SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

The Swiss economy remains in a good position overall and the country's market players are highly active in the international M&A market. Moreover, the Swiss private equity (PE) sector profited in 2016 from low interest rates and generous borrowing conditions, which led to an above-average deal activity. The total reported PE deals with Swiss involvement amounted to 86 deals, which corresponds to an increase of 13% compared to 2015. The reported PE deal value increased by 2% to $30.6 billion.

Sectors such as chemicals, financial services, commodities, pharmaceuticals and life sciences and technology, media and telecommunications also did well in 2016.

Another key trend was the strong participation of China and the US in the Swiss market.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

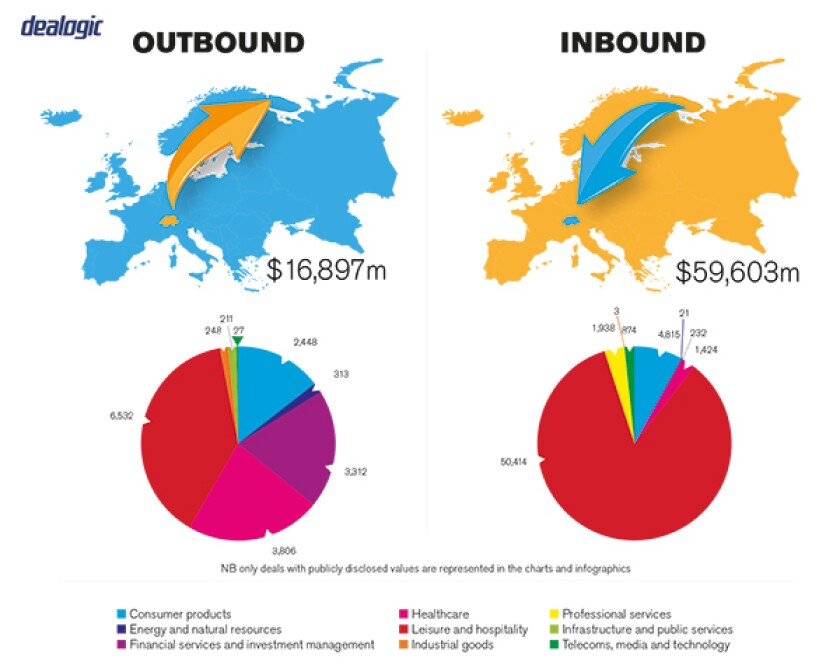

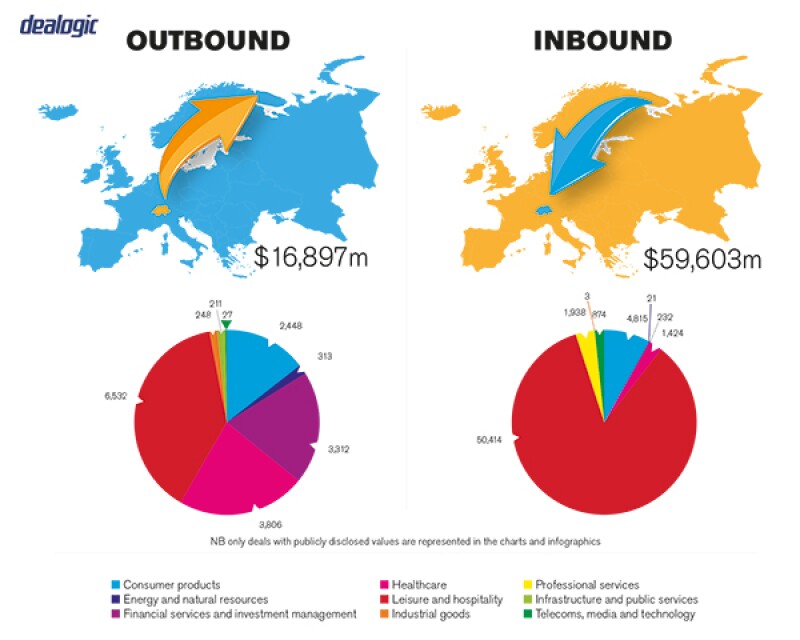

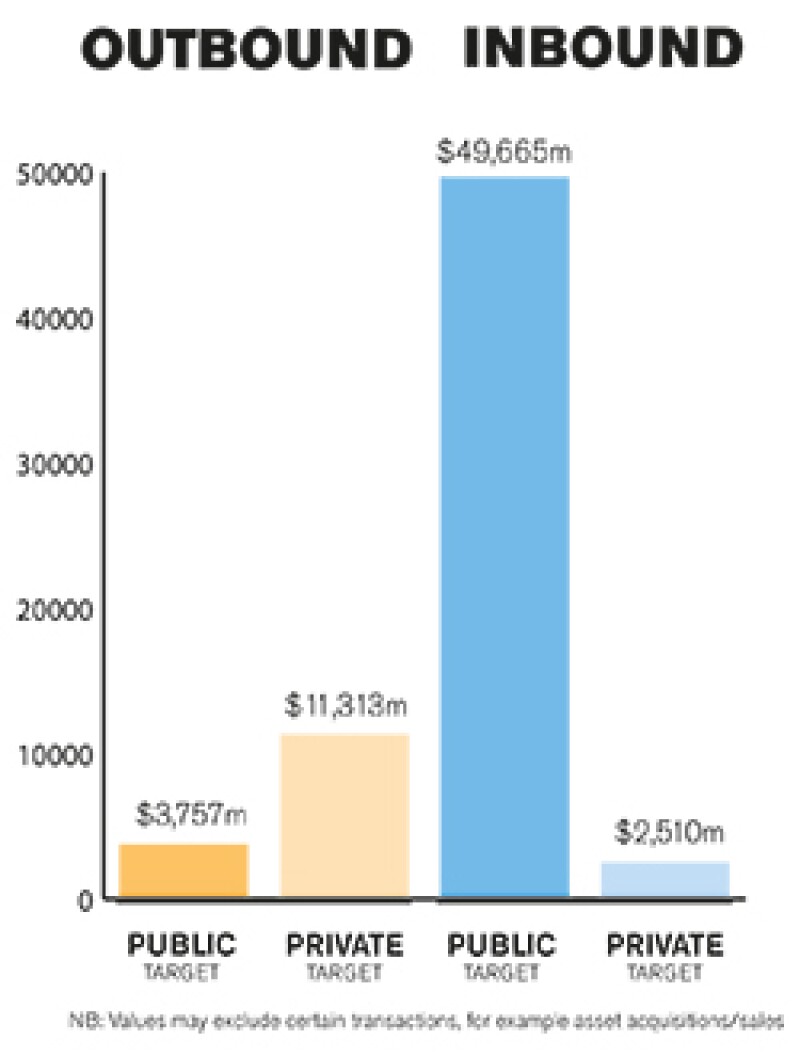

Last year developed into a strong one for M&A transactions: the number of transactions with Swiss involvement rose by 3.4% compared to the previous year, from 350 to 362 deals. The transaction volume grew by $34.1 billion, or 40%, over the previous year.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

The biggest Swiss M&A transaction was the $43.3 billion acquisition of Syngenta by China National Chemical Corporation. This is the largest outbound Chinese acquisition ever undertaken. In October 2016, the review of the acquisition by the European Commission entered Phase II.

The US, meanwhile, dominated outbound activities through deals such as the $5.5 billion acquisition of Capsugel by Lonza Group.

Another major transaction was the acquisition of 19.5% in Rosneft Oil Company for $11.27 billion by a consortium led by Glencore and Qatar Investment Authority.

2.2 What have been the most significant trends or factors impacting deal structures?

PE firms in Europe are increasingly using highly leveraged loans with few safeguards for lenders. The issuance of covenant-lite loans, which typically have high yields and loose limits on debt levels relative to earnings, is set to exceed last year's all-time high, according to sources in the industry.

The following debt financing arrangements are usually put in place for acquisition financings: senior (secured) credit facilities; junior (unsecured or junior-secured) credit facilities or mezzanine facilities; and subordinated (non-interest-bearing) shareholder loans.

Leveraged buyouts generally involve senior and junior debt in the form of revolving and term credit facilities provided by commercial lending institutions (banks) on a syndicated or non-syndicated basis. In addition to or instead of junior debt, PE investors typically provide financing in the form of mezzanine debt or subordinated loans, or both.

Collateral is sought at the level of the target company most of the time, but the debt arrangements are likely to be granted to the acquisition company becoming the target's parent at closing. Upstream collateral and cross-stream collateral are subject to certain restrictions. Essentially, to be valid, such collateral shall be allowed by the articles of association of the target, be in the corporate interest of the target and be at arm's length, as has been reaffirmed by the Supreme Court in a recent decision.

Should the granting of the collateral be considered not to be at arm's length, the collateral would be considered as a hidden distribution to shareholders and would be required to comply with distribution of equity rules. Equity distribution rules provide that the amount to be collateralised shall be limited to the amount that the target could distribute to its shareholders as a dividend at such time as enforcement is requested. This limitation is sometimes referred to as the free equity limitation.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

As of January 1 2016, Swiss M&A transactions involving public companies are mainly governed by the Financial Market Infrastructure Act (FMIA), which replaced the former Federal Act on Stock Exchanges and Securities Trading (including its implementing ordinances). This regulates both friendly and hostile public takeovers, irrespective of the consideration for Swiss resident companies with at least one class of equity security listed on a Swiss exchange and foreign resident companies, provided their shares are mainly listed on a Swiss exchange.

Pure merger transactions are subject to the provisions of the Swiss Merger Act. An exception applies if one of the merging companies acquires a controlling stake in the other merging company before the effective date of the merger, thereby triggering the obligation to submit a public offer according to the FMIA. However, in that case, the Takeover Board, allows the acquirer to postpone the offer and instead complete the merger with the consequence that the obligation to submit a public offer lapses due to the absorption of (usually) the target company.

To the extent an acquisition is financed by the issuance of securities or the transaction structure provides for additional securities to be issued, the relevant provisions of Swiss corporate law dealing with the obligation to prepare a prospectus and the technicalities of a capital increase have to be complied with. If the issuer is listed on a Swiss stock exchange the listing rules of such stock exchange will apply.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

According to the new FMIA, the target's board is no longer permitted to take any defensive measures without submitting them to the shareholders' meeting for approval once a public offer has been pre-announced. If the offeror elects not to publish a pre-announcement, this effect is triggered on publication of the offer prospectus.

Examples of frustrating actions which may no longer be taken upon (pre)announcement of an offer include:

actions taken with regard to the crown jewels of the target (for example a sale or pledge of any part of the business or intangible assets that form part of the main subject matter of the offer);

scorched earth tactics (for example a sale of assets which represent more than 10% of the latest annual balance sheet or which contribute by more than 10% to the company's profitability);

contracts providing for golden parachutes for the benefit of members of the target board or management (i.e. which provide for unusually high severance payments); and

certain actions pertaining to the target's securities (for example the repurchase of own shares or the issuance of new equity securities, with the exclusion of the pre-emptive rights of the existing shareholders).

SECTION 4: Market Idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

N/A

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

N/A

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

N/A

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

In most cases, a public offer starts with a preliminary announcement. Within six weeks after the publication of the pre-announcement, the offeror must publish the (final) offer. After the pre-announcement of the offer, the price and conditions of the offer can only be amended in favour of the shareholders. As a consequence, the preliminary announcement fixes the minimum price and triggers the best price rule as well as certain disclosure requirements for share transactions during the offer period. If the offeror elects to publish no pre-announcement, these effects are triggered on publication of the offer prospectus.

Shareholders holding three percent or more of the voting rights of the target company can request the status of a party in the proceedings before the Takeover Board and submit objections or requests to the latter and/or appeal against a decree issued by the Takeover Board. By making use of their procedural rights, qualifying shareholders have the possibility to considerably delay a takeover, because in case of an objection or appeal filed by a qualified shareholder, the cooling off period will in most cases be extended – and thus the offer period will not start – until the Takeover Board – or in case of an appeal the FINMA (Swiss Financial Market Supervisory Authority) – has issued its decision. The threat of extended litigation with a minority shareholder may thus well force the offeror to the negotiation table, trading better offer terms in exchange for withdrawing the legal challenges.

FMIA defines when a purchaser is required to make a mandatory offer for all outstanding equity securities of a target; this is the case if an acquirer directly or indirectly controls more than 33.3% of the company's voting rights whether exercisable or not. Exceptions apply if the target had increased this threshold in its articles of incorporation to up to 49% (opting up) or if the latter contain an opting out-clause.

5.2 What conditions are usually attached to a public takeover offer?

Certain statutory provisions, such as transfer restrictions and restrictions on voting rights (providing that a shareholder acquiring more that a certain percentage of shares, for example five percent, may not be entered into the share register with voting rights) may require the offeror to make its offer subject to the condition that the offeror is entered into the share register, or the restrictions are removed from the articles of incorporation.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

There is an increasing use of termination fees in the form of liquidated damages to mitigate the risk that the deal breaks. In public tender offers, the bidder and the target can agree on a break fee, provided that the clause is drafted in a way that does not oblige the shareholders to accept the offer. Break fees must be disclosed in the offer documents. As a general rule, they should not substantially exceed the cost incurred by the bidder in connection with the offer.

SECTION 5(b): Private M&A

5.4 What are the current trends with regard to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

When it comes to purchase price terms, PE deals offer a panel of various mechanisms. In the aftermath of the financial crisis, employing closing accounts to have more visibility and certainty on the purchase price to be paid at closing, had increasingly been used by PE professionals. In the recent past, locked box mechanisms have again been used more often by PE firms, in particular in competitive acquisition deals, as used to be frequent prior to the last financial crisis.

A locked box mechanism provides for price certainty for the seller, and price and time efficiency as it avoids lengthy pricing discussions and high expert fees after completion of the transaction. It is usually used for standalone entities in comparison with groups in multiple jurisdictions. The price may not be changed after signing. Therefore, anti-leakage provisions and indemnification provisions are usually included in the acquisition arrangements. These measures will prevent the seller from syphoning funds out of the target prior to closing.

The purchase price is often secured with an escrow solution.

5.5 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

The share purchase agreement (SPA) is generally governed by Swiss law, but may be subject to foreign law, if so required by a party. In such case, of Swiss public policy provisions are nonetheless applicable and fully enforceable. Somewhat a middle ground is a solution with a NWC-collar, for instance there is no adjustment to the purchase price as long as the NWC at closing is within a pre-agreed range.

5.6 How common is warranty and indemnity insurance on private M&A transactions?

The Swiss Code of Obligations provides for special representations and warranties, and certain guarantees are automatically applicable to the object of a sale performed under Swiss law (i.e. the shares themselves, as opposed to the underlying business of the target). The buyer of the majority or minority stake therefore, has an interest in ensuring that the SPA provides for extended representations and warranties with regards to all aspects relating to the assets, liabilities and agreements as well as the business of the target company.

In the case of a breach of a warranty under the SPA, the buyer is typically allowed to claim damages for the breach. Such right may be preceded by the right of the other party to remedy the breach itself on behalf, and at the cost, of the counterparty. The buyer is sometimes allowed to reduce the purchase price.

Swiss law also provides for a statutory right to rescind the purchase agreement in the event of a severe breach or a fundamental error, duress or fraud, but these rights are often contractually limited or excluded – to the extent permitted – by the parties. The purchase agreement usually provides that the right to take legal action based on a breach of representations and warranties by a counterpart is time barred within 12 to 36 months after the completion of the SPA. However, if a controlling or minority interest is sold by a PE company, the purchase agreement very often provides for only very limited, fundamental representations and warranties, and such claims are usually time barred after 6 to 12 months, while any claims the buyer may have against the PE seller are limited to a certain position of the purchase price, which is secured with an escrow solution.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market and how do you expect legal practice to respond?

Based on a survey of the M&A market in Switzerland, the outlook for the Swiss market in 2017 is very positive, with 93% of the participants believing that it will be a good year with high industry activity. In addition, 82% of the participants advise that the M&A market will either stay at its current level or moderately increase in 2017. Particularly high activity is expected by market participants in the area of private banking. A high level of M&A activity is also expected in other areas such as the pharmaceuticals, life science (such as the planned takeover of Actelion by Johnson & Johnson) and chemicals sectors.

About the author |

||

|

|

Alexander Vogel Partner, Meyerlustenberger Lachenal Zurich, Switzerland E: alexander.vogel@mll-legal.com Alexander Vogel has over 25 years' experience across a wide range of industries, transaction types and countries, with a particular interest in complex cross-border transactions. His principal areas of work include M&A, private equity, acquisition finance and capital markets as well as real estate transactions. His clients include listed companies, financial institutions as well as other large and medium-sized companies, with a particular industry focus on financial services, real estate, technology and construction. He has particular expertise advising boards of directors on corporate governance and related issues, including compensation issues, incentive schemes, listing rules, corporate law and other corporate governance questions. He is consistently highly ranked throughout legal directories such as Chambers, Legal 500 and IFLR1000 for Corporate/M&A, banking/finance and real estate. Chambers Europe describes him as "an expert in his fields according to his high level of experience and the deep and profound advice as well as his attention to details." He was admitted to the bar in Switzerland in 1992 and to the New York Bar in 1994. He holds a degree from the University of St Gallen law school and a master's from Northwestern University school of law. He speaks German, English and French. |

About the author |

||

|

|

Andrea Sieber Partner, Meyerlustenberger Lachenal Zurich, Switzerland E: andrea.sieber@mll-legal.com Andrea Sieber specialises in national and cross-border M&A, private equity and capital market transactions as well as national and international company reorganisations. She also advises Swiss and foreign clients on collective investment schemes, corporate governance questions, listing rules and general corporate law. Her clients include several listed companies, financial institutions as well as other large and medium-sized companies and she has a particular industry focus on regulated industries (such as financial services and health care) as well as machinery, media entertainment and retail industry. According to Chambers Europe, she is appreciated for her thorough handling of transactions and skill in negotiations and is "highly experienced and pragmatic" according to Legal500. Sieber was admitted to the bar in Switzerland in 2003. She holds a degree from the University of St Gallen law school (HSG) and a master's from the University of California, Davis, school of law. She is a partner and member of MLL's M&A/corporate group since 2011. She serves as a member of the board of a Swiss listed company and is the chairwoman of the supervisory board of a German company. She speaks German and English. |

About the author |

||

|

|

Samuel Ljubicic Partner, Meyerlustenberger Lachenal Zurich, Switzerland E: samuel.ljubicic@mll-legal.com Samuel Ljubicic was admitted to the bar in Switzerland in 2010. He holds a degree from the University of Lucerne and a master's from King's College London in international financial law. His principal areas of work include M&A, banking and finance, capital market as well as real estate development and transactions. He has recently been involved in various financing transactions and national and cross-border acquisitions for Swiss and international clients. He speaks German and English. |