SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

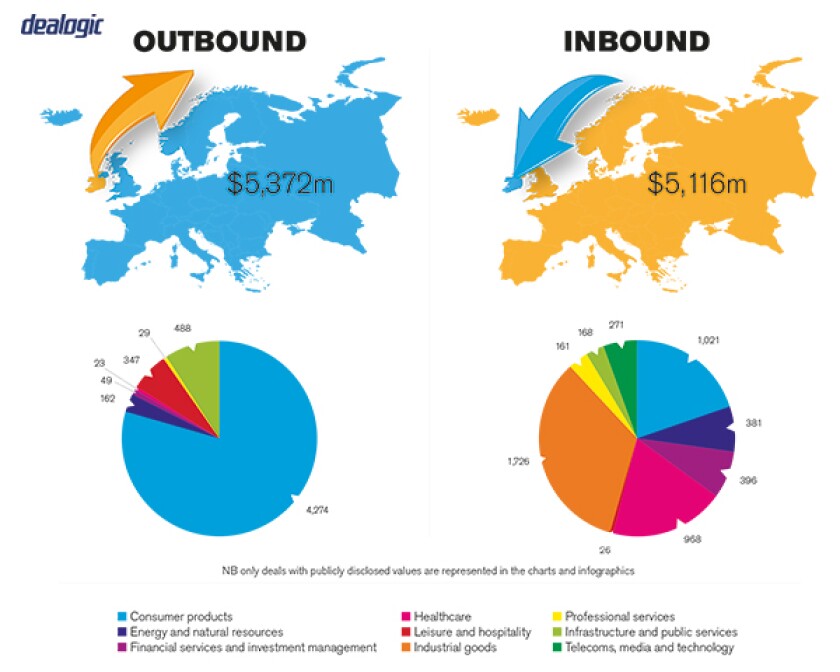

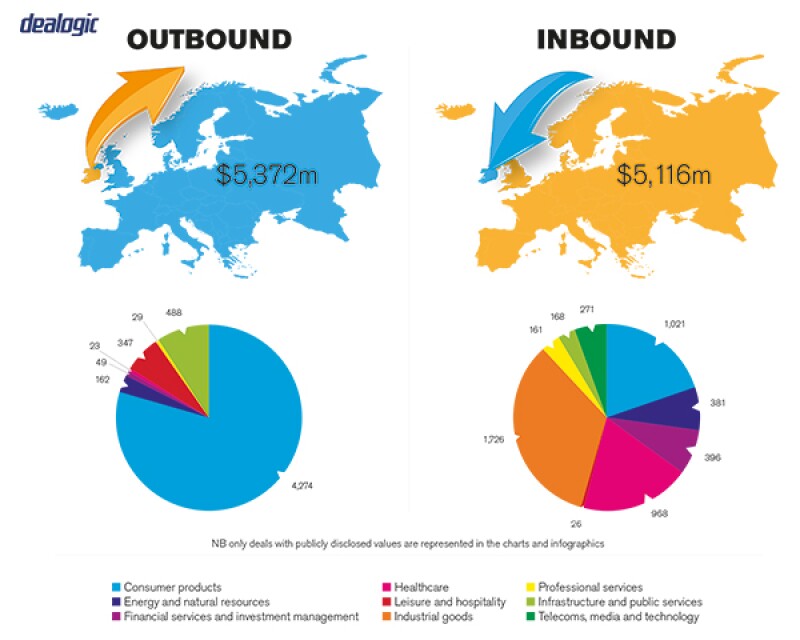

M&A activity remained strong in Ireland during the last 12 months, albeit at a more normalised pace than the record high levels recorded during 2014 and 2015. Whilst activity continued to be driven by inbound deals, with over 60% of deals being conducted by foreign acquirers (the US being the most active), domestic activity also grew with a number of large Irish corporates announcing acquisitions abroad. The economy continues to grow with unemployment falling and numbers at work returning to pre-crash highs. The impact of Brexit and the new US administration is yet to be seen but it is anticipated that any dislocation caused by Brexit in particular will contribute to M&A volumes.

In 2016, the most active sectors included real estate, technology and pharmaceutical.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

A total of 133 deals, with an aggregate value of €30.9 billion, were announced during 2016. Similar to the rest of Europe and the US, activity was slower in 2016 compared to 2015 and 2014, largely as a result of the uncertainty related to the Brexit vote, the changes in the US administration and the steps taken by the US Treasury in respect of corporate inversions.

1.3 Is your market driven by private or public M&A transactions, or both? What the dynamics between the two?

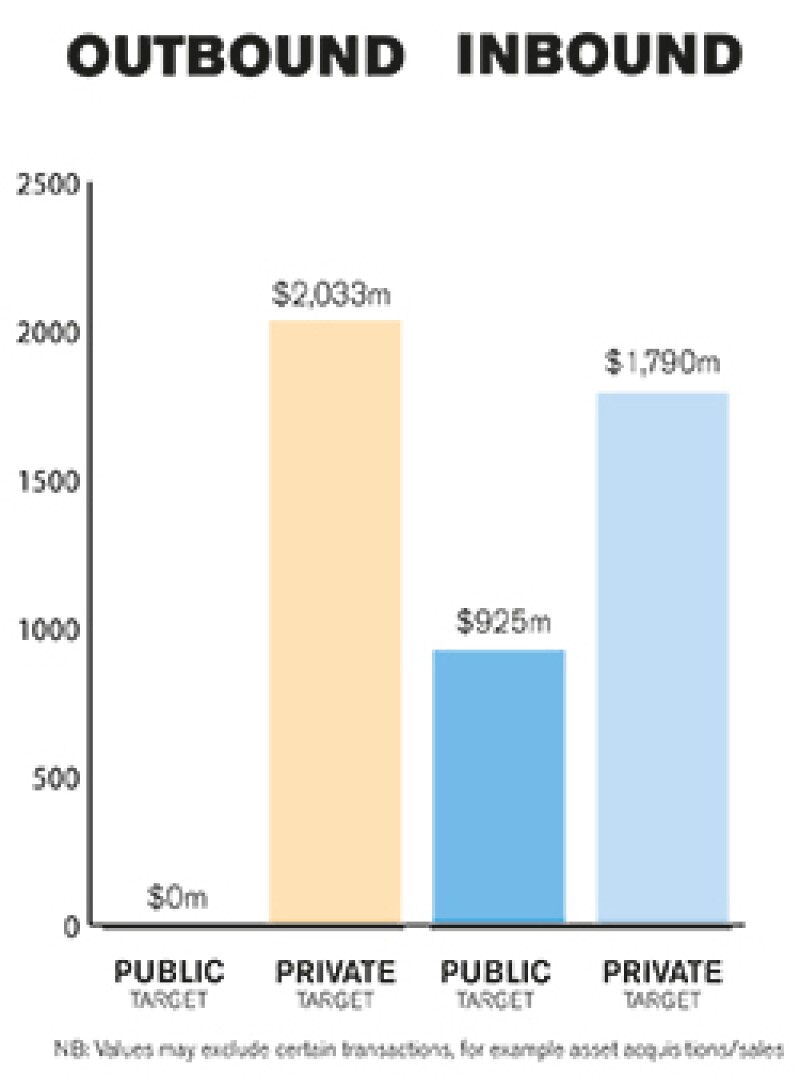

Both private and public M&A activity has been strong in recent years and this trend continued in 2016. Acquisitions of Irish entities by private equity houses have also increased in recent years.

SECTION 2: M&A structures

2.1 Please review recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

As noted above, foreign acquirers made a number of significant acquisitions last year:

the acquisition of Tyco International (an Irish incorporated, US listed company) by Johnson Controls (a US based company) for nearly €15.6 billion completed in September 2016 (and which also included a post-merger hive-off of Johnson Control's automotive interiors business into an independent Irish company, Adient). This transaction completed despite the changes to the US Treasury Rules regarding corporate inversions;

the acquisition of Fleetmatics Group (a company founded and headquartered in Ireland) by Verizon Communications (US based company) for $2.4 billion completed in November 2016; and

the acquisition of Fyffes (a company founded and headquartered in Ireland) by Sumitomo Corporation (Japanese based company) for €751 million was announced in December 2016 and completed in February 2017.

Private equity deal value increased significantly in Ireland during 2016:

the acquisition of motoring group AA Ireland by private equity fund Carlyle for €156 million; and

the sale by Permira (European private equity firm) of Creganna-Tactx Medical to TE Connectivity for $871 million.

In real estate, the most significant transaction was the sale by Chartered Land of a material Dublin retail real estate portfolio with a value of €2.6 billion (including the sale of Ireland's leading shopping centre, Dundrum Town Centre) to a joint-venture comprised of Allianz Real Estate and Hammerson.

Greencore Group's acquisition of CB-Peacock Holdings, the US convenience food group, for $747.5 million, is demonstrative of an increase in recent times of Irish businesses expanding internationally through significant acquisitions. This acquisition, Greencore's largest ever, significantly diversifies its revenue base and was part funded by a fully underwritten rights issue.

2.2 What have been the most significant trends or factors impacting deal structures?

Companies that had previously migrated to Ireland have recently used their Irish platforms to engage in further M&A activity. Transactions of this nature include the acquisition by Horizon Pharma of Raptor Pharmaceutical for $800 million.

There has also been a return to more normalised activity with international buyers undertaking strategic acquisitions of Irish companies, including the acquisitions of Fyffes and Fleetmatics referred to above.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your market?

The primary laws and regulations that govern M&A transactions include:

The Irish Takeover Panel Act 1997 (the Act), the Irish Takeover Panel Act 1997 Takeover Rules 2013 (the Irish Takeover Rules), the Substantial Acquisition Rules (SARS) and the European Communities (Takeover Bids) Regulations (the Regulations), together regulate the M&A activity relating to certain public companies. The provisions of the Act, Rules and Regulations are enforced by the Irish Takeover Panel (the Panel), which is established under the Act.

The Companies Act 2014 governs various aspects of both private and public M&A activity.

The Competition Acts 2002 to 2014 require certain M&A transactions be reported to the Competition and Consumer Protection Commission for approval.

Market Abuse Regulation (EU 596/2014) (MAR) and the Market Abuse Directive (Directive 2014/57/EU) (CSMAD) implemented in Ireland through European Union (Market Abuse) Regulations 2016 (S.I. 349 of 2016) imposes obligations on companies whose security is listed on regulated markets.

The Irish Listing Rules apply if the company is listed on the Irish Stock Exchange.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Broadly speaking there have not been any new Irish regulations or regulators that would impact M&A activity (though US Treasury rules restricting inversion transactions clearly have had an impact). At an EU level, a new market abuse regime was introduced on July 3 2016, it comprises of MAR and CSMAD. MAR sets out the revised market abuse framework, while CSMAD sets out minimum rules for the criminal sanctions that member states, including Ireland, must impose for breaches of the new market abuse framework. Although MARS/CSMAD have introduced reasonable procedural changes, the substantive law remains the same.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

It is expected that the Companies (Statutory Audits) Bill (which is currently being drafted by the legislature) will extend the facility for certain Irish incorporated but US listed companies to use US GAAP for financial reporting requirements in Ireland (in lieu of IFRS or Irish GAAP) for a further ten years from the current deadline of end 2020.

BEPS and the EU Commission's Anti-Tax Avoidance Package may have a material impact on M&A activity across Ireland and the EU.

As mentioned above, Brexit and the UK's negotiation of its withdrawal from the EU is likely to impact M&A (positively from an Irish perspective in our view). However until greater clarity is brought to the UK negotiation, it is difficult to be definitive on the impact.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction?

There are no common mistakes or misconceptions that exist about the M&A market in Ireland. It is broadly similar to the UK and US common law systems with the public takeover framework quite similar to the UK Takeover Code. One issue to be aware of is that the Irish Takeover Rules apply to any Irish incorporated company with an equity listing on New York Stock Exchange (NYSE) or Nasdaq.

4.2 Are there frequently asked questions or often over looked areas from parties involved in an M&A transaction?

As mentioned above, Irish incorporated companies listed on the NASDAQ or New York Stock Exchange may be subject to the Irish Takeover Rules and other Irish regulations. A foreign acquirer of an Irish incorporated, US listed entity, will invariably require advice on the applicability of the Irish Takeover Rules and its impact on transaction structure and timetable.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Local Irish law advice should be sought in advance of a potential buyer agreeing to a transaction structure or timetable – particularly if the target is a public company.

SECTION 5(A): Public M&A

5.1 What are the key factors involved in obtaining control of public companies in your jurisdiction?

In friendly deals, a scheme of arrangement is often used which requires the approval of: the target company's shareholders (being a majority in number and representing at least 75% in value of those voting at the relevant shareholder meeting); and the Irish High Court. This transaction structure was used in the Fyffes/Sumitomo and the Fleetmatics/Verizon deals mentioned above. A scheme of arrangement is usually structured so no stamp duty (at one percent of deal value) is payable on the acquisition.

A tender offer which is made by a buyer to the target's shareholder is more commonly used in hostile situations. In adopting this structure, a buyer may use a statutory procedure to compulsorily acquire the shares of dissenting shareholders (i.e. a squeeze out). If the target company is listed on a regulated market in any EU or European Economic Area member state, the buyer must have obtained the consent of the holders of 90% of the issued share capital in order to avail of the squeeze out. The threshold is slightly lower, being 80%, for Irish public companies quoted on secondary markets. In a tender offer, stamp duty on the transfer of shares is payable at one percent of the deal value.

5.2 What conditions are usually attached to a public takeover offer?

Whilst it is commonplace for offerors to include a list of conditions in the terms of an offer, the practical effect of such conditions is limited by the Irish Takeover Rules. The Irish Takeover Rules restrict the use of subjective conditions in public takeover offers and, other than with the consent of the Panel, an offer may not be made subject to any condition the satisfaction of which depends solely on the subjective judgement of the bidder, or which is solely within its control. Typically, public takeover offers are conditional upon antitrust clearance (as applicable), the acceptance of at least 50% of the targets shareholders and any necessary regulatory approvals being granted.

5.3 What are the current trends/market standards for break fees in public M&A deals in your jurisdiction?

Break fees are subject to the Irish Takeover Rules, which prohibit a target company from agreeing to compensate the bidder, or indemnify the bidder for the costs of the transaction, if the payment or indemnification is contingent upon the offer lapsing or not being made, except with the prior consent of the Panel. The Panel will normally consent only to reimbursement of specific quantifiable third party costs, subject to an upper limit of one percent of the value of the offer. When seeking the Panel's approval, the board of the target company and its financial adviser must confirm to the Panel in writing that they consider the proposed arrangement to be in the best interests of the shareholders of the target.

The Panel generally only approves expense reimbursement (subject to the one percent limit) in circumstances where the target board withdraws or modifies their recommendation of the transaction, or where a competing bidder causes the original bidder's acquisition to fail.

A number of recent transactions involving Irish companies (including the Tyco/Johnson Controls transaction referred to above) have been structured as reverse takeovers. The Irish Takeover Rules do not automatically apply in their entirety to a reverse takeover and, accordingly, the Panel has been more flexible in relation to applicability of the rules relating to break fees in such transactions.

SECTION 5(B) Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanism, completion accounts, earn outs and escrow?

Completion accounts remain the most commonly used consideration mechanism in Irish M&A transactions. A locked box mechanism is used more frequently in circumstances where the seller has the stronger negotiating position (for example, auction processes).

Escrow accounts are commonly put in place for a one to two-year period following completion of a private M&A transaction to deal with potential warranty and indemnity claims (and occasionally to settle amounts owing to a buyer following the finalisation of completion accounts).

Earn outs are more frequently used where the target company is non-revenue generating (but may have significant growth potential and/or valuable intellectual property).

5.5 What conditions are usually attached to a private takeover offer?

The approval of the Competition and Consumer Protection Commission and other regulatory bodies (which depend upon the industry sector of the target company) are usually included as conditions. Depending upon the nature of the target company and the transaction, a buyer may require certain third party consents to have been granted prior to closing and may also require a condition that no material adverse change has occurred between signing and completion.

5.6 Is it common practise to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It would be standard for Irish law to govern, and the Irish courts to have jurisdiction in respect of any disputes arising out of, private M&A share purchase agreements involving an Irish target company. However, from time to time and depending upon the location of the buyer and seller, a foreign governing law and/or jurisdiction can apply.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is not commonplace in private M&A transactions in Ireland, but it is being used more frequently in recent times. Consistent with international trends, it is often used in private equity transactions where the private equity seller is not willing to provide warranty protection to the buyer.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Whilst the full extent of the impact of new US administration and Brexit is yet to be determined, the Irish market is cautiously optimistic that the 2016 M&A activity levels will continue at the same level (or grow) in 2017. We expect that domestic businesses will continue to expand by way of acquisition and that foreign acquirers will continue to consider Ireland as an attractive jurisdiction to secure a strategic acquisition.

About the author |

||

|

|

Cian McCourt Partner, Arthur Cox Dublin, Ireland T: 353 1 779 4400 F: 353 1 618 0618 Cian McCourt is a partner in Arthur Cox's corporate department. McCourt specialises in mergers and acquisitions, advising on public and private transactions as well as corporate finance and equity capital markets transactions. He has experience advising on domestic and cross border transactions in a number of industries including the pharma/healthcare, financial services and technology sectors, as well as advising on corporate migrations, holding company structures, schemes of arrangement and cross border mergers. McCourt was previously a partner in another Irish law firm and was based in London and New York for a number of years. He advised international clients and boards of directors on investing in Ireland and Irish based acquisitions including advising on some of the largest and most high profile public transactions in Irish corporate history. |

About the author |

||

|

|

Maeve Moran Senior associate, Arthur Cox Dublin, Ireland T: 353 1 618 0000 F: 353 1 618 0618 Maeve Moran is a senior associate in Arthur Cox's corporate department and advises on domestic and cross border public and private transactions such as mergers, acquisitions, reorganisations and joint-ventures across a range of industries. Moran has experience representing issuers and underwriters in public and private offerings including IPOs and secondary offerings and she also advises on corporate governance, commercial agreements and inward investments. Moran was previously based in the New York office of Arthur Cox. |