SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The Portuguese market in 2016 has seen over 300 M&A transactions, according to Transactional Track Record (TTR). The total aggregate deal value (disclosed for 120 of the transactions) was €12 billion. Last year and for the second consecutive year real estate was the most dynamic subsector. We also highlight the 54% growth in the financial and insurance subsector, which saw 40 transactions.

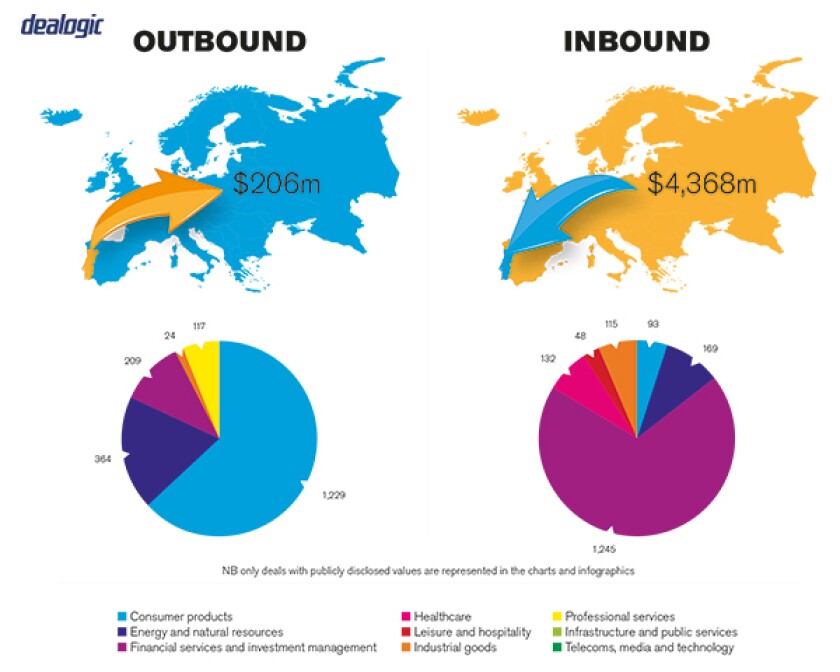

Despite the severe impact of the financial and economic crisis on the Portuguese economy, the efforts undertaken in recent years and the current economic environment allow us to look with optimism – although moderate – to the M&A market. The majority of the registered transactions refer to acquisitions made by foreign entities in Portugal (inbound transactions), particularly by US, Spanish, French and UK companies. The outbound transactions – acquisitions made by Portuguese companies abroad – have mainly occurred in Spain, Brazil and France.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

The official figures regarding M&A deal flow in the national market have not yet been disclosed. However, based on our experience and ongoing transactions we believe 2017 will see more inbound than outbound activity. Regarding the amounts involved, in a market like the Portuguese market, in which most of the companies are SME, it is foreseeable that the majority of transactions will be of a medium value.

Regarding the type of investments and/or transactions, we do not expect many changes for 2017. Trends will be similar to the past five years, with the traditional M&A operations largely dominating the market.

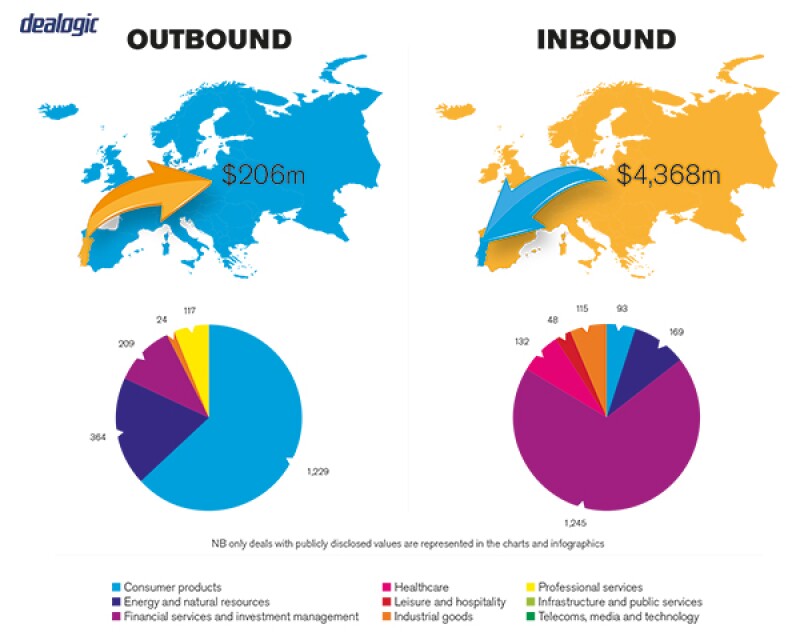

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Considering the size of the Portuguese M&A market we are not able to identify a clear trend regarding public or private transactions. During periods of privatisations, it is normal for the public market to be more active, with public companies becoming privately owned (or where the majority of the share capital is held by private entities).

However, following the privatisation of TAP, the Portuguese aviation company, we do not expect that any further privatisations will take place in the medium term. As in the previous year, Portugal will remain an attractive market for foreign investors searching for opportunities through the acquisition of distressed assets. We are still witnessing the sale of assets at reduced prices, conducted mainly by a fragile financial sector searching to clean up balance sheets and secure more liquidity. This will most certainly increase foreign investment in Portugal. In this regard, we must highlight the sale of Novo Banco, which is expected to conclude soon.

SECTION 2: M&A structures

2.1 Please review some recent relevant M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Please see answer to Section 1.3.

2.2 What have been the most significant trends or factors impacting deal structures?

We believe that the strategy of disinvestment in non-strategic and distressed assets will remain a trend in 2017. After experiencing a period of some growth, many companies have chosen to sell non-strategic assets.

The recovery of the Portuguese economy is still moderate and Portuguese banks (which are an important factor for the growth of the M&A market) still have an important number of non-productive assets on their balance sheets. The Portuguese financial system is also aware that some risks may seriously compromise GDP growth. Those risks mainly rest on a global economic downturn, which would impact foreign demand for Portuguese exports namely from important commercial partners such as Brazil or Angola. Brexit may also impact the Portuguese economy.

Internal demand may be subject to adjustments resulting from the need for additional budgetary measures; because the deficit target has also been difficult to achieve in a situation where private indebtedness may be an obstacle to investment, despite the monetary policy pursued in the last years by the European Central Bank.

The amount of credit granted by the Portuguese banks is still low, given the context of deleveraging of the non-financial sectors of the economy. Persisting low interest rates have contributed to the decrease of the spread over deposit accounts in Portuguese banks, a tendency maintained in 2016, and has compensated the reduction of credit spreads. Levels of profitability in the banking sector since the beginning of the financial crisis has limited their capacity for internal capital generation.

Despite some recent signs of improvement, the Portuguese economic environment is still challenging and poses an important degree of uncertainty to Portuguese issuers seeking external financing. There is also an external risk of a global economic downturn due to volatility in the international financial markets and political instability in the European Union due to Brexit.

These factors, combined with the reduction of public and private indebtedness, the possible need of further adjustments in the labour market and the tax pressure on private and corporate income represent an economic and political environment always subject to revision.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

In addition to general corporate laws and the companies law, the M&A sector is governed by the Portuguese Securities Code (PSC) and ancillary legislation. Depending on the companies involved, other specific laws may apply (for example financial institutions laws).

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The recent tax law and regulation changes both in Portugal and in the European Union, and tax increase and tax benefit reductions may have a negative impact on M&A activity. This is easy to understand if we bear in mind that several measures adopted to achieve budgetary consolidation, economic stimulus and to support the banking system have led to an important increase of public indebtedness. In a context of low GDP growth, the need to balance public finances in the medium term will lead to tax increases, by increasing the contribution base, the tax rates or by reducing the tax benefits. This will most certainly have a direct impact on M&A activity.

In the financial system, the implementation of legislation regarding financial sector taxation may have an adverse impact on bank operating results. Despite the fact that this measure was not included in the 2016 and 2017 budgets, the 2013 to 2015 budgets included rules allowing the government to create a stamp duty on financial transactions. However, at this date tax over financial transactions was yet to be implemented.

The new insurance companies' solvency regime is also uncertain and may negatively impact the activity of financial institutions and consequently, M&A volume.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The legal initiatives regarding the tax regime, as well as the adoption of ECB guidelines and supervision measures they foresee, may have a negative impact in business. In this regard, we would like to highlight the obligations resulting from the budgetary balances of the member states that must fulfill specific medium term objectives determined by the Stability and Growth Pact and that are annually monitored within the cycle of economic policy supervision and guidance (The European Semester). Considering current Portuguese public debt, these measures will most certainly have a long term impact on the government's economic stimulus policies, such as increasing public investment or reducing the tax burden.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

There is a lot of information regarding the Portuguese M&A market. This is a market that can be considered as mature, with clear and transparent procedures that are thoroughly supervised. With this level of information it is not normal that errors of assessment or of conception, or of any other type regarding the Portuguese M&A market, appear. Furthermore, the recent presence of the Troika as kept the country under the spotlights implying a thorough analysis over its rules, practices, procedures and principal players. As a result, Portugal is a M&A market easy to be acquainted with.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

There is a tendency to consider planning as a predominant factor. The due diligence phase is considered as the starting point for a transaction. This phase is centered on financial and legal issues that may affect the transaction and it will also impact the price of the transaction. Multidisciplinary teams will conduct this phase and will also act in strategic questions such as human resources evaluation, marketing or client base.

M&A is still the main growing tool adopted by companies, to enter into new markets or defend themselves from hostile moves by competitors. Despite the different motivations, the common goal is to maximize assets and avoid loss.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

We believe that the best measure any investor can take before entering the Portuguese market is to get legal and financial advice and to gather the maximum information regarding the economic, financial, political, labour and tax environment. The legal advice on the M&A structure is mandatory in our opinion.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Control of a public company is regulated by the Portuguese Securities Code. However, the Portuguese Securities and Exchange Commission (CMVM) sets forth important regulations relating to public companies and there is additional legislation which imposes reporting obligations on the acquisition of holdings in public companies in general.

In Portugal, obtaining control of a public company is usually voluntary, nevertheless in some cases it could be mandatory.

5.2 What conditions are usually attached to a public takeover offer?

As a rule the conditions regarding the prospectus of a public takeover offer are the following: presenting the main warnings regarding the characteristics of the operation and the effects of the registration; identifying the responsible party for the information provided in the prospectus; description of the offer, amount, nature and category of the securities that are the object of the offer; consideration offered and the justification thereto, as well as form of payment; security deposit or guarantees offered of the price; type of offer; assistance; purpose of the purchase; acceptance statements; offer result; information regarding the offeror, shares and agreement; identification of the offeror; attribution of voting rights; shares of the targeted company owned by the offeror; voting rights and shares of the offeror owned by the targeted company; agreements entered into with members of the corporate bodies of the targeted company; and representatives for relations with the market.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

There is no specific fee determined by the law for breach of the rules for launching a public offer. However, it has as necessary and ipso jure (independently of judicial or regulatory decision) effect: prohibition of the exercise of voting rights; and regarding the payment of dividends in respect of the shares that will exceed the limit over which the public offer should have been launched. This sanction envisages forcing the wrongdoer to abide by the law and to protect the market, the company and the minority shareholders. Civil liability towards the owners of shares that should have been subject to a public offer is also a protective measure defending minority shareholders' interests.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Locked box, completion accounts, earn-outs and escrow are common to the Portuguese market. Conventional completion accounts allow the purchase price to be adjusted (upwards or downwards) if the financial position of the target company or business at completion differs from the assumed position. When a completion accounts mechanism is used, the buyer will pay for the actual level of assets and liabilities of the target as at completion in accordance with a post-completion pricing adjustment.

In contrast, a locked box mechanism involves the parties agreeing a fixed equity price calculated using a recent historical balance sheet of the target prepared before the date of signing of the sale and purchase agreement. Cash, debt and working capital as at the date of the locked box reference accounts are therefore known by the parties at the time of signing and there is no post-completion adjustment. The economic risk and benefits of the business pass to the buyer from the date of the locked box reference accounts.

5.5 What conditions are usually attached to a private takeover offer?

Gathering information as to the legal and tax implications in the origin country of purchasing, detaining, encumbering or selling the shares of the target company is an essential condition investors in any private M&A transaction should meet. Any decision should be based on the information gathered following independent appraisal of the economic and financial situation or of any other relevant aspect of the targeted company. No decision should be taken without previous analysis by the potential investor and its consultants of the situation of the targeted company. This should include the analysis under the legislation applicable to companies' governance, the securities legal regime, labour law, tax law and activity related laws and regulations.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It is common practice to choose foreign governing law and/or jurisdiction in private M&A share purchase agreements (SPA).

5.7 How common is warranty and indemnity insurance on private M&A transactions?

The negotiation of guarantee clauses or civil liability insurance to assure the breach of any representation or warranty made by the seller in the SPA is not very common to the Portuguese market. However, it is becoming more common, especially in bigger operations or in operations involving foreign entities. We believe this is a result of the offer by the Portuguese insurance market and of the lack of knowledge by some of the investors that such a mechanism may work in benefit of the seller when determining the price.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

2016 was a year in which Portugal followed the global trend of increasing M&A. Despite the economic and financial downturn, in this first quarter we expect that 2017 will be similar to 2016 regarding the number of transactions. We believe that the main players will still be foreign companies (inbound transactions). In what concerns outbound transactions, we do not foresee any change in the most recent trend – moderate acquisitions in markets such as Spain, Brazil and France. The more active sectors will be the financial, real estate, tourism and TMT (technology, media and telecom).

About the author |

||

|

|

Nelson Raposo Bernardo Managing partner, Raposo Bernardo Lisbon, Portugal T: 351 21 312 1330 F: 351 21 356 2908 Nelson Raposo Bernardo is the founder and global managing partner of Raposo Bernardo. His reference practice areas are corporate law, mergers and acquisitions, banking and finance, capital markets, project finance and private equity. He advises national and multinational leading players, in operations concerning M&A, debt, equity, structured finance and securitisation, project finance, private equity, restructuring and regulation. He has published books and articles on corporate law, banking and contract law, and participated as a speaker seminars and conferences in Portugal and abroad. He is also strongly experienced in drafting legislation packages, being co-author of the present Portuguese Securities Code, and led several legislative reform committees in several countries in the banking, financial, real estate and construction areas. He was a member of the higher commission for the approval of ad-hoc judges (2000) and consultant for capital markets to the Portuguese Auditors Association (1998-2006). He holds a degree in law and a masters in juridical sciences (corporate law) (1998) from the University of Lisbon Law School. He was assistant professor of corporate and commercial law at the University of the Lisbon Law School (1991-2006) and in entrepreneurship courses at INDEG/ISCTE (Audax) (2005-present). He is fluent in Portuguese, English, French and Spanish. |

About the author |

||

|

|

Joana Andrade Correia Partner, Raposo Bernardo Lisbon, Portugal T: 351 21 312 1330 F: 351 21 356 2908 Joana Andrade Correia co-heads Raposo Bernardo's corporate and M&A department. For over ten years, she has dedicated her work to this area, building a solid experience and notable reputation. Throughout her career she gained an extensive experience in advising relevant domestic and international operations. Her activity concentrates in corporate advisory, mergers and acquisitions and project finance for companies acting in different sectors such as pharmaceutical, banking and finance, tourism and energy, among others. Andrade Correia was also part of the teams drafting legislation packages for different countries by the request of local governments and the World Bank. She holds a degree in law from the University of Lisbon Law School and a post-graduate degree in business and corporate law (from Catholic University of Lisbon), in legistics (from the University of Lisbon Law School) and in tourism law (from Estoril Tourism School). She is fluent in Portuguese, Spanish, French and English. |

About the author |

||

|

|

Manuel Esteves de Albuquerque Partner, Raposo Bernardo Lisbon, Portugal T: 351 21 312 1330 F: 351 21 356 2908 Manuel Esteves de Albuquerque has over 20 years of experience in the areas of corporate, contracts and real estate, alongside the coordination and development of international business projects, as well as advising in cross-border operations. After finishing his law degree in 1988 in the University of the Lisbon Law School, he held management and legal positions in FMCG (Fast Moving Consumer Goods) companies. During this period and in his activity as a lawyer he became highly experienced in corporate law – general corporate advisory, M&A and in commercial agreements across a wide range of industries. De Albuquerque has advised on many investment projects and in M&A operations in Portugal and abroad. He is fluent in Portuguese, English, French and Spanish. |