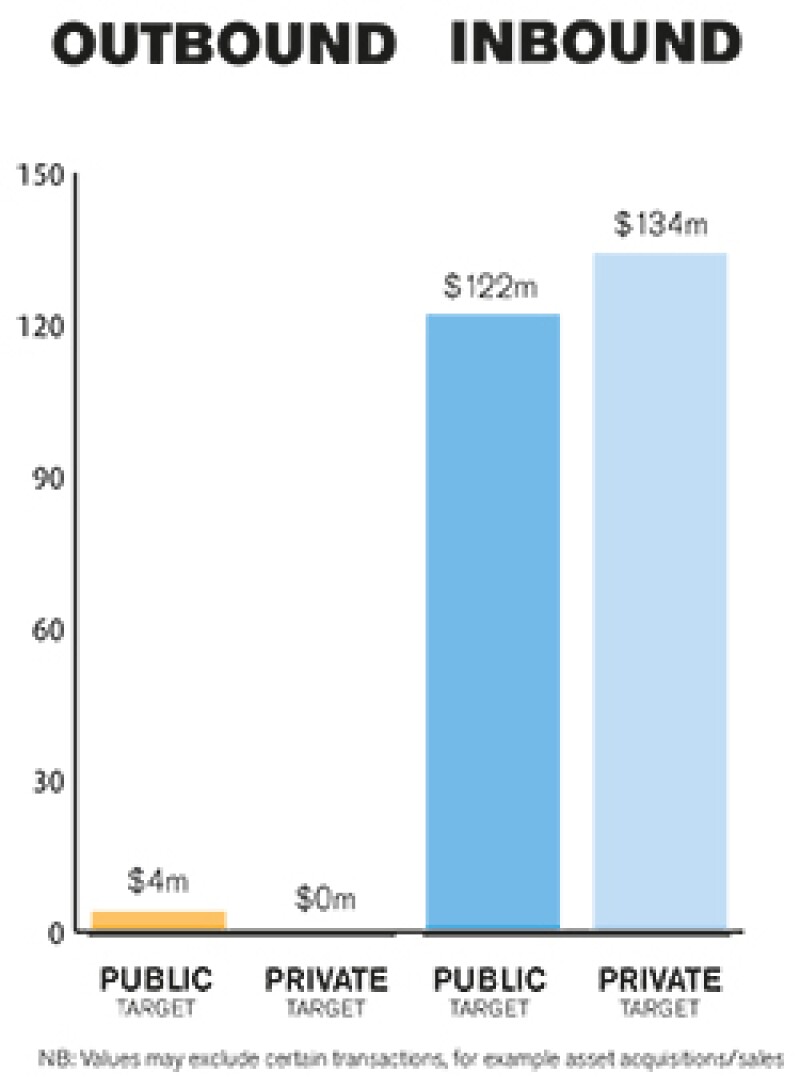

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Egyptian market has a recent tendency towards public M&A transactions for exit purposes of big scale businesses; albeit the market focus was mainly towards private M&A transactions in Q3 and Q4 of 2016.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Matouk Bassiouny acted as transaction counsel on the majority acquisition of Solb Misr, advising both the National Service Authority under the supervision of the Assistant Minister of Defense General and Litat Group.

The pre-closing structure of the target included a publicly subscribed company which was not part of the transaction. The structure had to be altered for closing purposes, so the seller divested from the undesired vehicle through an MTO process prior to closing.

The parties also entered into various negotiations with the creditors of the target company in relation to financial debts and underlying securities, including pledge of the target's shares and the impact of the change of shareholding structure post-closing. The parties reached an arrangement with the creditors to release the pledge of shares against other securities to enable the buyer to conduct the purchase of shares.

Furthermore, the parties faced a hindrance during the last phase of the transaction due to the float of the Egyptian pound, which required creativity to overcome. The parties opted for financing strategies including assignment of debt and adjusted the purchase price accordingly.

2.2 What have been the most significant trends or factors impacting deal structures?

The most common factors that impact deal structures are restrictions on direct foreign ownership in relation to certain sectors, inter alia, higher education, importing vehicles and commercial agents. Such restrictions are usually overcome through restructuring and adding multiple SPVs.

Furthermore, financing can be a challenging factor for acquisition finance. However, the constraints of securities and restrictions adopted by financial institutions may prevent closing the deal.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

M&A is regulated in Egypt by diverse legislation, which includes the Egyptian Companies Law 159 of 1981 and its executive regulations governing, inter alia, corporate governance issues, and the Capital Market Law 95 of 1992 and its executive regulations (Capital Market Law) governing mainly listed companies and publicly subscribed companies. Particularly, M&A deals involving unlisted shares are subject to the Egyptian Companies Law and EFSA decrees while M&A for listed shares are regulated by the decrees promulgated by the Egyptian Financial Supervisory Authority (EFSA) and the Egyptian Exchange (EGX).

The regulatory bodies that govern M&A activity in Egypt are the General Authority for Investment and Free Zones (GAFI), EFSA and EGX.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Towards mid last year, EGX introduced a key change in relation to transacting over unlisted shares by virtue of Decree 135 dated May 31 2016, whereby the parties to any unlisted shares transaction, where the value exceeds EGP£100,000 ($6,250) or which involves parties outside of Egypt, must deliver evidence of depositing the purchase price at a bank accredited by the Central Bank of Egypt (CBE).

Furthermore, the rules regulating the transfer of title of unlisted securities over the counter have been recently changed by virtue of Decree No. 17 of 2017 issued by EFSA. The decree was issued after nullifying EFSA's Decree 54 of 2009, as amended, by the Supreme Constitutional Court.

The head of EFSA announced that the new decree outlines the conditions of transfer of unlisted securities and added that the protection given to trading parties on listed securities are not applicable to unlisted ones, as there is neither calculated closing or opening price of any security, price limits for dealing nor any indicators for prices, whether the transfer was through the Orders Market or Deals Market.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

There are certain amendments currently before the Egyptian Parliament regarding Egyptian Competition Law No. 3 of 2005 (ECL), which allows the Egyptian Competition Authority (ECA) to examine the impact of an envisaged M&A transaction on the Egyptian market via a pre-merger/acquisition control. Such examination before transactions' implementation would enable the ECA to assess the competitive impact of a potential M&A transaction to prevent any negative impact on the market.

The ECA announced in this context that it will only block those transactions that present significant impediment to effective competition and which negative effect cannot be addressed through imposition of remedies. To this effect, the ECA expects the amount of blocked transactions to range between 0.3% and 1% of the notified transactions, which matches the EU reported figures.

In this regard, it is worth mentioning that ECL currently provides merely for a post-merger/acquisition notification of the M&A transaction served to ECA.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

During legal due diligence, sellers are mainly the ones to commit the common mistakes/misconceptions, as outlined hereunder.

In this regard, it is very common for sellers not to have a well-established virtual data room (VDR) prepared in advance. In fact, a number of sellers prefer that, for confidentiality reasons, the buyer physically review the documents of the target company instead of reviewing the same on a VDR noting that, typically, the VDR saves time and effort. In all events, the buyer should sign a non-disclosure agreement (ie a confidentiality agreement) that protects the sellers' rights against any unlawful disclosure of confidential information by the buyer.

In parallel, not all target companies hold complete books, records and contracts of their company. To this effect, we note that due diligence processes may take longer than usual because it is common that the target companies are not in proper compliance with the regulations of its industry and do not follow proper corporate governance. This is likely demonstrated in case of family owned businesses.

Further, in few cases, sellers tend to provide misleading information or abstain from disclosing specific information during the diligence process and disclose all accurate information in the disclosure letter immediately before executing the transaction documents.

It is also common that, while negotiating the deal and before the due diligence phase, the parties do not conclude the key terms of the said deal in a letter of intent.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Sellers may overlook to designate a financial advisor which may give rise to commercial dispute. Furthermore, non-strategic buyers may omit to appoint a technical advisor during the diligence process.

Also, in the event the potential buyer is a foreign entity, its main concern would usually be related to the market's stability and growth, the payment mechanism of the purchase price and, more importantly, repatriation of funds post acquisition in relation to dividends distributions.

Furthermore, the sellers are always keen on the repatriation of funds in relation to the purchase price, which was an issue for the past period; however, the CBE announced recently that it succeeded to cover all the delayed proceeds due to foreign investors in hard currency, which reflects the current policy implemented by the CBE.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

It is highly recommended to conduct a proper legal due diligence over the target. More importantly is to conduct a tax, commercial and technical diligence to avoid last-minute findings that may hinder going further with the envisaged deal. Selection of a tax advisor is crucial as the Tax Authority's practice may vary from time to time.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Acquisition of at least one-third of the share capital of the companies listed on the EGX or companies that are unlisted but offer its shares to the public triggers a mandatory takeover offer (MTO). Pursuant to the Capital Market Law, any entity that acquired or wishes to acquire, whether individually or through related parties, one-third or more of the issued share capital or voting rights of a target company shall notify EFSA and undertake an MTO to purchase 100% of the target company's shares addressed to all shareholders of the respective company. In case the offeror the entity launching the MTO, has already acquired the stake, the MTO should be launched within 30 days of the date of acquisition.

Pursuant to the Capital Market Law, if an entity acquired, whether individually or through related parties, 90% or more of the issued share capital or voting rights, other shareholders who have at least three percent of the share capital may request from EFSA within the next 12 months to the acquisition to notify the majority to submit an MTO to buy the minority shares.

5.2 What conditions are usually attached to a public takeover offer?

Pursuant to the Capital Market Law, the MTO should not be unconditional. However, subject to EFSA's approval, the MTO may be exceptionally conditional on the acquisition of at least 51%, to ensure control, or 75%, in case of acquisition with ultimate purpose of merger of the target company's shares. In such case, if the MTO does not result in the acquisition of at least 51% or 75% (as the case may be) of the target company's shares, the offeror may elect to not perfecting the purchase of the offered shares, without the need to obtaining EFSA's prior approval.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The offeror cannot revoke or amend the terms of the MTO draft as approved by EFSA during its effective term. However, pursuant to the Capital Market Law, the offeror may withdraw the MTO draft only if a fundamental harmful incident occurs after publishing the MTO draft, which adversely affects the target company, its activities or the value of its shares, provided EFSA approves the withdrawal or the amendment of the terms of the MTO. No break fees should be involved in case of withdrawal pursuant to the terms of the Capital Market Law.

However, in private M&A transactions, break fees are commonly mutually agreed between the parties as a percentage of the purchase price, which is usually covered in the transaction documents. Though, under Egyptian law, there is room to claim reduction in the case of excessive break fees. Based on the principle of Egyptian Civil Code pacta sunt servanda, break fees are applicable when and if there has been a contractual arrangement to that end.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

The most commonly used pricing adjustment mechanism is completion accounts, which is used on the basis of the estimated accounts provided usually by the seller. Locked box mechanisms are also used but not as commonly as completion accounts, due to leakage indemnity claims. However, there has been a tendency to deduct leakage from deferred payments instead of resorting to an indemnity claim. The foregoing has recently helped in growing an appetite for locked box mechanisms. Nevertheless, some parties still prefer the completion accounts mechanism as it covers any deviation from agreed upon figures (for example net debt, net cash or normalised working capital), as opposed to locked box which protects the buyer only from leakage, which basically encompasses money withdrawn by the seller or its related parties.

Though resisted by sellers, deferred components are commonly used in relation to the adjustment mechanisms so that the purchase price is adjusted through deduction from said deferred component. Such deferred component is usually deposited at an escrow account to give the seller certainty and avoid any trust issues. However, earn-outs are not commonly used.

5.5 What conditions are usually attached to a private takeover offer?

There is no constant practice in this regard, as conditions are decided on a case-by-case basis.

However, it is customary that each transaction includes a certain number of conditions that govern the sale of a private entity and once satisfied the deal is deemed closed. Such conditions depend on the share/asset subject to the said sale. Typically, conditions may include prior governmental approvals, payment of certain debts and non-competition restrictions, among others.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Yes, it is very common. In fact, most of the share purchase agreements concluded in Egypt are governed by English Law since the latter is more flexible than Egyptian Law, and tends to prevail the contractual intent/ agreement of the parties in contrast to Egyptian law, which provides for a number of public policy provisions which contracting parties cannot contract out of.

Consequently, the overwhelming majority of M&A share purchase agreements refer any disputes arising thereof to arbitration, which is a much faster and efficient process than normal courts despite being more expensive.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Insurance companies in Egypt do not provide their services over warranties or indemnities, so the parties insisting on having insurance in relation to warranty and indemnity coverage would resort to offshore insurers, which is not a common trend.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

The lack of visibility on monetary policies and restrictions on sourcing and repatriating currency will continue to have a chilling effect on investments in Egypt. However, we predict activity in private M&A deals given that an increasing number of private equity firms will be seeking exits for their investments. In addition, multinational companies are willing to bet on the long-term future of Egypt as they see stability improving, even if some industries may see a slight bump in activity over the next 12 months, due to hard currency constraints.

The Egyptian government is growing in willingness and with blatant attempts to attract international and local investments that contribute to increasing employment opportunities and economic growth. The foregoing approach is confirmed by the new draft of investment law which is expected to soon be approved by the parliament to help improve the rhythm of the economic scene and enhance Egypt's investment climate and economic conditions.

About the author |

||

|

|

Tamer El Hennawy Managing partner, Matouk Bassiouny Cairo, Egypt T: 202 2796 2042 E: tamer.elhennawy@matoukbassiouny.com Tamer El Hennawy is the managing partner of Matouk Bassiouny and co-head of the corporate/M&A and capital markets groups. Tamer usually represents Egyptian leading corporations and he has worked on most of the public offerings that have occurred in the country in the past five years. In particular, El Hennawy has helped execute high-value acquisitions, restructurings and divestitures in Egypt for companies in the natural resources, manufacturing, construction, real estate, pharmaceutical and tourism industries. El Hennawy also worked on the sale of operating fields that was carried out by the Egyptian Petroleum Corporation. El Hennawy has an LLM from University of London and LLB from Cairo University. He speaks Arabic and English. |

About the author |

||

|

|

Nevine Abou Alam Counsel, Matouk Bassiouny Cairo, Egypt T: 202 2796 2042 Nevine Abou Alam is a counsel at Matouk Bassiouny and a member of the corporate and M&A group. Abou Alam has over 11 years of experience in general corporate, commercial, M&A and capital markets transactions, including initial public offerings and M&A transactions involving listed companies. Her area of expertise focuses on handling acquisition transactions and assisting the client throughout the entire transaction, including conducting legal due diligence, drafting and negotiating share purchase agreements and shareholders agreements. In addition, she advises on listings and initial public offerings, including drafting the prospectus. Her recent highlights include advising on the acquisition of a group of educational institutions, including a private university, with a value of over $100 million, where she advised on the restructuring, legal due diligence, drafting and negotiating of the transaction documentation. Abou Alam has a master's degree in business law from Paris 1 Panthéon Sorbonne and an LLB from Cairo University. She speaks Arabic, English and French. |