SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The M&A market in 2016 has remained strong, driven in part by an uptick in large scale auctions and leveraged acquisitions. We have noticed increased activity in the financial services, energy and infrastructure sectors and the real estate sector. Investors are hopeful that this trend will continue through 2017.

Overall, the markets in Hong Kong have been somewhat subdued in 2016. This has resulted in heightened interest in take-privates although the required approval thresholds to successfully complete a take-private continue to make potential buyers nervous about committing the significant time and resources to mount a take-private without sufficient deal certainty.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

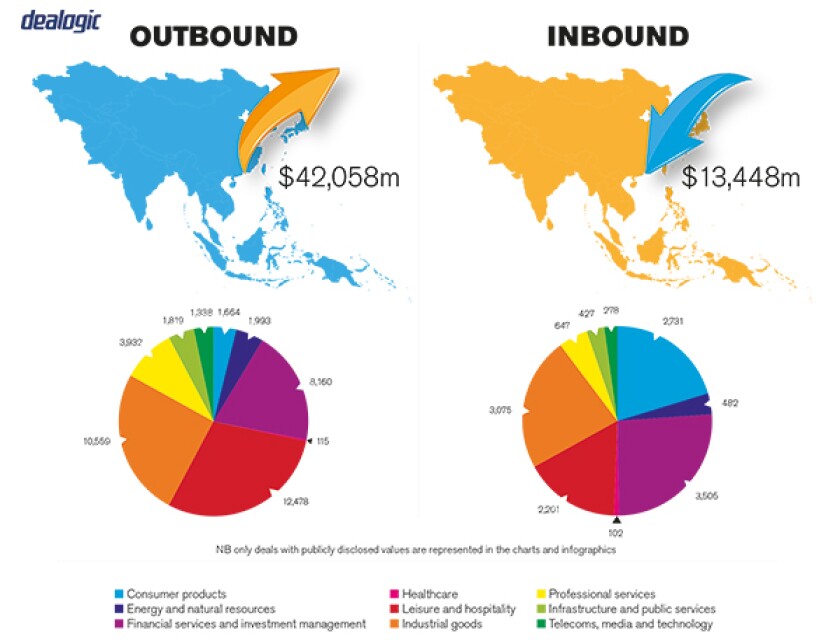

Hong Kong experienced healthy levels of inbound M&A activity in 2015 both in terms of deal value and volume. We noticed a drop off in 2016 for inbound M&A (in value and volume), but overall the M&A outlook remains healthy.

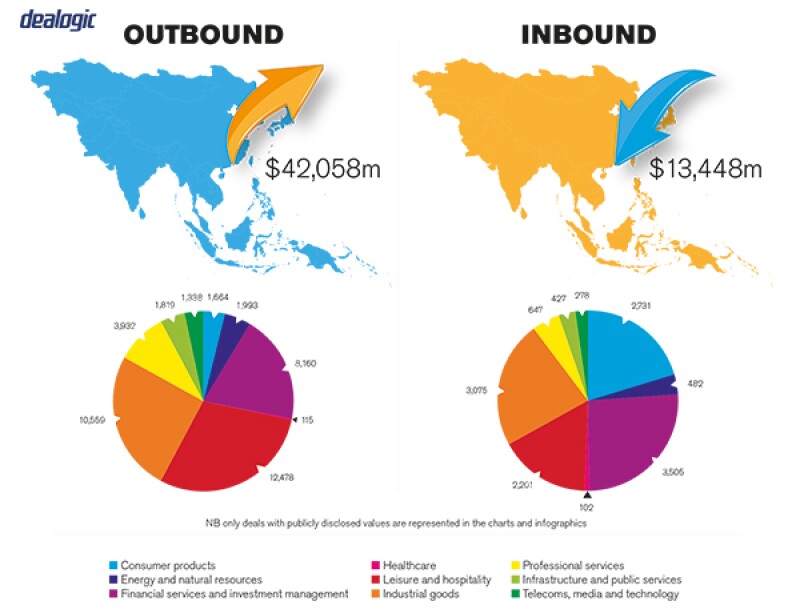

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Hong Kong has always been a hub for large scale private and public M&A transactions and that is unlikely to change in the near term. As with the markets globally, we are in a period of uncertainty as a result of certain macroeconomic factors and the changing political climate. A lot of Hong Kong businesses are listed and therefore there is a lot of M&A involving listed companies but take-private transactions continue to be relatively rare for the reasons set out below.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The acquisition by MBK Partners and TPG of Wharf T&T from The Wharf (Holdings), and the acquisition by Permira of Tricor Holdings (Tricor) from The Bank of East Asia and NWS Holdings were done at high valuations and illustrate that: private equity sponsors remain keen to deploy significant dry powder; and strategic sellers remain keen to dispose of non-core assets. With several international private equity sponsors raising further large Asian funds, and ready to deploy that capital, there will likely be continued appetite for large transactions, which may mean an increase in the average deal value in 2017.

2.2 What have been the most significant trends or factors impacting deal structures?

We increasingly see auction sale processes being undertaken by sellers to maximise sale proceeds (for example the sale of Wharf T&T and Tricor, and the acquisition by Citic, Citic Capital Holdings and The Carlyle Group of a controlling stake in the mainland China and Hong Kong operations of McDonald's Corporation).

These deals also evidence that: private equity sponsors are increasingly less averse to forming partnerships for the appropriate M&A transactions; and a resurgence of subordinated holdco financings (labelled in the market generically as mezzanine financing) to assist buyers in reaching valuations required to be successful in the competitive auction process.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

M&A transactions involving public companies or companies with a primary listing of their equity security securities in Hong Kong are subject to the regulations of The Codes on Takeovers and Mergers and Share Buy-backs (the Code) administered by the Executive Director (the Executive) of the Corporate Finance Division of the Securities and Futures Commission (SFC), the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and the Securities and Futures Ordinance. Where a Hong Kong target entity or subsidiary operates in a regulated industry (for example securities and futures, banking or insurance), consent of the relevant regulator (the SFC, the Hong Kong Monetary Authority or the Insurance Authority) may be required as a precondition to a change-of-control. All companies operating locally are also subject to the provisions of the Companies Ordinance.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Whilst the past year has seen various general regulatory updates being implemented (such as the launch of the Shenzhen Stock Connect, enabling reciprocal stock market access between Shenzhen and Hong Kong for eligible investors, and the phased introduction of an independent insurance authority to assume the regulatory responsibilities of the existing governmental authority, the Office of the Commissioner of Insurance), there have been no recent regulatory changes in Hong Kong that significantly impact local M&A activity.

In mainland China, the recently intensified regulatory scrutiny of overseas investments is expected to result in a slowdown in acquisitions of Hong Kong target companies in the near term, given that such transactions often involve Chinese investors.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

Hong Kong's merger control regime currently only applies to M&A transactions involving an undertaking that directly or indirectly holds a carrier licence within the meaning of the Telecommunications Ordinance. There have been indications from the government of plans to introduce an industry-wide merger control regime, but no commitments have been given as to the timing for its implementation.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

It is commonly assumed that the Code only applies to companies listed in Hong Kong when in fact it applies to public companies in Hong Kong, which may include unlisted companies.

Another misconception is that there is no merger control regime in Hong Kong. As mentioned above, there is a merger regime but it only applies to certain companies in the telecommunications and broadcasting sectors.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

We are often asked to advise on potential consideration structures, especially in the context of auction processes where the bid needs to be as competitive as possible. As expected, most buyers still pay cash at completion but it is not unusual, particularly in certain sectors, to combine this with some form of deferred consideration.

We are also often asked to advise on the merits of warranty and indemnity insurance. This is a tool that parties are increasingly using on M&A deals both on sell-side to execute a clean break and on buy-side to create a more competitive bid in auction context. Typically we see premiums in the range of one to two percent of the sum insured and a claims period of 18-24 months but terms are negotiable.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Consistent with other markets, advanced preparation is key to any successful M&A process. M&A transactions in Hong Kong can be time consuming, especially for foreign buyers navigating the regulatory framework (in particular in a public M&A context). Instructing seasoned advisors with strong relationships with the regulators and experience in executing complex M&A transactions will help to ensure a smooth process.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The majority of listed companies in Hong Kong have a controlling shareholder holding more than 30% (and often more than 50%) of the company's shares therefore it is vital to have the controlling shareholder on board in any attempt to obtain control.

A takeover of a public company listed in Hong Kong may be effected principally by way of a general offer (which may be mandatory or voluntary) or a scheme of arrangement (SOA). Where a takeover offer is made and acceptances are received in respect of 90% or more of the shares to which the offer relates, the offeror may compulsorily acquire the non-accepting shareholders' shares. A SOA requires approval by members representing at least 75% of the voting rights of members present and voting in person or by proxy at the meeting, with not more than ten percent of the voting rights attached to all disinterested shares opposed to the scheme (this requirement is unique to Hong Kong). Many public companies listed in Hong Kong are incorporated in offshore jurisdictions such as the Cayman Islands, which also have a head count test for a SOA, requiring in addition that a majority in number of shareholders present and voting at the scheme meeting vote in favour.

An independent committee of the board of the target must make a recommendation to the shareholders as to whether the offer is, or is not, fair and reasonable and as to acceptance or voting.

5.2 What conditions are usually attached to a public takeover offer?

All conditions to a voluntary general offer (VGO) or SOA must be satisfied within the time periods prescribed by the Code. Consequently, many takeovers in Hong Kong are effected by way of pre-conditional offer or SOA where there are mandatory regulatory conditions that cannot (or may not) be satisfied within the prescribed time periods. Other than the acceptance condition, conditions that are usually attached to a takeover offer include regulatory approvals and various standard no material adverse change (MAC) or illegality conditions, although the consent of the Executive is required to invoke such conditions.

No financing conditions are accepted as the announcement of an offer should include confirmation by the financial adviser that the offeror has sufficient financial resources to satisfy full acceptance of the offer.

In the case of a mandatory general offer, there must be no conditions other than an acceptance level of 50% of the voting rights.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees in public M&A remain relatively uncommon in Hong Kong, mainly due to the fact that most deals are consensual due to the controlling shareholder having to agree to the deal. The Code provides that an inducement fee or a break fee must be de minimis (usually no more than one percent of the offer value). The board of the target and its financial advisor must confirm to the Executive that each of them believes that any agreed fee is in the best interests of the shareholders.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Consideration mechanisms involving post-completion net debt and/or working capital adjustments based on completion accounts are more prevalent in M&A transactions in this region than locked box structures, although locked box mechanisms are becoming more widespread in the secondary buy-out market. We do not commonly see earn-out structures feature in transactions in this region, largely due to the uncertainties that such structures create for both buyers and sellers involved. Escrow arrangements are still widely used (or deposits in real estate transactions), with a range of corporate services providers and corporate services arms of various banks able to act as escrow agents and/or escrow banks.

5.5 What conditions are usually attached to a private takeover offer?

In competitive auctions, sale conditions may be limited to receipt of requisite third party consents, such as regulatory consents in respect of targets operating in regulated industries (for example the SFC's approval of the incoming controller of a licensed asset manager) and consents required under contractual obligations binding on the vendors and/or target entities (for example lender consents required under finance documents). In bilateral transactions, potential buyers generally have more leverage to negotiate additional, bespoke conditions precedent, including MAC clauses and no breach conditions (requiring that no material breaches of warranties and/or pre-completion covenants have occurred), particularly in transactions involving a lengthy interregnum period due to the time required to receive regulator consents.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Under Hong Kong law, contract parties are generally free to choose the governing law of their agreement and the jurisdiction for dispute resolution or seat of arbitration. In M&A transactions involving a Hong Kong target entity, the transaction documentation is typically governed by Hong Kong law, given that local laws dictate the share transfer and attendant control transfer procedures. For regional M&A transactions, foreign governing laws are commonly adopted (typically being the laws of a common law jurisdiction such as England, Singapore or New York) and parties increasingly designate Hong Kong or Singapore arbitration as the preferred dispute resolution method, as opposed to resolution of disputes in local courts.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is still an emerging feature in transactions in this market, although we increasingly see parties consider its use as a tool to bridge gaps between liability caps offered by sellers and coverage required by buyers, particularly in Hong Kong private equity deals. Insurance underwriters within the region generally view Hong Kong as a relatively stable and low risk jurisdiction, which has a positive effect on premium levels and the choice of insurance providers available.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Consistent with markets across the world, Hong Kong is in a period of uncertainty due to the changing political climate in the US and Europe and various macroeconomic factors, including volatile foreign exchange rates. The concern for deal makers is the impact on short-term M&A activity, as investors sit on the sidelines in Q1/Q2 awaiting greater clarity on the economic landscape. Investors and advisors remain hopeful however that investment activity will be reasonably robust in 2017 (especially in Q3/Q4, when investors will have greater certainty on the political and economic climate) given the abundant dry powder available to be deployed.

There is also confidence in the market in the continuation of divestments by European banks of their non-core businesses in Hong Kong, which should lead to some interesting opportunities.

About the author |

||

|

|

Simon Cooke Partner, Latham & Watkins Hong Kong T: 852 2912 2709 F: 852 2912 2600 W: www.lw.com Simon Cooke is a partner in the corporate department of Latham & Watkins' Hong Kong office and the global co-chair of the firm's private equity practice. Based in Hong Kong since early 2009, Cooke is an M&A lawyer specialising in public and private M&A and corporate finance with a focus on pan-Asia private equity transactions. Cooke regularly advises Asian and international private equity clients on a broad range of domestic and cross-border buy-outs, growth capital, pre-IPO, PIPE and other private equity transactions. He also advises a range of clients on general private and public company and cross-border M&A and corporate finance transactions. |

About the author |

||

|

|

Amy Beckingham Partner, Latham & Watkins Hong Kong T: 852 2912 2550 F: 852 2912 2600 W: www.lw.com Amy Beckingham is a partner in the Hong Kong office of Latham & Watkins and a member of the corporate department and the private equity practice. Beckingham specialises in public and private M&A and joint-ventures, acting for private equity and other financial investor clients on transactions throughout Asia, across a wide range of industry sectors. She has also advised private equity clients on their IPO exits in a number of jurisdictions across Asia. |

About the author |

||

|

|

Frank Sun Partner, Latham & Watkins Hong Kong T: 852 2912 2512 F: 852 2912 2600 W: www.lw.com Frank Sun, a partner in the Hong Kong office of Latham & Watkins and a member of the corporate department, specialises in private equity investment and public and private M&A transactions. Sun regularly advises private equity funds and corporate clients in private equity investments, cross-border acquisitions, PIPEs, privatisations and a wide range of other complex M&A transactions. |