SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Over the past 12 months the M&A market in Spain has maintained the upward trend initiated in 2015. Multiple factors have led to this but we would highlight the following as the most relevant: a robust economic atmosphere; the consensus that certain structural changes have been put in place to strengthen the economy; and the designation of a prime minister during Q4 of 2016 after months of political instability.

The most active sectors in the M&A field during this period have been real estate, technology and financial.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

According to Transactional Track Record (TTR), 2,023 M&A transactions were reported during 2016, the value of 964 of which has been disclosed, and which amounted to €111 billion. This represents a 1.86% and 10.16% increase respectively in comparison with 2015.

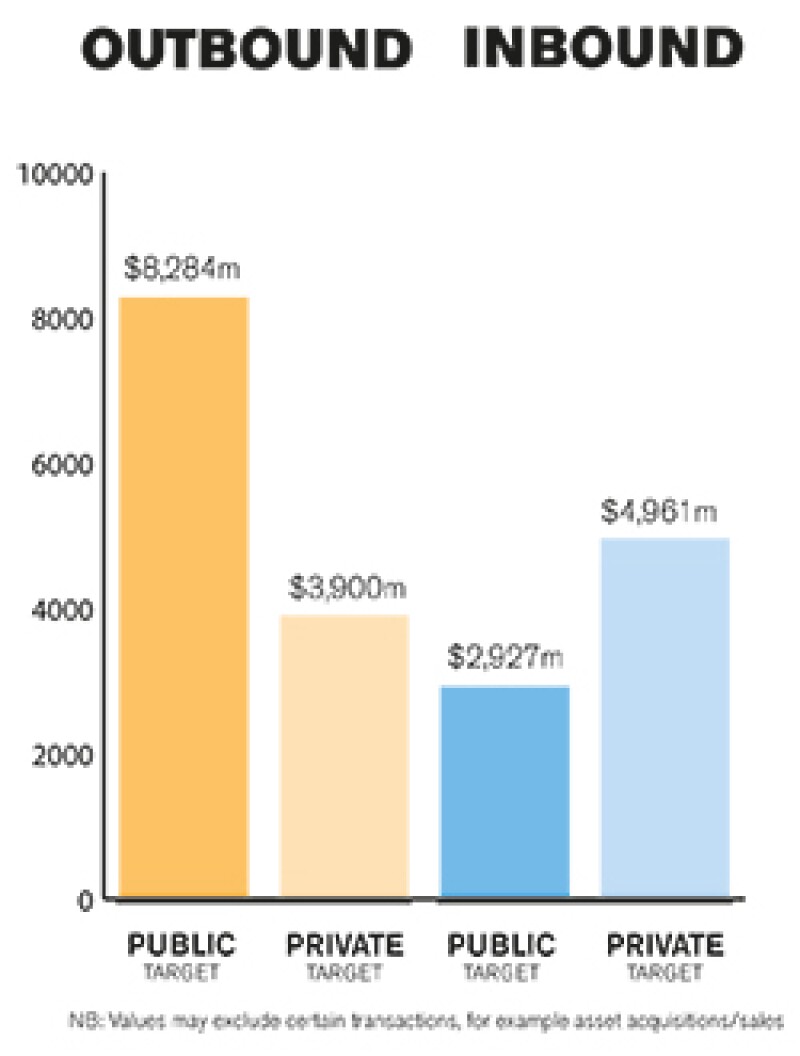

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

Private and public M&A transactions have both contributed to a similar degree to the recovery of the M&A market. On the negative side, we would highlight that the IPO market has still not made a full recovery.

SECTION 2: M&A structures

2.1 Please review some recent relevant M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

Some of the most notable M&A transactions during 2016 have been the following:

The acquisition of Grup Maritim TCB by APM Terminals for €911 million.

The share capital increase of Banco Popular for €2.51 billion.

The acquisition of 20% of Gas Natural Fenosa by Global Infrastructure Partners for €3.8 billion.

The acquisition of Urbaser by Firion Investments for €1.28 billion.

The most relevant and encouraging upshot of these and other relevant M&A transactions during 2016 is the realisation that institutional investors are looking at the Spanish market with renewed interest.

2.2 What have been the most significant trends or factors impacting deal structures?

The Spanish M&A market has become more and more sophisticated and complex during the last years. Not only new actors, but also more complex deal structures and financing formulas are driving the main transactions. This complexity obliges investors to seek high-skilled, imaginative and versatile advisors who will understand their needs and design an ad-hoc, specific structure that will protect their interests.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key pieces of legislation that govern M&A transactions in Spain are:

Ley de Sociedades de Capital: the Corporate Enterprises Act (CEA) 1/2010 of July 2;

Ley de Modificaciones Estructurales: the Corporate Restructuring Act (CRA) 3/2009 of April 3; and

Ley del Impuesto sobre Sociedades: the Corporate Income Tax Act (CITA) 4/2004 of March 5.

Also, when strictly referring to public M&A activity:

Ley del Mercado de Valores: the Securities Market Act (SMA) 4/2015 of October 23; and

Real Decreto sobre Régimen de las Ofertas Públicas de Adquisición de Valores: the Royal Decree on the Public Acquisition of Securities (PAS) 1066/2007 of July 27.

The main regulatory bodies that govern M&A transactions are:

The National Securities Market Commission (NSMC); and

The National Markets and Competition Commission (NMCC).

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Political instability during 2016 has led to a reduction in the number of amendments to the legal and regulatory framework. The reelection of the acting prime minister has brought some new appointments of heads of certain regulatory bodies. However, we do not expect any major changes in current policy lines to take place in the near future.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The Spanish legislative body is currently highly atomized, with no political party or political alliance holding a stable majority to pass legislative resolutions. Hence, in line with the above, we do not expect any key legislative resolutions to be passed in the near future.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

It is notable that most foreign investors tend to approach investments in Spain from a common law perspective. This leads to some misconceptions about alternatives for structuring or negotiating an M&A transaction in Spain. The best way to avoid potential inconsistencies or ex-post weaknesses in a deal is to involve legal counsel at the earliest stage possible. It is commendable that more and more foreign investors in Spain recognise this fact and the need to seek appropriate advice during the entire deal process.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

From a strictly legal standpoint and without prejudice to the comments about planning in Question 4.1, another area often overlooked regarding transactions in Spain concerns the formalities that need to be observed. Spanish legal tradition is very formalistic and consequently not only the content but also the need to observe the formalities to document any transaction in Spain need to be strictly observed. The consequences of failing to observe these kinds of provisions rank from the imposition of fines to the potential nullity of an agreement.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

Based on the foregoing, seeking local legal advice and involving the local counsel in all the phases of the deal (from the preliminary negotiations until completion of the relevant post-closing formalities) is crucial. Even if the transaction is not subject to Spanish Law, there are certain mandatory legal provisions that will apply to any deal that takes place in Spain.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

a) Control of a listed company in Spain is deemed to take place in the following scenarios:

(i) direct or indirect acquisition of a percentage of voting rights equal to, or in excess of 30%; or

(ii) holding any interest carrying less than 30% of the voting rights but appointing, within 24 months following the acquisition, a number of directors which, together with those already appointed by the bidder, if any, represents more than one-half of the members of the board of directors.

b) Whenever a person gains control of a listed company according to the parameters mentioned above, that person will be obliged to launch a takeover bid for all the securities of the target at a price that is considered equitable.

c) Control of a listed company may be gained by any of the following means:

(i) Acquisition of securities that grant direct or indirect voting rights in the company;

(ii) Shareholders´ agreements; or

(iii) Indirect or unexpected takeovers (in situations such as mergers, restructuring or others that result in control), as described in PAS.

d) Hostile bids are permitted.

5.2 What conditions are usually attached to a public takeover offer?

Structure, content and procedure for formalising a public takeover offer are regulated by Spanish law. The most relevant conditions that need to be observed in any such offer are the following:

a) An offer may be placed in the form of an acquisition, exchange of shares or a combination of both;

b) The offer must ensure equal treatment of security holders who are in the same position;

c) Collateral shall be provided to ensure that the obligations assumed within the offer are honoured.

d) The resources to file the offer and the content and requirements are regulated by PAS.

e) The submission of the offer is subject to the prior authorisation of the NSMC.

f) The term to accept the offer is determined by the offeror. However, it shall necessarily be between 15 and 70 days.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Break fees are common in public M&A transactions in Spain.

However, break fees are governed by Spanish law and are particularly subject to the following conditions:

a) They can only be agreed with the first offeror;

b) They may not exceed an amount equivalent to one percent of the total amount of the offer;

c) They need to be approved by the management body of the target company;

d) The financial advisors of the target need to pass a favourable report on the break fees; and

e) They need to be explicitly detailed in the offer document.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

As previously mentioned, private M&A deals have been growing more and more complex during the last years. This process has led to a plethora of different structures and of mechanisms to determine the price of the transaction. Differences between sectors in this regard are also gradually increasing. Hence, it is difficult to identify general trends in the whole M&A market.

In any case, earn-outs and escrows continue to be the most recurrent mechanisms for buyers to secure part of their investment, while locked box or completion account mechanisms are more frequently seen in specific sectors such as M&A transactions related to project companies.

5.5 What conditions are usually attached to a private takeover offer?

As opposed to public takeovers, private takeovers are not governed by Spanish legislation and consequently the parties may choose the mechanism they find most appropriate to initiate a negotiation. Based on the foregoing, there is no formal or standard structure for private takeover offers. It will vary on a case by case basis depending on multiple factors such as the profile of the parties, the size of the transaction, the urgency to close the deal or any other specific characteristic of the transaction.

Nevertheless, when it comes to competitive tender processes, and notwithstanding the preceding paragraph, some common features of the process for launching a private takeover offer are the following:

i) Bidders are granted access to a part of the target´s information and documentation to carry out a high level due diligence.

ii) Bidders draft a tentative offer in the form of heads of terms, letter of intent or any other similar document describing the main terms of their offer (for example, price and valuation of the target, price adjustment mechanism, funding sources and/or guarantee for the offered price, potential conditions precedent).

iii) The bidder that has submitted the best offer is granted an exclusivity period by the seller(s) to negotiate the terms of the transaction.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

On the one hand, M&A transactions are seldom subject to a foreign law in Spain. There are many reasons for this, but we would highlight the following:

a) Spanish Law provides for a secure, balanced, fair and stable legal environment which investors can completely rely on.

b) There are parts of Spanish legislation, especially those that refer to the structure and governance of limited liability companies which most frequently form the target companies of M&A deals, that are mandatory and cannot be waived by mutual consent of the parties. Hence, submitting a deal to a foreign law could give rise to disputes in relation to conflict of laws.

On the other hand, it is increasingly more frequent to submit M&A deals to a foreign jurisdiction. In this case, it is particularly recurrent that a transaction is subject to arbitration and specifically to the jurisdiction of international, unbiased, well reputed arbitrators. The main reasons for this are to avoid the delays that Spanish Courts are experiencing and to ensure that the members of the court that will decide on the specific controversy are individuals with reputed experience and long-time background in the particular subject matter.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

Warranty and indemnity insurance on private M&A transactions is also gaining ground lately. Especially in cases where the seller is an institutional investor looking for a clean exit, the parties agree to insure any liability that could arise for the seller in connection with the transaction.

This increasing trend is also driving the insurance companies to offer new, more specialized and price competitive products to the market.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

We expect the growing trend initiated two years ago to continue in 2017 and even increase. The real estate and financial sectors, as well as the technological and energy sectors, could be the most dynamic, following the trend of previous years.

The main indicators for these conclusions are the predictions of a stable political background in the years to come for the reasons explained above, the consolidation of Spain as one of the strongest economies in the eurozone and the fact that Spanish companies have gained interest for foreign investors due to the restructuring and consolidation decisions adopted during the financial crisis.

About the author |

||

|

|

Fernando de las Cuevas Castresana Partner, Gómez-Acebo & Pombo Madrid, Spain T: 34 91 582 91 32 F: 34 91 582 91 14 E: fcuevas@gomezacebo-pombo.com Fernando de las Cuevas specialises in M&A, banking law, securities market's law, collective investment institutions, and family and private equity businesses. He is consistently recognised in all prestigious legal directories, including Best Lawyers, Chambers and Partners, Legal500, IFLR1000 and Who's Who. He is particularly renowned for his commendable M&A and financial knowledge. De las Cuevas joined Gómez-Acebo & Pombo Abogados in 1983. He was a foreign associate at Shearman & Sterling in New York from 1985 to 1986. He has been a partner of Gómez-Acebo & Pombo Abogados since 1990 and managing partner from 1998 to 2000. Currently he is the head of M&A. He holds a master of law, a bachelor of business science and a diploma in European studies from the Universidad de Deusto (1981), and a diploma in higher European studies from the College of Europe, Bruges (1982). He received a research scholarship from the European Free Trade Association, Geneva (1982-1983), and graduated from the PIL course at Harvard Law School (1990). He is fluent in Spanish, English and French. |

About the author |

||

|

|

Ignacio de la Fuente Muguruza Associate, Gómez-Acebo & Pombo Madrid, Spain T: 34 91 582 93 87 F: 34 91 582 91 14 E: idelafuente@gomezacebo-pombo.com Ignacio de la Fuente graduated in law and business sciences from the Universidad Pontificia de Comillas in Madrid, and obtained a scholarship from the University of Texas in Austin where he developed his studies in business sciences. De la Fuente is an associate at Gómez-Acebo & Pombo Abogados, and his specialisations include M&A, family and private equity businesses and insolvency proceedings. He has also worked as head of the legal department of Hyundai Motor Group in Spain. He is a member of the Guipúzcoa Bar Association and he is fluent in Spanish, English, German and Basque. |