SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

In 2016 Italy's M&A market was stimulated by both domestic and cross-border transactions (both in the private M&A and in the public M&A).

The most active sectors were financial services (39 deals worth €16 billion), the consumer sector and energy.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

Italy's M&A market posted 509 deals worth €49 billion during 2016 (its highest annual deal count since 2001), representing a seventh consecutive yearly increase.

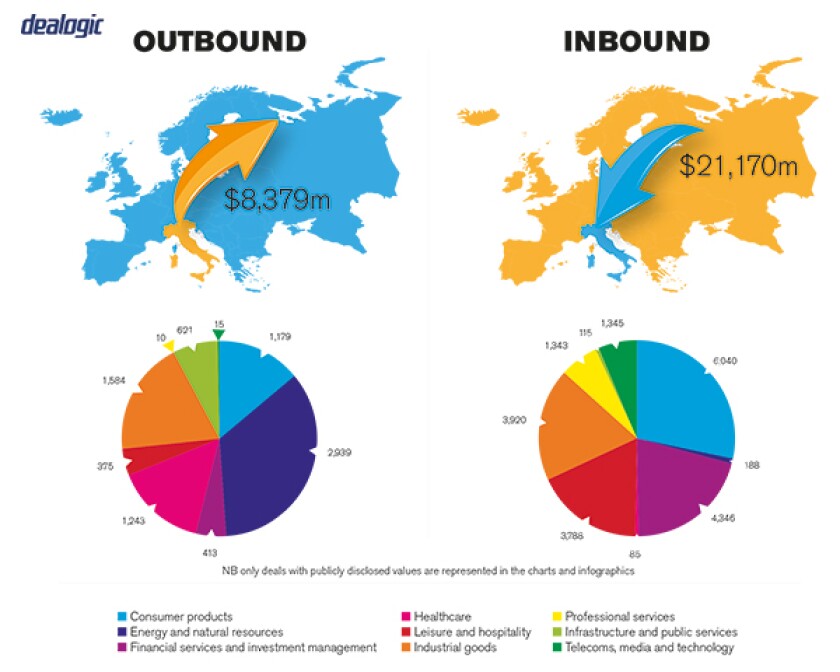

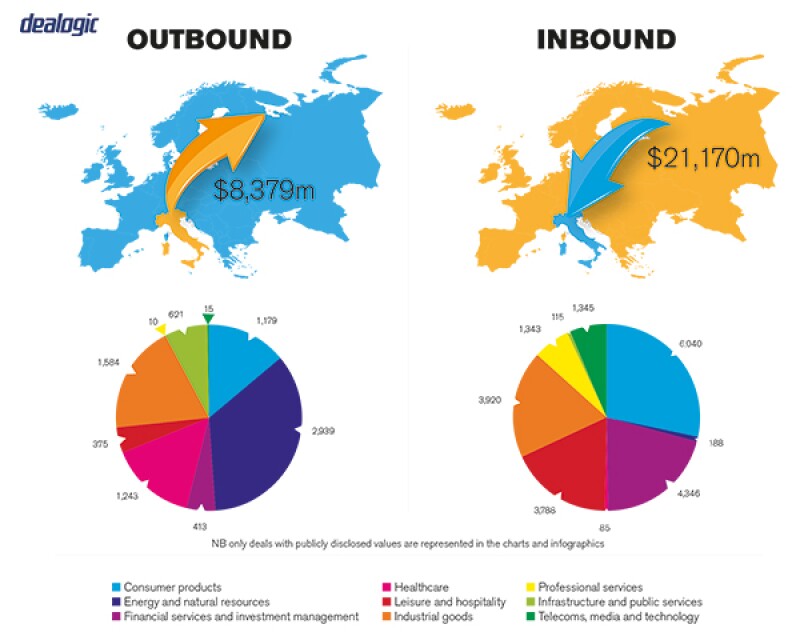

During 2016 Italian companies were the subject of 233 transactions worth a combined €24 billion from foreign investors.

This marks the second highest annual value since 2010 following a spike in activity in 2015 (461 deals worth €65 billion).

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

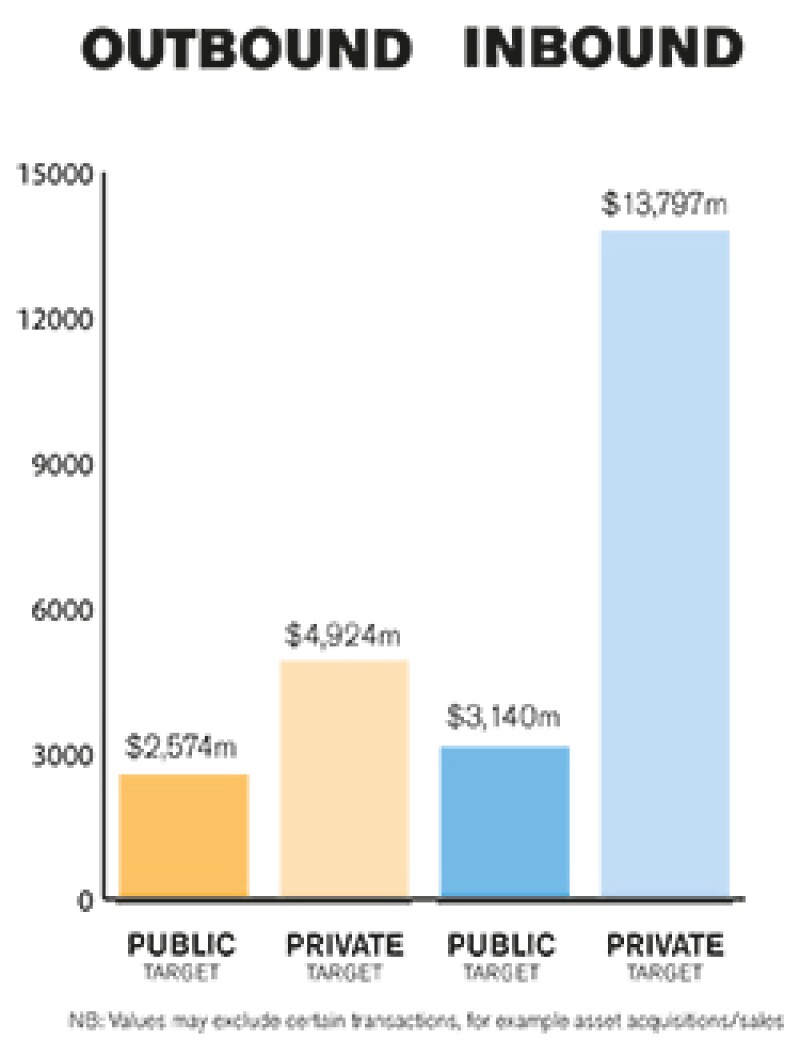

The Italian M&A market is driven both by private M&A transactions and public M&A transactions.

The dynamics between private and public M&A are substantially the same, even if public M&A is characterised by the involvement of a major number of players (especially related to public authorities, stock exchanges, control bodies and others).

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Over the past 12 months the Italian M&A market has registered a substantial development in special purpose acquisition companies (SPACs).

SPACs are publicly-traded buyout companies that raise money through an initial public offering (IPO), for the purpose of completing an acquisition of an existing private company. The money raised through the IPO of an SPAC is put into a trust where it is held until the SPAC identifies a merger or acquisition opportunity (business combination) to pursue with the invested funds.

Through the so-called business combination the shares of the target company are automatically listed on a regulated market (such as, in Italy, the Italian Equities Market (MTA) or Market for Investment Vehicles (MIV)) or on a multilateral trading facility (such as, in Italy, AIM Italia), without incurring in any risk connected to the private placement/public offering typical of a standard IPO.

2.2 What have been the most significant trends or factors impacting deal structures?

The main factors impacting deal structures in 2016 have been timing, costs (also in terms of fees and ancillary items) and tax impacts.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key set of rules governing private M&A transactions, mergers and de-mergers is represented by the Italian Civil Code.

In respect of public M&A deals, in addition to the general rules of the Italian Civil Code, detailed provisions concerning extraordinary transactions involving listed companies are set forth by Legislative Decree no. 58/98, as amended (the Italian Financial Act); and Consob Regulation no. 11971/1999, as amended (the Consob Regulation on Issuers).

The Commissione Nazionale per le Società e la Borsa (Consob) is an independent public supervisory authority which regulates financial markets and listed companies and is responsible, among other things, for supervising public takeover offers.

In addition to the foregoing, the M&A process generally involves domestic and EU competition authorities and may require specific authorisations by industry regulators (for example in the telecommunications sector).

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

In 2014, the general prohibition to issue shares carrying multiple votes as then provided under Article 2351 of the Italian Civil Code has been overcome by the introduction into the Italian legal framework of multiple voting shares and enhanced voting shares.

Such categories have been introduced in order to encourage equity injections into companies without entailing significant dilution of the controlling shareholders.

In particular, multiple voting shares can be adopted only by non-listed companies, even though they maintain their characteristics following the company's admission to listing; may cast up to three votes; immediately grant multiple voting rights; and are not fungible with ordinary shares but represent an independent equity class.

On the other hand, shares with enhanced voting rights can be adopted by listed companies or being listed; may cast up to two votes; grant enhanced voting rights only upon lapse of a 24-month period of ongoing possession of the shares, as attested by a specific corporate register; and lose such enhanced voting rights upon sale or change of control over the entitled shareholder. Enhanced voting shares enable the reference shareholder to maintain control over the relevant company while, at the same time, potentially reducing its shareholding and increasing the liquidity of the shares.

In the early stages of an envisaged M&A deal, therefore, a perspective purchaser should carefully review the target company's by-laws to verify whether multiple voting shares or enhanced voting shares are provided thereunder with a consequent impact on quorum and majorities and, thus, on the corporate governance of the target company.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

In July 2016, the entry into force of EU Regulation no. 596/2014 (the MAR) has introduced, among others, new rules governing the disclosure to the market of inside information by public companies.

Such disclosure is particularly relevant in the context of M&A transactions, as the early stages of the relevant negotiations would now be deemed as price-sensitive even though the terms and conditions of the envisaged deal are not binding or are yet to be finalised or formalised.

Under the MAR regime, however, public companies may delay the disclosure of inside information to the extent: an immediate disclosure would be likely to prejudice the legitimate interests of the company; the delayed disclosure would not be likely to mislead the public; and the company is able to ensure the confidentiality of the relevant information.

In October 2016, the European Securities Market Authority (ESMA) issued guidelines establishing a non-exhaustive list of corporate legitimate interests which may constitute grounds for a delay in the disclosure of inside information, including without limitation when: the company is conducting negotiations, where the outcome of such negotiations would likely be jeopardized by immediate public disclosure (such as in mergers, acquisition, spin-offs, major disposal of assets); the financial viability of the relevant company is in grave and imminent danger (such as in corporate reorganizations or restructurings).

In light of the foregoing, a maximum degree of confidentiality must be ensured since the early stages of a public M&A deal.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

The Italian M&A market features several peculiar aspects which should be carefully evaluated in advance by any prospective foreign investor.

A very common mistake occurs, for example, when foreign investors underestimate the complexity of the Italian articulated labour law legal framework.

Italian M&A players tend to predominantly focus their efforts on the extensive negotiation of the purchase price and of representations, warranties and indemnities, without however taking into consideration other key aspects such as additional contractual protections (for example post-closing non-compete clauses).

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

In private M&A, sellers are generally keen to define in detail the payment modalities of the purchase price and to restrict the scope and the enforceability of their representations and warranties.

On the other hand, from the purchasers' standpoint one of the major aspects to be considered is represented by the conditions precedent to closing, in order to grant the purchaser an exit strategy should material adverse circumstances arise between signing and closing.

In the context of industrial M&A deals, purchasers often lack sufficient post-closing planning, as they exclusively focus on the target company's profitability without properly evaluating the actual post-closing integration process.

In the context of public M&A, private investors approaching listed targets tend to overlook certain legal aspects concerning the disclosure and transparency rules applicable to public companies under the Italian Financial Act and the Consob Regulations on Issuers, while being extremely concerned by potentially triggering the obligation to launch a mandatory takeover offer on the entire share capital of the target company.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

When planning an M&A deal on the Italian market, the relevant player should certainly consider the elements listed under sections 4.1 and 4.2 and seek the assistance of top-tier domestic legal advisors as well as of financial advisors and tax experts in order to thoroughly assess all the pitfalls and criticalities related to or arising out of the envisaged transaction.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Pursuant to Article 2359, first paragraph of the Italian Civil Code, the legal control over a company is obtained when the relevant shareholder holds a percentage of voting rights equal to or higher than 50.1%.

In addition to the legal control, the combined provisions of Article 2359, second paragraph of the Italian Civil Code and Article 93 of the Italian Financial Act also provide for a de facto control, which occurs when the relevant shareholder holds votes lower than 50.1% but, in any event, sufficient to exercise a dominant influence in the ordinary shareholders' meeting.

According to the prevailing interpretation, a dominant influence is displayed through: the power to appoint and/or remove the majority of the company's directors; and the power to determine, also by means of the approval of the annual financial statements, the general address of the company's management.

Furthermore, the situation of de facto control, in order to be identified as such, must be stable and continuous. Such stability must be determined through an analysis of the shareholders' meetings for a reasonably significant period of time (i.e. at least two financial years).

5.2 What conditions are usually attached to a public takeover offer?

Voluntary takeover offers are generally subject to several conditions precedent, including without limitation:

(i) the acquisition of a shareholding exceeding certain thresholds (50/66.6%.);

(ii) the non-occurrence of material adverse changes affecting either the market or the target company;

(iii) the obtainment of any required authorisations from competition authorities/industry regulators;

(iv) the release of irrevocable commitments to adhere to the takeover offer from certain reference shareholders (if any).

On the other hand, mandatory takeover offers cannot be subject to any conditions (but certain conditions precedent may however be anticipated in the share purchase agreement concerning the original acquisition).

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The contractual structures based on success/break-up fees are generally used in the context of M&A deals. In particular, break-up fees may be alternatively structured as lump-sum amounts or as a monthly retainer with a cap.

In general, the aggregate amount of the break-up fee generally does not exceed 25/30% of the envisaged aggregate consideration of the deal.

Success/break-up fee structures are not adopted, however, in respect of the opinions to be released by independent experts (such as those concerning related-party transactions), as the provision of a fee directly related to the positive outcome of the transaction would hinder the required independence of judgment of the relevant advisor.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

In the recent past the private M&A share purchase agreements have evolved in terms of consideration mechanisms – for example, whilst in the past the typical mechanism was to provide a provisional purchase price with a subsequent purchase price adjustment after the closing (in terms of closing net financial position and/or net working capital of the target), recently the use of locked box mechanisms (with leakage provisions) materially increased, especially in consideration of the fact that such locked box mechanisms provide certainty in terms of price, save delays in terms of purchase price adjustment procedures and maximise the ability of the seller to achieve its sale proceeds.

Escrows and/or other similar guarantees (such as first demand bank guarantee or patronage letters) continue to be largely used in private M&A share purchase agreements.

Sometimes, when there is a gap between the price expectations by the seller, on one hand, and the buyer's available resources or business valuation, such gap is bridged through the recourse to vendor financings, earn-outs or any other similar form of contingent purchase price payments.

5.5 What conditions are usually attached to a private takeover offer?

The typical conditions provided for in a private M&A deal are related to financing, antitrust clearance, no material adverse changes (between signing and closing), as well as bring-down of the representations and warranties.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

As to the governing law, when the target is an Italian entity, generally such governing law is the Italian one.

As to the jurisdiction, the parties generally provide for the exclusive competence of an Italian court or of a national or international arbitration.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Such mechanisms are largely used in private M&A transactions where the seller gives several representations and warranties to the buyer (good standing, authority, financial statements, taxes, labor, environmental, accounts receivable, inventory, no undisclosed liabilities, etc.), with a seller's undertaking to indemnify and hold harmless the buyer from any loss or liability arising from or in connection with the breach of such representations and warranties.

The use of indemnity insurance policy is becoming more and more popular. An indemnity insurance policy is often used when the indemnification liability limitations under the share purchase agreement are not perceived to provide adequate protection to the buyer.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

The trends for the Italian M&A market in 2017 are expected to be positive.

The main sectors of M&A activity in the next months will likely continue to be financial services and consumer goods, with a specific look to the fashion industry, where companies have turned to consolidation in the wake of aggressive competition from large international giants.

About the author |

||

|

|

Federico Amoroso Senior associate, Chiomenti Rome, Italy T: 39 06 4662 2261 F: 39 06 4662 2600 E: federico.amoroso@chiomenti.net Federico Amoroso graduated with a degree in law from Rome University, Rome, in May 2003. He obtained an LLM degree from Columbia Law School (NY) in 2008. He was admitted to the Rome Bar in October 2006 and to the New York Bar in June 2012. Amoroso joined Chiomenti in July 2012 and works in the corporate and capital markets department (with a particular focus on equity capital markets and public M&A transactions). |

About the author |

||

|

|

Giovanni Filippo Pezzulo Senior associate, Chiomenti Milan, Italy T: 39 02 7215 7474 F: 39 02 7215 7227 E: giovannifilippo.pezzulo@chiomenti.net Giovanni Filippo Pezzulo graduated with a degree in law from Bocconi University, Milan, in May 2004. He was admitted to the Milan Bar, Italy, in January 2008. He joined Chiomenti in June 2005 and works in the corporate and capital markets department (with a particular focus on equity capital markets and public M&A transactions). In 2008-2009 he worked in New York at Chiomenti New York office in the corporate/M&A department. |