SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

Last year saw a very high participation of Chinese investors in the German M&A market. Compared to previous years, the value of transactions with Chinese investor involvement increased significantly by a factor of 32 (3,200%). Within the first quarter of 2016 the deal value of Chinese acquisitions in Germany already exceeded the overall deal value of 2015. This rapid increase is even more noteworthy considering that US deals, representing the largest foreign involvement in German business, fell by ten percent. The focus of Chinese investments shifted from struggling automotive suppliers and the solar industry to the technology sector.

A second trend within the German market can be seen in takeovers of highly valued foreign companies which have also characterised 2016. Bayer taking over Monsanto with a deal value of $66 billion is the highest rated transaction in German M&A history.

Also, private equity investors were again perceptibly active, not so much on big ticket deals, but (mid-size) private equity funds invested in a large number of mid and small-cap targets in all kinds of industries.

The most active sectors in German M&A in 2016 were real estate, high technology, and energy and power.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

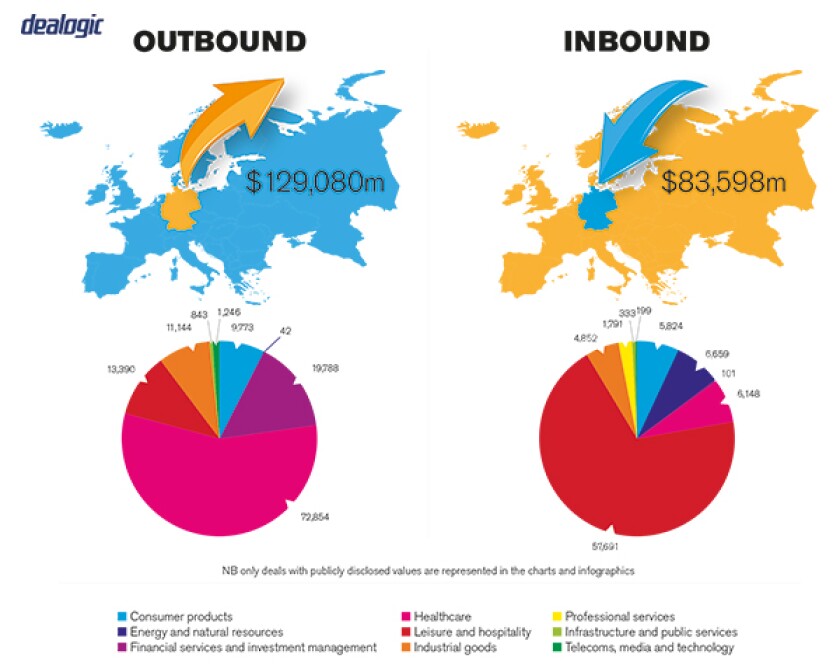

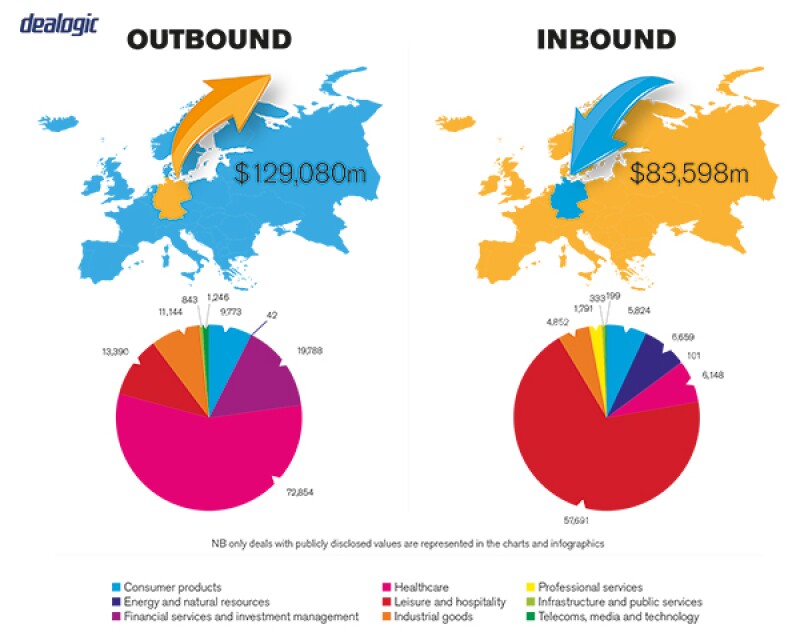

German M&A has remained resilient in the face of the tide of change sweeping across Europe. Compared to previous years (with the exception of 2014), the volume and value of the German M&A market increased significantly. The deal value of M&A transactions with German participation (inbound and outbound) in 2016 amounts to $200 billion (2015: $116 billion; 2014: $224 billion; 2013: $127 billion; 2012: $118 billion). Other than in the years before, the deal value in the different quarters of 2016 is unevenly distributed. More than half of the value (about $118 billion) is attributable to the second quarter of 2016.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

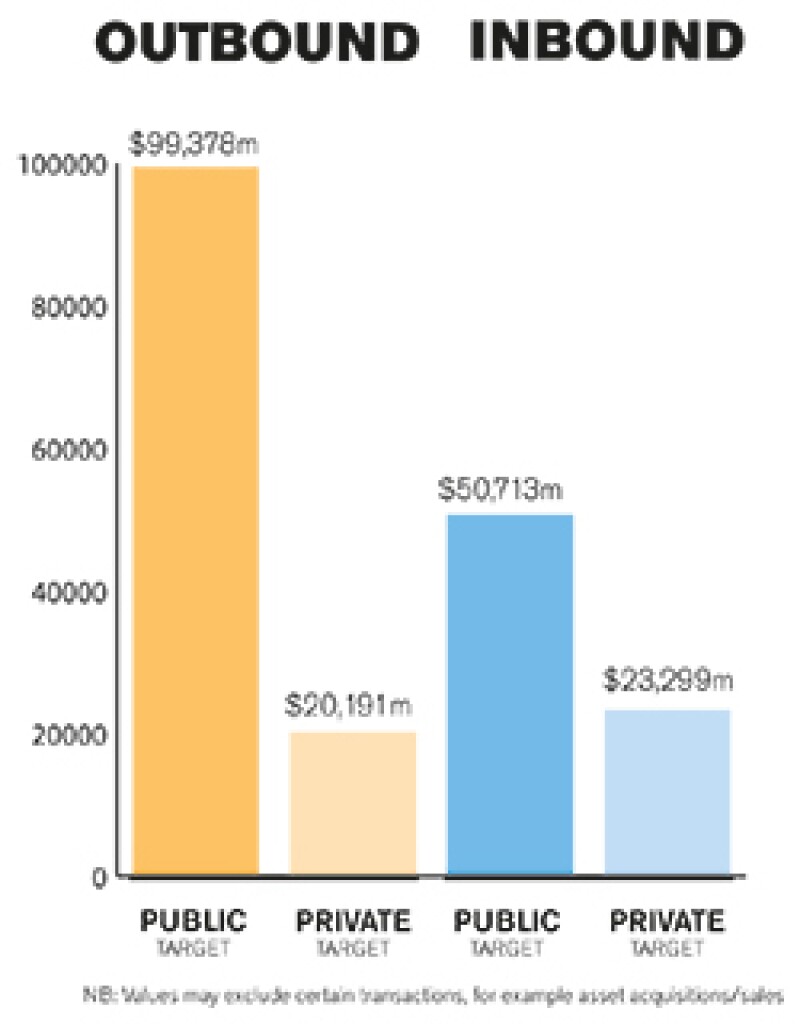

In volume, most German M&A transactions are of a private nature with no listed company involved. Nevertheless, a few public transactions with a high transaction value (Bayer-Monsanto, $66 billion) have made a big part of the total deal value for a given period. In everyday legal practice, small cap and mid-market private transactions are driving the German M&A market; however, large public transactions still attract the bulk of media and expert attention. Differences include the fact that private company sales are more likely to turn into extended auction processes. Also, the share price is an important indicator of the target's goodwill. Determining the purchase price therefore seems to be more difficult within private transactions than with listed targets.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The first notable M&A transaction concerns Bayer's takeover of Monsanto for a deal value of $66 billion as described above. However, the deal has not yet been closed. The Monsanto management has signed a binding merger agreement but the shareholders of Monsanto have to approve and agree to sell their shares for the price offered by Bayer. Also, closure of the deal depends on the competition authorities giving the green light to the deal. The parties expect the closing of the deal by the end of 2017. The acquisition will make Bayer the worldwide number one in the agrochemical sector.

Another example is the merger of two major retail chains: Edeka's takeover of Tengelmann. The transaction did not obtain the merger control clearance from the competent German Federal Cartel Office, but the German Minister for Economic Affairs gave his controversial permission to the deal. In the end, the transaction succeeded after several court actions, thus showing that private deals may sometimes be part of political discussions affecting M&A.

In early 2016, the announced merger of the German Stock Exchange (Deutsche Börse) and the London Stock Exchange (LSE) attracted a great deal of attention. Nevertheless, the merger is about to fail at the fifth attempt. The LSE is apparently not willing to accept the prerequisites set forth by the EU Commission's for the granting of the EU approval.

2.2 What have been the most significant trends or factors impacting deal structures?

In the almost ten years since the 2007 financial crisis, a limitation of liability in favor of the seller has become increasingly popular, and as a consequence W&I insurance policies have become increasingly common. Sellers tend to have a quite strong position as the supply of sound transactions is significantly smaller than the demand (even stronger than before the financial crisis) coming from financial as well as from strategic investors. Buyers are sometimes willing to overpay fair values of targets. As regards financing of transactions, money is available in the market at all ends, and does not appear to make deals complicated.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The key legislation that governs M&A activity in Germany is German corporate law with its specific codes. The main regulatory bodies are the Federal Cartel Office, the Federal Financial Supervisory Authority (BaFin) and lately the Federal Ministry of Economics.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

Apart from certain changes in the tax regulations, there were no material changes in the regulations that may have a direct impact on M&A transactions in the recent years.

However, there were material changes in the regulatory environment for the so called grey capital market, which could have an indirect influence on M&A transactions. Attention should be paid to capital market regulations if the acquiring company raises capital from a number of investors to finance the transaction. In such case the newly established Capital Investment Code (Kapitalanlagegesetzbuch) may be applicable and therefore authorisation by the BaFin could be required. Furthermore, if the transaction is financed by subordinated loans or loans which interest rate is linked to borrower's profit (so called partiarische Darlehen) the applicability of the Capital Investment Act (Vermögensanlagengesetzbuch) or the Banking Act (Kreditwesengesetz) must be verified.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

The Federal Ministry of Economics is about to draft a bill that grants the Ministry veto rights against foreign direct investments. Today, the Federal Ministry of Economics can prohibit transactions if public safety and public order are in danger. The bill will expand the veto right, particularly in four cases: investments driven by industrial policy; state subsidisation of the buyer; takeovers by a (partially) state-owned enterprise; and direct investments from countries that offer German companies limited access to the market. This draft itself was reason enough for a wave of uncertainty amongst Chinese investors. During a visit to Beijing, the German Minister for Economic Affairs advocated equal framework conditions for investments by German companies in China and Chinese companies in Germany.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Over the last two decades, the M&A market in Germany has become more and more sophisticated and adheres to international standards. A frequent mistake is that foreign investors, including private equity funds, try to apply this standard, including very long and detailed Anglo-American forms of documentation (including bank financing), to German sellers from the so-called Mittelstand (mid-sized companies). This leads to misunderstandings and long negotiations.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

Foreign investors, in particular those from the US, are not familiar with the German concept of employees' co-determination on supervisory boards. According to these rules and depending on the target's total number of employees, the employees' representatives constitute up to half of the supervisory board members. Moreover, Germany's rather extensive labour law regulations restrict post-merger restructurings more than in many other country, in particular the US.

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

In order to prepare for a smooth transaction, the parties should ensure early consideration and structuring of the transaction, including the documentation and any post-closing measures, in a way that is tailored to meet the parties' expectations and needs. As regards a certain type of seller, especially from the German Mittelstand, this might comprise shorter, more focused documentation than that used in English or American transactions.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

The key factor involved in obtaining control of a public company is the majority of votes at the shareholders' meeting. The German Takeover Code rests on the assumption that a shareholder owning 30% or more of the voting rights has obtained a controlling stake, and is thus obliged to submit a mandatory public takeover offer to all outstanding shareholders. This low percentage was chosen because the actual participation of shareholders (in particular the free float) in the shareholders' meetings of listed companies in Germany is often rather low and a shareholder with a 30% stake might indeed have control of the company. However, public takeover offers regularly contain a requirement relating to the acquisition of at least 75% of the shares, because the acquirer intends to obtain a clear majority in the target.

5.2 What conditions are usually attached to a public takeover offer?

Public takeover offers in Germany regularly contain a requirement regarding merger control clearance as well as a threshold (as described above) for the minimum percentage of shares to be acquired, often 75% of the total shares. The latter requirement may be waived during the course of a transaction. Also, due to legal restrictions, no further requirements are commonly used.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

In contrast to the US market and due to legal restrictions, break fees are not commonly used in public M&A transactions.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

In German transactions, you will find all such concepts used in a transaction. Transactions in Germany follow the Anglo-American design, of course often driven by financing requirements. As the market tends to favor sellers, there is a trend to limit the sellers' risks in transactions. This implies more frequent use of locked box mechanisms, the avoidance of earn outs and lower escrows.

5.5 What conditions are usually attached to a private takeover offer?

Usually, standard conditions such as scope of transaction, purchase price calculation and payment mechanisms, probably conditions precedent and carve-out expectations, finance requirements, closing mechanisms and time lines, side agreements, confidentiality, exclusivity (if negotiable) and the like.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

Common practice is that German law and jurisdiction govern an SPA; however, from time to time (a slowly upward trend) foreign law is made applicable. This is causing considerable problems, particularly as far as speed and certainty of completion of a transaction is concerned. However, the law allows the inclusion of such a mechanism if the transfer of the shares in rem is governed by German law (and notarised in case of limited liability companies as the target).

5.7 How common is warranty and indemnity insurance on private M&A transactions?

W&I insurance policies are increasingly common. In a significantly increasing number of transactions, it has helped close the deal, mainly in private equity investments. This trend is continuing.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

The market will grow steadily, probably not as much as in 2016, however the demand for targets and investments therein seems to be unaffected. The key trends will be the same as set out above under Section 1.1 for the previous year.

About the author |

||

|

|

Stefan Duhnkrack Partner, Heuking Kühn Lüer Wojtek Hamburg, Germany T: 49 40 35 52 80 18 F: 49 40 35 52 80 80 Dr Stefan Duhnkrack leads Heuking Kühn Lüer Wojtek's corporate/M&A group and is specialised in complex transactions for mid-size and large conglomerates, particularly in the mechanical engineering, automotive and energy industry (upstream oil and gas as well as onshore and offshore wind farms). He also works on cooperation and financing agreements and private equity transactions. Duhnkrack has a long standing track record in M&A and is with his team advising on and completing around eight to ten domestic and international transactions every year. |

About the author |

||

|

|

Pär Johansson Partner, Heuking Kühn Lüer Wojtek Cologne, Germany T: 49 221 20 52 531 F: 49 221 20 52 1 Dr Pär Johansson advises private equity funds as well as listed and family-owned businesses concerning M&A transactions. He is a leading lawyer in Germany for mid-cap transactions, and his projects in the field include more than 100 buy-outs during the last two decades. Johansson is also a managing partner of the firm. |