SECTION 1: Market overview

1.1 What have been the key trends in the M&A market in your jurisdiction over the past 12 months and what have been the most active sectors?

January 2016 started off the year with 939 announced transactions, a continuation of the prior year's high deal volumes, but volumes gradually tapered off, reaching a low in December 2016 of 709 announced transactions, according to MergerStat deal data for pending and completed transactions in 2016 involving US public and private targets. Some of this decline was attributed to uncertainty in the future regulatory environment, caused by the election of a new presidential administration that was calling for significant change.

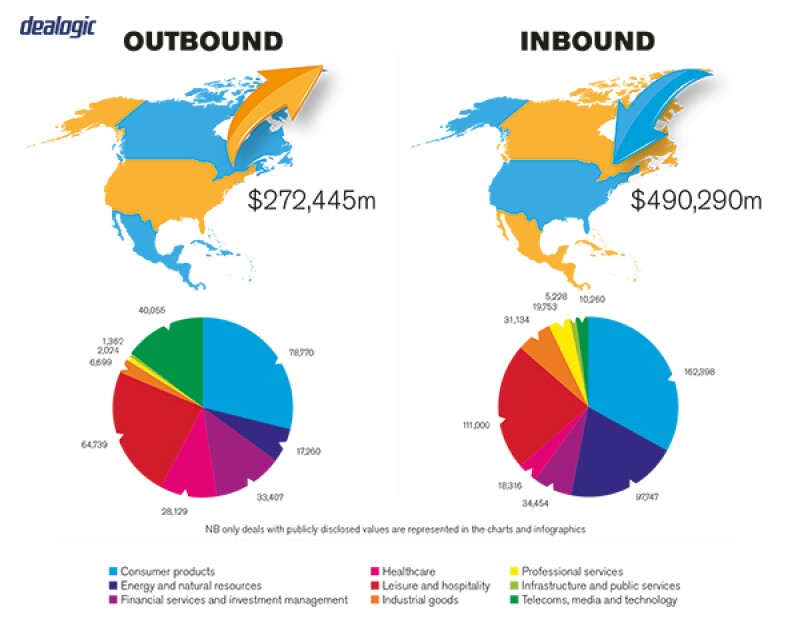

The telecom media and technology industry led all industries, accounting for approximately 22% of deal volume. Financial services and healthcare were second and third in deal volume, with 13% and ten percent, respectively. Other notable industries included retail and wholesale distributors, energy and natural resources, and industrials and manufacturing, accounting for nine percent, eight percent, and seven percent of deal volume, respectively.

1.2 What M&A deal flow has your market experienced and how does this compare to previous years?

Although 2016 did not exceed the deal volume and aggregate deal value from the record-setting year of 2015, it still was an extremely prolific year for M&A in the US. According to MergerStat, there were nearly 9,700 completed or pending deals in 2016, worth $1.515 trillion. One troubling trend, however, emerged in 2016: there were over 1,009 withdrawn deals worth $797.2 billion during the year, the most withdrawn deals since 2009 during the heart of the financial crisis.

1.3 Is your market driven by private or public M&A transactions, or both? What are the dynamics between the two?

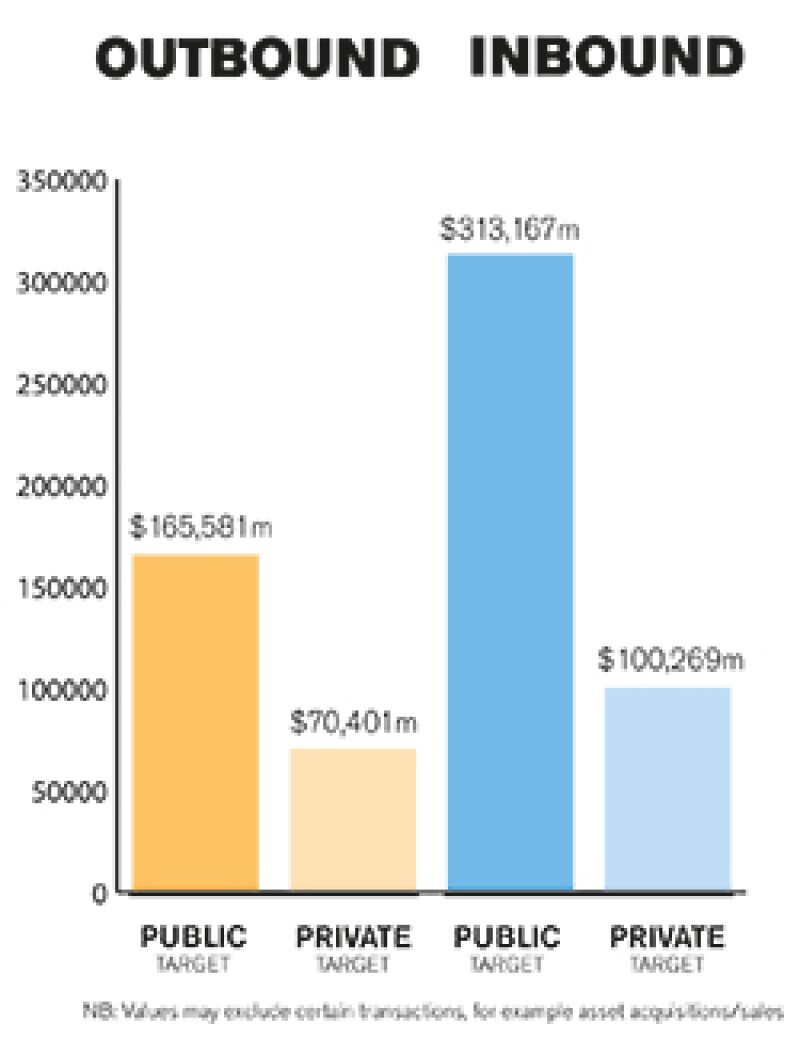

Both are prevalent in the US. The number of US listed companies declined, however, from 9,113 in 1997 to 5,734 in June 2016, resulting in fewer public M&A targets available for acquisition. The remaining public companies have grown in size, with the average public company now over three times larger than in 1997, after adjusting for inflation. These two factors have shifted deal volume from public to private targets, while causing public deal values to increase.

SECTION 2: M&A structures

2.1 Please review some recent notable M&A transactions in your market and outline any interesting aspects in their structures and what they mean for the market.

In 2016, Grand Chip Investment, a German company owned by Chinese nationals, attempted to purchase Aixtron, a German manufacturer of equipment for the global semiconductor industry with some military applications. Aixtron's US subsidiary gave the Committee on Foreign Investment in the US (CFIUS – described under Sections 3.1 and 4.2) jurisdiction over the transaction and CFIUS clearance was a condition to closing under the parties' transaction agreement. After concluding its review of the transaction, CFIUS informed the parties that it would recommend that the US President block the transaction. On December 2 2016, President Obama issued an executive order declaring that the deal threatened to impair US national security and prohibiting the acquisition of Aixtron's US operations and assets that were "used in, or owned for the use in or benefit of" Aixtron's activities in US interstate commerce. The executive order was a rare instance of the executive branch blocking proposed foreign investment in the US, and continued a recent pattern of thorough (and disruptive) review of proposed investments in US businesses by Chinese investors, particularly where sensitive technology is involved.

Cybersecurity concerns are also playing an increasing role in M&A deals. These issues came to the forefront in the recently announced merger of Yahoo! with Verizon and the subsequent discovery of a breach of over one billion user accounts. Breaches like Yahoo!'s can result in substantial reputational and monetary damages, particularly in industries where cybersecurity is paramount. Acquirers often seek to conduct enhanced cybersecurity due diligence, add enhanced representations and warranties regarding cybersecurity and data protection and allocate related risks through special indemnities and closing conditions. As advanced technologies continue to proliferate, these provisions may become more commonplace.

2.2 What have been the most significant trends or factors impacting deal structures?

See Section 2.1.

SECTION 3: Legislation and policy changes

3.1 Describe the key legislation and regulatory bodies that govern M&A activity in your jurisdiction.

The primary federal laws that govern US M&A activity include:

Federal securities laws, such as the Securities Exchange Act of 1934, enforced by the US Securities Exchange Commission and apply primarily to publicly listed target companies;

Antitrust laws, including the Hart-Scott-Rodino Antitrust Improvements Act, Clayton Act and Federal Trade Commission Act, enforced by the US Department of Justice and Federal Trade Commission;

Federal tax laws enforced by the Internal Revenue Service; and

Laws governing foreign investment in the US, such as the Exon-Florio Amendment to the Defense Production Act of 1950 that is enforced by CFIUS, a committee comprised of US government agencies. CFIUS has broad jurisdiction to review transactions that could result in a foreign investor holding significant influence over a US business.

At the state level, the corporate laws of the state in which the target company is incorporated will usually govern (see Section 5.6). The laws of the state(s) where the target operates or resides may also apply. These laws can impact the transaction structure, minority stockholder rights, approval and notice requirements, state taxes, environmental issues and many other relevant issues.

Stock exchange listing requirements may require stockholder approval for a US listed company to issue more than 20% of its outstanding stock in a transaction. However, US stock exchanges do not impose mandatory offer requirements, as they do in many European jurisdictions.

3.2 Have there been any recent changes to regulations or regulators that may impact M&A transactions or activity and what impact do you expect them to have?

The Trump administration and US Congress have declared an ambitious agenda of change, with many potential laws and regulations that could affect M&A activity. It is difficult to predict which of the proposals will be implemented, but the new administration may use CFIUS and antitrust regulations to protect US companies, potentially making it harder to complete transactions.

Policymakers also are discussing significant federal tax changes, including:

A reduction in the federal corporate tax rate;

Taxation of imports and exclusion of exports from taxation;

Elimination of the net interest expense deduction; and

A shift from a worldwide to a territorial taxation system for multinational corporations that will include a one-time repatriation tax on overseas earnings.

At the state level, prior to 2016, execution of an agreement to acquire a public company was typically followed by lawsuits seeking disclosure-only settlements. These settlements granted the target company's board of directors a broad release of liability from the company's stockholders in exchange for additional information disclosures and an award of attorneys' fees. In January 2016, a Delaware court announced that it would approve disclosure-only settlements only if the disclosures were "plainly material". The court also indicated a preference for disclosure claims to be litigated or resolved in connection with a mootness fee application, which does not provide defendants a release of liability. Disclosure-only settlements have since become less common, plaintiffs' counsel have begun to file slightly fewer lawsuits with more of them being filed outside of Delaware, and mootness fee applications are on the rise.

3.3 Are there any rules, legislation or policy frameworks under discussion that may impact M&A in your jurisdiction in the near future?

See Question 3.2.

SECTION 4: Market idiosyncrasies

4.1 Please describe any common mistakes or misconceptions that exist about the M&A market in your jurisdiction.

Foreign acquirers of US companies often expect to receive vendor due diligence reports summarising the target company. However, this practice is unusual in the US. It is more typical to receive an information memorandum or management presentation regarding the US target, but these are marketing documents that are not intended to reveal potential due diligence issues. Buyers are generally expected to conduct their own due diligence in the US.

Foreign buyers are also often less familiar with the Material Adverse Effect language in US agreements and overestimate their ability to utilise the associated closing condition or termination right. Such provisions may appear to provide the parties with great flexibility to end the deal if the target suffers an adverse change. However, courts rarely decide that a Material Adverse Effect has actually occurred, making it difficult for an acquirer to terminate a deal based on those provisions.

4.2 Are there frequently asked questions or often overlooked areas from parties involved in an M&A transaction?

See Question 4.1. In addition, foreign buyers often ask about the CFIUS process, which involves the filing of a detailed notice by the parties (in draft and then final form). Once CFIUS accepts the filing, CFIUS reviews the transaction for up to 30 days. Although CFIUS can clear the transaction before 30 days, CFIUS often initiates a further investigation lasting up to 45 additional days. If CFIUS is unable to clear the transaction at the end of the cumulative 75-day period, CFIUS must make a recommendation to the US President regarding the transaction. The President then has 15 days to permit, block or impose conditions on the transaction. CFIUS cases are difficult to predict because the concept of what presents a national security threat is not defined in the statute or regulations, the CFIUS review process is not open to the public, and CFIUS generally does not attempt to justify its decisions (in writing or otherwise).

4.3 What measures should be taken to best prepare for your market's idiosyncrasies?

A potential acquirer should consult with M&A attorneys early in the acquisition process to identify potential deal risks, regulatory approvals and legal and market requirements.

SECTION 5(a): Public M&A

5.1 What are the key factors involved in obtaining control of a public company in your jurisdiction?

1. A public company target must follow many federal securities laws, rules and regulations that cover: potential disclosure of minority acquisitions in excess of five percent of the target's outstanding voting securities; insider trading; disclosure of material non-public information; and disclosure, procedural and time requirements for tender offers and proxy solicitations.

2. State corporate laws typically impose a fiduciary duties (known as Revlon duties) on the target company's board of directors in a sale transaction to obtain the best economic transaction reasonably available. Public company stockholders often file lawsuits following announcement of a public company merger and allege a breach of these duties. These lawsuits provide an opportunity for courts to scrutinise the process the board used to satisfy its fiduciary duties.

3. Both public and private US companies typically must obtain approval from their stockholders holding a majority of the outstanding voting securities before transferring control of the company to a buyer. Public companies usually obtain this approval after transaction documents are executed, leaving less certainty that the target's stockholders will approve the deal.

5.2 What conditions are usually attached to a public takeover offer?

1. Accuracy of representations and warranties, and compliance with covenants, usually qualified by materiality or material adverse effect thresholds.

2. Absence of a material adverse effect on the target (but see Question 4.1).

3. Receipt of relevant governmental approvals.

4. Absence of court injunction or governmental litigation to block the transaction.

5. Receipt of requisite consent of the target company stockholders.

Notably, in a US public deal, it is unusual (although legally permissible) to have any sort of closing condition relating to completion of financing or due diligence.

5.3 What are the current trends/market standards for break fees in public M&A in your jurisdiction?

Public target companies commonly pay a termination fee to the buyer if the merger agreement is terminated under various circumstances involving a competing offer, the target's breach of non-solicitation restrictions, or a change in the recommendation of the target company's board of directors to its stockholders to approve the transaction. These triggering circumstances are usually heavily negotiated. Break fees typically fall between two to four percent of the transaction value but vary greatly based on deal size, consideration type, and other factors. Sometimes, break fees are bifurcated in a go shop structure, where the target is allowed to solicit other buyers for a period of time during which the fee is lower.

Reverse termination fees, where the acquirer must pay the target if the merger agreement is terminated under various circumstances, are less common. These fees are often provided when the buyer is a financial investor or has unique risks that are not present with other buyers, such as additional regulatory risks. Reverse termination fees are highly variable but often range from five to seven percent of the transaction value.

SECTION 5(b): Private M&A

5.4 What are the current trends with regards to consideration mechanisms including the use of locked box mechanisms, completion accounts, earn-outs and escrow?

Completion accounts (referred to as working capital or balance sheet adjustments in the US) adjust the purchase price between signing and closing of a transaction based on changes in the target's balance sheet accounts. In contrast, locked box mechanisms generally provide for a fixed purchase price, regardless of balance sheet changes, as long as no assets are distributed to security holders between signing and closing. In US private company transactions, completion accounts are more prevalent than locked box mechanisms, whereas locked box mechanisms are standard for public company transactions. An American Bar Association (ABA) review of 117 private M&A transactions that closed in 2014 (the most recent year available) indicated that approximately 86% of those deals had a completion account mechanism, while locked box mechanisms accounted for approximately 14%.

The ABA's review also indicated that earn-out provisions appear in about 26% of agreements, and that escrow accounts were utilised to provide security for indemnity claims in approximately 79% of the agreements closed in 2014.

5.5 What conditions are usually attached to a private takeover offer?

Private company M&A closing conditions are similar to those in public company deals discussed in Question 5.2. However, stockholder approval is usually not a condition to closing in a private takeover offer, because that approval is often obtained contemporaneously with the signing of the acquisition agreement.

5.6 Is it common practice to provide for a foreign governing law and/or jurisdiction in private M&A share purchase agreements?

No. Such agreements are typically governed by the law of the state in which the target company is incorporated. The majority of US companies are incorporated in the state of Delaware. Thus, Delaware law often governs US M&A agreements. In addition, many parties will choose New York law as the governing law due to familiarity with those laws by parties and New York's role as a leading commercial and financial center.

5.7 How common is warranty and indemnity insurance on private M&A transactions?

According to Woodruff Sawyer & Co, warranty and indemnity insurance was used in approximately 13% of private deals in the US in 2015 and is more than three times as popular in 2016 compared to 2011.

SECTION 6: Outlook 2017

6.1 What are your predictions for the next 12 months in the M&A market?

The current political and regulatory environment in the US is undergoing significant change. Although US M&A activity has continued to be robust through January 2017, it is difficult to predict how companies will respond to the pending changes.

About the author |

||

|

|

David Lee Partner, Latham & Watkins Costa Mesa, US T: 1 714 755 8069 F: 1 714 755 8290 W: www.lw.com David Lee is a partner in the mergers and acquisitions practice group at Latham & Watkins. Lee specialises in cross-border acquisitions from China into the United States, private equity transactions and public company M&A. He has lead a number of high profile cross-border acquisitions, including the pending sale of Vizio to LeEco, the pending sale of a majority interest in Newegg to LianLuo and the acquisition of Brookstone by Sanpower. In his career, Lee has been a certified public accountant, the co-chairman of the transactions affinity group of the American Health Lawyers Association, recognised as a Southern California Rising Star 2013 for M&A by Super Lawyers, and recognised for his work in capital markets by the Who's Who Legal guide in 2014. |