SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The PRC M&A market has seen a record amount of activity in 2016. Outbound M&A deals were robust. Sectors such as real estate, entertainment and sports, technology and consumer products have been the most active in terms of transaction value. However, since the end of 2016, PRC regulators have begun to take a more conservative approach when reviewing and approving M&A deals, particularly for domestic deals involving PRC A-share listed companies and outbound direct investments.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

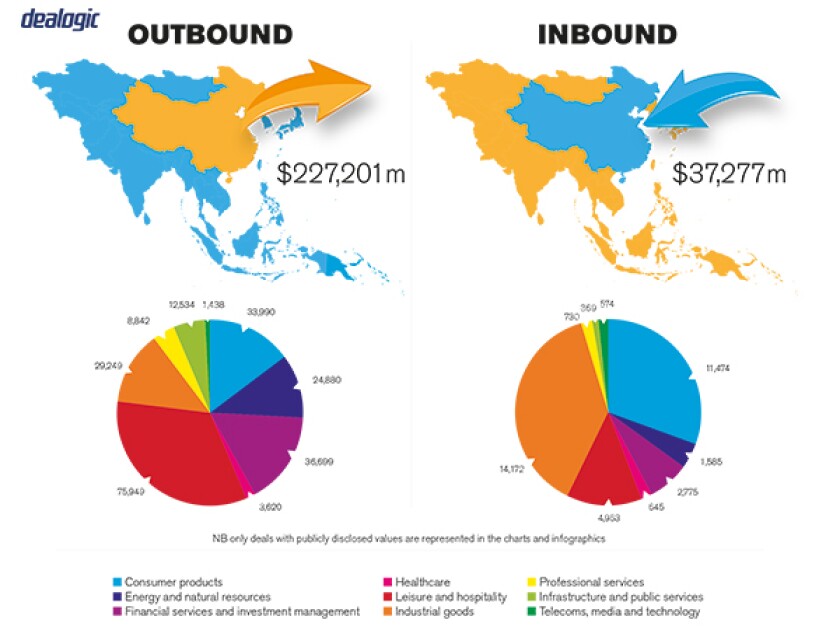

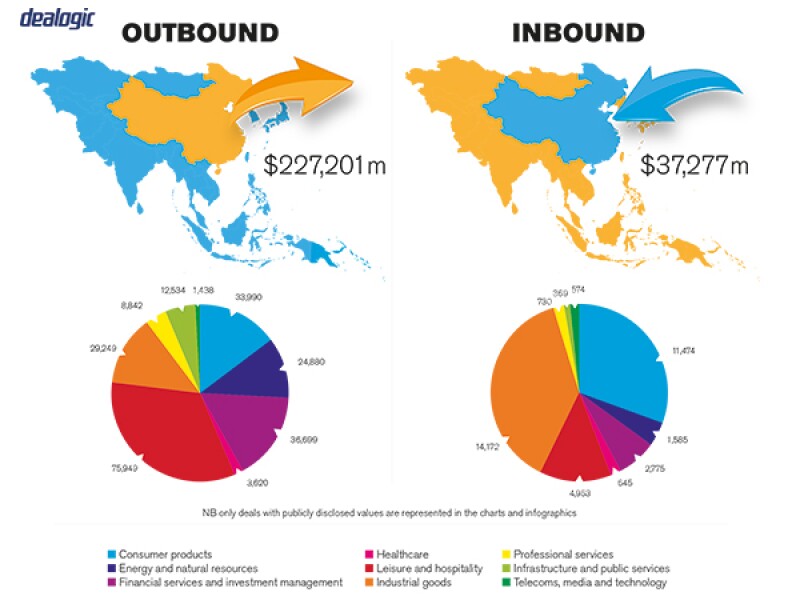

According to the M&A 2016 Review published by PwC in January 2017, deal volume rose 21% in 2016 as compared to 2015 with 11,409 transactions; this marks an 11% increase in total value, at $770 billion. Outbound investment alone grew by more than 100% as compared to 2015, which shows Chinese buyers' keen interest in high quality offshore targets. Financial investors, including large state-owned institutional investors and government funds, have led a significant portion of the M&A deals.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

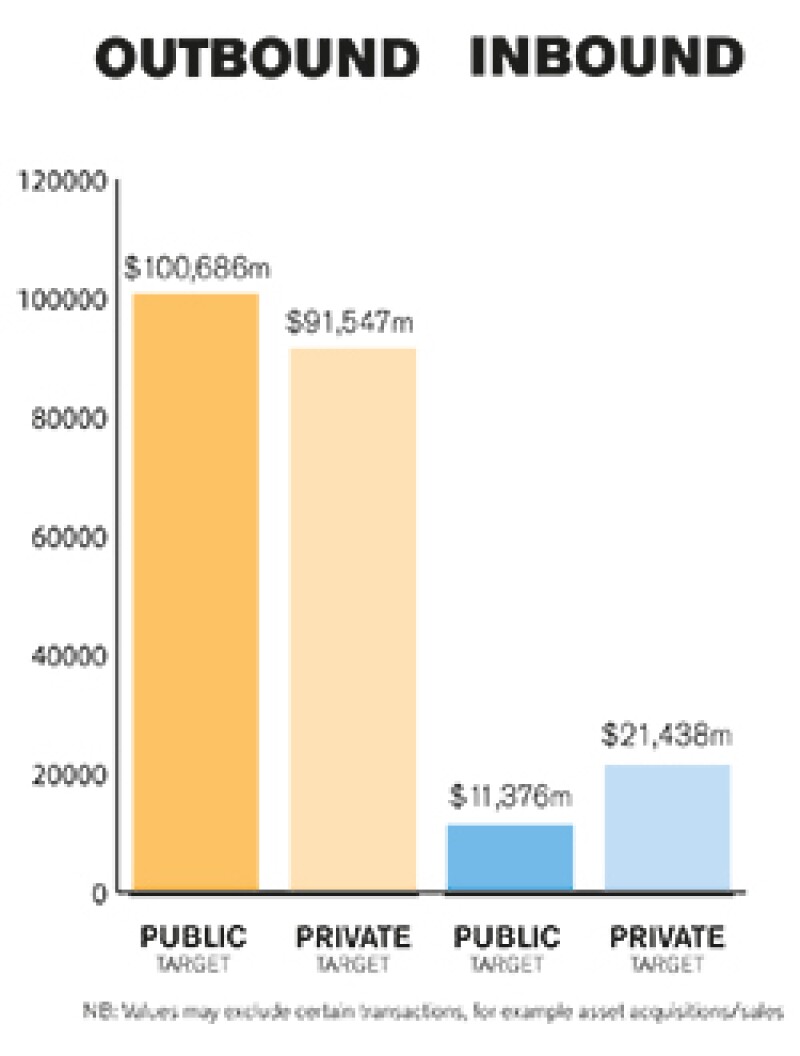

PRC M&A transactions are increasingly driven by both private and public companies. It is increasingly common for A-share listed companies to acquire private entities for strategic development or market expansion. Likewise, many private companies choose to acquire shares of a public company via major asset restructuring or backdoor listings. In recent years, we have seen increasingly more dynamic interactions between private and public M&A transactions.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

SF Express, a leading PRC logistics company, announced its IPO plans in February 2016 but soon decided to terminate them due to a long waiting list for the China Securities Regulatory Commission's (CSRC) approval. It is quite common for a company to wait two to three years to successfully obtain CSRC approval for an IPO. Instead, SF Express announced in May 2016 that it would conduct a backdoor listing via a major asset restructuring with Dingtai New Materials. Dingtai split off its original assets and purchased the assets of SF Express. Upon closing, the shareholders of SF Express became the controlling shareholders of Dingtai. This deal closed on February 24 2017.

It took SF Express seven months to complete the backdoor listing. The timeline is quite aggressive for such a deal in the PRC capital markets. During the seven-month period, the CSRC released several policy changes that tightened approval standards for a backdoor listing. For example, the CSRC will not approve backdoor listing applications with financial assets, and thereafter, it took SF Express only one month to spin off all of its financial assets.

SF Express's successful completion of the backdoor listing in such a short period was made possible through the quick decisions of its shareholders. In light of tightened regulatory environment, a company needs to quickly adapt to such changes.

2.2 What have been the most significant trends or factors impacting deal structures?

In PRC M&A deals, regulatory approvals are the most significant factors that impact deal structures. Since the outbound investment policy changes in December 2016, many ongoing deals have needed to adjust their deal structure, financing strategies and timeline to accommodate such policy changes. As a matter of fact, PRC government approvals or filings are often set as key milestones, and are in many cases deal breakers, for an outbound M&A deal.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key laws and regulations are:

Company Law;

Securities Law;

Administrative Measures on Takeovers of Listed Companies;

Administrative Measures on Major Asset Restructuring of Listed Companies;

Administrative Measures on Strategic Investment in Listed Companies by Foreign Investors;

Law of the PRC on State-Owned Assets of Enterprises;

Regulations Concerning Mergers and Acquisitions of Domestic Enterprises by Foreign Investors;

Anti-Monopoly Law; and

Rules of the State Council on the Declaration Thresholds for Concentration of Operators.

The main regulatory bodies are:

China Securities Regulatory Commission (CSRC);

Ministry of Commerce (Mofcom);

National Development and Reform Commission (NDRC);

State Administration for Industry and Commerce (SAIC);

State Administration of Foreign Exchange (Safe);

State Administration of Taxation (SAT); and

State-owned Asset Supervision and Administration Commission of the State Council (Sasac).

In addition, outbound deals are subject to the oversight of the Safe for remitting payments offshore.

Subject to the specific industry, other laws, regulations and regulatory bodies may be involved. For example, the acquisition of an internet service company may need approvals from the Ministry of Industry and Information Technology (MIIT) or the State Administration of Press, Publication, Radio, Film and Television (SAPPRFT).

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

(1) On September 8 2016, the CSRC published the amended Administrative Measures on Major Asset Restructuring of Listed Companies, which sets stricter rules for companies that intend to go public via backdoor listings.

(2) In late November 2016, Mofcom, NDRC, Safe and the People's Bank jointly announced a policy change regarding outbound investment. The proposed changes are principally aimed at curbing the capital flow of RMB offshore through irrational or non-commercial outbound investments, as well as high-value transactions (for example state-owned enterprise (SOE) real estate deals over $1 billion). The new restrictive measures attributed to PBOC have specified six types of transactions that are no longer acceptable:

Large scale outbound investments, includes: SOE real estate transactions over $1 billion; non-core business transactions over $1 billion; and transactions over $10 billion;

Direct outbound investments by LLPs (Limited Liability Partnerships);

Minority investments (ten percent or less) in overseas listed companies;

Transactions by a small domestic parent acquiring a large offshore subsidiary;

Delisting of overseas listed Chinese companies; and

Acquiring businesses with high asset-liability ratios and low return on equity (ROE).

As discussed above, this policy change will likely impact the overall deal structuring and financing strategies of an outbound M&A deal.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

As the legal environment in China has changed significantly since the 1980s, some of the clauses in the current foreign investment laws have become obsolete. The PRC government is considering to adopt a new foreign investment law to overhaul the regulatory framework over foreign investment in China. Recent filing and approval system changes since October 2016 represent the Chinese government's efforts to further simplify foreign investment in China. Mofcom published a draft foreign investment law for comments from the public in early 2015. However, there has been no further development in terms of the legislation process to abolish the current laws and adopt a new law. Traditionally, it has been the PRC government who drives the legislation process, but it is uncertain when the government will reach the consensus necessary to adopt a new foreign investment law.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

According to the current Sino-Foreign Joint Venture Law, the highest authority of a joint-venture (JV) is not the shareholders' meeting, but the board. In fact, the JV Law does not specifically mention the rights and obligations of the shareholder, for either the foreign or domestic JV partners. Therefore, carefully designed board rules, either in the JV contract or a company's articles of association, are key cornerstones for the successful operations of a JV.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

When planning for an acquisition of a PRC company, the most often asked question is: when will the equity ownership be transferred to the buyer? According to the PRC Company Law, once the seller executes a shareholder resolution to approve the merger and key transaction documents, the new shareholder will legally own the equity in the company. However, in PRC legal practice, the key milestone for an equity transfer is not the execution of the transaction documents, but rather the filing and registration with the relevant government authorities, for instance the SAIC and Mofcom.

Without proper registration and filings with the government, it is very likely that the transfer could be successfully challenged by a third party, or sometimes even by the seller. Therefore, it is always recommended that any purchase price payment is tied to the completion of proper government filings and registrations.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Before deciding to purchase any target assets in the PRC, a general overview of the key regulatory environment and legal issues is a must, as many industries are restricted for foreign investors. Once substantial negotiations with a seller have begun, it is always necessary to have professional legal and accounting service providers to provide an overview not only of the relevant laws and regulations, but also actual industry practice.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

From a regulatory perspective, listing rules and CSRC review and approval (if applicable) need to be strictly followed. Particularly in a hostile takeover situation, key thresholds (for example purchase of more than 30% of the outstanding shares of a listed company) must be observed in order not to violate relevant rules and face CSRC penalties. It is worth noting that there has been no precedent in the PRC market where a foreign investor has gained control of a PRC-listed company.

From a commercial perspective, the operational status and historical legal compliance of the target assets will have a material impact on the overall deal structure for gaining control of a public company.

5.2 What conditions are usually attached to a public takeover offer?

The conditions attached to a public takeover offer usually include the following:

Shareholder approval;

CSRC approval (if there will be an issuance of new shares ) or stock exchange consent (in the case of an all cash deal);

Other regulatory approval, for example anti-trust or special permits; and

Completion of key closing conditions, for example restructuring or spinoffs.

5.4 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Due to uncertainty in receiving regulatory approval, more public M&A deals include breakup fee arrangements, in order to lock in a target and recover transaction costs. However, if the breakup fee is to be paid to a foreign buyer/seller, PRC foreign exchange restrictions may create additional issues when remitting the fee offshore. To avoid foreign exchange uncertainties, we have seen deals with alternative mechanisms, such as escrow accounts or deposits into a Chinese subsidiary.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

All four types of consideration mechanisms exist in private M&A deals in China. According to our observation of the M&A deals in the market, when the buyer and seller are individuals, a locked box mechanism is often adopted subject to the parties' negotiations on the total consideration amount. When large corporations are either the buyer or seller in an M&A deal, more comprehensive consideration adjustment mechanisms such as completion accounts, earn-outs and/or escrow are often adopted.

5.5 What conditions are usually attached to a private takeover offer?

A private takeover offer will normally attach conditions for purchase price, payment schedule, validity period, modifications, revocations, and obtaining relevant governmental approvals.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Usually for an offshore target, it is common for Chinese buyers to accept foreign governing law and/or jurisdiction. However, M&A deals between domestic players or involving a foreign buyer will generally be governed by PRC laws. When a foreign buyer is involved, it is not uncommon for the parties to agree to arbitration in a neutral location, such as Hong Kong or Singapore.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance on private M&A transactions is not common in the PRC M&A market.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Due to the outbound direct investment policy changes, it is expected that outbound investment for 2017 may experience a significant slowdown, at least for the first half of the year. In the long run, the temporary policy adjustment is intended to thwart false outbound investments which in fact aim to illegally transfer assets out of China.

Due to the outbound investment policy changes, investors with sufficient capital will try to look within the Chinese market for high quality investment targets. Therefore, domestic M&A, particularly those driven by financial investors, may see significant growth in 2017.

About the author |

||

|

|

Richard Ma Managing partner, DaHui Lawyers Beijing, China T: 86 10 6535 5888 F: 86 10 6535 5899 E: Richard.Ma@DaHuilawyers.com Richard Ma is the managing partner and key founding member of DaHui Lawyers. As a recognised expert and preeminent lawyer in the IT/telecoms and media sectors, Ma has advised numerous US/UK investors and other multinational companies on countless successful deals in the Chinese market, ranging from market entry, M&A and joint-ventures to financing and restructuring. Ma particularly excels in devising practical and creative solutions to transactional complications, which are frequent in China due to its complex and rapidly developing legal system and unique business environment. Clients frequently commend him on his high level of responsiveness, practical problem solving skills, and strong commercial sense. |

About the author |

||

|

|

Leo Wang Associate, DaHui Lawyers Shanghai, China T: 86 21 5203 0688 F: 86 21 5203 0699 Leo Wang is a member of DaHui Lawyers' M&A and corporate teams. He graduated from Peking University law school and Georgetown University law centre. He has worked for many years with extensive experience in foreign direct investment, M&A, general corporate compliance and outbound investment. He assists clients in a variety of different industries, including IT, entertainment, media telecoms, education, e-commerce and real estate. His recent representations include a PRC listed company's acquisition of a controlling interest in a Korean-listed company. To date, this deal is one of the largest ever investments made by a Chinese enterprise in a Korean television producer. He has also advised on a public M&A project on behalf of a PRC listed company to purchase two target companies in the video game and entertainment industries in China. He represented two leading exhibition and event organisation companies in purchasing several internationally recognised show events in China. |