SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Recent developments include the promulgation of amendments to the Kuwait Capital Markets Law (the CML) and the Kuwait Capital Markets Authority's (CMA) issuance of new executive bylaws to the CML (the CML Bylaws, which together with the CML constitute the CML Rules). In February 2016, Kuwait also issued a new Companies Law. There has been an increase in small to medium-sized acquisitions, largely involving local and regional investors including private equity firms. There has also been increased interest in larger acquisitions of listed companies, from international private equity investors.

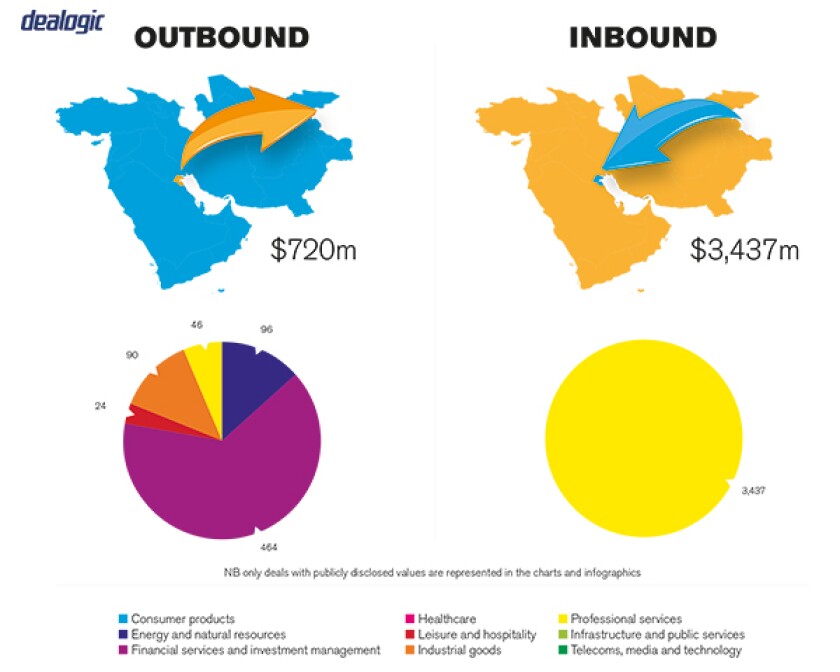

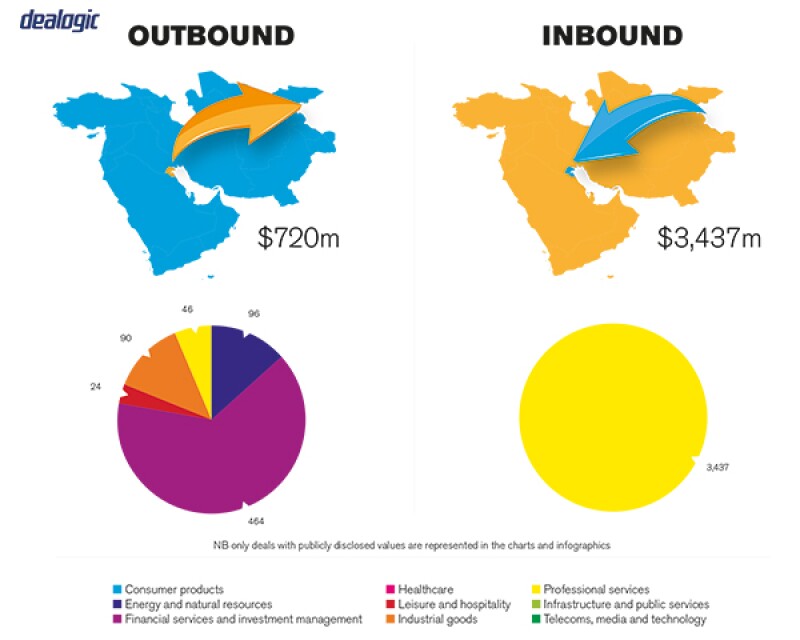

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

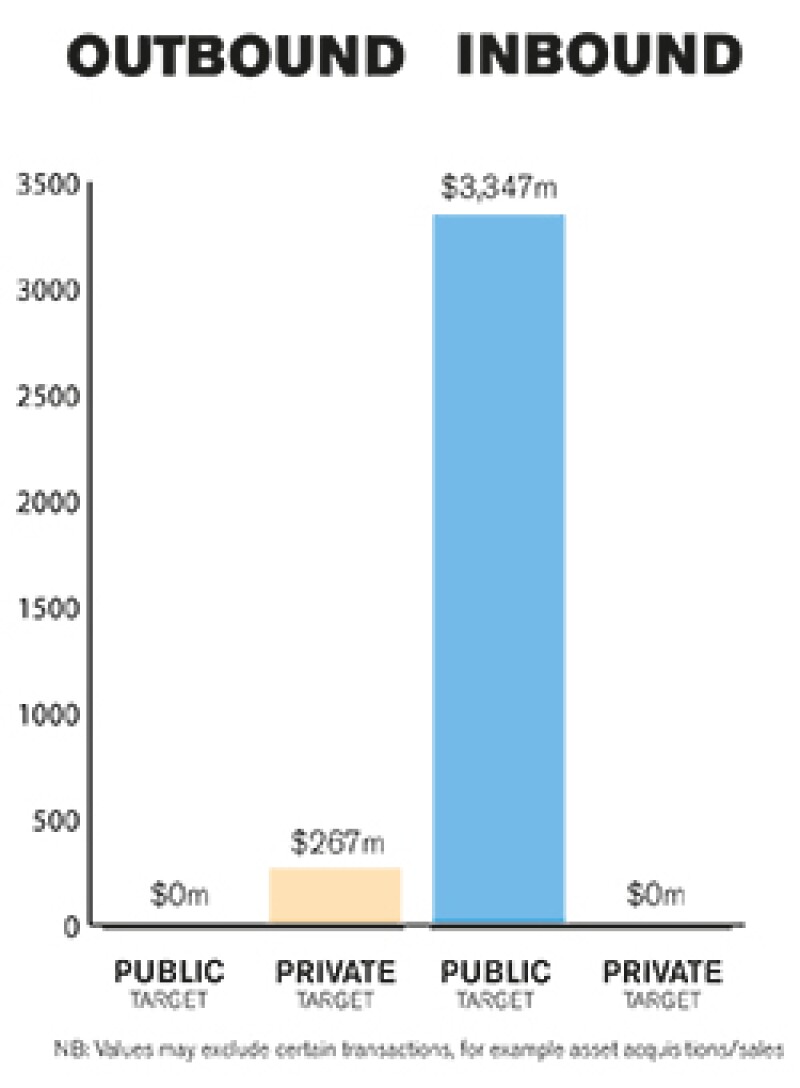

There has been a sizeable jump in the value of M&A deal flow during the 2016/2017 period. This is primarily due to the successful closing of Kuwait's largest ever M&A transaction, namely, that of the Americana transaction highlighted in Question 2.1. We anticipate a steady increase in public M&A activity in Kuwait over the next 12 months. The outlook for public M&A in Kuwait received added impetus from the recent promulgation of the amendments to the CML Rules.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

The Kuwaiti market is primarily driven by private M&A transactions.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The most notable M&A transaction in the Kuwaiti market during the 2016/2017 period was the recent acquisition by Adeptio AD Investments SPC (Adeptio) of 67% of the share capital of Kuwait Food Company KSCP (Americana) from Al Khair National for Stocks and Real Estate. This was Kuwait's largest ever M&A transaction under the recently amended CML regime.

The successful Adeptio acquisition of 67% of Americana triggered the initiation of a mandatory takeover offer (MTO) which allowed shareholders holding the remaining 33% of the share capital in Americana to tender their shares for sale to Adeptio. Taking into account the shareholders who tendered their shares under the MTO process, Adeptio's shareholding in Americana increased to more than 90% of the share capital of Americana. This M&A transaction is a landmark and precedent-setting transaction in Kuwait given the nature, size and complexity of the deal. It was more than two years in the making and involved major stakeholders, including some of the world's leading banks and investment advisors.

2.2 What have been the most significant trends or factors impacting deal structures?

One of the most significant factors impacting deal structures was the enactment of new legislation (including the new Companies Law and CML Rules).

One other important factor impacting deal structures is that acquisition finance is generally possible in Kuwait given that there are no financial assistance rules. However, because of corporate benefit considerations, the parties to an M&A transaction have to put in place various structures in order to ensure the funds obtained through such financing are pushed down the corporate structure.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The CML Rules (particularly Book IX (Mergers and Acquisitions) of the CML Bylaws), are the primary legislation governing public M&A in Kuwait. The CML Rules apply where there is an acquisition or consolidation of control of a Kuwait incorporated company listed on Boursa Kuwait (formerly know as the Kuwait Stock Exchange); or a non-Kuwait incorporated company with a primary listing on Boursa Kuwait.

The status of the target company determines whether or not the relevant CML Rules apply. The CMA is the primary regulator for public M&A activity in Kuwait. The CML Rules provide a statutory framework for public M&A in Kuwait where there is a takeover offer for 100% of the share capital of a company listed on Boursa Kuwait; and a mandatory takeover offer which must be made to remaining shareholders when the offeror acquires.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Other than as described herein, none that we are aware.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

We understand that amendments to the Competition Law and the executive regulations thereto will be forthcoming, however, we note that to date no such legislative amendments have been promulgated and/or issued in the Kuwait Official Gazette.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Some of the major mistakes or misconceptions with regards to the Kuwaiti market include: poor disclosure processes because sellers are sometimes inexperienced in the M&A processes, and targets do not keep track of all the documents needed to be disclosed to the buyers; and misconceptions about the regulatory processes which are often more complicated than what the parties expect. In addition, a common mistake made by practitioners is to import legal structures and documentation developed in other jurisdictions without a proper adaptation of same to the peculiarities of the Kuwait legal system. This can lead to complications in the execution phase of the transaction and in the enforcement of rights arising under M&A transaction documentation.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

An area that is often overlooked and/or paid less attention to, is due diligence. In particular, appropriate translation of due diligence findings into contractual protections, whether by means of pre-closing remedial actions, associated variation of commercial terms, special indemnities or other methods is deficient. This often arises because the legal practitioners that carry out the due diligence do not always lead the negotiation of transaction documentation. Parties involved in an M&A transaction also often overlook certain aspects of the Kuwait competition law. Furthermore, the rendering of M&A/investment advisory services with respect to securities onshore of Kuwait is a regulated securities activity under the CML Rules. As such, foreign services providers should be aware of the restrictions applicable in connection with the rendering of such services onshore of Kuwait.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

The best measures to prepare for the market idiosyncrasies is to perform an adequate due diligence of the target, engage well-experienced law firms, manage the expectations of the sellers (with respect to timing and requirements specific to the jurisdiction) and encourage parties to retain suitably qualified financial advisors.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The key factors are the following:

Obtaining regulatory consents of the regulatory body such as the CMA for licensed companies and/or CBK for financial institutions (as the case may be).

Disclosure of the transaction as required per the CML Rules.

Abiding by the laws and regulations of each sector. For example, pursuant to the CML Rules, for companies listed on the exchange of Boursa Kuwait, an MTO must be launched by the bidder once the bidder has come into possession of more than 30% of the voting shares of a target company listed on the exchange.

5.2 What conditions are usually attached to a public takeover offer?

An offer must not be subject to conditions that can only be satisfied at the discretion, and in the subjective judgment, of the bidder or the target company, or where their satisfaction is within the control of the bidder or the target company. Only voluntary takeover offers (VTO) may be subject to conditions required by the bidder. However, in the case of an MTO takeover offer, no conditions may be imposed by the bidder.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

The terms of the agreement are generally left to the discretion of the parties. There are no specific rules in Kuwait dealing with break fees and parties are free to agree specific arrangements to this effect. We are not aware of any trends/market standards in this regard.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Locked box mechanisms are common in Kuwait. Earn-outs and escrow are very common in large transactions of KD20 million ($65 million) and above, whereas completion accounts are less used in the Kuwaiti market.

5.5 What conditions are usually attached to a private takeover offer?

While a private takeover offer is permissible under the law, there is no trend that has been established in the market given that this is relatively new.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

It is quite common to have acquisition documents governed by foreign law (for example English law).

5.7 How common is warranty and indemnity insurance on private M&A transactions?

This is highly uncommon.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

We anticipate a steady increase in public M&A activity in Kuwait over the next 12 months. The outlook for public M&A in Kuwait received added impetus from the recent promulgation of the new CML Bylaws.

About the author |

||

|

|

John Cunha Partner, ASAR-Al Ruwayeh & Partners T: 965 2292 2700 F: 962 22400064 John Cunha is a partner at ASAR and has been with the firm since April 2006. Cunha practices in the areas of banking and finance, capital markets and mergers and acquisitions. Cunha holds a law degree awarded by the University of the Free State, South Africa in 1999. Cunha was in 2002 also awarded a master of business administration degree (MBA) from the University of the Free State, South Africa (in collaboration with De Paul University in Chicago, USA). Cunha also holds a master of laws degree (international trade law) (LLM) awarded by the University of Stellenbosch, South Africa. Cunha was admitted to the South African bar in 2000 and was admitted as a solicitor of the Senior Courts of England and Wales in 2007. Cunha's practice languages are English, Afrikaans and Portuguese. |

About the author |

||

|

|

Laurent Levac Senior associate, ASAR-Al Ruwayeh & Partners T: 965 2292 2700 F: 962 22400064 Laurent V Levac is a senior associate at ASAR and has been with the firm since August 2014. Prior to joining ASAR, Levac worked for international law firms with postings in France, the United Kingdom, the Netherlands and Canada. Levac currently practices in the areas of mergers and acquisitions, private equity, corporate law, banking and finance, project finance and energy. Levac holds a bachelor's degree in civil law (LLL) and bachelor's degree in common law (LLB) awarded by the University of Ottawa, Ontario, Canada, respectively in 2002 and 2003. He also holds a master's degree in American common law (LLM), awarded by Cornell Law School, New York, USA in 2005. Levac was admitted to the Quebec Bar (Canada) in 2005 and the Law Society of England & Wales in 2010. Levac's practice languages are English and French. |