SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

In terms of transaction value, the acquisition of PT Amman Mineral Internasional by PT Medco Energi Internasional with a transaction value of $2.6 billion marked the domination of the M&A market in Indonesia in 2016 by acquisitions in the mining sector.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

M&A deal flow in Indonesia in 2016 increased significantly to $8.5 billion compared to a deal flow in 2015 of $1.6 billion.

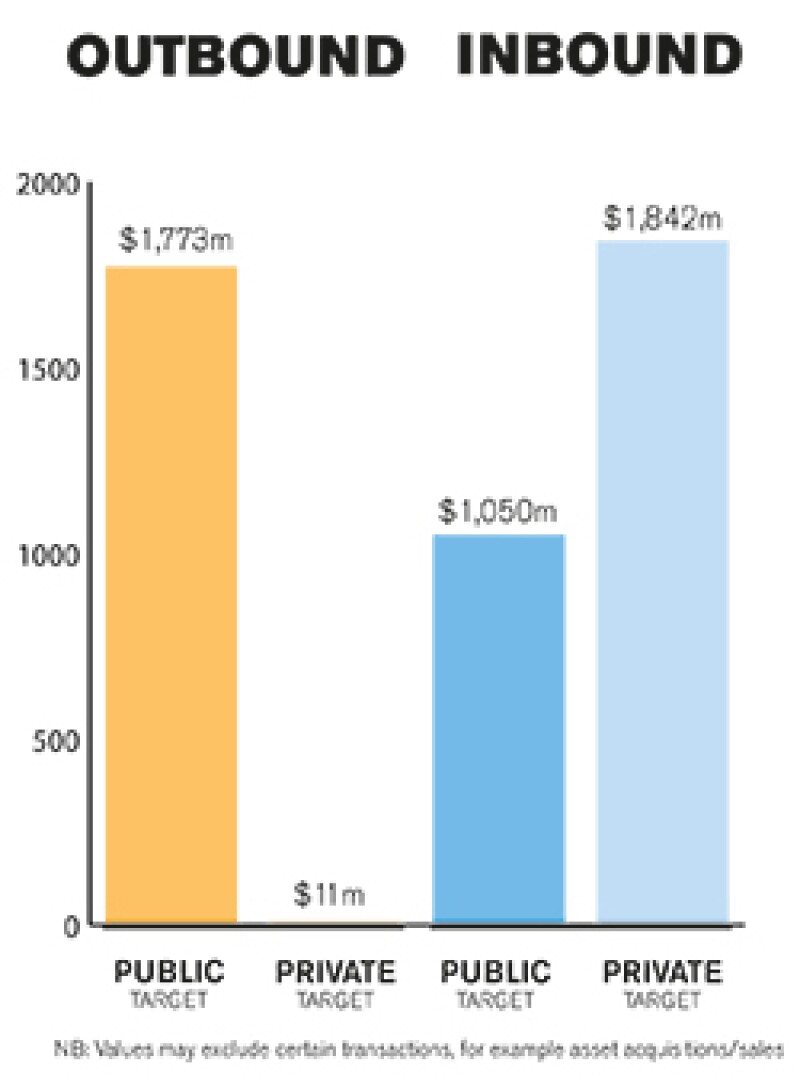

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Currently there are more private M&A transactions compared to public ones in Indonesia.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The acquisition by PT Medco Energi Internasional of a 50% stake in PT Amman Mineral Internasional, which controls 82.2% of PT Newmont Nusa Tenggara (a company which operates the world class Batu Hijau copper and gold mine on the Island of Sumbawa, Indonesia), is one of the most notable acquisition transactions in Indonesia. The transaction had a value of $2.6 billion and was supported by the three largest state-owned banks in Indonesia.

Another notable transaction is the acquisition by Apro Financial Co of 40% of the shares in PT Bank Andara, which will be followed by acquisition of 77.38% shares in PT Bank Dinar Indonesia and merger of those two banks to fulfill single presence policy. A similar trend is also expected to continue in the following years in order to strengthen the Indonesian banking sector.

2.2 What have been the most significant trends or factors impacting deal structures?

The most significant factor is the provision in the Investment Negative List under Presidential Regulation 44 of 2016 (that is, a list of the lines of business in Indonesia that foreign investors are not allowed to invest in). In practice, deal structures will be determined by the maximum foreign ownership on the line of business of the targeted company. There will be no issue if the line of business in the Negative List is open 100% for foreign investors, however, if the Negative List stipulates restriction, limitation and/or specific requirements, generally, deals will be restructured in order to comply with the provisions under the Negative List. Nevertheless, note that the Negative List is only applied on investments made by foreign investor.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

In general, M&A in Indonesia is governed by the following laws and regulations:

a. Law 40 of 2007 regarding Limited Liability Companies (Company Law) as well as its implementing regulation: including Government Regulation 27 of 1998 regarding Mergers, Consolidations, and Acquisitions of Limited Liability Companies (PP 27);

b. Law 25 of 2007 regarding investments as well as their implementation: Presidential Regulation 44 of 2016 regarding List of Business Fields that are Closed to Investment and Business Fields that are Conditionally Open for Investment; Regulation of Head of Investment Coordinating Board (BKPM) 14 of 2015 regarding Guideline and Procedure of Principle License in Investment as lastly amended by Regulation 8 of 2016; and Regulation of Head of Investment Coordinating Board (BKPM) 15 of 2015 regarding Guideline and Procedure of Investment Licensing and Non-Licensing. These laws and regulations only apply to M&A transactions which involve foreign investment;

c. Law 5 of 1999 regarding Prohibition of Monopoly and Unfair Business Competition as well as its implementing regulation, which includes among others: Government Regulation 57 of 2010 regarding Merger, Consolidation and Shares Acquisition which may Cause the Monopoly Practice and Unfair Business Competition; Business Competition Supervisory Commission (Komisi Pengawas Persaingan Usaha (KPPU)); Regulation 11 of 2010 regarding Consultation on Merger or Consolidation of Business Entity and Acquisition of Shares in the Company; and KPPU Regulation 13 of 2010 regarding Guidelines on Merger, Consolidation of Business Entity and Acquisition of Shares which may cause Monopoly Practices and Unfair Business Competitions, as lastly amended by KPPU Regulation 2 of 2013;

d. Law 8 of 1995 regarding the capital markets as well as several other regulations issued by the Capital Market and Financial Institution Supervisory Agency (Badan Pengawas Pasar Modal dan Lembaga Keuangan (Bapepam-LK)) which is currently known as Financial Services Authority (Otoritas Jasa Keuangan (OJK)), such as:

i) OJK Regulation 54/ POJK.04/2015 on Voluntary Tender Offers;

ii) Rule IX.G.1 on Mergers and Acquisition of Public Companies or Issuer Companies as an attachment to the Decree of Chairman of Bapepam- LK Kep-52/PM/1997;

iii) Rule IX.H.1 on Public Company Acquisition as an attachment to the Decree of the Chairman of Bapepam-LK Kep-264/BL/2011;

iv) Rule IX.E.2 on Material Transaction and Change of Main Business as an attachment to the Decree of Bapepam-LK Kep-614/BL/2011;

v) OJK Regulation f31/ POJK.04/2015 on Disclosure of Material Information or Fact by Issuers or Public Company; and

vi) OJK Regulation 29/ POJK.04/2015 on Issuers or Public Company exempted from Reporting and Disclosure Requirement.

These laws and regulations will be applied only if either the target or the purchaser is a publicly listed company;

e. Related tax regulations, including: Law 7 of 1983 as currently amended by Law 36 of 2008 regarding Income Tax Law; Law 8 of 1983 as currently amended by Law 42 of 2009 regarding Value Added Tax; Law 21 of 1997 as currently amended by Law 20 of 2000 on the Acquisition Duty of land and/or building; and Government Regulation 34 of 2016 on Income Tax of transfer of land and building and conditional agreement and its amendment; and

f. Any other specific regulations depending on the nature of business of the target or the purchaser (as applicable), such as in the banking sector, forestry, mining and others.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Major changes have been made in 2016 through the issuance of the Indonesian Economic Packages and Negative List on May 12 2016. The Indonesian Economic Packages aims to shorten the administrative procedures on licensing and to focus on several sectors (business activities). The Negative List was issued in order to attract foreign investor to invest in Indonesia.

Additionally, as of July 1 2016, the Indonesian government enacted Law 11 of 2016 on Tax Amnesty, in which the government will allow the taxpayer to write off outstanding and payable tax obligations after the taxpayer has first disclosed assets and paid certain ransom fees. The enactment of this tax amnesty might also affect M&A transactions in Indonesia, especially from the perspective of the local investor.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The government is planning to revise the Negative List this year. The government is willing to attract foreign investors to invest and build their business in Indonesia through a new negative list. These changes might affect M&A transactions in Indonesia foreign investment is involved.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Most investors believe that due diligence over the targeted entity prior to the M&A transaction can be conducted through public sources since it should be publicly available. In fact, the Indonesian system is not integrated, thus, most of the due diligence conducted will rely on documents provided by the targeted entity.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Yes, based on our experiences, there are some frequently asked questions in M&A transactions, which mostly relate to the law concerning the Indonesian limited liability company. Key questions include issues such as: the authority of the board of directors and board of the commissioner; the concept of class of shares; minority protection; and the procedure on transfer of shares or issuance of new shares.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

The best way to solve the Indonesian market's idiosyncrasies is to read various articles concerning investment in Indonesia from public sources and engage a legal consultant prior to entering into the term sheet, memorandum of understanding or offering letter.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

Control over a publicly listed company can be gained by either acquiring shares from the existing controller, or subscribing new shares by purchasing offered rights. Share acquisition in a publicly listed company will trigger a mandatory tender offer if there is a change of control. A party has control of a company when either: it owns more than 50% of the issued shares in the company; or it has less than 50% of shares but can determine the management and/or policies of the company. If a change in control results from issuing new shares under a rights issue, this is exempt from the mandatory tender offer requirement.

5.2 What conditions are usually attached to a public takeover offer?

Generally, a public takeover will occur due to a restructuring or divestment made by the strategic investor of such public company.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

In practice, break fees are uncommon but not prohibited. An arrangement to implement a break fee will be based on an agreement between the parties.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Subject to the size of the targeted company and the intention of the purchaser and seller, locked box and completion accounts mechanisms are quite common in practice. Generally, locked box is intended to be applied only by private equity or venture capital.

5.5 What conditions are usually attached to a private takeover offer?

The following conditions are common: restructuring; a new investment from a third party; or the divestment by the founder or its investor.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It is common for a share purchase agreement to provide for a foreign governing law and jurisdiction. English law is usually the governing law and the courts of Singapore or Hong Kong usually have jurisdiction.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance is rare on private M&A transactions.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

The new economic package and negative list will attract foreign investors to invest in Indonesia. We also understand from press releases that to attract more foreign investors and boost M&A activity in Indonesia, the government is planning to decrease corporate tax rates and provide more facilities for investors. Further, the current government programme to build 35,000 megawatts of power plants all over Indonesia will create opportunities and increase M&A transactions in the energy industry, and significantly strengthen infrastructure and real estate industry in the future.

About the author |

||

|

|

Freddy Karyadi Partner, ABNR Jakarta, Indonesia T: 62 21 2505 125 F: 62 21 2505 001 Web: www.abnrlaw.com Freddy Karyadi joined ABNR as a senior associate in July 2007 and became a partner on January 1 2012. He read law at the University of Indonesia (1998) and earned an LLM in international tax at Leiden University (2002). He also graduated cum laude in 1997 from the Faculty of Economics of Trisakti University in Jakarta and obtained an MBA from Peking University (2015). He has participated in various trainings and seminars in Indonesia and abroad. Prior to joining ABNR, he worked for a number of years in other prominent law firms in Jakarta. In 2010, he was seconded to a leading Dutch law and tax firm. His special practice areas are capital markets, M&A, investment, bankruptcy, corporate and debt restructurings, litigation, property, natural resources, tax, banking and project finance matters. He has represented international financial institutions, banks, private equity, venture capital, tech/digital, mining, and publicly listed companies. Karyadi also contributes articles to various publications and acts as speaker in the IBA, IPBA and various forums of IFLR. He is also a tax attorney, chartered accountant and licensed tax consultant. He has received awards from IFLR1000, Asialaw Profiles and The Asia Pacific Legal 500. |

About the author |

||

|

|

Ayik Candrawulan Gunadi Partner, ABNR Jakarta, Indonesia T: 62 21 2505 125 F: 62 21 2505 001 Ayik Candrawulan Gunadi joined ABNR as an associate in September 2001 and became a partner on October 1 2013. He graduated in 1997 from the faculty of law, Parahyangan Catholic University, majoring in economic and business law, and in 2000 completed his LLM programme at the Erasmus University Rotterdam, the Netherlands, majoring in business and trade law. Before joining ABNR, he worked for a law firm and reputable insurance company in Indonesia. He also worked in the Netherlands, as foreign trainee with an international legal and tax consultancy in Rotterdam, and thereafter with a Dutch bank in Amsterdam. He has extensive experience in matters involving corporate law, foreign investment, intellectual property and project finance, and has been actively involved in infrastructure projects in Indonesia. Gunadi returned to ABNR after a few months with a major Indonesian power company as senior legal manager. He has been listed by The Asia Pacific Legal 500 2016 as a recommended lawyer in projects and energy and intellectual property. |